KEY

TAKEAWAYS

- Financials sometimes battle in September, however are likely to rally in This autumn.

- XLF has damaged into all-time excessive territory, however its momentum is fading.

- If XLF dips in September, it might current a shopping for alternative.

Monetary sector shares are at an all-time excessive, fueled partly by earnings beats, a good and better rate of interest setting, and sector sentiment. Buyers are seeing worth shopping for alternatives in lots of beaten-down monetary shares. Do you have to observe their lead?

Monetary sector shares are at an all-time excessive, fueled partly by earnings beats, a good and better rate of interest setting, and sector sentiment. Buyers are seeing worth shopping for alternatives in lots of beaten-down monetary shares. Do you have to observe their lead?

In line with Fed Chief Powell’s newest remarks, fee cuts are on the horizon. Decrease rates of interest can minimize each methods, narrowing web curiosity margins and pressuring financial institution earnings whereas boosting the broader market and lifting shares, together with financials.

When navigating such elementary uncertainty, it helps to step again and think about the broader patterns at play. Think about seasonal tendencies and the way technical worth motion may inform your short-term technique. Let’s begin with seasonality.

5-Yr Seasonality Chart of XLF

The StockCharts seasonality chart can assist you determine how XLF performs every month and the typical worth change (see beneath).

CHART 1. FIVE-YEAR SEASONALITY PROFILE FOR XLF. Be aware September’s destructive efficiency.Chart supply: StockCharts.com. For academic functions.

The numbers above the bar signify the proportion of upper closes. The numbers on the backside of every bar signify the typical % return for the time interval being analyzed — on this case, 5 years.

Key factors from the XLF seasonality chart are as follows:

- September is the worst month for XLF, averaging zero larger closes during the last 5 years with a return of -4%.

- October, November, and December make up XLF’s strongest quarter with a higher-close fee of fifty% and 75% and a mean return of 4%, 7.2%, and a pair of.4%, respectively.

That is the seasonality profile during the last 5 years, and the current financial setting weighs in closely on the info. However what occurs when you zoom out to 10 years, which incorporates financial exercise earlier than the pandemic and inflationary pressures that formed the final 5 years?

10-Yr Seasonality Chart of XLF

CHART 2. 10-YEAR SEASONALITY PROFILE FOR XLF. September’s nonetheless a doozy.Chart supply: StockCharts.com. For academic functions.

Accounting for the sector exercise earlier than the financial challenges that took place throughout and after the pandemic, you possibly can see that September continues to be an terrible (although not the worst) month for XLF, raking in a mean return of -1.6% with a higher-close fee of solely 22%.

Just like the five-year profile, October by December nonetheless includes the strongest quarter, with November standing out because the strongest month with an 89% larger shut fee and a mean return of 6.2%.

these seasonality profiles, must you anticipate September’s weak point as a possible bullish setup for a powerful fourth quarter?

Financials—A Sector Breadth Perspective

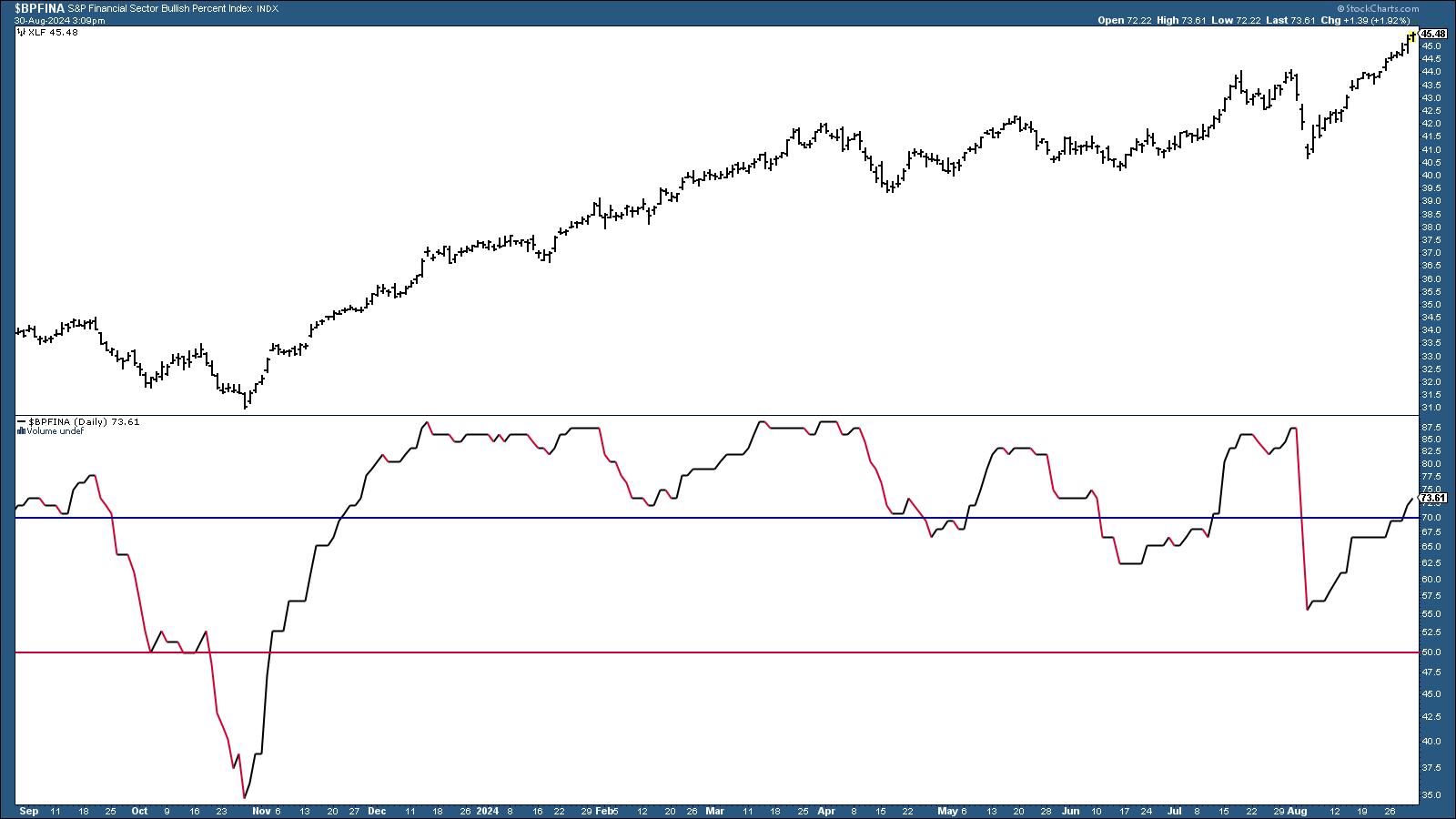

It helps to investigate the monetary sector when it comes to breadth and assess what number of monetary shares inside the ETF are taking part within the uptrend versus people who aren’t. Beneath is a chart of the S&P Monetary Sector Bullish P.c Index ($BPFINA) and XLF.

CHART 3. S&P FINANCIAL SECTOR BULLISH PERCENT INDEX. This indicator is coming into oversold territory however can stay above 70 for an prolonged interval if XLF continues trending larger.Chart supply: StockCharts.com. For academic functions.

StockCharts Tip!

StockCharts Tip!

To recreate the chart, click on on the above chart or observe these steps.

- Enter the image, on this case $BPFINA, within the image field.

- Choose your most well-liked chart settings, akin to chart type, time-frame, log scale, and many others.

- Enter horizontal line overlays utilizing completely different parameters, i.e., 70, 50, and 30.

- Below Indicators, choose Worth from the dropdown menu, enter XLF within the parameters field, and place it above, beneath, or behind the BPI.

As XLF continues to pattern larger (see worth chart above the BPI chart), the monetary sector as an entire can be coming into overbought territory, in response to the Bullish P.c Index (BPI).

Typically, a BPI line above 50% favors the bulls, whereas beneath 50% favors the bears. Nonetheless…

- An increase from beneath 30% (oversold) signifies potential bullishness.

- A decline from above 70% (overbought) suggests bearishness.

If the seasonality pattern performs out, what may you anticipate within the weeks forward? Let’s shift to the day by day chart of XLF.

A Nearer Have a look at XLF’s Each day Worth Motion

CHART 4. DAILY CHART OF XLF. No indicators of stopping, but word the divergence in CMF momentum.Chart supply: StockCharts.com. For academic functions.

In a nutshell:

- XLF exhibits no signal of slowing, but the near-term surge goes parabolic.

- The Chaikin Cash Stream (CMF) exhibits that purchasing stress is selecting up, however word the divergence between it and the worth pattern, suggesting that momentum might or is probably not adequate to gas a continued rise.

- Worth is hugging and nearing the highest of the Bollinger Bands; worth tends to revert again towards the center, which, coincidentally, will possible meet the “kumo” degree of the Ichimoku Cloud indicator.

In brief, it is a wait-and-see second. XLF’s entry into overbought territory, coupled with declining momentum, aligns with the seasonal tendency for September’s weak point. If a dip happens and the basics stay secure, a pullback towards the center Bollinger Band or the “cloud” might current a powerful shopping for alternative.

Closing Bell

XLF is using excessive (like, very excessive), however with September’s seasonal weak point and its low-momentum entry into overbought territory, it is necessary to stay cautious. Control how monetary shares carry out within the coming weeks. If the anticipated dip occurs and fundamentals keep stable, this could possibly be your likelihood to purchase in earlier than the anticipated This autumn power kicks in.

You should definitely save XLF in one among your StockCharts ChartLists.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Karl Montevirgen is an expert freelance author who focuses on finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in important research/writing and music composition from the California Institute of the Arts.

Be taught Extra