EUR/USD: ECB and Trump Pushing the Pair In the direction of 1.0000

● On Thursday, 17 October, the Governing Council of the European Central Financial institution (ECB) determined for the third time this 12 months to decrease its three key rates of interest, this time by 25 foundation factors. In consequence, the deposit price now stands at 3.25%, the primary refinancing operations price at 3.4%, and the marginal lending facility price at 3.65%. These adjustments will take impact from 23 October 2024. It’s price recalling that on the earlier assembly in September, the regulator additionally decreased the important thing charges by 25 foundation factors.

The ECB defined its determination by referring to a revised inflation forecast, core inflation tendencies, and the effectiveness of financial coverage transmission. In keeping with Eurostat, inflation within the Eurozone fell to 1.7% in September, the bottom degree since April 2021. Inflation is predicted to rise barely within the coming months. Due to this fact, as acknowledged by the ECB management, the regulator intends to maintain charges at restrictive ranges for so long as essential to sustainably obtain the two.0% goal. That is anticipated to occur by the top of 2025.

● The outcomes of the present Governing Council assembly weren’t a shock, as the choice to decrease borrowing prices totally aligned with market expectations. The EUR/USD pair reacted with a slight, momentary drop to 1.0810, however there isn’t any doubt that the euro “bears” will try to push it even decrease.

Specialists predict that the ECB will proceed decreasing charges at every assembly till March 2025, after which the tempo of easing might decelerate. Undoubtedly, the dynamics of EUR/USD can even be influenced by the tempo of financial coverage easing by the US Federal Reserve. In the intervening time, the important thing rate of interest on the greenback stands at 5.0%, giving the US forex a major benefit over the euro with its 3.4%.

● The chance of the greenback reaching parity with the euro is rising amid issues over a possible international commerce struggle, ought to Donald Trump win the US presidential election. As reported by Bloomberg, Trump indicated that america’ tariff measures could possibly be directed towards Europe, China, and different nations. In response, ECB President Christine Lagarde warned that any limitations may pose a “threat of exacerbation” for the already struggling economic system of the bloc.

Coupled with the rate of interest reduce on Thursday, 17 October, this triggered an additional decline within the euro, which is ending its third consecutive week of losses towards the US greenback. Moreover, this week noticed the biggest decline within the euro towards the British pound this 12 months.

● Foreign money strategists at Pictet Wealth Administration imagine that “EUR/USD parity is unquestionably doable if Trump wins and imposes large-scale tariffs.” Analysts at J.P. Morgan Non-public Financial institution and ING Groep NV additionally don’t rule out the chance that the frequent European forex may attain the 1.0000 degree by the top of the 12 months. This sentiment is supported by information from the choices markets, the place members are more and more betting towards the euro.

As of the time of penning this evaluate (18 October, 12:00 CET), EUR/USD is buying and selling round 1.0845. The one-month threat reversal indicator for the pair has reached its most detrimental degree prior to now three months, reflecting merchants’ willingness to wager on additional weakening of the euro.

● Subsequent week, Thursday, 24 October, guarantees to be fairly eventful. A flood of enterprise exercise information is predicted on today. The PMI index figures for numerous sectors of the economies of Germany, the Eurozone, and america can be launched. Moreover, as is customary on Thursdays, the variety of preliminary jobless claims in america can even be introduced.

GBP/USD: Victory Over Inflation – Defeat for the Pound

● The report launched every week earlier by the UK’s Workplace for Nationwide Statistics confirmed that the nation’s GDP grew by 0.2% (m/m) in August. Thus, the UK economic system returned to development after two months of stagnation. Nevertheless, when trying on the annual dynamics, the slowdown within the second half of the present 12 months turns into evident.

On Wednesday, 16 October, one other batch of macroeconomic information was revealed, exhibiting that inflation within the UK fell to its lowest degree in additional than three years. The Shopper Worth Index (CPI) on a month-to-month foundation remained flat at 0.0%, which is beneath each the earlier determine of 0.3% and the market expectation of 0.1%. On an annual foundation, with a forecast of 1.9%, shopper costs really rose by 1.7% in September, considerably decrease than the earlier 2.2%. Specialists notice that the drop was primarily attributable to declining airfares and petrol costs.

● Thus, for the primary time since 2021, inflation has fallen beneath the Financial institution of England’s (BoE) 2.0% goal, strengthening market expectations of a key rate of interest reduce for the pound on the regulator’s subsequent assembly. It’s now anticipated that on 7 November, borrowing prices can be decreased by one other 25 foundation factors, from 5.0% to 4.75%.

It’s price recalling that in August, the regulator already lowered the speed by 25 foundation factors, marking the primary easing of its financial coverage because the begin of the COVID-19 pandemic in March 2020. At the moment, the speed was at 0.1% and remained at that degree till November 2021, after which the Financial institution of England started elevating it to fight inflation. In August final 12 months, the rate of interest peaked at 5.25%.

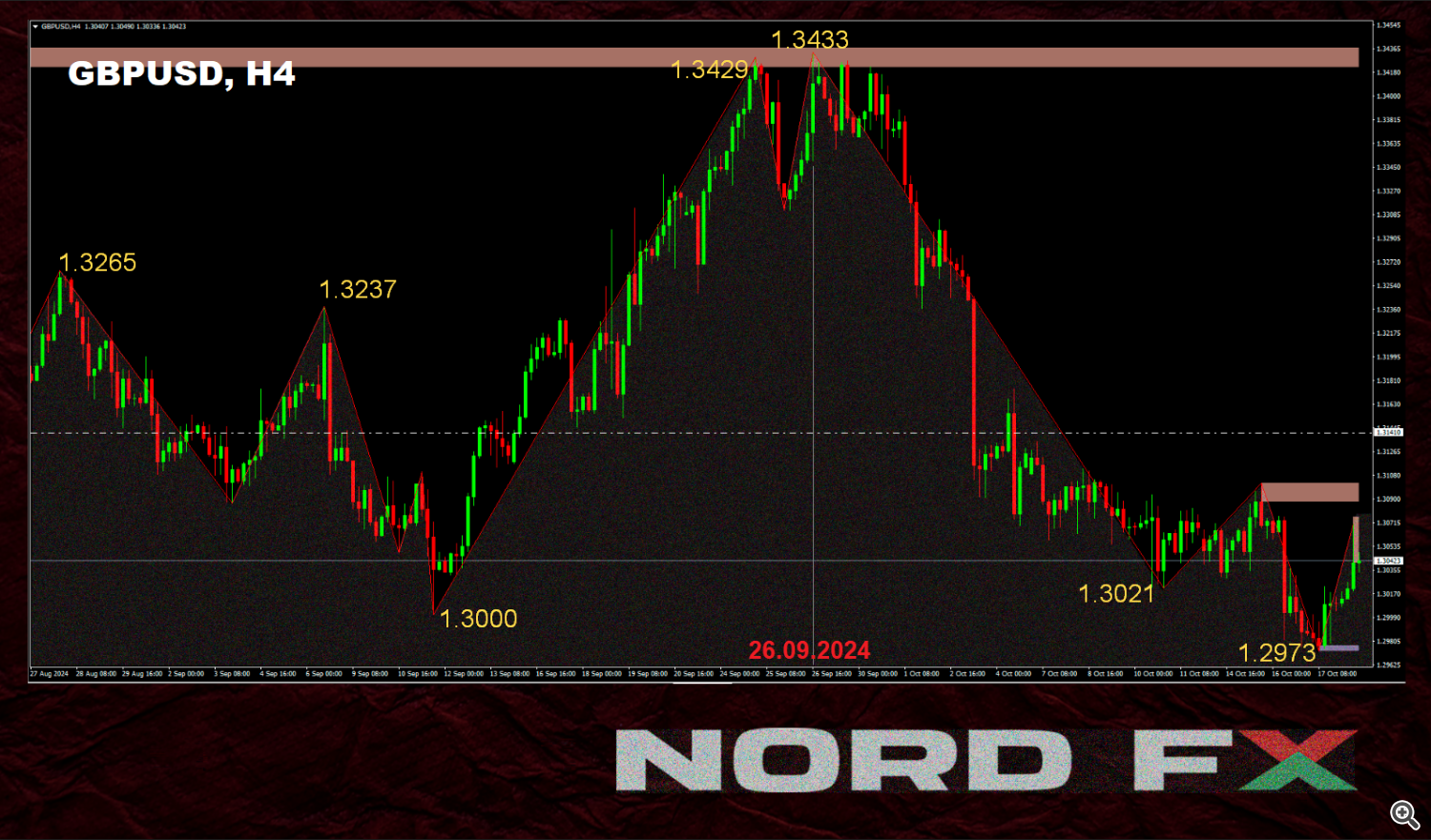

This tightening of financial coverage had a constructive impact, bringing inflation down from 11.1% in November 2022 to the present 1.7%. This success permits the BoE to proceed on the trail of easing financial coverage, shifting its focus to supporting financial development, however on the similar time, it pushes the GBP/USD pair decrease. In mild of latest occasions, the British forex plummeted to 2-month lows, reaching a neighborhood backside at 1.2973 on 17 October.

● Among the many key occasions and publications in regards to the state of the UK economic system within the upcoming week are the speeches by Financial institution of England Governor Andrew Bailey on 22 and 23 October. On Thursday, 24 October, enterprise exercise information (PMI) can be launched, together with the Inflation Report listening to in the UK. The week will conclude with one other speech by Mr. Bailey, scheduled for Saturday, 26 October.

CRYPTOCURRENCIES: 4 Causes for Bitcoin’s Rise

● The cryptocurrency trade CoinEx revealed a report on the cryptocurrency marketplace for September 2024. In keeping with the trade’s analysts, the primary occasion—one with which it’s exhausting to disagree—was the Federal Reserve’s 50 foundation level rate of interest reduce. This transfer delighted buyers and triggered one other wave of threat urge for food. Inventory indices such because the S&P 500 reached new highs, adopted by an increase in cryptocurrencies. The European Central Financial institution (ECB) and the Financial institution of England (BoE) additionally contributed to this course of by steering in the direction of financial coverage easing (QE).

The bull rally of the main cryptocurrency started on 7 September on the $52,554 degree. After the Fed’s determination on 18 September, bitcoin surged to $66,517 and ended the month at $62,396.

Analysts level to 2 extra causes that pushed bitcoin upwards. The primary was the information that the disaster managers of the bankrupt crypto trade Mt.Gox postponed their plans to return stolen bitcoins to collectors by a 12 months. In keeping with some stories, Mt.Gox held round $10 billion price of bitcoins. Payouts to collectors started in July this 12 months, with plans to finish them within the coming months. The discharge of such numerous cash into the market may have considerably depressed bitcoin costs. Nevertheless, it has now been revealed that the distribution of tokens won’t be accomplished till the top of October 2025, thus averting a possible value dump because of this.

● And eventually, motive quantity 4. It was the speech made on Monday, 14 October, by US presidential candidate Kamala Harris, during which she promised to help a regulatory framework for cryptocurrencies. The small print of her plan are nonetheless unknown, and it’s doable that that is merely election rhetoric. Nevertheless, this promise has sparked some hope that Harris might not proceed Biden’s strict coverage in the direction of the digital business. In keeping with media stories, if elected president, she plans to stimulate Black crypto buyers by the “Black Individuals Alternatives Programme.” It’s anticipated that this initiative may have an effect on greater than 20% of Black Individuals who presently maintain cryptocurrencies.

● Analysts notice that related value actions for bitcoin had been noticed forward of the 2016 and 2020 US presidential elections. In 2016, BTC traded inside a really slender vary for over three months. Nevertheless, three weeks earlier than the election, it started to rise, doubling in worth by the beginning of 2017.

An identical sample occurred in 2020: first, sideways motion for half a 12 months, adopted by a bull rally beginning three weeks earlier than the election. In consequence, after beginning at $11,000, the flagship cryptocurrency practically tripled in worth to $42,000 by early January. If one thing related occurs this time, it’s doable that bitcoin may enter the New 12 months 2025 within the $120,000–180,000 vary.

● The dealer and analyst identified by the nickname Stockmoney Lizards believes that earlier than the subsequent pump, BTC is more likely to see a correction into the $63,000–63,600 zone. “Bitcoin is coming into the Worry of Lacking Out [FOMO] zone,” writes Stockmoney Lizards. “In some unspecified time in the future, a short lived correction will start, and merchants caught within the FOMO may have their positions liquidated earlier than the upward motion resumes.”

Stockmoney Lizards’ colleagues additionally notice that regardless of the latest rise in bitcoin, the value has not but managed to solidify above the higher boundary of the descending channel that started on 14 March. Presently, this boundary sits at $68,050. In the meantime, the CoinEx Analysis group identifies $70,000 because the vital degree.

● Analysts at CryptoQuant imagine that the worry of one other drop (FOMO) amongst small retail buyers is benefiting giant gamers who aren’t involved with the short-term fluctuations within the value of the main cryptocurrency. “The buildup of bitcoins by whales within the $54,000 to $68,000 value vary is a major indicator. New whales are coming into the sport and actively accumulating, whereas present ones are rising their positions. Total, all whales are accumulating on this value zone. Their rising balances recommend potential development on the horizon, whether or not within the medium or long run,” states the CryptoQuant report.

“Bitcoin has been buying and selling in a slender vary for seven months now,” the consultants add, “and the longer this era lasts, the extra highly effective the rally of the primary cryptocurrency and the general market capitalization of the crypto market could possibly be.”

● On the time of penning this evaluate (18 October, 12:00 CET), the BTC/USD pair is buying and selling across the $67,800 zone. The general cryptocurrency market capitalization has elevated to $2.33 trillion (up from $2.20 trillion every week in the past). The Bitcoin Worry & Greed Index has surged from 32 to 73 factors, skipping the Impartial zone and shifting instantly from the Worry zone to the Greed zone.

● And to conclude the evaluate, listed here are a number of nice numbers for bitcoin fanatics. There is a physicist and monetary analyst named Giovanni Santostasi (his surname considerably resembles the identify of bitcoin’s creator, Satoshi). In 2018, this scientist utilized the Energy Regulation to calculate the value trajectory of the main cryptocurrency. To clarify briefly: Energy Regulation is a relationship between two portions the place a change in a single causes a proportional change within the different, expressed by an influence perform. Santostasi used this legislation to mannequin the connection between bitcoin’s value and time.

We cannot burden the reader with formulation. Nevertheless, in response to Santostasi’s calculations, by the beginning of 2030, the value of BTC ought to vary between $174,500 and $1.49 million. Ten years later, by the start of 2040, the value may even attain $10 million, and it shouldn’t fall beneath $1.6 million. That stated, Giovanni Santostasi himself warns that the market circumstances may change considerably over the subsequent 16 years, which means that precise figures would possibly differ vastly from these estimates.

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or pointers for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #foreign exchange #forec_forecast #nordfx #cryptocurreencies #bitcoin