Candlestick Patterns are important instruments that assist buyers establish traits and reversal factors in monetary markets. From fundamental patterns just like the Doji to extra advanced ones just like the Engulfing and Three Line Strike, every sample offers particular indicators concerning value actions. Understanding and appropriately making use of candlestick patterns not solely enhances analytical expertise but additionally will increase decision-making effectiveness in buying and selling.

All Candlestick Patterns is a robust device that totally helps the identification of candlestick patterns in your chart, permitting you to effortlessly observe crucial indicators with out the necessity for handbook looking. This device is very helpful while you want a fast evaluation of reversal or pattern continuation indicators based mostly on every candlestick sample. It helps save time and improves resolution accuracy.

See extra in regards to the All Candlestick Patterns indicator right here:

– MT5 model: All Candlestick Patterns MT5

– MT4 model: All Candlestick Patterns MT4

Under are some widespread candlestick patterns and their meanings:

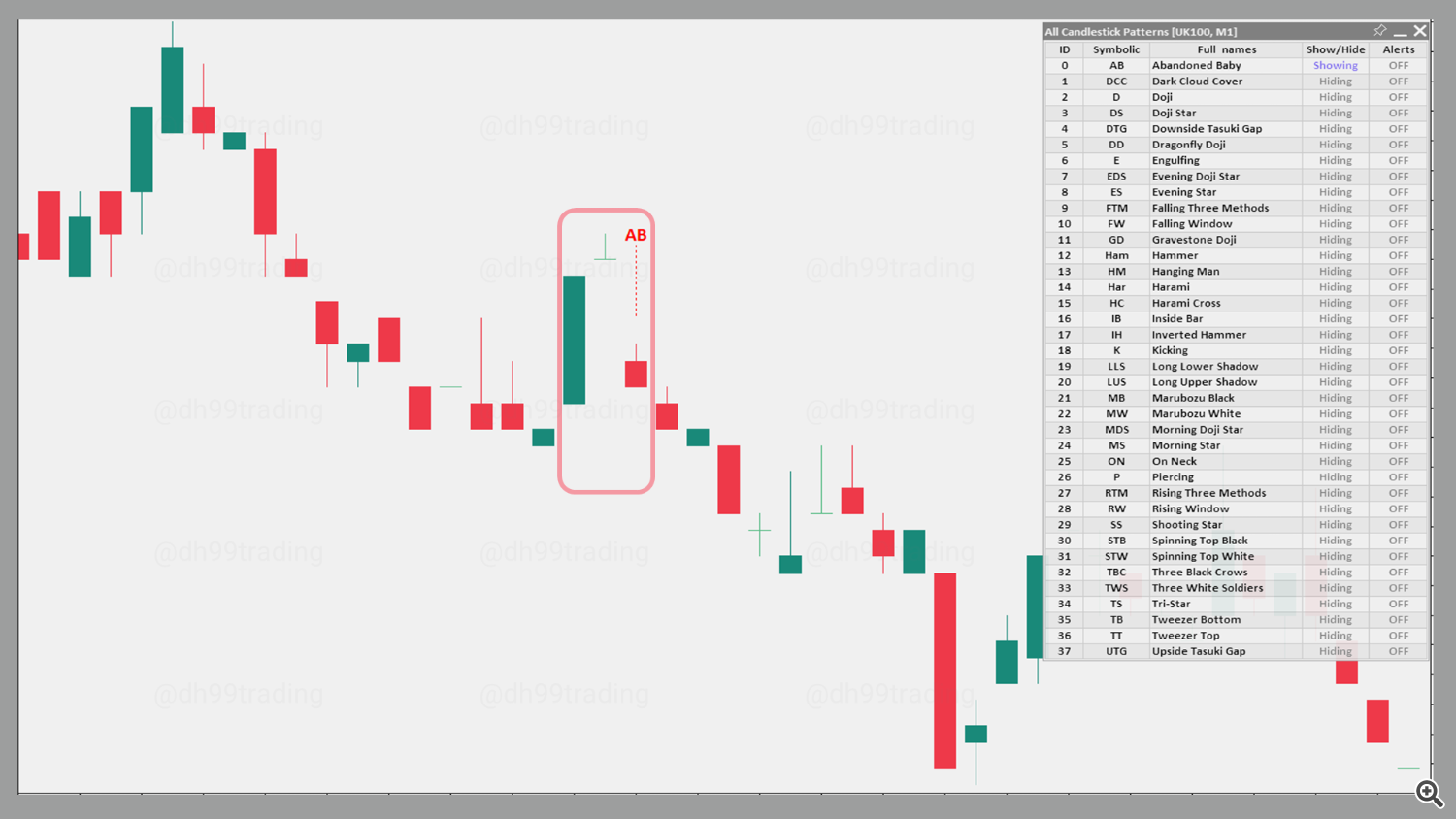

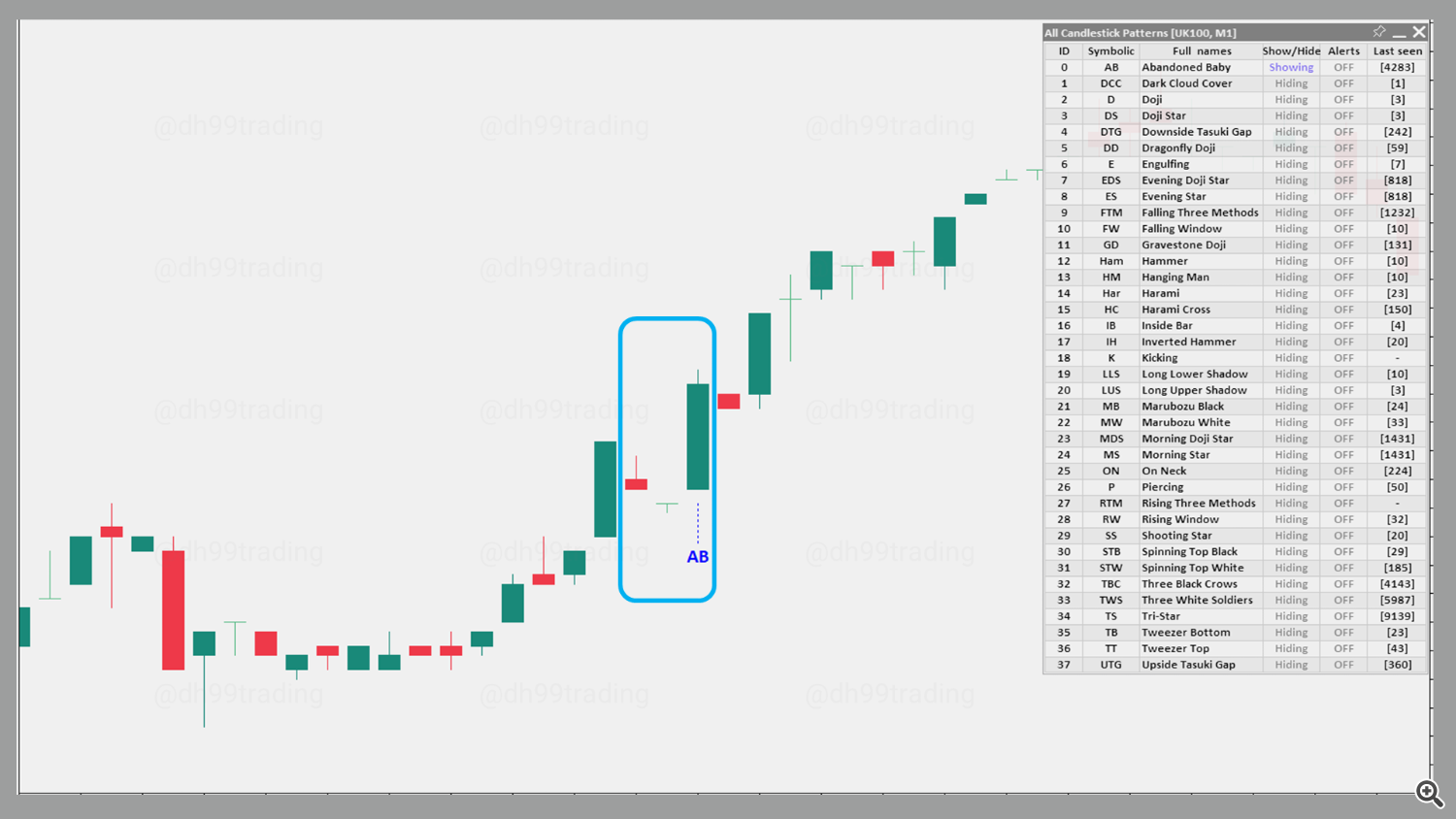

A bearish deserted child is a particular candlestick sample that usually indicators a downward reversal pattern when it comes to safety value. It’s fashioned when a niche seems between the bottom value of a doji-like candle and the candlestick of the day earlier than. The sooner candlestick is inexperienced, tall, and has small shadows. The doji candle can also be tailed by a niche between its lowest value level and the very best value level of the candle that comes subsequent, which is purple, tall and in addition has small shadows. The doji candle shadows should fully hole both beneath or above the shadows of the primary and third day in an effort to have the deserted child sample impact.

The bullish model of the Deserted Child sample is the Bullish Deserted Child sample.

2. Deserted Child – Bullish

A bullish Deserted Child candlestick sample is kind of uncommon so far as reversal patterns go. It kinds throughout a downtrend and consists of three value bars. The primary of the sample is a big down candle. Subsequent comes a doji candle that gaps beneath the candle earlier than it. The doji candle is then adopted by one other candle that opens even greater and swiftly strikes to the upside.

The bearish model of the Deserted Child sample is the Bearish Deserted Child sample.

3. Darkish Cloud Cowl – Bearish

Darkish Cloud Cowl is a two-candle bearish reversal candlestick sample present in an uptrend. The primary candle is inexperienced and has a bigger than common physique. The second candle is purple and opens above the excessive of the prior candle, creating a niche, after which closes beneath the midpoint of the primary candle. This sample reveals a potential shift within the momentum from the upside to the draw back, indicating {that a} reversal may occur quickly.

The bullish model of the Darkish Cloud Cowl sample is the Piercing candlestick sample.

4. Piercing – Bullish

Piercing is a two-candle bullish reversal candlestick sample present in a downtrend. The primary candle is purple and has a bigger than common physique. The second candle is inexperienced and opens beneath the low of the prior candle, creating a niche, after which closes above the midpoint of the primary candle. This sample reveals a potential shift within the momentum from the draw back to the upside, indicating {that a} reversal may occur quickly.

The bearish model of the Piercing sample is the Darkish Cloud Cowl candlestick sample.

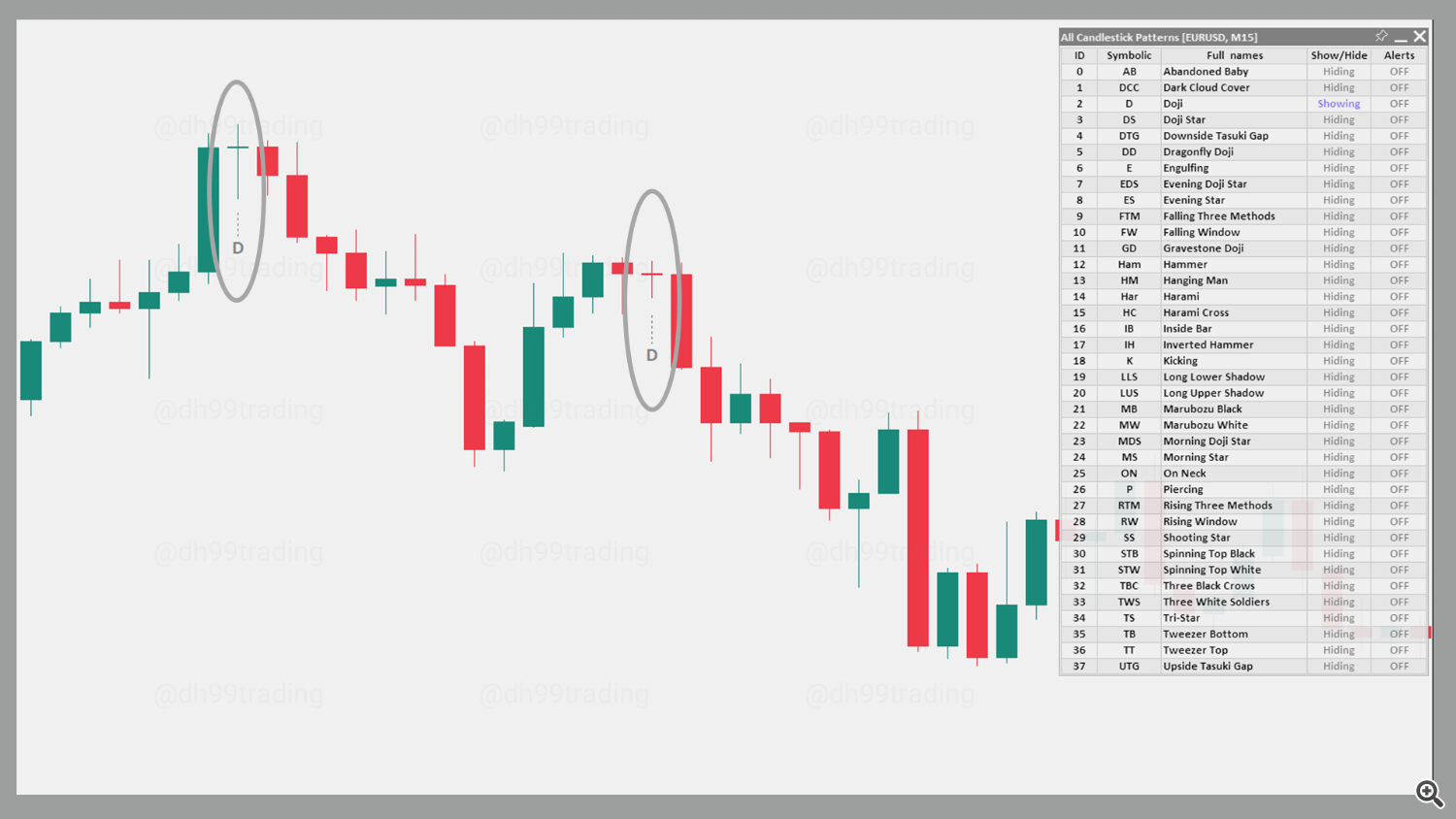

5. Doji

A doji candle kinds when the open and shut of a safety are primarily equal to one another. The size of each higher and decrease shadows might differ, inflicting the candlestick to both resemble a cross, an inverted cross, or a plus signal. Doji candles point out indecision out there as patrons and sellers compete for management.

Doji is commonly used as a impartial sample however can trace at potential reversals in particular contexts.

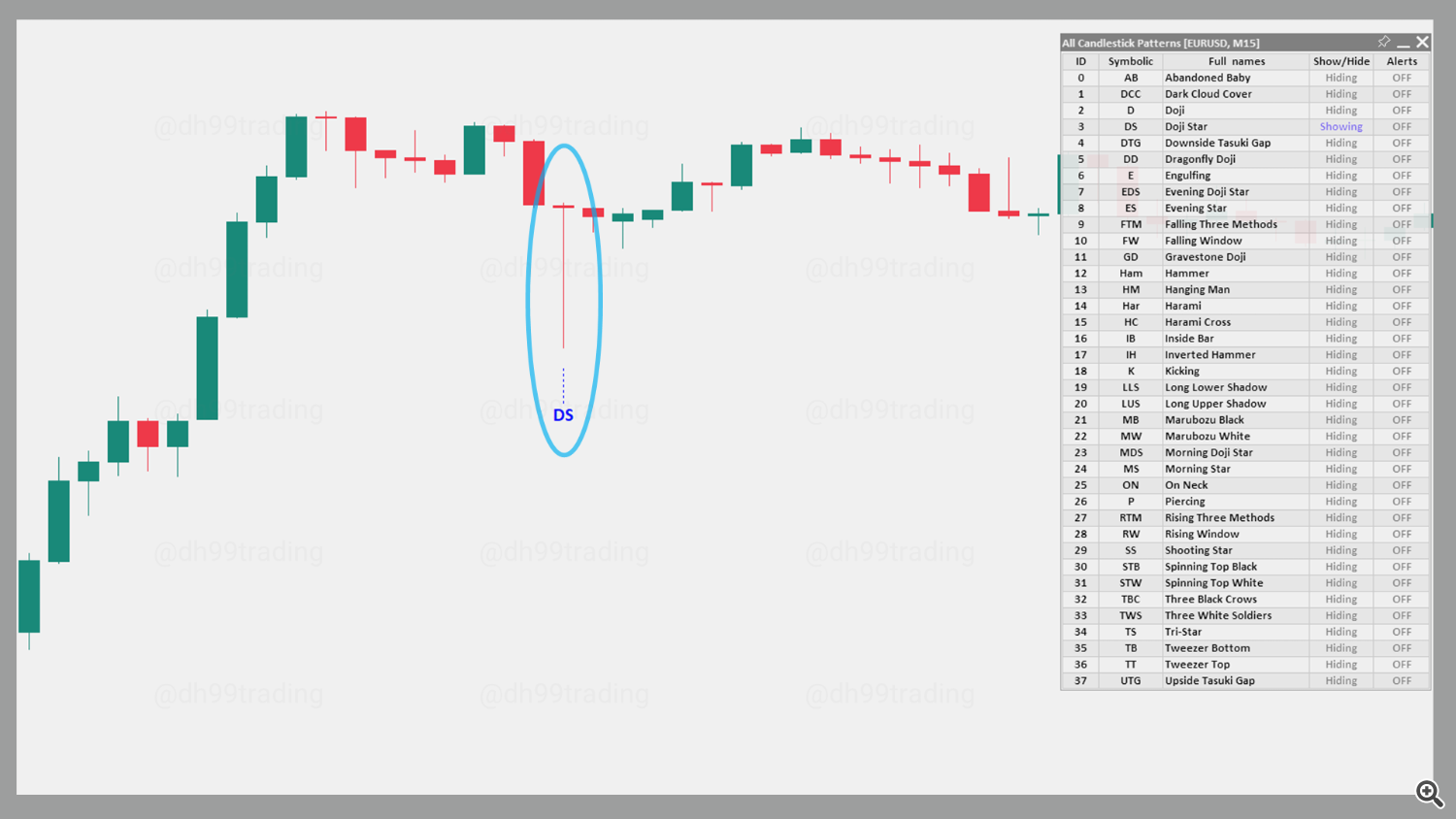

6. Doji Star – Bearish

The Bearish Doji Star is a two-candle sample usually present in an uptrend. It consists of a protracted inexperienced candle adopted by a Doji candle that opens above the physique of the primary one, creating a niche. This sample suggests a reversal sign with potential affirmation on the subsequent buying and selling day.

The bullish model of the Doji Star sample is the Bullish Doji Star sample.

7. Doji Star – Bullish

The Bullish Doji Star is a two-candle sample generally present in a downtrend. The sample consists of a protracted purple candle, adopted by a Doji candle that opens beneath the physique of the primary candle, creating a niche. It signifies potential reversal with affirmation from the subsequent day’s buying and selling.

The bearish model of the Doji Star sample is the Bearish Doji Star sample.

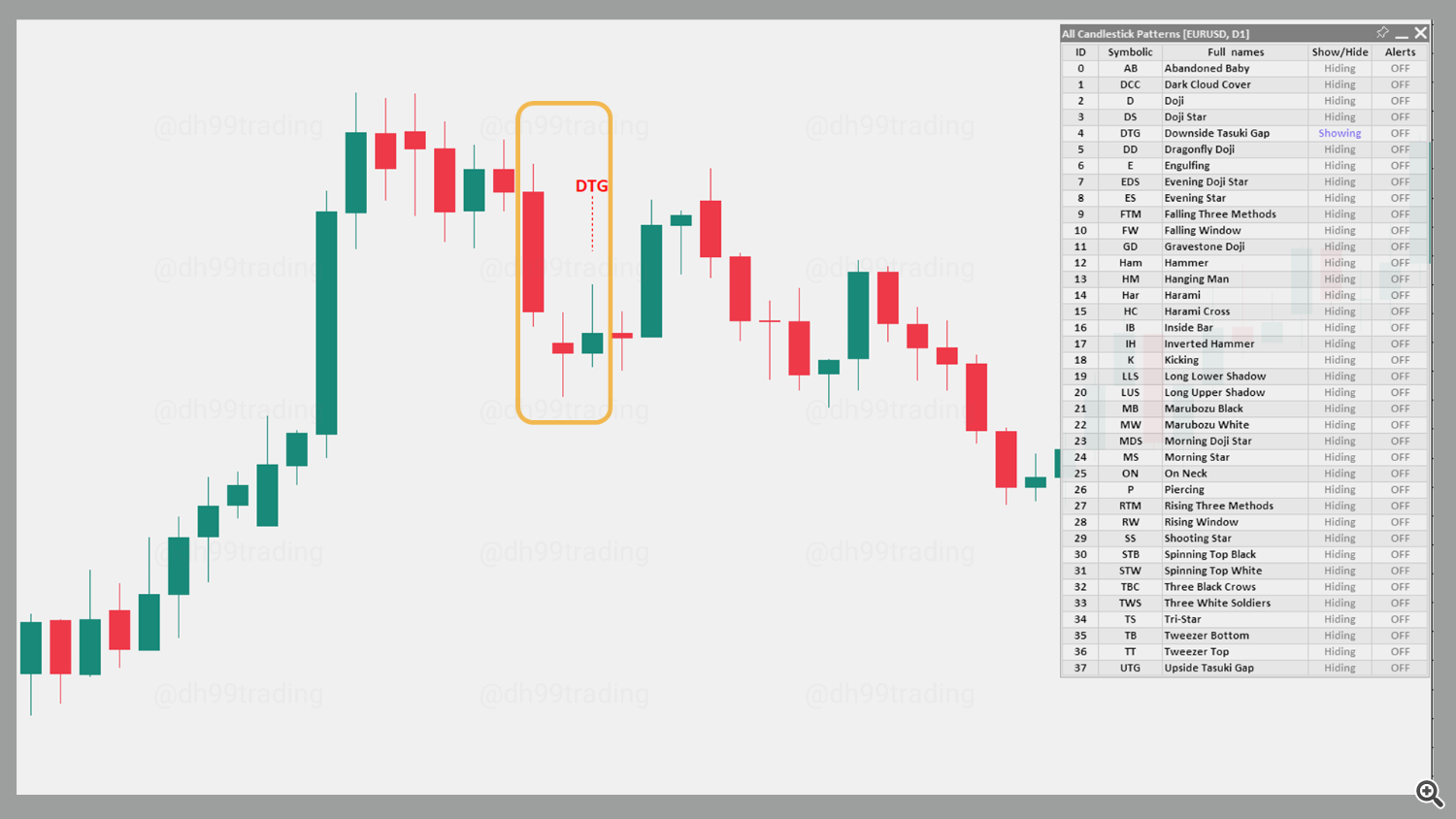

8. Draw back Tasuki Hole – Bearish

The Draw back Tasuki Hole is a three-candle sample present in a downtrend, suggesting a continuation of the bearish pattern. The primary two candles are lengthy and purple, with the second opening with a niche beneath the primary. The third candle is inexperienced and closes inside the hole however doesn’t shut it fully, indicating that the downtrend might proceed.

The bullish counterpart to this sample is the Upside Tasuki Hole sample.

9. Upside Tasuki Hole – Bullish

The Upside Tasuki Hole is a three-candle bullish continuation sample present in an uptrend. It consists of two lengthy inexperienced candles, with the second candle opening above the shut of the primary, creating a niche. The third candle is purple and closes inside the hole however doesn’t shut it solely, suggesting that the uptrend might proceed.

The bearish counterpart to this sample is the Draw back Tasuki Hole sample.

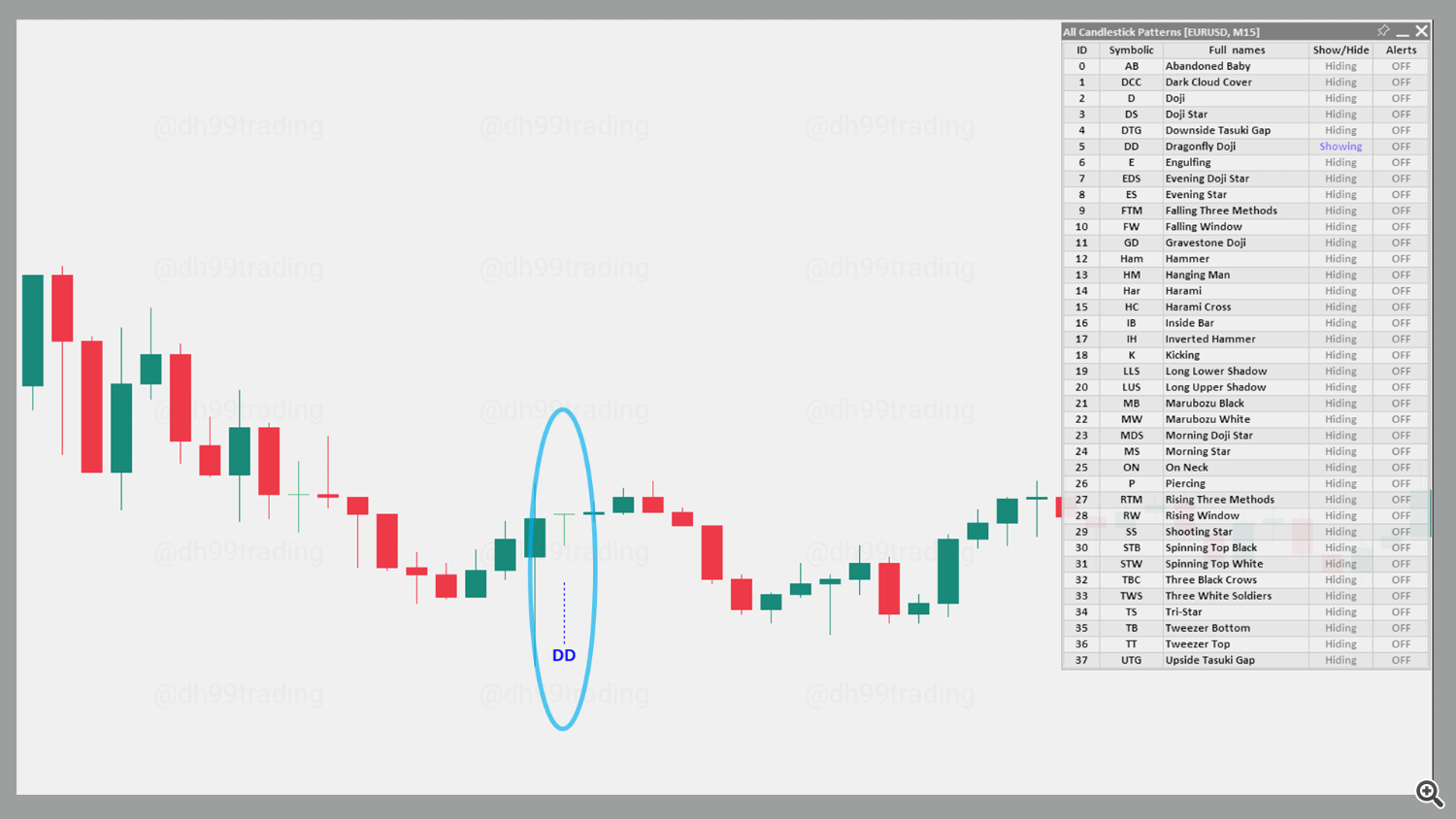

10. Dragonfly Doji – Bullish

The Dragonfly Doji is a particular Doji the place the open and shut are on the excessive of the session, leaving a protracted decrease shadow. This sample signifies that patrons regained management after sellers pushed costs decrease, and might usually counsel a bullish reversal, significantly when discovered at help ranges.

The bearish model of this sample is the Headstone Doji.

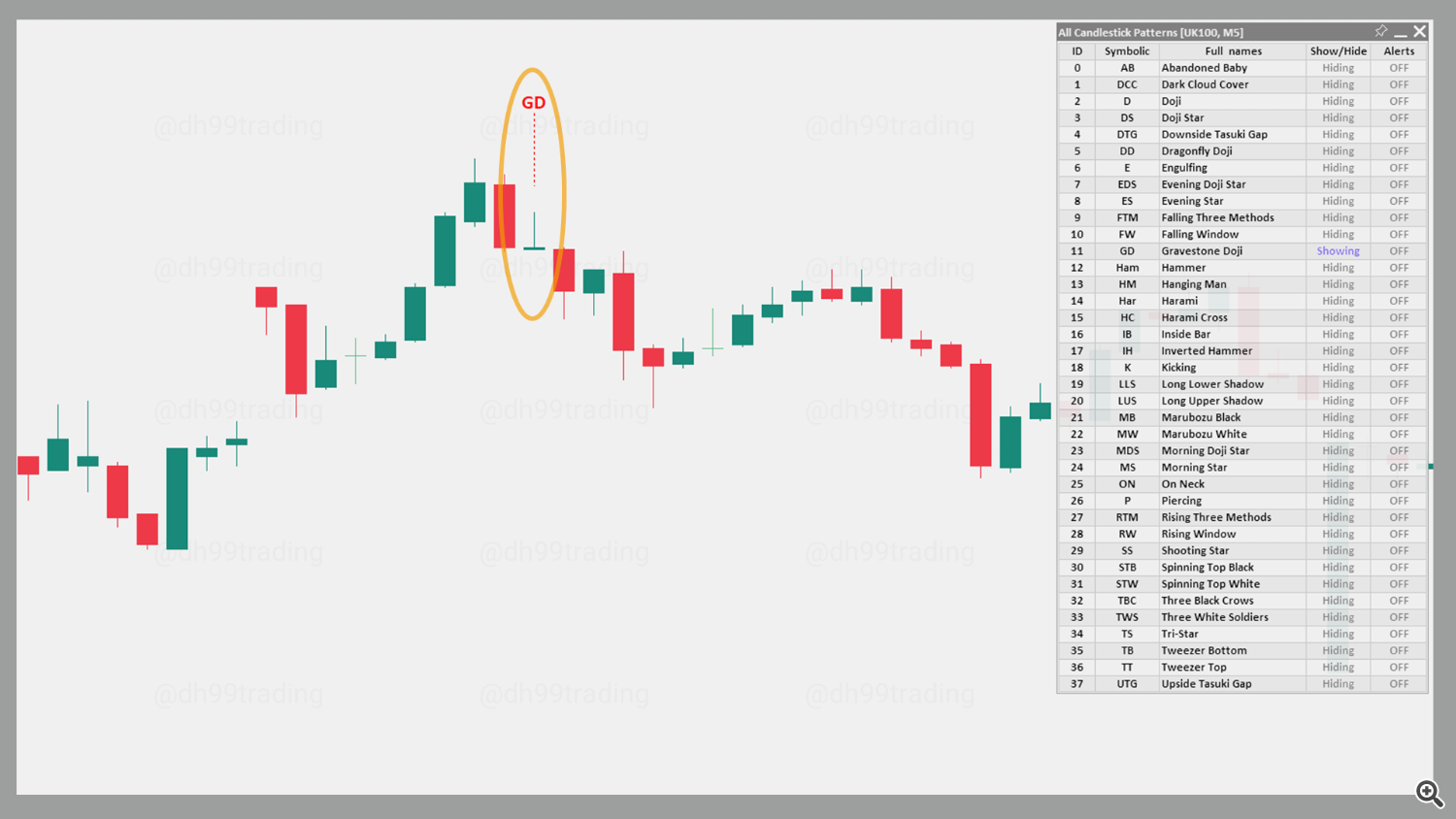

11. Headstone Doji – Bearish

The Headstone Doji is a bearish sample the place the open and shut are at or close to the low of the session, with a protracted higher shadow. This sample means that patrons pushed costs greater initially, however sellers regained management, pushing the value again down. It could actually sign a bearish reversal, particularly at resistance ranges.

The bullish model of this sample is the Dragonfly Doji.

12. Engulfing – Bearish

The Bearish Engulfing sample is a two-candle reversal sample sometimes discovered on the finish of an uptrend. The primary candle is inexperienced and smaller, whereas the second candle is purple and totally engulfs the physique of the earlier candle, indicating a shift from bullish to bearish sentiment.

The bullish model of this sample is the Bullish Engulfing sample.

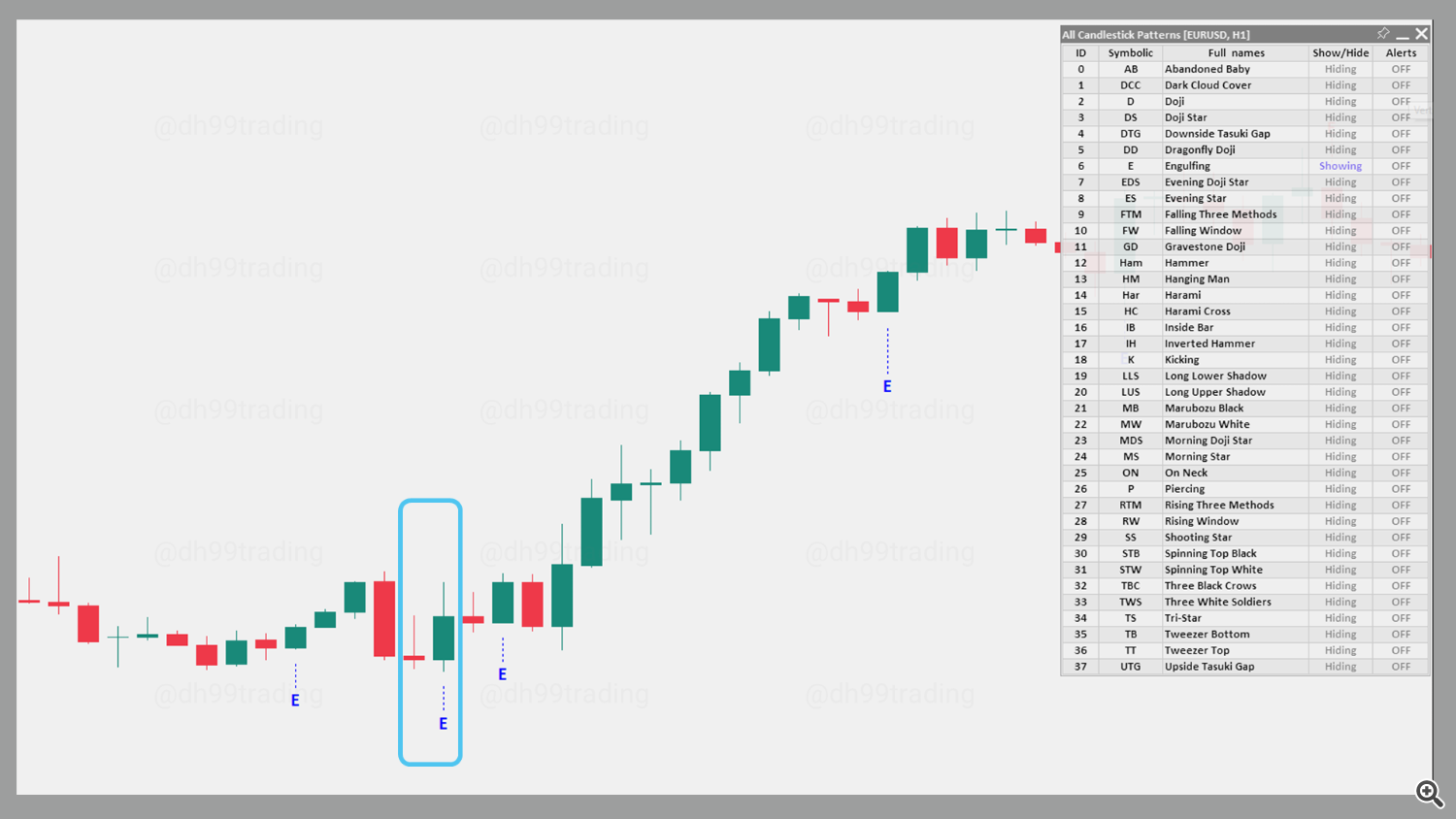

13. Engulfing – Bullish

The Bullish Engulfing sample is a two-candle reversal sample usually discovered on the finish of a downtrend. The primary candle is purple and smaller, whereas the second candle is inexperienced and totally engulfs the physique of the earlier candle, indicating a shift from bearish to bullish sentiment.

The bearish model of this sample is the Bearish Engulfing sample.

14. Night Doji Star – Bearish

The Night Doji Star is a three-candle sample that begins with a protracted inexperienced candle in an uptrend, adopted by a Doji that gaps up, and concludes with a purple candle that closes beneath the midpoint of the primary. This sample suggests a robust reversal as bullish momentum fades and promoting stress takes over.

The bullish counterpart to this sample is the Morning Doji Star sample.

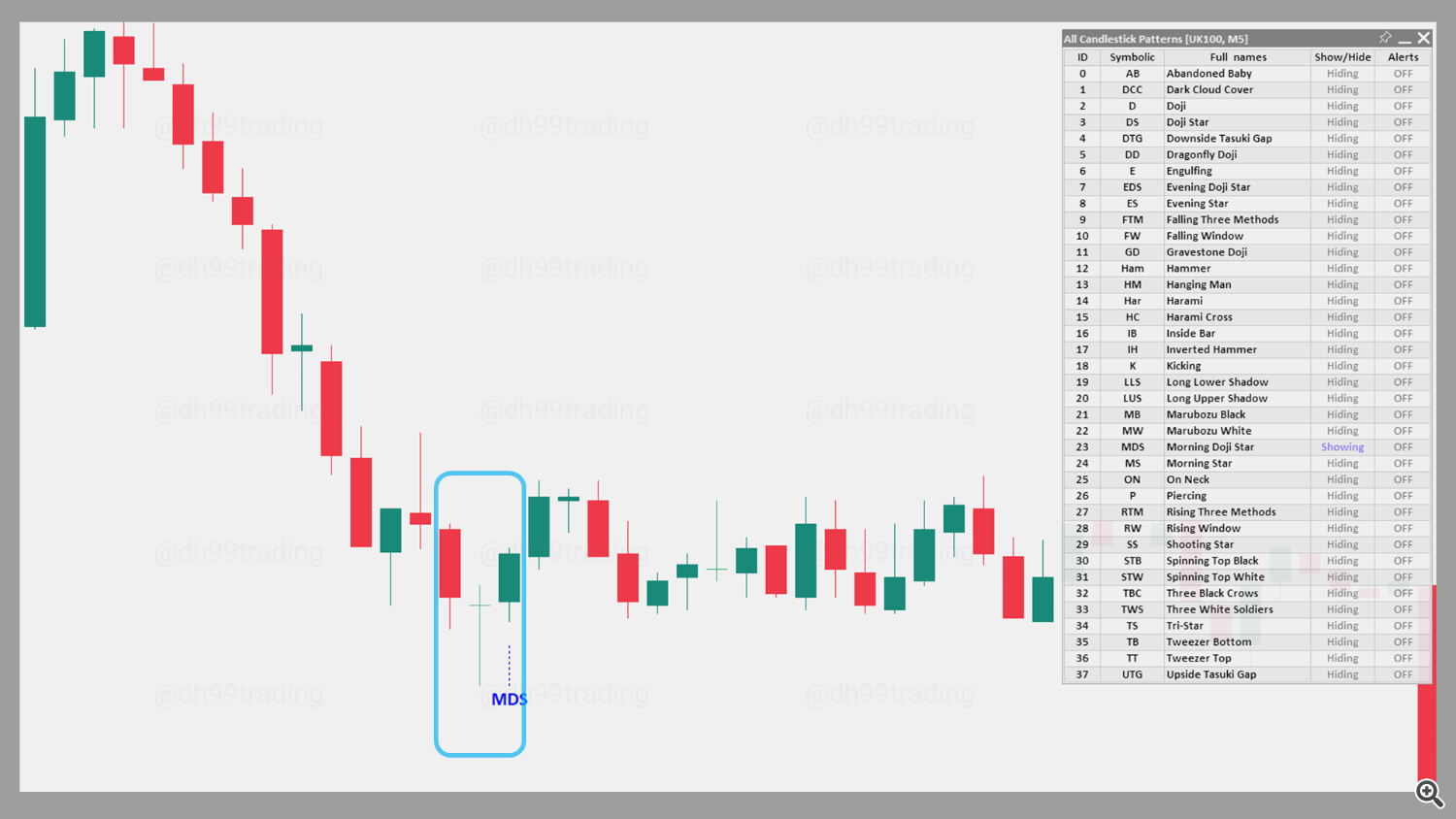

15. Morning Doji Star – Bullish

The Morning Doji Star is a bullish reversal sample that consists of a protracted purple candle in a downtrend, adopted by a Doji that gaps down, and concludes with a inexperienced candle that closes above the midpoint of the primary. This sample suggests a robust reversal as promoting stress fades and patrons regain management.

The bearish counterpart to this sample is the Night Doji Star sample.

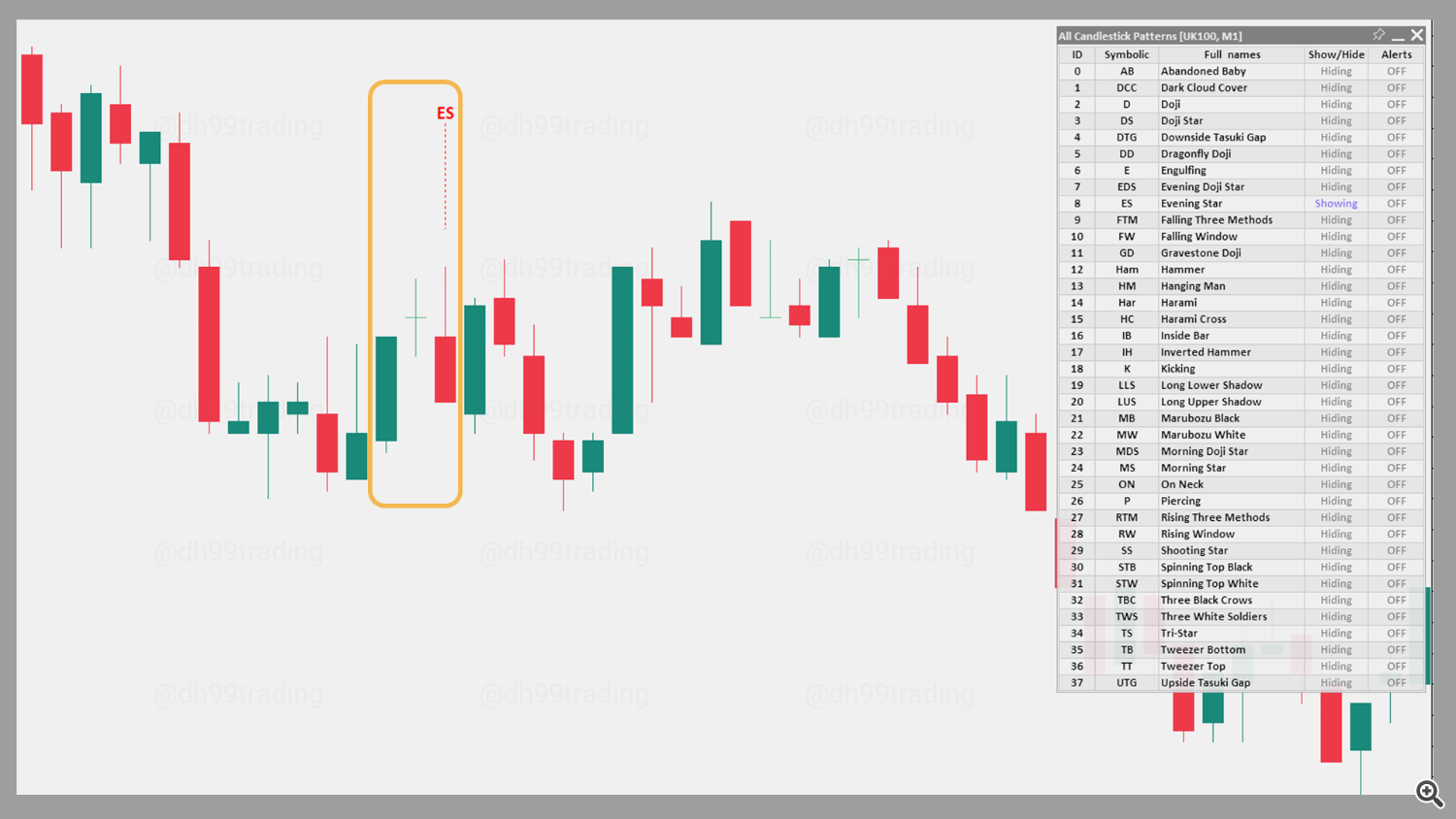

16. Night Star – Bearish

The Night Star is a bearish reversal sample that seems throughout an uptrend and consists of three candles. It begins with a protracted inexperienced candle, adopted by a small-bodied candle that gaps greater, and ends with a protracted purple candle closing beneath the midpoint of the primary. This sample indicators a reversal as bullish momentum weakens.

The bullish counterpart to this sample is the Morning Star sample.

17. Morning Star – Bullish

The Morning Star is a three-candle bullish reversal sample sometimes discovered on the finish of a downtrend. It begins with a protracted purple candle, adopted by a short-bodied candle that gaps down, and concludes with a protracted inexperienced candle that closes above the midpoint of the primary. This sample signifies a possible shift from bearish to bullish momentum.

The bearish counterpart to this sample is the Night Star sample.

18. Falling Three Strategies – Bearish

The Falling Three Strategies is a five-candle bearish continuation sample present in a downtrend. It begins with a protracted purple candle, adopted by three quick inexperienced candles that stay inside the vary of the primary, and concludes with one other lengthy purple candle closing beneath the primary. This sample means that the downtrend will proceed.

The bullish counterpart to this sample is the Rising Three Strategies sample.

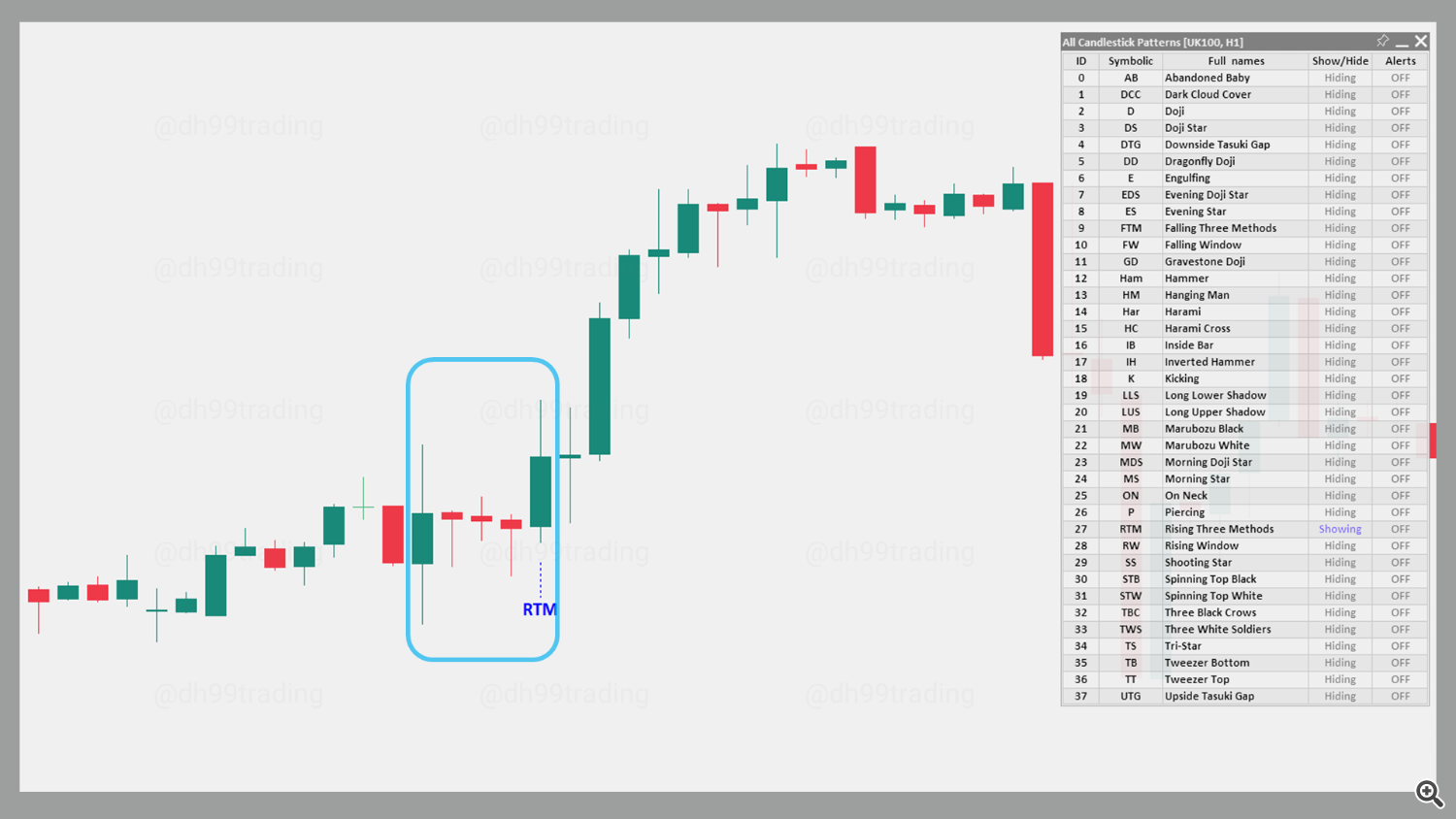

19. Rising Three Strategies – Bullish

The Rising Three Strategies is a bullish continuation sample sometimes present in an uptrend. It begins with a protracted inexperienced candle, adopted by three quick purple candles inside the vary of the primary candle, and ends with a protracted inexperienced candle that closes above the excessive of the primary. This sample signifies that the uptrend is more likely to proceed.

The bearish counterpart to this sample is the Falling Three Strategies sample.

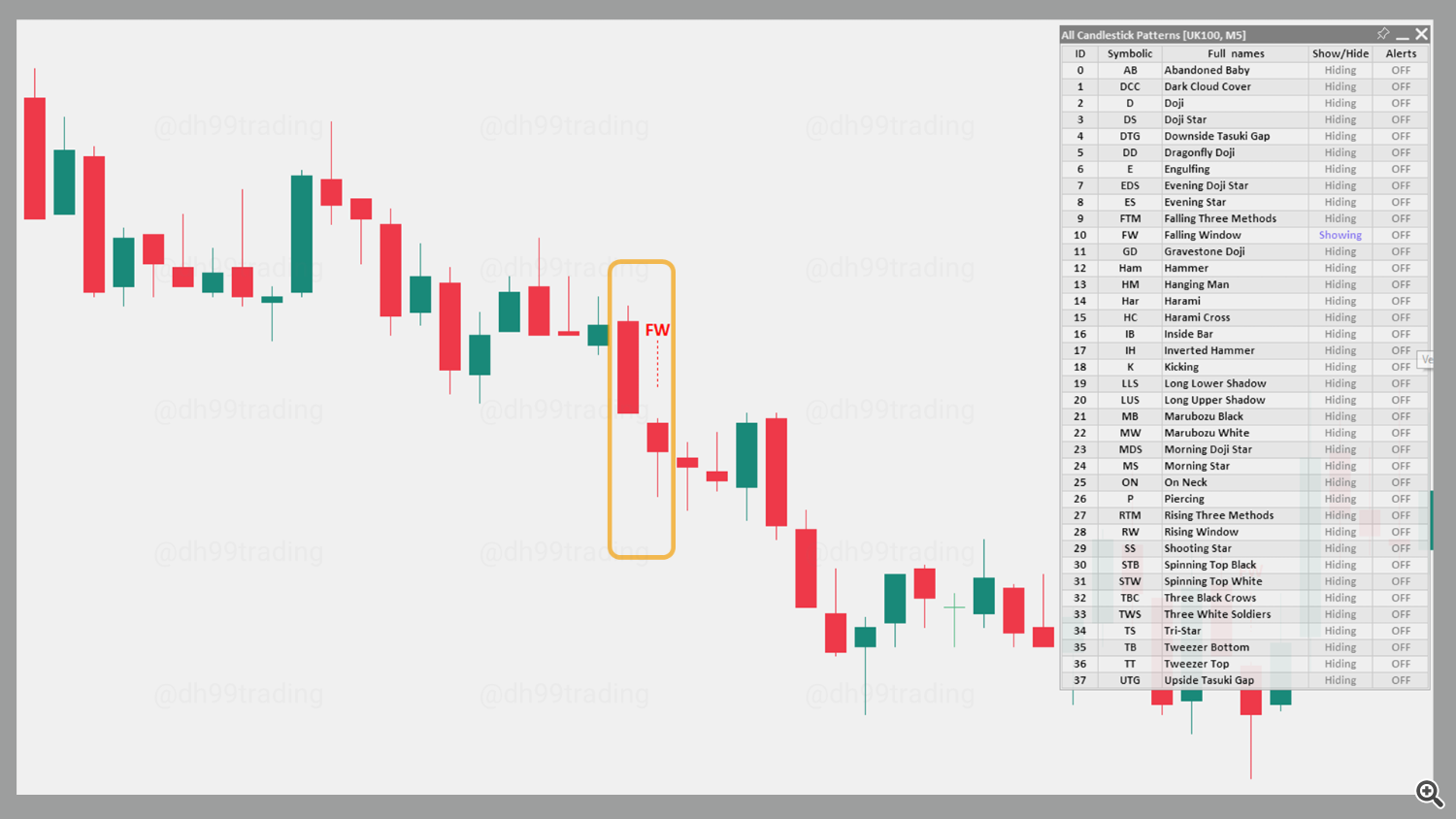

20. Falling Window – Bearish

The Falling Window is a two-candle bearish continuation sample that kinds throughout a downtrend. The second candle opens with a niche beneath the low of the primary candle, making a “window.” This sample signifies that the downtrend will seemingly proceed because the hole acts as resistance.

The bullish counterpart to this sample is the Rising Window sample.

21. Rising Window – Bullish

The Rising Window is a two-candle bullish continuation sample that kinds throughout an uptrend. The second candle opens with a niche above the excessive of the primary candle, making a “window.” This sample means that the uptrend will seemingly proceed because the hole acts as help.

The bearish counterpart to this sample is the Falling Window sample.

22. Hammer – Bullish

The Hammer is a bullish reversal sample that kinds on the backside of a downtrend. It has a small physique and a protracted decrease shadow, indicating that sellers initially pushed costs decrease however patrons regained management, closing the value close to the open. This sample suggests a possible upward reversal.

The bearish counterpart to this sample is the Hanging Man sample.

23. Hanging Man – Bearish

The Hanging Man is a bearish reversal sample that seems on the high of an uptrend. It has a small physique and a protracted decrease shadow, related in look to the Hammer, however indicators the alternative pattern. This sample suggests a possible reversal if adopted by a bearish candle.

The bullish counterpart to this sample is the Hammer sample.

24. Harami – Bearish

The Bearish Harami is a two-candle sample that normally seems throughout an uptrend. The primary candle is a protracted inexperienced candle, adopted by a smaller purple candle that’s solely inside the vary of the primary. This sample suggests a lack of bullish momentum and hints at a potential bearish reversal.

The bullish counterpart to this sample is the Bullish Harami sample.

25. Harami – Bullish

The Bullish Harami is a two-candle reversal sample present in a downtrend. The primary candle is a protracted purple candle, adopted by a smaller inexperienced candle that’s solely inside the vary of the primary. This sample suggests a weakening in bearish momentum and hints at a possible bullish reversal.

The bearish counterpart to this sample is the Bearish Harami sample.

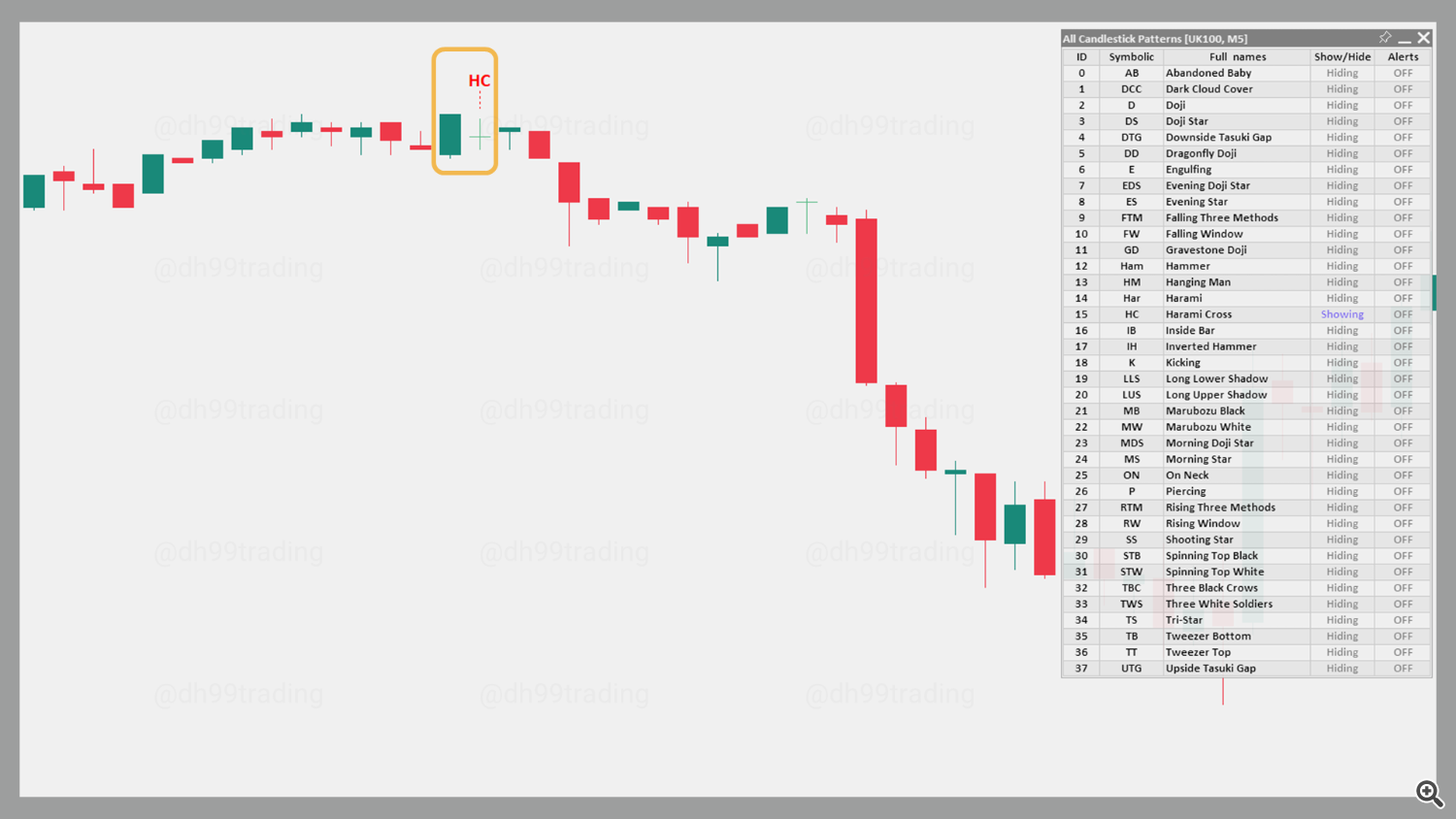

26. Harami Cross – Bearish

The Bearish Harami Cross is a variation of the Harami sample that sometimes seems throughout an uptrend. It consists of a protracted inexperienced candle adopted by a Doji candle that’s solely inside the vary of the primary candle. This sample signifies robust indecision amongst patrons and hints at a possible bearish reversal.

The bullish counterpart to this sample is the Bullish Harami Cross sample.

27. Harami Cross – Bullish

The Bullish Harami Cross is a variation of the Harami sample that seems throughout a downtrend. It consists of a protracted purple candle adopted by a Doji candle solely inside the vary of the primary. This sample suggests a possible bullish reversal as promoting stress diminishes.

The bearish counterpart to this sample is the Bearish Harami Cross sample.

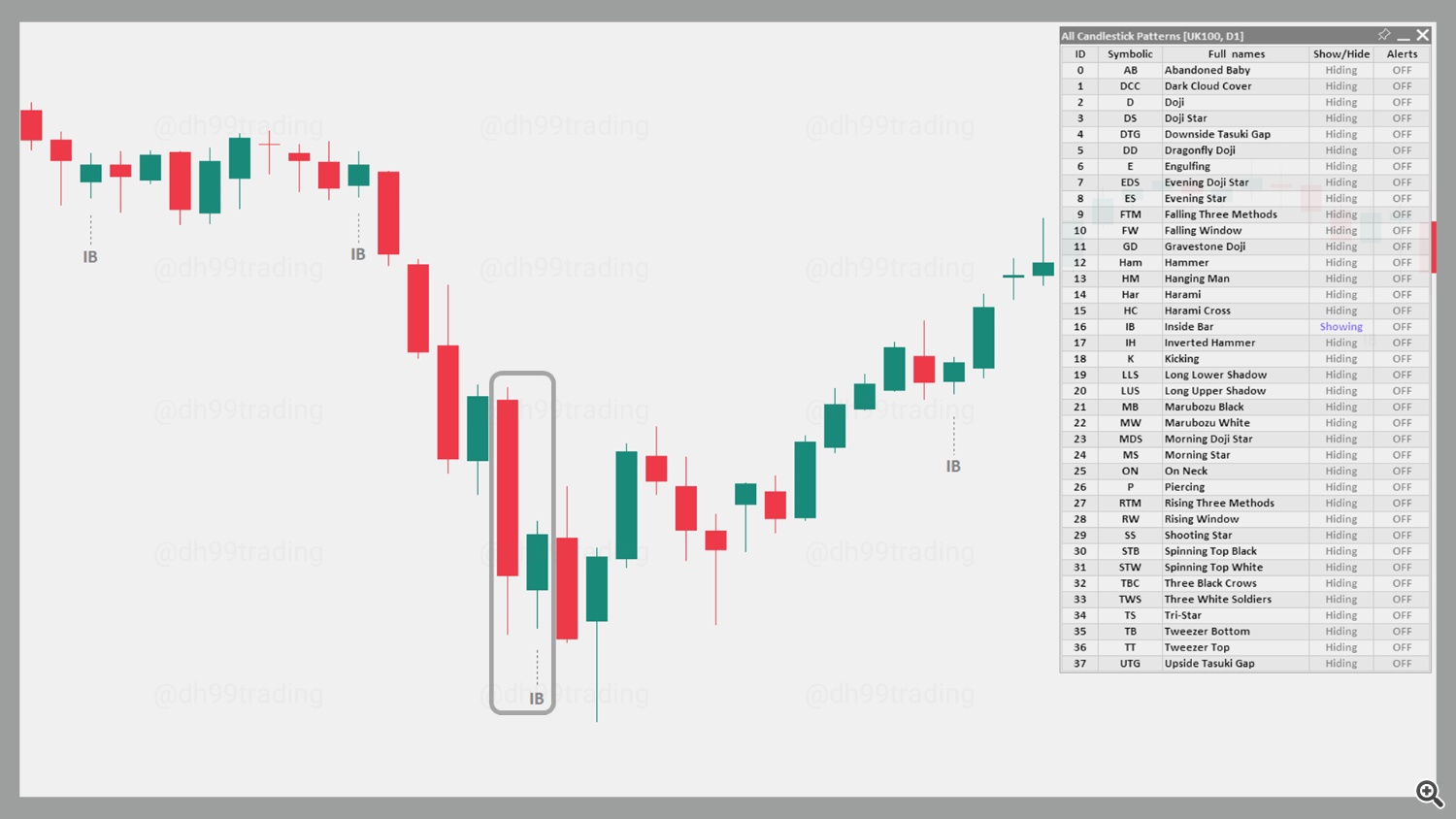

28. Inside Bar – Indecision

The Inside Bar is a candlestick sample the place the present bar’s excessive is decrease than the earlier bar’s excessive, and the present bar’s low is greater than the earlier bar’s low. This sample signifies consolidation and indecision out there, suggesting a breakout might happen. It could actually function a continuation or reversal sample, relying on the pattern context.

29. Inverted Hammer – Bullish

The Inverted Hammer is a bullish reversal sample that kinds throughout a downtrend. It has a small physique and a protracted higher shadow, resembling an upside-down hammer. This sample reveals that patrons tried to push costs greater however met resistance, suggesting a possible reversal if adopted by a bullish candle.

The bearish counterpart to this sample is the Taking pictures Star sample.

30. Taking pictures Star – Bearish

The Taking pictures Star is a bearish reversal sample that seems on the high of an uptrend. It has a small physique close to the low of the candle and a protracted higher shadow, indicating that patrons initially pushed costs greater however sellers took management, pushing the value again down close to the open. This sample suggests a possible downward reversal.

The bullish counterpart to this sample is the Inverted Hammer sample.

31. Kicking – Bearish

A bearish Kicking sample consists of two candles and signifies a possible reversal towards a downtrend. It begins with a bullish marubozu adopted by a bearish marubozu that gaps down, suggesting robust bearish momentum. This sample indicators a potential begin of a downtrend if the hole stays unfilled.

The bullish counterpart to this sample is the Bullish Kicking sample.

32. Kicking – Bullish

A bullish Kicking sample consists of two candles and signifies a possible reversal towards an uptrend. It begins with a bearish marubozu adopted by a bullish marubozu that gaps up, displaying robust bullish sentiment. This sample indicators a potential begin of an uptrend if the hole stays unfilled.

The bearish counterpart to this sample is the Bearish Kicking sample.

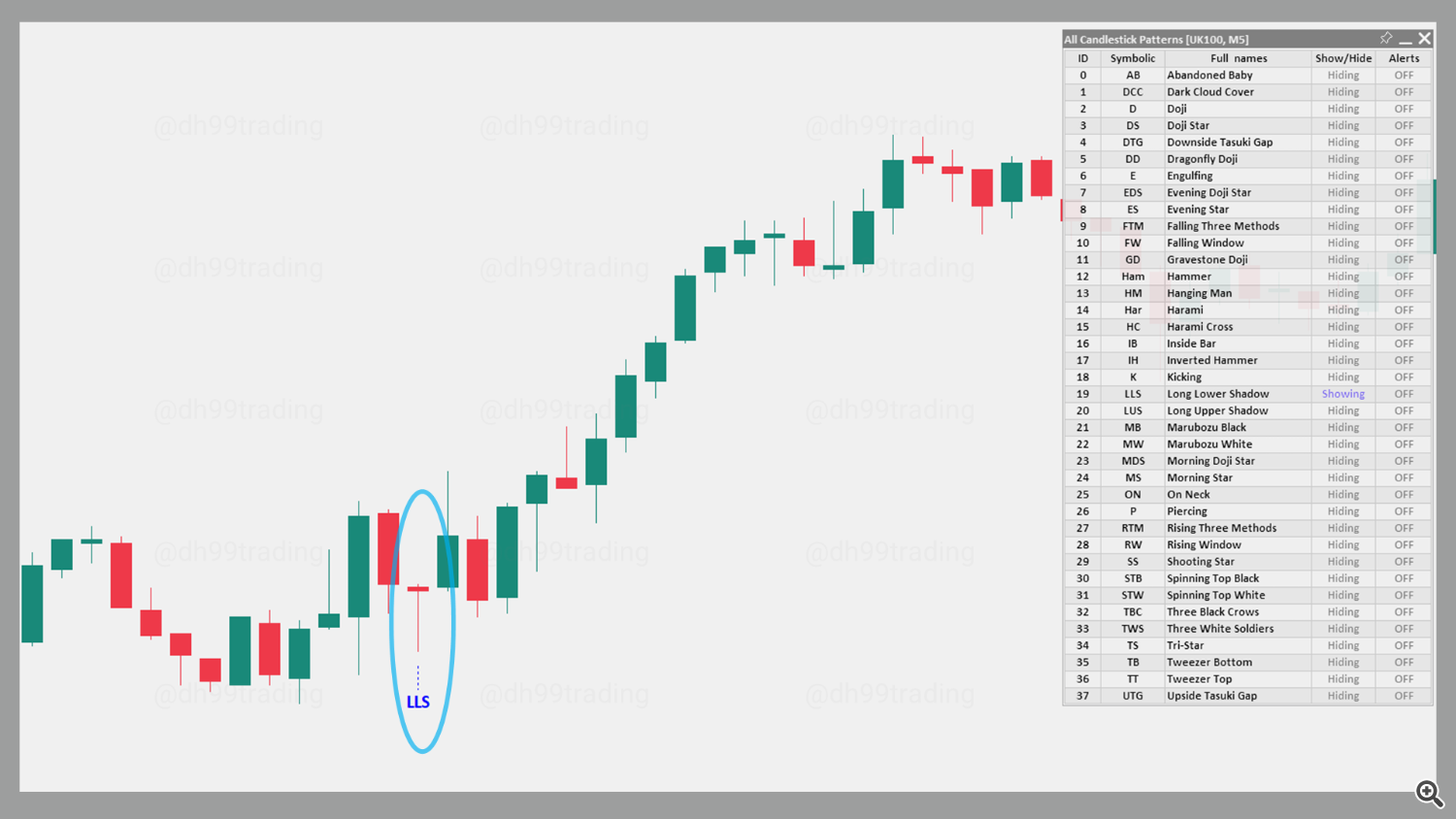

33. Lengthy Decrease Shadow – Bullish

The Lengthy Decrease Shadow is a bullish candlestick sample, indicating that sellers initially pushed costs decrease however patrons regained management by the shut. This sample suggests a possible upward reversal because the lengthy decrease shadow indicators shopping for curiosity.

The bearish counterpart to this sample is the Lengthy Higher Shadow sample.

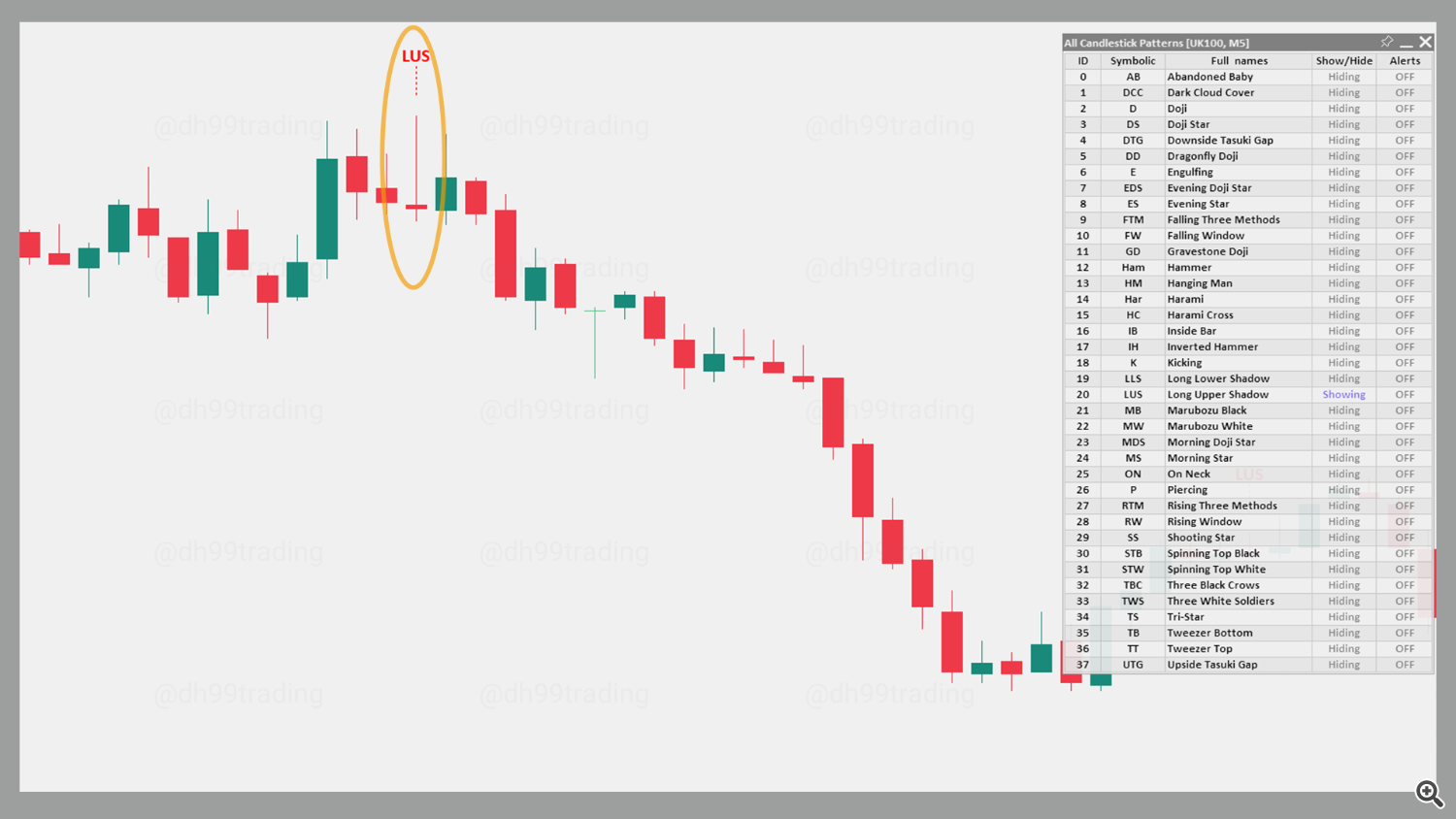

34. Lengthy Higher Shadow – Bearish

The Lengthy Higher Shadow is a bearish candlestick sample, indicating that patrons initially pushed costs greater however sellers regained management by the shut. This sample suggests a possible downward reversal because the lengthy higher shadow indicators promoting curiosity.

The bullish counterpart to this sample is the Lengthy Decrease Shadow sample.

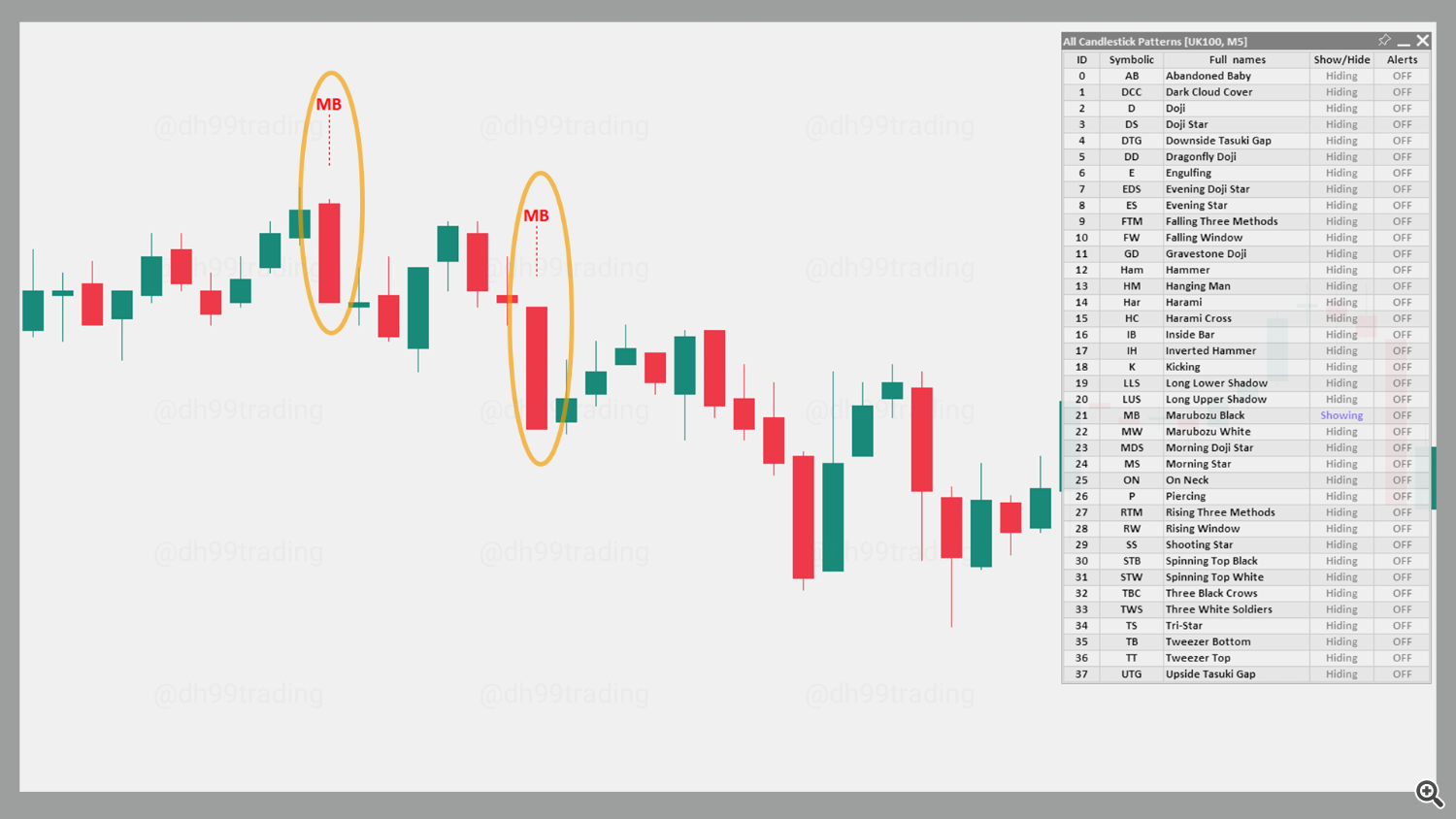

35. Marubozu Black – Bearish

The Marubozu Black is a bearish candlestick with no shadows, indicating robust promoting stress all through the session. It opens on the excessive and closes on the low, signaling that sellers have been in full management. This sample usually indicators a continuation of a downtrend.

The bullish counterpart to this sample is the Marubozu White candlestick sample.

36. Marubozu White – Bullish

The Marubozu White is a bullish candlestick with no shadows, indicating robust shopping for stress all through the session. It opens on the low and closes on the excessive, signaling that patrons have been in full management. This sample usually indicators a continuation of an uptrend.

The bearish counterpart to this sample is the Marubozu Black candlestick sample.

37. On Neck – Bearish

The On Neck is a two-candle bearish continuation sample present in a downtrend. The primary candle is lengthy and purple, adopted by a smaller inexperienced candle. The inexperienced candle’s shut is close to the low of the earlier purple candle, suggesting the downtrend may proceed.

38. Spinning Prime Black – Indecision

The Spinning Prime Black is a candlestick with a small purple physique and lengthy shadows, indicating indecision out there. This sample usually indicators a potential pause or reversal, as neither patrons nor sellers have gained management.

The bullish counterpart to this sample is the Spinning Prime White sample.

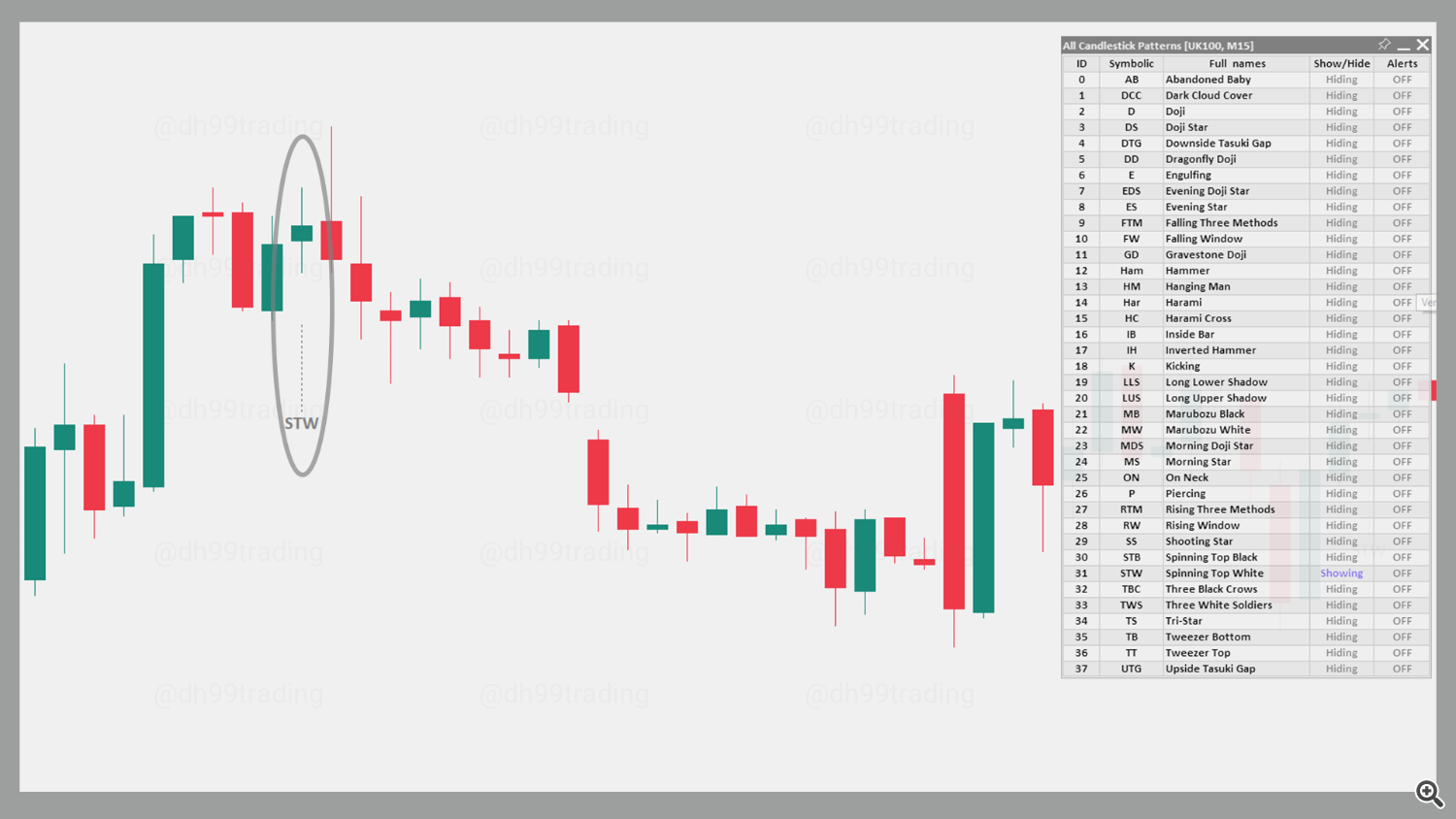

39. Spinning Prime White – Indecision

The Spinning Prime White is a candlestick with a small inexperienced physique and lengthy shadows, additionally indicating indecision out there. This sample indicators potential pause or reversal, displaying that neither patrons nor sellers have gained management.

The bearish counterpart to this sample is the Spinning Prime Black sample.

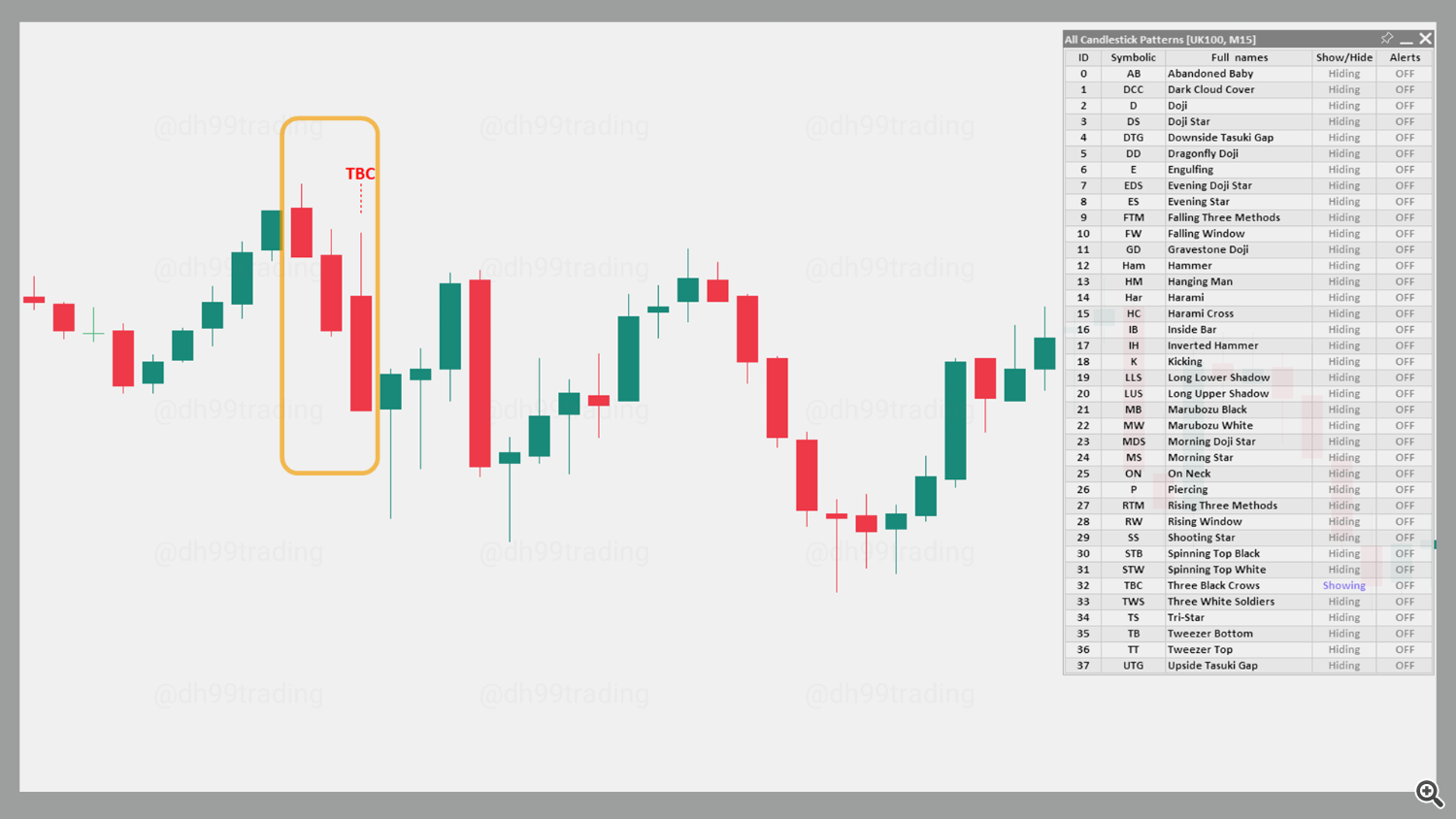

40. Three Black Crows – Bearish

The Three Black Crows is a bearish reversal sample that consists of three consecutive lengthy purple candles, every opening inside the physique of the earlier candle and shutting close to the low. This sample indicators robust bearish sentiment and the probability of a continued downtrend.

The bullish counterpart to this sample is the Three White Troopers sample.

41. Three White Troopers – Bullish

The Three White Troopers is a bullish reversal sample made up of three consecutive lengthy inexperienced candles, every opening inside the physique of the earlier candle and shutting close to the excessive. This sample suggests robust bullish sentiment and the probability of a continued uptrend as patrons push costs greater in succession.

The bearish counterpart to this sample is the Three Black Crows sample.

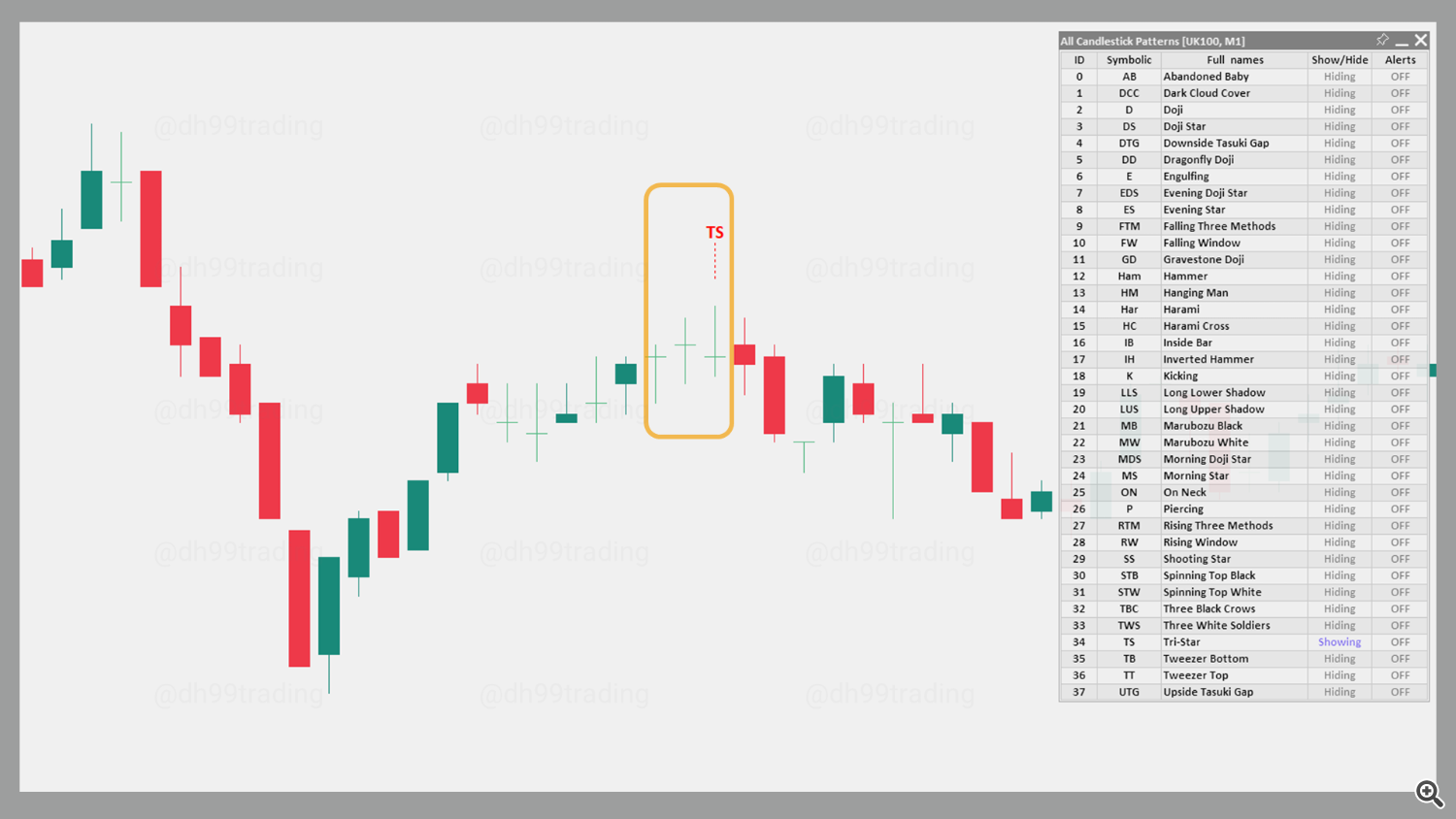

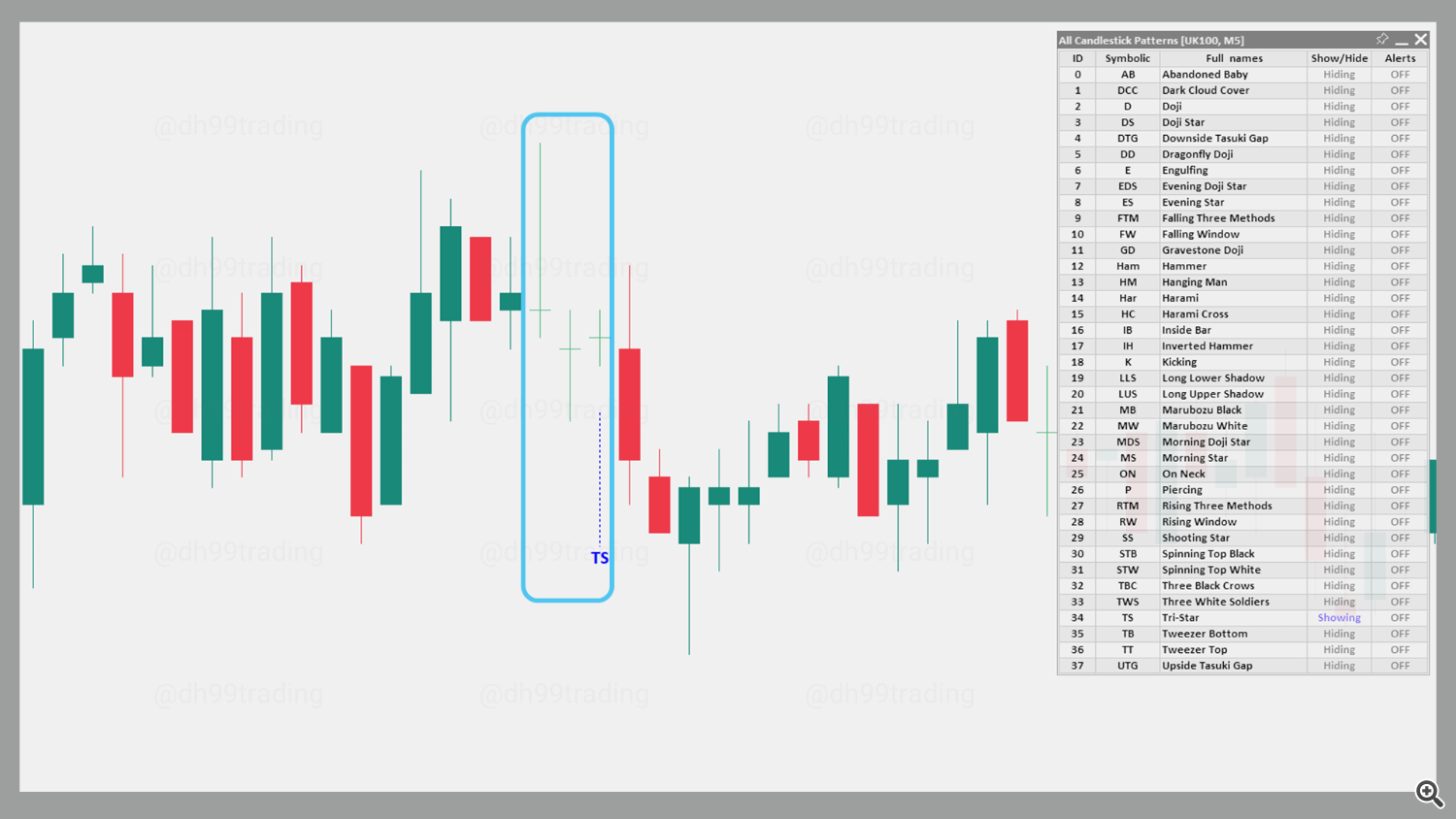

42. Tri Star – Bearish

A bearish Tri Star sample can kind when three consecutive Doji candles seem on the high of an uptrend. The sample signifies robust indecision adopted by a possible reversal, as market sentiment shifts from bullish to bearish.

The bullish counterpart to this sample is the Bullish Tri Star sample.

43. Tri Star – Bullish

A bullish Tri Star sample can kind when three consecutive Doji candles materialize on the tail-end of a downtrend. The sample signifies robust indecision adopted by a possible reversal, as market sentiment shifts from bearish to bullish.

The bearish counterpart to this sample is the Bearish Tri Star sample.

44. Tweezer Backside – Bullish

The Tweezer Backside is a two-candle sample that signifies a possible bullish reversal. The sample is discovered throughout a downtrend. The primary candle is lengthy and purple, and the second candle is inexperienced with a low practically similar to the low of the earlier candle. The same lows, together with the inverted instructions, trace that patrons could also be taking up.

The bearish counterpart to this sample is the Tweezer Prime sample.

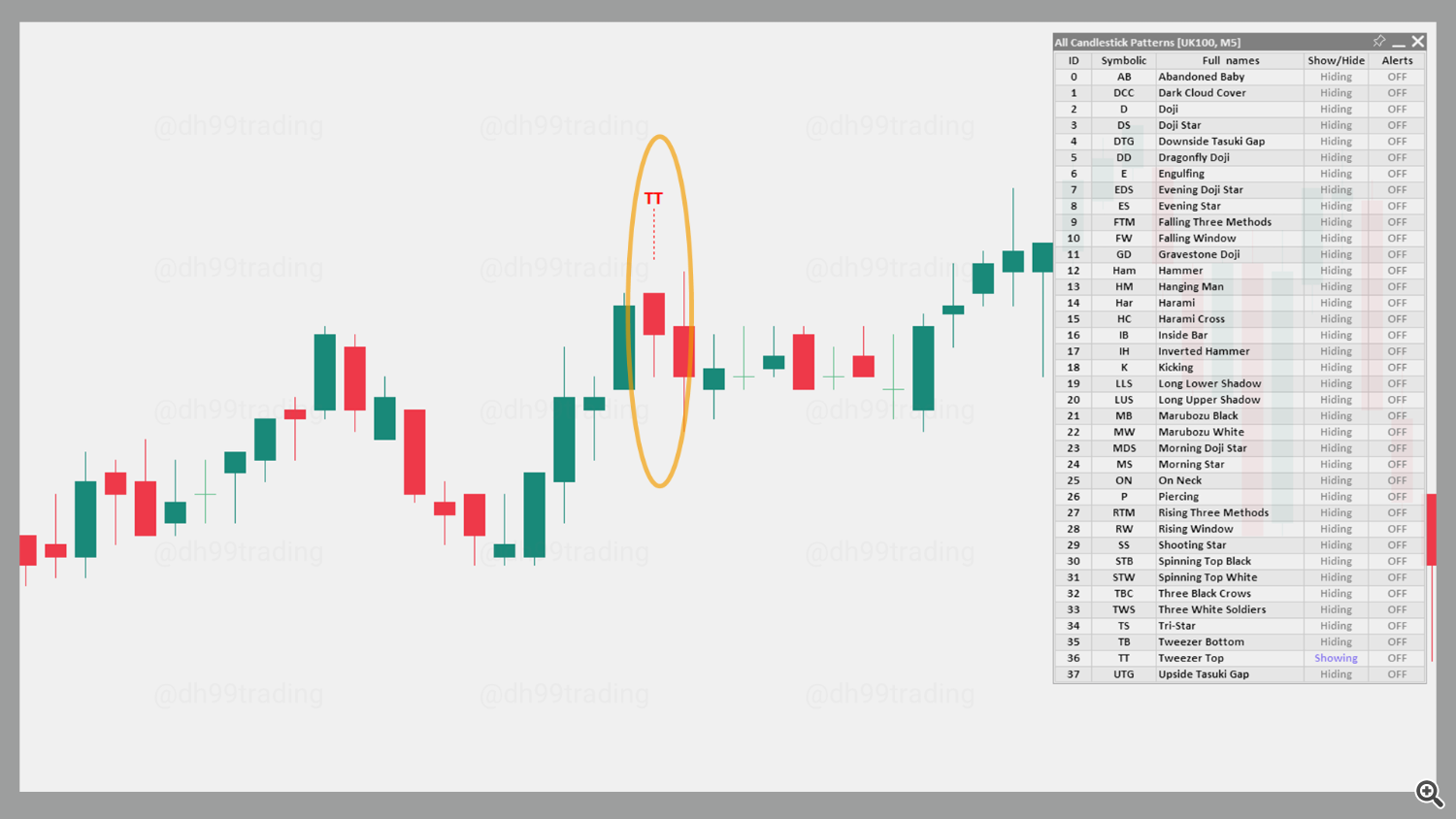

45. Tweezer Prime – Bearish

The Tweezer Prime is a two-candle sample that signifies a possible bearish reversal. The sample is discovered throughout an uptrend. The primary candle is lengthy and inexperienced, and the second candle is purple with a excessive practically similar to the excessive of the earlier candle. The same highs, together with the inverted instructions, trace that sellers could also be gaining management.

The bullish counterpart to this sample is the Tweezer Backside sample.

Candlestick patterns present invaluable insights into market psychology and potential value actions, serving to merchants anticipate reversals, continuations, and factors of indecision. By mastering these patterns and understanding the nuanced indicators they provide, merchants can enhance their analytical expertise and make extra knowledgeable choices. Whether or not a novice or an skilled dealer, the applying of those patterns, supported by the All Candlestick Patterns indicator, can function a robust asset in navigating advanced monetary markets. Embrace these instruments to reinforce your buying and selling technique and keep forward in a dynamic market panorama.