Ethereum is in a traditional accumulation part following its latest correction and is now concentrating on a $3,000 worth. After dropping to $2,116 simply 20 days in the past, ETH skilled a big worth surge, recovering to increased ranges, suggesting bullish momentum was constructing.

Associated Studying

This accumulation part has drawn the eye of analysts and traders alike, who at the moment are intently monitoring Ethereum’s worth motion for indicators of a extra important transfer to the upside. The restoration from latest lows has sparked renewed optimism, with some market consultants predicting that ETH might attain $3,000 within the coming days.

This potential rally is a important milestone in Ethereum’s ongoing market cycle, reflecting its power and traders’ confidence in its long-term worth. As Ethereum continues to build up and consolidate, the market is bracing for what might be a serious breakout, setting the stage for brand new highs shortly.

Ethereum Value Construction Suggests A Coming Breakout

After a comparatively lengthy interval of consolidation, Ethereum seems poised for a transfer towards increased costs.

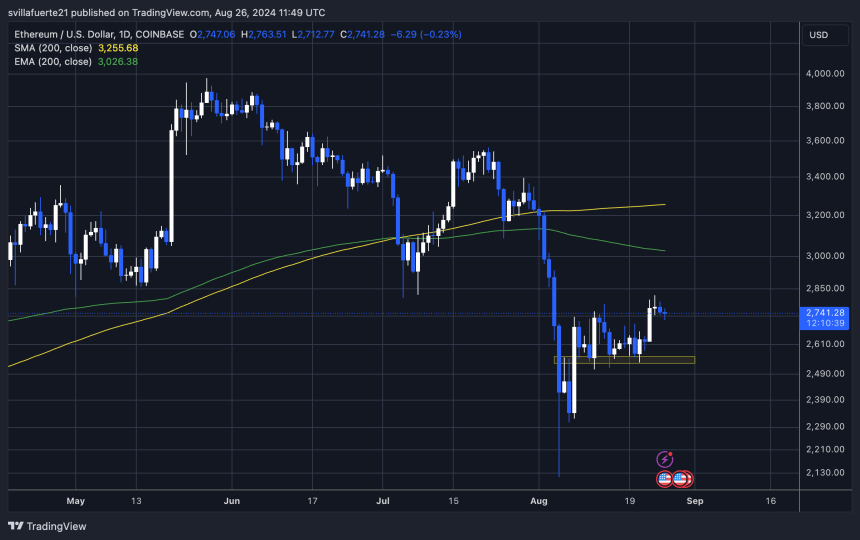

Analyst and dealer Castillo Dealer shared a technical evaluation on X, highlighting a possible ETH trajectory shift. In keeping with Castillo, ETH will seemingly retest decrease demand at $2,611 earlier than concentrating on the numerous $3,000 mark. The 4-hour chart means that this era of consolidation has reached a tipping level, an vital transfer might be imminent.

The $3,000 degree is not only a psychological barrier; it has additionally acted as a help in latest months earlier than breaking down firstly of this month, making it an important resistance to interrupt. If Ethereum efficiently breaks above this degree and consolidates, it might pave the best way for a sustained uptrend.

Associated Studying

This anticipated breakout might start a brand new bullish part for Ethereum because the market seems to maneuver previous the latest interval of stagnation and push towards new highs. Traders and merchants are intently watching these developments, as the following few days might be important in figuring out Ethereum’s path.

ETH Technical Evaluation

Ethereum is buying and selling at $2,743; its subsequent transfer might go both manner. ETH may retest decrease demand round $2,500 earlier than making an attempt to push towards the $3,000 mark. This retest would enable the market to determine a stronger basis for a sustained uptrend. Nonetheless, given latest volatility, there’s additionally an opportunity that Ethereum might bypass the retest and push to $3,000.

Volatility has proven that something can occur, and the speedy worth actions are a testomony to this unpredictability. A vital technical degree to observe is the each day 200 exponential transferring common (EMA), at the moment at $3,026. This EMA acts as a resistance level, and breaking above it might strongly point out a bullish continuation for Ethereum.

Associated Studying

It might verify power if Ethereum breaks via the $3,000 psychological degree and closes above the 200 EMA. This could solidify the bullish sentiment amongst merchants and traders, positioning Ethereum for a extra prolonged rally.

Featured picture created with Dall-E, chart from Tradingview.com