Irrespective of the way you slice it, small and mid caps have been completely crushed on a relative foundation since 2021. The unlucky half about that is that almost all merchants have recency bias. They consider no matter has been working will proceed to work and issues that have not been working ought to proceed to be ignored. In the event you examine inventory market historical past, you recognize this is not the way it works.

First, I would like you to take a look at a small cap vs. massive cap relative ratio (IWM:SPY) for the reason that flip of the century:

It is quite clear that small caps have been utterly out of favor for the previous 3 years. And that is what merchants know and bear in mind. But when we step again and have a look at the Large Image, then we understand that there are occasions when small caps completely TROUNCE massive caps. I consider we’re coming into a kind of bullish durations and I circled the current motion as an instance it. Whereas small caps have seen an enormous leap lately, this charts demonstrates that if this era of small cap management is simply starting, issues might get VERY thrilling into yr finish and all through 2025. Should not we no less than entertain this concept? For additional affirmation of a serious shift into small caps, watch the July relative excessive close to 0.41. If that degree is cleared, the chances of a way more important rotation into small caps improve considerably.

I started discussing small cap outperformance all the best way again in January 2024 at our MarketVision 2024 occasion the place I laid out my themes for 2024. I indicated that the Fed’s reducing of the fed funds fee would ship the small and mid cap areas flying, which it has, although it was delayed on account of the Fed protecting charges “increased for longer”. The inventory market started anticipating a a lot decrease fed funds fee again in July, when the June Core CPI got here in a lot better than anticipated. Small caps RIPPED to the upside with the IWM outperforming the QQQ by 18 share factors in just a bit over two weeks – speedy and violent rotation that, in my view, predicted far more rotation to small and mid caps forward. We’re now seeing that.

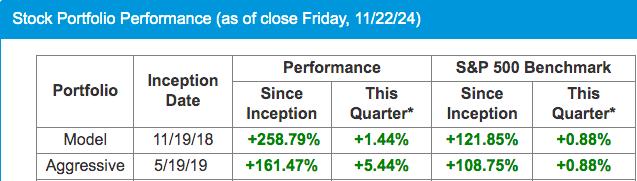

At EarningsBeats.com, we “draft” 10 equal-weighted shares into our portfolios each quarter. At our draft on August nineteenth, we loaded our Aggressive Portfolio with small and mid cap shares in anticipation of management in these asset lessons. Our Aggressive Portfolio outcomes had been very spectacular:

The S&P 500, from August nineteenth by the replace on November fifteenth, gained 4.68%, however our Aggressive Portfolio scorched increased by 25.75%. That kind of outperformance could make an enormous distinction in your monetary future. On Monday night time, we introduced the shares that may be a part of our Aggressive Portfolio for the following 90 days. Up to now, it is a small pattern, however outcomes have been equally spectacular:

After quintupling the S&P 500 within the prior quarter, our Aggressive Portfolio has upped its relative efficiency and at present is sextupling the S&P 500’s efficiency. One inventory on this portfolio is Lemonade (LMND). Once we introduced our Aggressive Portfolio shares that we “drafted” on Monday, LMND had simply closed at 34.31. By Thursday, LMND had surged to an intraday excessive of 52.22, representing greater than a 50% transfer in lower than 3 days! Whereas we actually do not count on this kind of outperformance, it does underscore the chances when small and mid caps get on a roll and are seeing cash rotate into these asset lessons. One other inventory on this Portfolio jumped practically 25% and a pair others had gained greater than 10%.

Study Extra About Small and Mid Cap Shares

Final weekend, I provided our FREE EB Digest subscribers a Particular Supply. I produced a video highlighting a chart that’s SCREAMING at us to purchase small and mid cap shares, together with 10 small and mid cap shares that I actually like. A few of these 10 made it into our Portfolios that had been introduced on Monday. I am glad to increase this provide. Anybody that would really like a duplicate of this Small and Mid Cap recording and in addition want to see ALL of the shares that at the moment are in our Portfolios, CLICK HERE to start out your 30-day FREE trial to our EB service. There is a quite simple elementary purpose why we’re seeing this shift into small and mid caps and I present you on the Small and Mid Cap recording. If I proceed to be appropriate about this small and mid cap explosion, it will seemingly transform your finest choice of 2024. Kick the tires at EarningsBeats.com, take a look at our small and mid cap favorites, and prepare to enhance your buying and selling outcomes!

It is also the beginning of our Fall Particular. Due to this fact, signing up for a FREE 30-day trial makes a ton of sense proper now. In the event you like our service, you may have the chance to avoid wasting $200 on our annual membership underneath the Fall Particular. An annual membership will embrace your FREE registration into our MarketVision 2025 occasion in January, priced at greater than $500 for non-members.

YouTube Present

Lastly, my weekly market report, “This is Why Small and Mid Caps Will Hold Flying!”, was up to date earlier and is now accessible on YouTube. Please “Like” the video and “Subscribe” to our YouTube channel as we proceed to construct our on-line neighborhood! Thanks a lot in your help!

Glad buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Every day Market Report (DMR), offering steering to EB.com members each day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a novel talent set to strategy the U.S. inventory market.