I’ve shared a number of articles outlining why I imagine actual property funding trusts (REITs) are higher investments than rental properties generally. In abstract, research persistently exhibit that REITs ship superior returns, are inherently safer, and require considerably much less effort to handle.

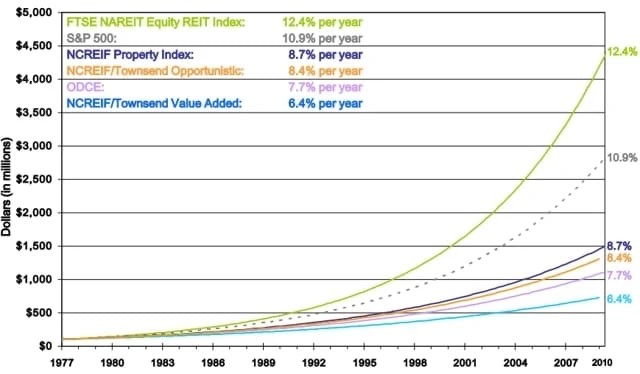

Examine 1: FTSE Fairness REIT Index in comparison with NCREIF Property Index as an annual return proportion (1977-2010)—EPRA

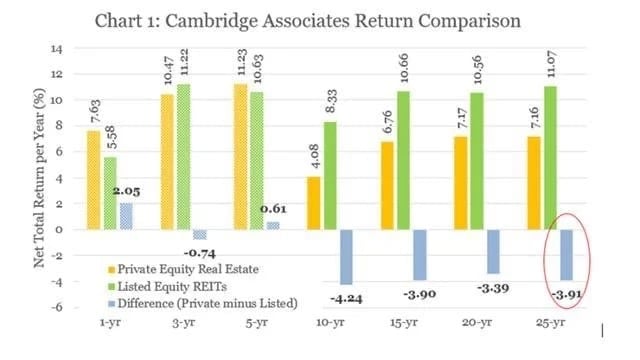

Examine 2: Personal fairness actual property in comparison with listed fairness REITs as internet whole return per yr over 25 years—Cambridge Associates

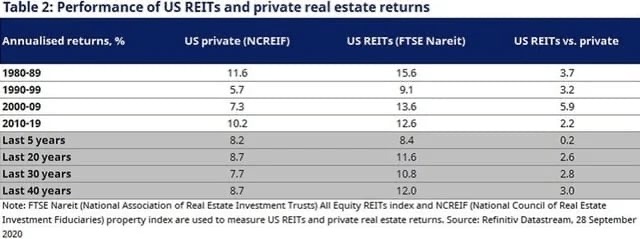

Examine 3: Efficiency of U.S. REITs and personal actual property returns (1980-2019)—NAREIT

This is especially true at the moment, as REITs are at the moment priced at traditionally low valuations—ranges not seen because the Nice Monetary Disaster. It’s commonplace to search out REITs buying and selling at substantial reductions to the intrinsic worth of their properties after accounting for debt.

Given these situations, investing in rental properties makes even much less sense now, as it could contain paying a premium for related publicity.

Now, let’s transition from concept to observe: I’ll spotlight three of my prime REIT picks for 2025. I’ve intentionally chosen higher-yielding REITs to handle the widespread false impression amongst rental property traders that REIT dividend yields are too low.

This notion is way from correct. The REITs I’m about to debate supply dividend yields of as much as 10%—yields which can be not solely sustainable but in addition rising. Moreover, these REITs commerce at important reductions, providing upside potential of as much as 50% in a restoration.

1. Armada Hoffler Properties (AHH)

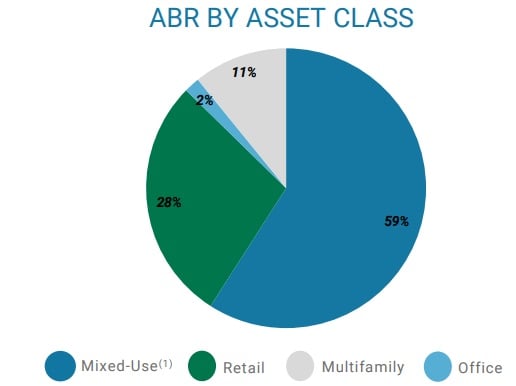

AHH stands out as the one REIT specializing in mixed-use properties, which mix retail, residential, workplace, and different makes use of right into a single improvement:

These mixed-use properties are extremely fascinating, commanding premium rents in comparison with single-use properties and persistently sustaining excessive occupancy charges. The mix of completely different makes use of creates synergies that improve comfort, livability, and walkability.

Sadly, the market appears to miss the enchantment of AHH’s distinctive “live-work-play” properties. As a substitute, traders deal with the truth that roughly one-third of AHH’s money circulation comes from workplace area, which has negatively impacted its market sentiment and led to a deeply discounted valuation:

| Armada Hoffler Properties | Common REIT | |

| FFO* a number of | 8.5x | 15x |

(*FFO stands for funds from operations. It’s a generally used metric within the REIT sector to estimate the money circulation. The FFO a number of is the equal of the P/E a number of for normal shares.)

We see this as a transparent mispricing. A valuation of 8.5x FFO suggests important challenges, however that doesn’t replicate actuality.

Residential properties usually warrant premium valuations, with friends like Camden Property Belief buying and selling at roughly 16x FFO.

Retail, at the moment the most well liked property sector as a consequence of restricted new provide and powerful lease development, additionally trades at premium valuations, with friends like Federal Realty Belief (FRT) at 16x FFO.

AHH’s workplace portfolio, in the meantime, consists of exactly the kind of properties that ought to carry out effectively in the long run. Many tenants are shifting to hybrid work fashions, favoring high-quality workplace areas in handy mixed-use places. AHH’s workplace properties boast a 94.7% occupancy charge, long-term leases, and constant lease development even in at the moment’s market.

Whereas AHH employs barely greater leverage than a few of its friends, its stability sheet stays sound, with a 50% loan-to-value (LTV) ratio and a BBB investment-grade credit standing.

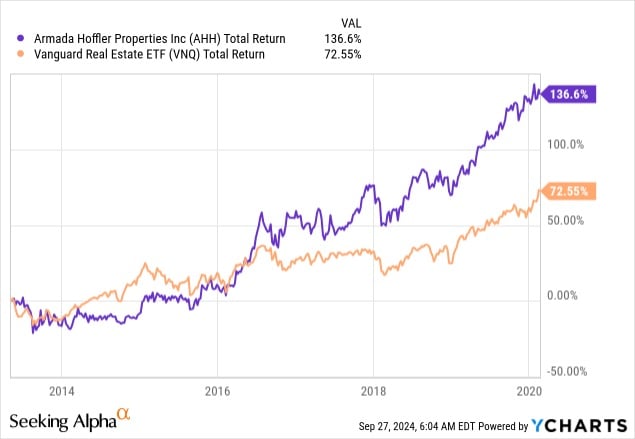

Due to this fact, we anticipate AHH to maintain doing simply fantastic over the long term. It’s a high-quality REIT that considerably outperformed the broader REIT market up till the pandemic.

Nevertheless, issues about workplace properties have suppressed its valuation, which has but to get better. At the moment, AHH trades at a steep low cost and affords a close to 8% dividend yield, safely lined by a low 75% payout ratio. The REIT has persistently raised its dividend lately, and we anticipate this pattern to proceed.

We estimate AHH’s truthful worth at 14x FFO, which suggests roughly 50% upside. Within the meantime, the excessive yield makes it simpler to stay affected person.

2. EPR Properties (EPR)

EPR is in an identical place to AHH, with its belongings and threat profile misunderstood by the market, leading to an unusually excessive yield and low valuation.

EPR focuses on experience-oriented internet lease properties, together with golf complexes, film theaters, and water parks. The market appears involved that these belongings, reliant on discretionary spending, may battle throughout a recession.

This notion is incessantly echoed in feedback on monetary blogs, the place many traders categorical reservations about EPR as a consequence of recession fears.

Nevertheless, these issues overlook EPR’s enterprise mannequin as a internet lease REIT. Its leases common 12 years, with rents locked in for the period and ~2% annual escalations. Consequently, rents will proceed to develop even in a recession:

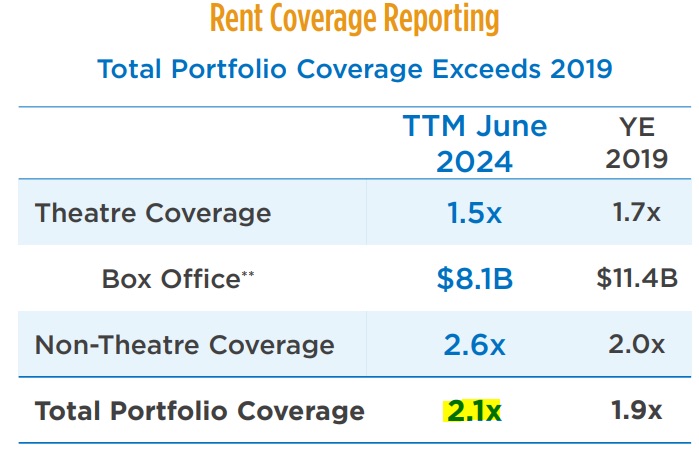

The first threat can be tenant defaults. However with a historic lease protection ratio of two.1x, EPR’s tenants are extremely worthwhile on the property stage. Even when earnings have been halved, most tenants would nonetheless stay worthwhile. This gives EPR with a major margin of security:

EPR Properties

Tenants are unlikely to forfeit long-term, worthwhile properties over short-term difficulties. Keep in mind, they didn’t abandon properties en masse even in the course of the pandemic—arguably the worst disaster possible for EPR’s portfolio.

Actually, an everyday recession may truly profit EPR by driving down rates of interest. For some tenants, their most important problem is overleveraged stability sheets reasonably than operational struggles, and decrease charges may alleviate this stress whereas additionally bettering EPR’s market sentiment.

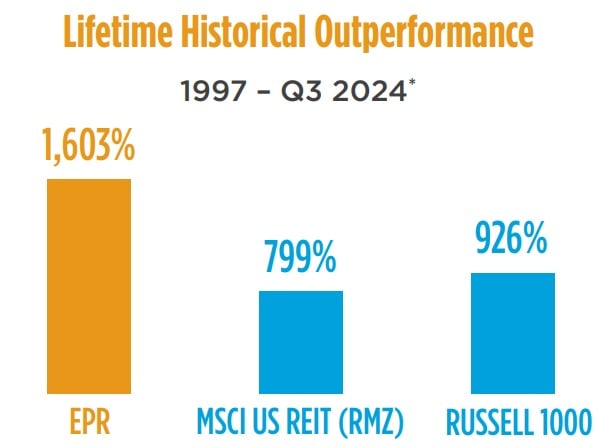

Like AHH, EPR has an investment-grade stability sheet with a 40% LTV and a robust historical past of market outperformance:

EPR Properties

Regardless of this, EPR trades at a reduced valuation and a excessive yield. Its near-8% dividend yield is effectively lined by a 70% payout ratio, and the dividend has been rising steadily, very like AHH’s.

We undertaking roughly 50% upside for EPR because it demonstrates its resilience and re-rates nearer to 14x FFO. For that reason, EPR is likely one of the largest positions in our high-yield landlord portfolio.

3. NewLake Capital Companions (NLCP)

Lastly, we now have NLCP, the highest-yielding REIT on this lineup.

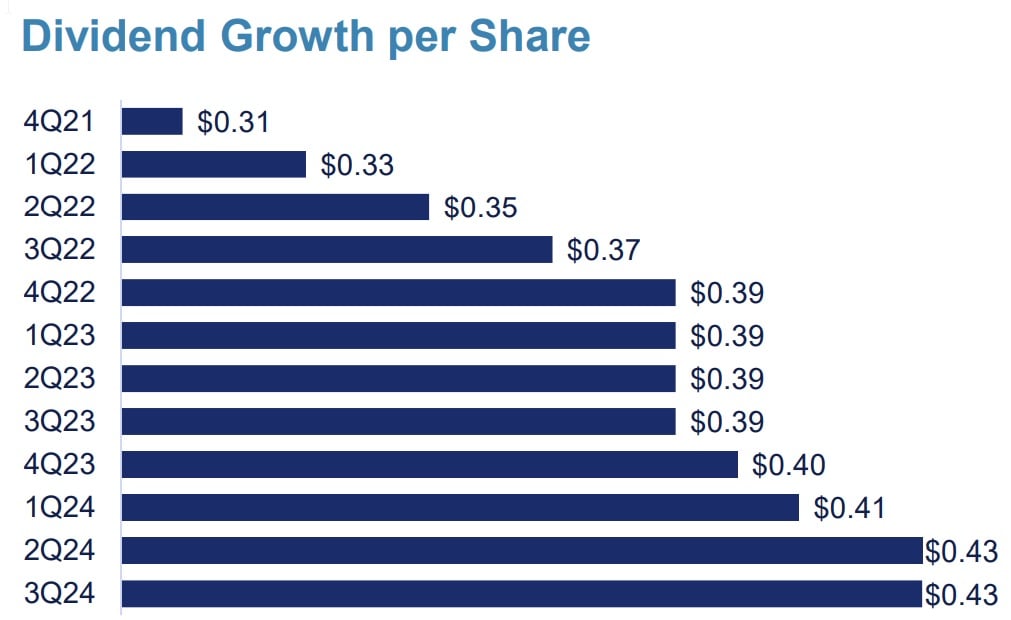

Following a latest dip, NLCP is priced close to a ten% dividend yield. Though it’s simply shy of this mark, a pending dividend hike is prone to push it above 10%.

Why are we assured in such a excessive yield? NLCP has raised its dividend almost each quarter since going public:

We not too long ago interviewed NLCP’s CEO, who expressed sturdy optimism in regards to the firm’s future.

NLCP primarily owns hashish cultivation amenities in limited-license states. These restrictions restrict property provide whereas demand for hashish continues to rise. Moreover, NLCP advantages from very lengthy lease phrases, averaging 14 years, with 2.6% annual lease escalations.

Crucially, NLCP carries virtually no debt, giving it the pliability to broaden its portfolio considerably. By incomes substantial spreads over its value of capital, NLCP may meaningfully increase money circulation and dividends.

At the moment, NLCP’s payout ratio is on the decrease finish of its 80% to 90% goal vary, giving us confidence that one other dividend improve is imminent. Not unhealthy for a REIT yielding near 10%!

Make investments Smarter with PassivePockets

Entry training, non-public investor boards, and sponsor & deal directories — so you may confidently discover, vet, and put money into syndications.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.