KEY

TAKEAWAYS

- Merchants can enhance their odds with market, sector and inventory filters.

- We needs to be in a bull market and the sector needs to be in an uptrend.

- The inventory needs to be in a long-term uptrend and main.

Despite the fact that buying and selling primarily based on chart evaluation includes some discretionary choices, chartists can enhance the percentages of success by systematizing their course of. This report will present 4 prerequisite filters primarily based on a top-down strategy. We’ll begin with the broader market, have a look at the sector, after which apply two qualifying filters to the inventory.

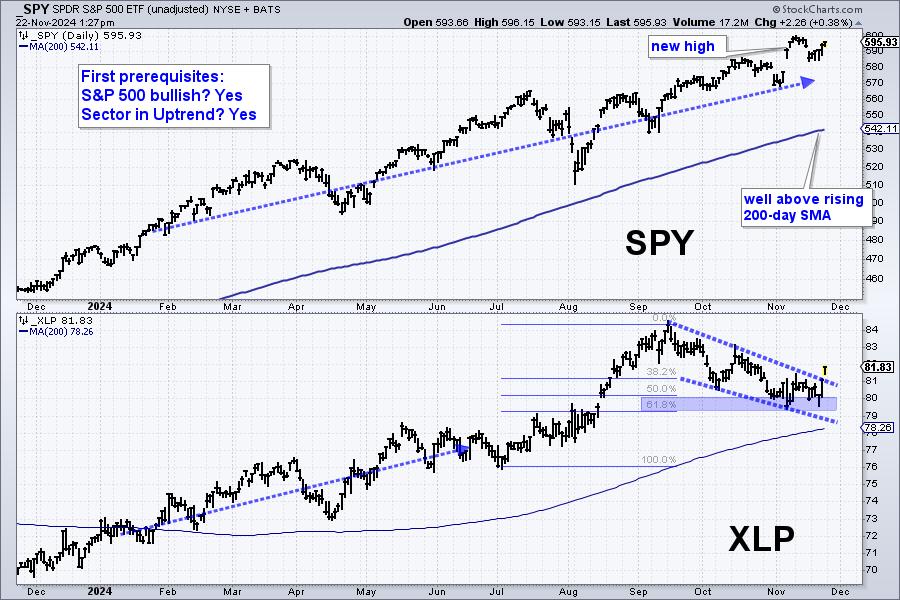

First, I’d make sure that we’re in a bull market. The chart under exhibits SPY hitting a brand new excessive in early November and buying and selling effectively above its rising 200-day. That is clearly bullish for the market as a complete.

Second, I’d make sure the sector can also be in a long-term uptrend. TJX Cos (TJX) is a part of the Client Staples SPDR (XLP) and this sector recorded a brand new excessive in September. It fell again into November, however stays above its rising 200-day SMA, and in a long-term uptrend. Be aware that TJX featured in our report and video on Friday. Click on right here to affix and get two bonus experiences.

Second, I’d make sure the sector can also be in a long-term uptrend. TJX Cos (TJX) is a part of the Client Staples SPDR (XLP) and this sector recorded a brand new excessive in September. It fell again into November, however stays above its rising 200-day SMA, and in a long-term uptrend. Be aware that TJX featured in our report and video on Friday. Click on right here to affix and get two bonus experiences.

Additionally discover that XLP is breaking out this week. The ETF fashioned a falling wedge and retraced 50-62.18% of the July-September advance. Each the sample and the retracement are regular for corrections inside greater uptrends. XLP is breaking out of the wedge to sign a continuation of the larger uptrend.

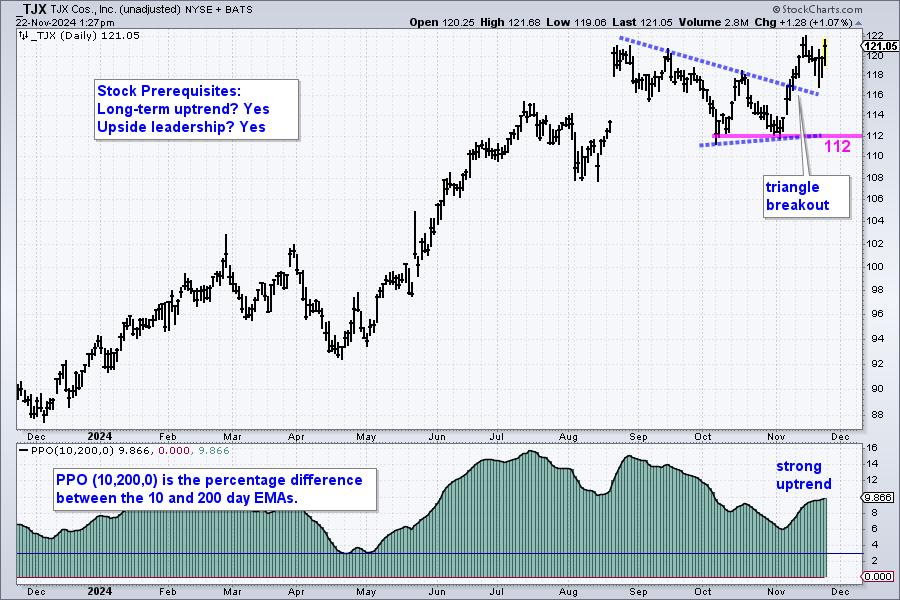

Turning to the inventory filters, I would like the inventory to be in a long-term uptrend and to indicate upside management. On the TJX chart under, costs are shifting from the decrease left to the higher proper, and the inventory recorded a brand new excessive this month. Shares hitting new highs are in robust uptrends and present upside management. Additionally discover that the 10-day EMA is 9.8% above the 200-day EMA. The underside indicator exhibits the PPO (10,200,0), capturing the share distinction between these two EMAs.

TJX meets all of the stipulations and in addition sports activities a bullish breakout on the worth chart. After surging to a brand new excessive in mid August, the inventory consolidated with a triangle. A consolidation inside an uptrend is a bullish continuation sample. TJX broke out with a powerful transfer in November and this alerts a continuation of the uptrend. Re-evaluation help is about at 112.

Highlights from Current Stories/Movies:

- S&P SmallCap 600 SPDR surges after throwback to breakout zone.

- A Brief-term setup might result in a long-term breakout for DataDog (DDOG).

- Medical Units stand out in an underperforming healthcare sector.

- Robotics & AI ETF triggers huge breakout and holds above breakout zone.

- Gold and Uranium escape as Lithium units up.

Click on right here to affix and get two bonus experiences!

//////////////////////////////////

Select a Technique, Develop a Plan and Observe a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Writer, Outline the Pattern and Commerce the Pattern

Wish to keep updated with Arthur’s newest market insights?

– Observe @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic strategy of figuring out pattern, discovering alerts throughout the pattern, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.