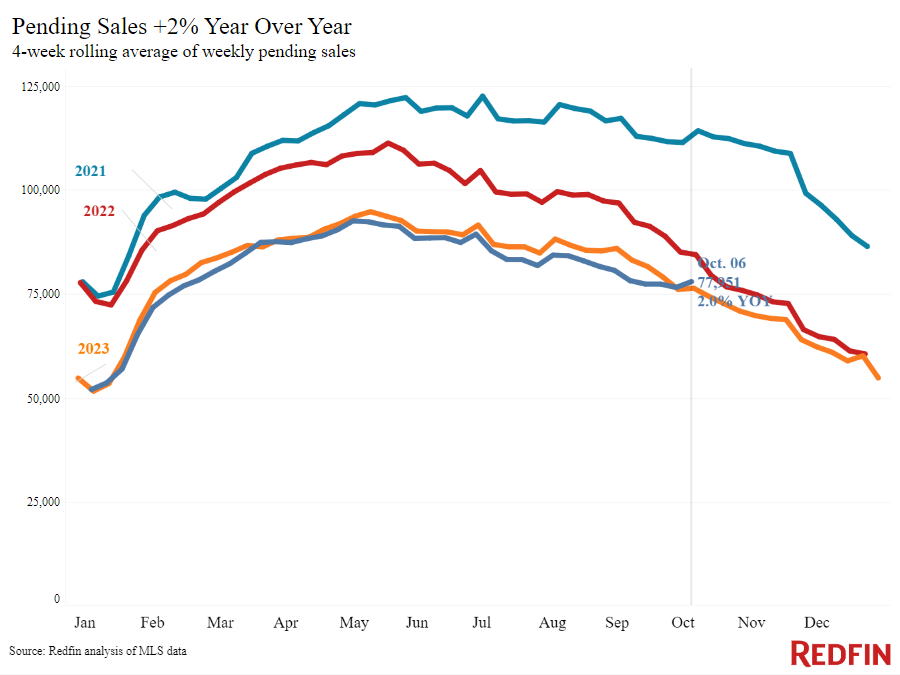

Is the U.S. housing market lastly rising from the pandemic Ice Age-like circumstances? There are indicators that this can be the case. In line with a latest report by Redfin, pending dwelling gross sales in early October confirmed the greatest year-over-year enhance since 2021, rising 2% throughout the four-week interval ending Oct. 6.

These numbers will be encouraging to actual property traders who’ve felt—justifiably—that alternatives have been skinny for the previous couple of years. However, it pays to be thorough and never misread a single metric as an indication of a wider pattern.

Can we definitively say that the housing market is returning to its wholesome pre-pandemic state at this level? Let’s check out the various factors at play.

Curiosity Charge Cuts: Key Issue or a Crimson Herring?

Redfin’s report explicitly ties the spike in dwelling gross sales to the Federal Reserve’s much-anticipated charge reduce announcement on Sept. 18. Patrons lastly “got here out of the woodwork in late September” following the announcement, “despite the fact that mortgage charges had already been declining for a number of weeks in anticipation of the reduce,” in accordance with Redfin’s press launch concerning the report.

This ‘‘despite the fact that’’ is a big one. It’s not as if potential homebuyers have been unaware of rates of interest declining earlier than the announcement; it does appear that they wanted it on a psychological degree, although. Partly, this has to do with the truth that it’s laborious to let go mentally of the thought of three% to 4% rates of interest loved by patrons pre-2022.

Any announcement of a charge reduce has the mandatory impact of convincing some people who now could be lastly a greater time to purchase a home than, say, a month or so in the past. In a risky mortgage market, official bulletins do maintain sway.

Nevertheless, mortgage charges are at all times solely a part of the story of how a housing market is performing. Investopedia, for instance, identifies it as simply one of many 4 key elements that drive the true property market. The opposite three are demographics, the economic system, and authorities insurance policies and subsidies.

We have now many examples of demographics driving big adjustments inside U.S. actual property markets all through the pandemic period. Enormous actions of individuals, just like the much-documented Sunbelt surge, noticed actual property in cities like Phoenix and Austin, Texas, growth and then turn out to be unaffordable thereafter.

Demographics are about age, too, and for sure, pent-up demand among the many so-called millennial technology remains to be the driving power behind the present uptick in dwelling purchases. Millennials longing to purchase their first houses and quiet down didn’t go anyplace throughout the previous 4 years—in lots of circumstances, there merely weren’t houses there for them to purchase.

Stock Progress Indicators Restoration in A number of Areas

This brings us to the following main issue that’s serving to to stabilize the housing market: the regular enhance of stock over the previous 12 months. The shortage of accessible houses on the market severely impacted the U.S. housing market because the starting of the pandemic.

First, sellers weren’t promoting due to COVID restrictions. Then it was as a result of the will increase in mortgage charges post-2022 made promoting appear unpalatable for a lot of.

We’re saying “unpalatable” moderately than “unaffordable” for a motive. Whereas some sellers, particularly these trying to upsize, would certainly have discovered themselves in no place to promote and tackle a way more costly mortgage, others merely have been in no instant rush to promote and bided their time for so long as they might.

That is nonetheless true, to an extent: In line with the most recent Realtor.com Housing Market Developments Report, stock nationwide “remains to be down 23.2% in contrast with typical 2017 to 2019 ranges.” The “rate-lock hurdle” (sellers postpone by excessive rates of interest) “hasn’t disappeared,” says the report.

Nonetheless, the pattern has been shifting steadily since final 12 months—observe that this was the time when rates of interest have been effectively above 7%. In line with the Redfin report, new listings elevated 5.7% 12 months over 12 months within the 4 weeks ending Oct. 6, however “not like the rise in pending gross sales, that’s a continuation of a pattern; new listings have been rising for almost a 12 months.”

As of September 2024, seven states have really returned to pre-pandemic stock ranges, in accordance with ResiClub’s evaluation of Realtor.com information. Beneath is the expansion of stock in comparison with ranges in September 2019.

- Tennessee (11%)

- Texas (10%)

- Idaho (10%)

- Florida (9%)

- Colorado (4%)

- Utah (4%)

- Arizona (3%)

Washington very almost joined this record, lacking by simply 35 houses.

When folks have to promote, they promote; it’s not at all times a selection. In line with Development Protection evaluation of U.S. Census Bureau’s Constructing Allow Survey and Inhabitants and Housing Unit Estimates information, these are the highest states the place stock elevated most dramatically since September 2023:

- Florida (59%)

- Georgia (49%)

- North Carolina (48%)

- California (41%)

- Washington (48%)

- Hawaii (62%)

- Arizona (45%)

These areas have been battered by extreme climate, from historic forest fires to hurricanes, over the previous 12 months. Certainly, the surge in dwelling listings in these areas will partly be down to sellers determined to promote broken properties they can’t afford to restore as a result of insurance coverage issues.

The Redfin report narrows in on Florida, explaining that dwelling gross sales there are down, in distinction with the general nationwide pattern. The information isn’t out but for North Carolina and different areas hardest hit by Hurricane Helene final month, however a latest survey by Redfin means that the devastating storm has made some homebuyers assume twice about the place they wish to reside.

This isn’t to say that these are all of a sudden no-go areas for traders. Nevertheless, like common homebuyers, traders ought to give some thought to the place they’re going regionally. The variety of accessible listings could point out a recovering housing market—or it will possibly really point out a housing market in bother due to local weather change and/or an insurance coverage disaster.

Investing in these areas will be difficult in case you don’t have the means to guard your funding from excessive climate. Discovering tenants in disaster-prone areas might also turn out to be tougher over time. Though the Redfin survey doesn’t specify whether or not its respondents are owners or renters, it’s not unreasonable to imagine that renters (who’re disproportionately impacted by pure disasters) could select “safer” areas sooner or later.

Traders can actually hit the candy spot proper now in areas the place stock is rising for causes aside from folks fleeing weather-related bother. Extra particularly, you wish to be wanting for areas which can be at the least partially fixing their long-standing housing crises by constructing extra houses.

In line with analysis performed by Development Protection, utilizing information from the U.S. Census Bureau and Zillow, Idaho, Utah, North Carolina, Texas, and Florida comprise the highest 5 states constructing probably the most new houses. Traders might want to do thorough analysis into particular areas in these states, since a few of these which can be actively constructing new houses are additionally on the highest danger for local weather change impression. Locations like Idaho and Utah, or Tennessee (which is No. 10 in homebuilding), emerge as enticing present locations.

The Midwest and Northeast, alternatively, have fairly a protracted method to go towards restoration. These are the areas the place the present charges of stock progress can’t even start to convey provide to ranges wanted for regular market circumstances. Present houses are just about all there may be in these areas, so traders will proceed to seek out that they’re competing for scarce alternatives. After all, that might all change if new insurance policies are applied for these and different areas following the upcoming presidential election.

The Backside Line

The actual image of the U.S. housing market is, as ever, way more intricate and diverse than the one statistic of pending dwelling gross sales will increase would recommend. Whereas the market total is undoubtedly shifting in the precise path, it’s doing so at various paces and with various factors in play in completely different areas.

Rates of interest do play a key half in loosening up the market, however traders ought to pay shut consideration to different elements, particularly regional challenges round homebuilding, local weather change, and residential insurance coverage insurance policies.

Prepared to achieve actual property investing? Create a free BiggerPockets account to find out about funding methods; ask questions and get solutions from our group of +2 million members; join with investor-friendly brokers; and a lot extra.

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.