KEY

TAKEAWAYS

- The MACD and PPO indicators are trend-following units designed to substantiate a pattern reversal has occurred.

- The histogram exhibits when the MACD indicator is exhibiting indicators of a possible reversal, offering extra of a number one indicator.

- Traders can use different indicators, such because the Chandelier Exit system, on shorter time frames to assist verify the indicators on the weekly chart.

The Shifting Common Convergence/Divergence (MACD) indicator, created by technical analyst Gerald Appel, is a technical indicator designed to substantiate as soon as a pattern change has occurred. Primarily based on exponential transferring averages, it’s not constructed to anticipate a worth reversal, however somewhat to determine that one has already occurred.

The lesser-known MACD histogram can really present a strong main indicator as to when a turning level could possibly be simply across the nook. As we speak, we’ll use the weekly chart of IBM to indicate how, by combining these two strategies, we are able to anticipate potential reversals after which verify when and the way the pattern has shifted.

Utilizing the MACD or PPO Indicator to Outline the Development

To start out this dialogue, let’s be clear on why we’re utilizing the PPO indicator as an alternative of MACD on our instance charts. The MACD indicator is predicated on the worth distinction between two exponential transferring averages, whereas the PPO indicator is predicated on the % distinction between these two averages.

For a short-term time-frame, the indications are virtually similar and both one can be utilized for efficient indicators. For long-term time frames, nevertheless, utilizing proportion phrases as an alternative of worth phrases permits for a extra constant comparability, particularly if the inventory or ETF has skilled huge worth swings.

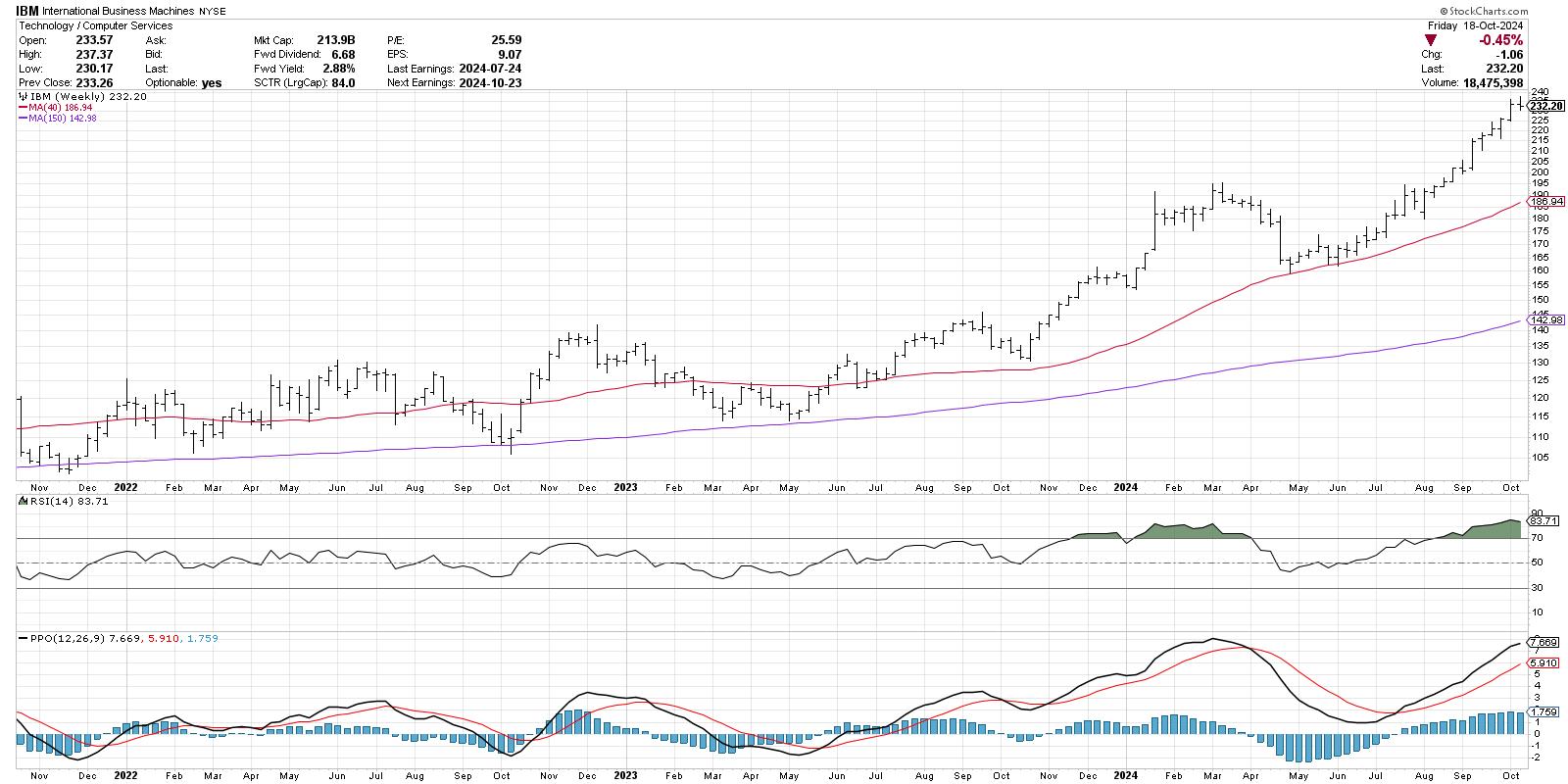

On the weekly chart of Worldwide Enterprise Machines (IBM), the PPO indicator (backside panel) begins with the PPO line, which represents the distinction between the 12- and 26-week exponential transferring averages. Then we now have the crimson sign line, which is solely a 9-bar transferring common of the PPO line.

Be aware the promote sign in late March 2024, when the PPO line crossed down by means of the crimson sign line. Conversely, the purchase sign in mid-July is predicated on the PPO line crossing again up by means of the crimson sign line. At the moment, the PPO indicator suggests the uptrend is alive and nicely, with the PPO line sloping greater above the crimson sign line.

Including the Histogram Helps to Anticipate the Alerts

See how the promote sign in March got here after the height had occurred, and the worth was already in a brand new downtrend?Additionally, discover how the purchase sign in July appeared nicely after the precise worth low in April?

That is really by design, because the PPO indicator is taken into account a lagging indicator. It isn’t designed to let you know a reversal could also be coming quickly, however somewhat {that a} reversal just lately occurred and is now being confirmed. However what if we wish to anticipate these reversals earlier than they happen?

The PPO histogram, proven behind the PPO indicator in blue, represents the distinction between the PPO line and the sign line. Return to that March peak, and you might discover that the histogram had began to slope downward beginning in February. Then, in Might, proper as the worth was discovering a brand new swing low, the histogram began to slope again upwards.

So, to summarize the parts, the histogram reversals increase the “crimson flag” {that a} potential worth reversal is coming, after which the precise PPO crossover confirms that the pattern reversal has really occurred. Now we are able to use the PPO indicator as each a number one and a lagging indicator!

Utilizing the Histogram With Different Indicators

Quick ahead to October 2024, and you may see that this week the PPO histogram moved barely decrease. This might symbolize the early warning of an impending prime for IBM. For this example, I prefer to go to a decrease time-frame, on this case the day by day chart, and use trend-following strategies to substantiate a breakdown on the shorter time-frame. Whereas the weekly should still be my major indication, a promote sign might come earlier on the day by day chart and assist me to take motion earlier than the ache will get too insufferable!

Right here I am exhibiting the Chandelier Exit system, which is a trailing cease indicator based mostly on Common True Vary (ATR). So long as IBM stays above the Chandelier Exit, the uptrend is most probably nonetheless alive and nicely on the day by day chart. A breakdown of this trailing cease might assist me verify the bearish divergence we have famous on the weekly PPO chart.

The technical evaluation toolkit consists primarily of main indicators and lagging indicators. Whereas I primarily use lagging indicators to observe the developments and ensure pattern reversals, I’ve additionally discovered main indicators such because the PPO histogram to be a significant a part of managing threat and figuring out alternatives for my portfolio.

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any approach symbolize the views or opinions of some other individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps lively buyers make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra