Canadians love their financial institution shares – and it’s simple to see why. They’re dependable, worthwhile, and have a historical past of regular dividend development. By extension, Canadian buyers additionally love financial institution exchange-traded funds (ETFs).

There’s no scarcity of choices right here. You could find equal-weight financial institution ETFs, mean-reversion financial institution ETFs, yield-weighted financial institution ETFs, dividend-growth-weighted financial institution ETFs, and even coated name financial institution ETFs designed for increased month-to-month revenue at the price of capped upside.

However none of those are my decide for a growth-focused, long-term buy-and-hold funding. For that, I choose a leveraged financial institution ETF. In the event you’re gonna go large, go for broke proper?

Now, I do know what you’re considering: “Leveraged financial institution ETFs are dangerous! They’re solely appropriate for short-term buying and selling!” You’re not incorrect – most leveraged ETFs are geared for day buying and selling. Nonetheless, this ETF isn’t like the standard leveraged choices. Right here’s why it’s value contemplating.

What makes these ETFs totally different

When Canadian buyers hear “leveraged ETFs,” they normally consider the traditional 2 occasions merchandise designed to multiply the each day efficiency of an index by two. For instance, a 2 occasions leveraged Canadian financial institution ETF would theoretically rise 2% on a day when its underlying index features 1% – and drop 2% if the index falls 1%.

The issue? These ETFs reset their leverage each day, which means the compounding impact over time turns into unpredictable. That’s as a result of they depend on derivatives referred to as swaps to attain their leverage. Whereas positive for day buying and selling, holding these ETFs long run can result in vital efficiency divergence from the underlying.

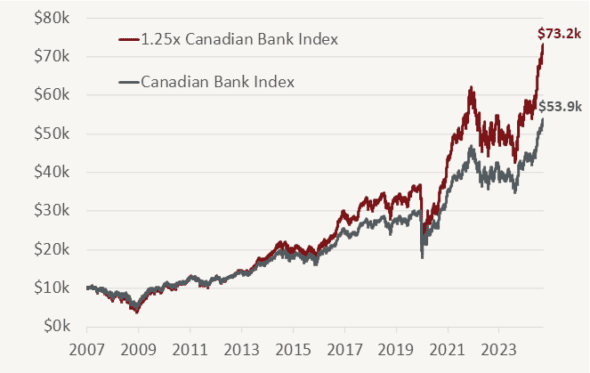

The brand new era of leveraged ETFs, nonetheless, solves this situation. They don’t use swaps or reset each day. As an alternative, they take an easy method – borrowing cash, much like a margin mortgage, to amplify publicity. With leverage capped at a manageable 1.25 occasions, these ETFs present a extra secure possibility for long-term buyers.

The leveraged financial institution ETF to look at

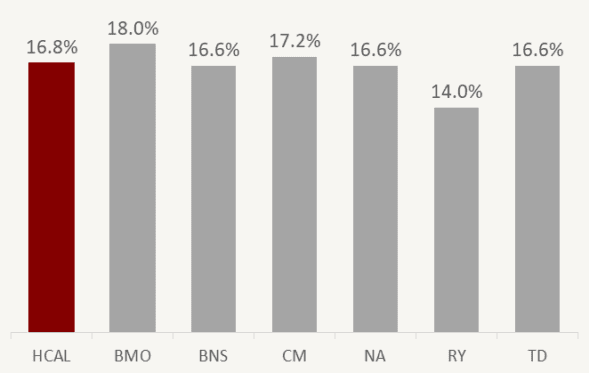

The leveraged financial institution ETF I like is the Hamilton Enhanced Canadian Financial institution ETF (TSX:HCAL).

HCAL takes a portfolio of Canada’s Massive Six banks, as represented by the Solactive Equal Weight Canada Banks Index, and applies 1.25 occasions leverage to it. In contrast to conventional leveraged ETFs, HCAL doesn’t use swaps or derivatives. As an alternative, it employs money margin at institutional borrowing charges to amplify its publicity.

The consequence? Amplified threat and return, but additionally a lift in yield. With roughly 25% extra dividends than a typical financial institution ETF, HCAL affords a 6% distribution yield as of Dec. 12, 2024.

Whilst you can anticipate extra pronounced annual volatility in comparison with a non-leveraged financial institution ETF, it’s roughly according to the ups and downs of particular person Massive Six banks.

Traditionally, holding 1.25 occasions leveraged Canadian financial institution publicity lengthy sufficient has additionally delivered superior returns in comparison with common financial institution investments.