The Federal Reserve (Fed) implements financial coverage in a regime of ample reserves, the place short-term rates of interest are managed primarily by means of the setting of administered charges, and lively administration of the reserve provide just isn’t required. In yesterday’s put up, we proposed a technique to guage the ampleness of reserves in actual time primarily based on the slope of the reserve demand curve—the elasticity of the federal (fed) funds fee to order shocks. On this put up, we suggest a set of complementary indicators of reserve ampleness that, collectively with our elasticity measure, will help policymakers make sure that reserves stay ample because the Fed shrinks its stability sheet.

Complementary Measures of Ampleness of Reserves

As we clarify in yesterday’s put up, one might operationalize the notion of ample reserves because the area of the reserve demand curve the place the slope is just modestly adverse, which signifies that the elasticity of the fed funds fee to shocks within the provide of reserves is small. At increased reserve ranges (considerable reserves), the elasticity is zero (that’s, the curve is flat); at decrease ranges (scarce reserves), the elasticity is adverse and enormous (the curve is steeply sloped).

The ampleness of central financial institution reserves, nonetheless, impacts not solely the fed funds fee but additionally different necessary money-market variables and financial institution liquidity administration. In in the present day’s put up, we introduce 4 new indicators of reserve ampleness, that are complementary to our estimates of the slope of the reserve demand curve and work as an exterior validity examine of our measure of reserve ampleness. Importantly, these indicators don’t depend on the identical sources of data as our elasticity measure as a result of they don’t use variation within the fed funds fee or amount of reserves; quite they have a look at different variables that, primarily based on financial principle and institutional particulars, must be affected by the ampleness of reserves.

- Late Funds

The primary indicator is the share of interbank funds settled after 5 p.m. All through every enterprise day, banks use their accounts on the Fed to make and obtain funds, transferring reserves over a system often known as Fedwire® Funds Service. As the provision of reserves declines and transitions from considerable to ample, banks have an incentive to postpone their outgoing funds, pushing the settlement in the direction of the top of the enterprise day to make sure they’ve ample reserves to settle their transactions (as defined on this paper).

- Banks’ Intraday Overdrafts

If banks’ capability to postpone outgoing funds is restricted, they could enhance their use of intraday credit score supplied by the Fed, often known as daylight or intraday overdraft. A financial institution incurs an intraday overdraft when the stability in its account on the Fed is adverse through the enterprise day. As reserves grow to be much less considerable and banks extra liquidity constrained, we might anticipate to look at extra intraday overdrafts. To replicate broad liquidity situations within the banking system, we take the common greenback worth of banks’ intraday overdrafts as an indicator of the relative ampleness of reserves.

- Home Borrowing within the Fed Funds Market

As mentioned on this put up, home banks predominantly borrow within the fed funds market once they want short-term liquidity, whereas U.S. branches of overseas banks actively borrow in that market to earn the unfold between the speed of curiosity on reserves (IOR) and the fed funds fee, even when they’re awash with reserves. A rise within the quantity of fed funds borrowing by home banks might subsequently sign that reserves have gotten much less considerable as banks are extra liquidity constrained.

- Upward Stress in Repo Charges

Charges on in a single day repurchase agreements (repos) can affect the fed funds fee as a result of repos and fed funds are shut substitutes for a lot of market members. Furthermore, as mentioned in a number of papers (see right here, right here, and right here), decrease reserve ranges can enhance repo charges by tightening the liquidity constraints of huge banks lively as repo intermediaries. We measure upward strain in repo charges because the share of in a single day Treasury repo transacted at or above IOR.

Trying on the Suite of Measures Collectively

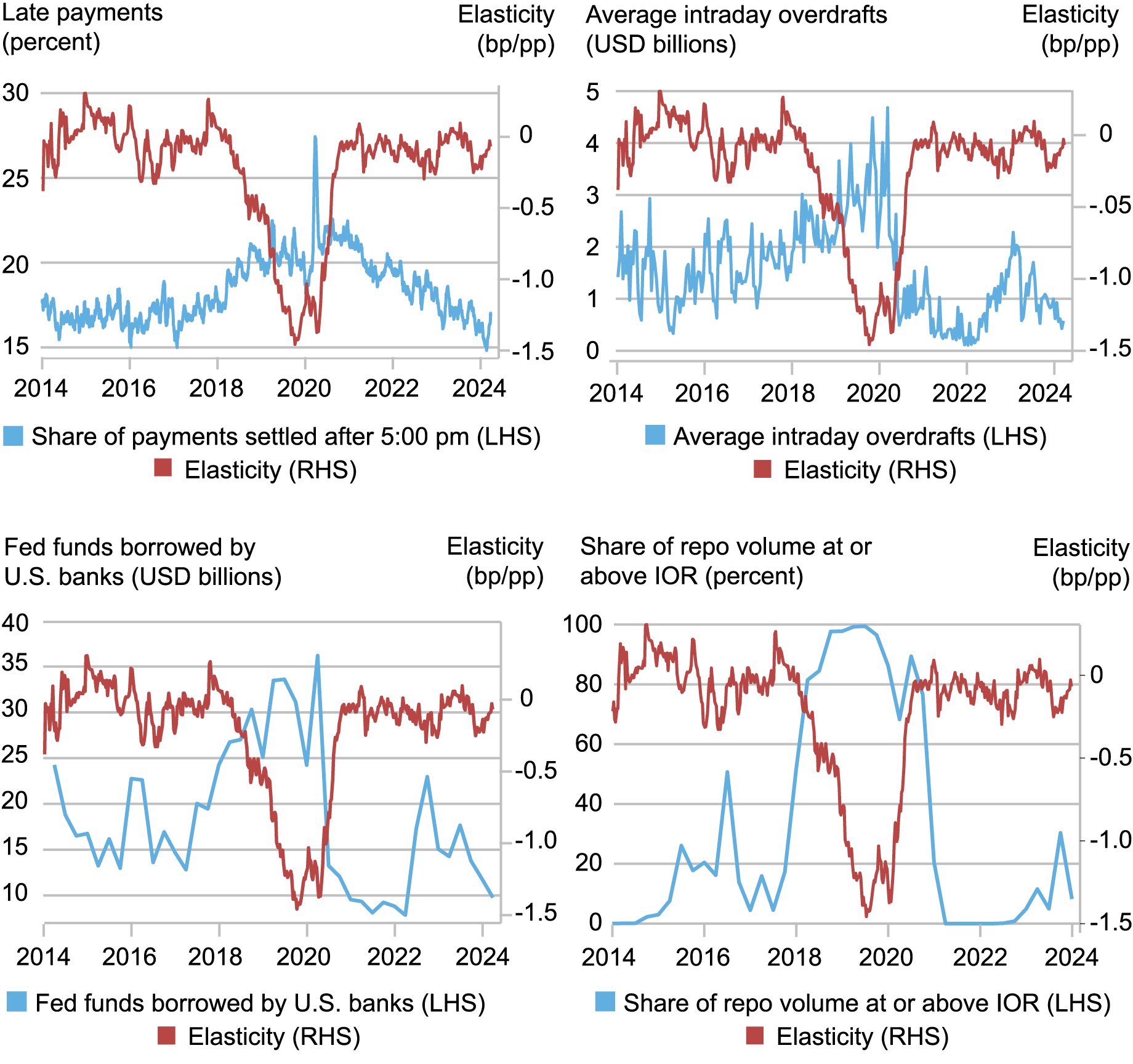

By development, all these indicators ought to enhance as mixture reserves transition from being considerable to ample after which scarce. Certainly, the chart beneath reveals that, over time, our 4 complementary indicators of reserve ampleness have been in line with our real-time estimate of the fed-funds-rate elasticity to order shocks. In every panel, we plot one of many indicators and the real-time elasticity estimate: in all circumstances, the complementary indicators enhance because the fed-funds-rate elasticity decreases, indicating a decline in reserve ampleness. Particularly, all complementary indicators begin to development upward—suggesting that reserves had been transitioning from being considerable to ample—across the finish of 2017 or starting of 2018, when the elasticity turns into adverse for the primary time since 2014. The symptoms then attain a most between September 2019 and March 2020, as our real-time elasticity measure reaches its minimal, indicating the best shortage of reserves during the last ten years. Since then, they’ve gone again to their 2014-17 ranges, suggesting that reserves have been considerable during the last 4 years, in line with the elasticity being zero.

Indicators Improve because the Elasticity and Reserve Ampleness Decline

Notes: This panel chart plots 4 complementary indicators of reserve ampleness versus time-varying estimates of the fed-funds-rate elasticity to order shocks. “Late funds” is the share of Fedwire® Funds Service funds settled after 5 p.m. ET. “Common intraday overdrafts” is the common per-minute daylight overdrafts for all establishments over a upkeep interval. “Fed funds borrowed by U.S. banks” is the greenback worth of fed funds borrowed by home banks. “Share of repo quantity at or above IOR” is the share of repo transactions traded at charges at or above the speed of curiosity on reserves. The views expressed on this put up don’t signify the views of the Workplace of Monetary Analysis, the Monetary Stability Oversight Council, or the U.S. Division of the Treasury.

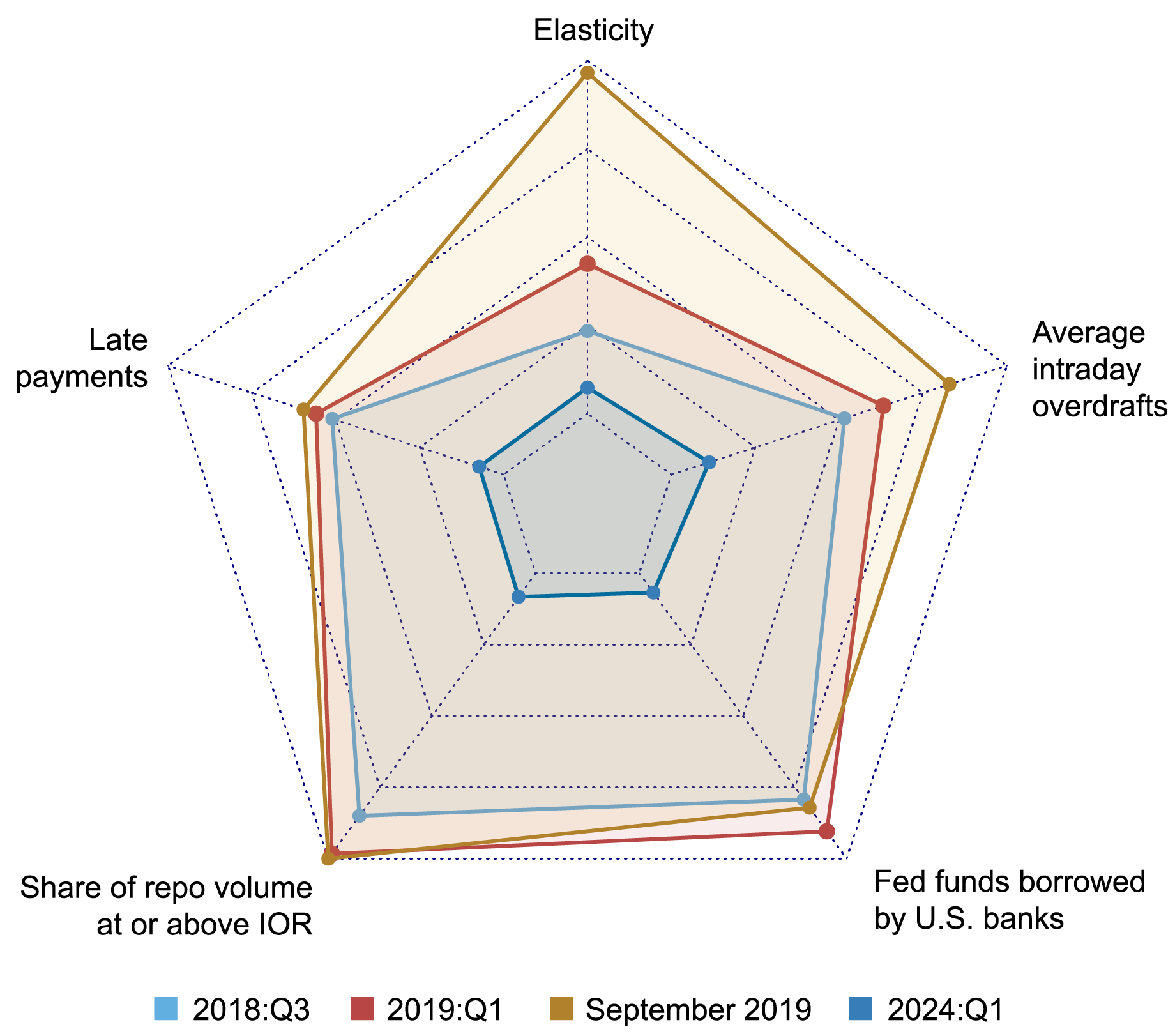

The next spider internet chart reveals the 4 complementary indicators along with (absolutely the worth of) our measure of the elasticity at 4 completely different closing dates: 2018:Q3, 2019:Q1, September 2019, and 2024:Q1. For every indicator, the purpose on the respective axis within the innermost dashed pentagon represents the extent of most considerable reserves throughout 2014-2024:Q1 in line with that indicator; the purpose on the indicator’s axis within the outermost pentagon corresponds to the extent at which reserves had been most scarce. As of the primary quarter of 2024, all indicators counsel that reserves stay considerable and much from their 2018-19 situations.

Reserves Stay Ample as of 2024:Q1

Notes: This spider internet chart plots, in 4 completely different intervals, 5 measures of reserve ampleness: the fed-funds-rate elasticity to order shocks and 4 complementary indicators. The elasticity turns into vital on the 68% confidence stage in 2018:Q3 and on the 95% confidence stage in 2019:Q1. The 2024:Q1 Name Report is the final obtainable report. Overdraft information are publicly obtainable as much as the upkeep interval ending on March 20, 2024. The views expressed on this put up don’t signify the views of the Workplace of Monetary Analysis, the Monetary Stability Oversight Council, or the U.S. Division of the Treasury.

In Sum

Monitoring reserve ampleness is a key activity of the Fed, significantly amid the continuing stability sheet discount course of. In yesterday’s put up, we proposed a measure of reserve ampleness primarily based on estimating the slope of the reserve demand curve (that’s, the elasticity of the fed funds fee to modifications in mixture reserves) on the every day frequency. On this put up, we suggest a set of complementary indicators primarily based on completely different information that describe situations in cash markets and financial institution liquidity, whose evolution over time is in line with our estimates of the fed-funds-rate elasticity. These indicators, collectively with our real-time elasticity estimates, will help inform policymakers on whether or not mixture reserves within the banking system have gotten much less considerable and doubtlessly scarce.

Gara Afonso is the top of Banking Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Kevin Clark is a Capital Markets Buying and selling Principal within the Federal Reserve Financial institution of New York’s Markets Group.

Brian Gowen is a Capital Markets Buying and selling Principal within the Federal Reserve Financial institution of New York’s Markets Group.

Gabriele La Spada is a monetary analysis advisor in Cash and Funds Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

JC Martinez is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Jason Miu is a Capital Markets Buying and selling Affiliate Director within the Federal Reserve Financial institution of New York’s Markets Group.

William Riordan is a Capital Markets Buying and selling Advisor within the Federal Reserve Financial institution of New York’s Markets Group.

The right way to cite this put up:

Gara Afonso, Kevin Clark, Brian Gowen, Gabriele La Spada, JC Martinez, Jason Miu, and Will Riordan, “A New Set of Indicators of Reserve Ampleness,” Federal Reserve Financial institution of New York Liberty Avenue Economics, August 14, 2024, https://libertystreeteconomics.newyorkfed.org/2024/08/a-new-set-of-indicators-of-reserve-ampleness/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).