Being financially impartial means having sufficient passive earnings to cowl your important or desired residing bills. A typical guideline is to intention for a web value equal to 25 occasions your annual bills, usually used as a baseline for attaining monetary independence. Nevertheless, this strategy is overly simplistic as a result of it is determined by the composition of 1’s web value.

In case your web value consists solely of liquid, income-producing belongings, 25 occasions your bills ought to suffice. But when a lot of it’s tied up in a main residence or illiquid non-public investments, you might not be capable to generate sufficient passive earnings or readily promote belongings for true monetary independence. Liquidity and money move are paramount for retirement.

Not solely ought to everybody give attention to the liquid share of their web value when planning for early retirement, however they need to additionally pay shut consideration to its composition. Under, I am going to share a real-life instance as an instance this level.

For these retiring on the conventional age of 65, a web value of 25X your annual bills, supplemented by Social Safety, is often ample for a snug retirement. Nevertheless, the 25X rule turns into extra precarious for these looking for early retirement. The a number of must be a goal in your liquid, income-producing belongings, not your web value. Longer time horizons, inflation, and life-style adjustments—like rising households—can shortly erode a seemingly enough web value.

Could not Keep Totally Retired For Lengthy On 25X Bills

After I revisited my funds after a 2013 monetary session, I used to be reminded of the restrictions of the 25X rule for attaining FIRE (Monetary Independence, Retire Early).

Though I retired in 2012 at age 34 with a web value of roughly 38 occasions my annual bills, I couldn’t maintain full retirement past 18 months. The problem lay within the composition of my web value—a lot of it tied up in my main residence—and the rising prices of sustaining a rising family. These elements made early retirement much more advanced than I had initially anticipated.

My authentic plan was to embrace an easier life with my spouse on my grandparents’ farm in Waianae, Oahu. The imaginative and prescient was idyllic: we’d supply most of our meals from the land and stay comfortably on $80,000 a yr. Nevertheless, detaching ourselves from San Francisco, a metropolis we’ve known as house since 2001, proved tough. Life pulled us in a distinct route.

Our journey took a fair greater flip with the births of our youngsters in 2017 and 2019, additional anchoring us to San Francisco. The imaginative and prescient of a quiet life on the farm shifted to balancing the calls for of elevating a household in one of the costly cities on this planet. Early retirement, it turned out, required greater than a excessive web value—it demanded better money move and a willingness to adapt to life’s surprising turns.

Why A Web Value Equal To 25X Annual Bills Is Not Sufficient To Retire Early

At present, our web value is even better than the 38X bills we had in 2012. But, I do not really feel financially impartial as a result of our passive earnings does not totally cowl our present residing bills.

We had exchanged a considerable amount of productive investments producing passive earnings for a house that, though paid off, requires ongoing bills akin to property taxes, upkeep, and utilities—prices that shares and bonds don’t have.

My aim now’s to recoup the productive investments we allotted to our house over the following three years.

Rollover IRA as a Case Examine on Web Value Composition

Let’s take my rollover IRA as a easy instance of why 25X annual bills falls brief as a retirement web value goal. 25X is the inverse of 4%, the secure withdrawal fee popularized within the Nineties by Invoice Bengen, creator of the 4% Rule.

Think about my IRA had been my solely asset, with a steadiness of $1,300,000. Which means that my complete web value consists of my rollover IRA, a 100% productive, income-producing asset.

Coincidentally, in keeping with a Northwestern Mutual survey from late 2023, this quantity aligns with what People imagine they should retire comfortably. Let’s assume I stay off $40,000 a yr in bills. If we multiply $40,000 by 25, that equals $1,000,000, suggesting I could possibly be financially impartial.

Nevertheless, because of the sort of investments in my portfolio, it does not come shut to offering sufficient dividend earnings to stay on.

Low Passive Revenue Attributable to a Progress-Centered Portfolio

Ninety % of my Equities – $826,191- is allotted to progress shares. Microsoft affords the very best dividend yield on this class at about 0.78%, adopted by Apple at 0.48%. This brings my common dividend yield throughout all my progress inventory holdings to round 0.2%, leading to simply $1,653 in dividends yearly.

The majority of my ETF holdings – $476,000 – is in VTI, the Vanguard Complete Inventory Market Index, which has a dividend yield of roughly 1.33%. Consequently, my blended yield for your complete portfolio is round 0.6%, translating to about $7,800 in annual passive earnings.

With post-tax annual bills at $40,000, I’d want a portfolio roughly 6.4 occasions bigger—$8,320,000—to generate $50,000 in gross passive earnings to cowl bills after taxes.

It could appear extreme to wish an $8,320,000 portfolio to attain monetary independence with annual bills of $40,000. And it’s. Nevertheless, few folks maintain their complete web value in liquid, income-generating belongings. For a lot of, their fairness just isn’t as readily accessible as it’d seem.

Adjusting Your Web Value Composition Isn’t At all times Straightforward

Astute readers might counsel that the simple method to obtain monetary independence on a $1,300,000 web value is to regulate the funding composition: promote sufficient progress shares and buy sufficient dividend shares or ETFs to generate $50,000 a yr, which might require a 3.8% dividend yield.

To do that, I must rebalance nearly all of my portfolio. If my retirement portfolio was in a taxable brokerage account, I’d incur vital capital positive factors tax.

Thus, a rational investor is unlikely to promote shares they’re constructive on until completely crucial. As a substitute, they’d proceed working or discover supplemental retirement earnings to assist their life-style. Any surplus money move could possibly be directed towards dividend-paying shares or ETFs over time.

The Profit Of A Roth IRA For Early Retirees

Fortuitously for Roth IRA holders, investments may be traded inside these accounts with out triggering capital positive factors taxes. This enables for changes with out a right away tax invoice, providing extra flexibility for portfolio restructuring. Therefore, for many who can construct a big sufficient Roth IRA for retirement, the pliability in repositioning your portfolio with out tax penalties is usually a nice profit.

For individuals who want to retire earlier than 59.5, you may at all times withdraw your authentic contributions tax- and penalty-free, no matter your age or how lengthy the account has been open. Since contributions are made with after-tax {dollars}, they’re not topic to penalties or taxes. After 59.5, you may then withdraw earnings tax- and penalty-free, offered your Roth IRA has been open for a minimum of 5 years.

For these planning to retire early, the method requires meticulous planning. After years of following a selected funding technique, you’ll want to regulate the composition of your portfolio to align together with your new monetary wants. On prime of that, you’ll face the problem of transitioning from accumulation to withdrawal, beginning with tapping into your contributions. This shift is simpler stated than accomplished and requires a transparent technique to keep away from pointless taxes, penalties, or liquidity points.

Housing Is A Excessive Share Of Web Value

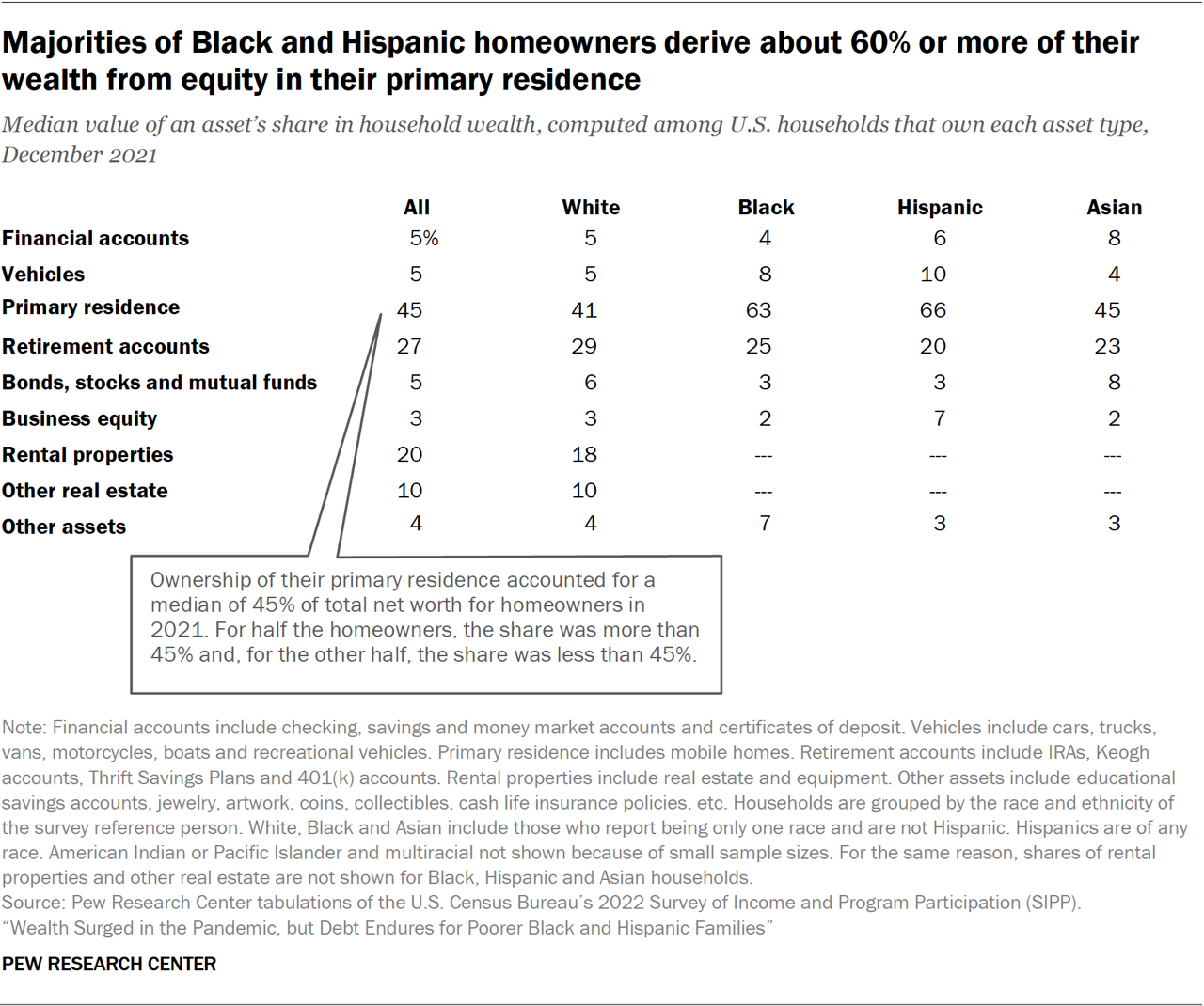

One more reason why a web value of 25X annual bills is probably not ample to retire early is the excessive share of web value tied up in housing. In response to Pew Analysis, in 2021, the median web value of U.S. households stood at $166,900, together with all belongings, with house fairness accounting for a median of 45% of this web value. The share is probably going related as we speak.

Nevertheless, when analyzing Pew’s article, they state, “In 2021, householders usually had $174,000 in fairness of their properties,” alongside the nationwide median web value determine of $166,900. This discrepancy suggests house fairness might signify an even bigger share of web value for a lot of households.

Assuming 45% of 1’s web value is of their main residence is correct, that also leaves the standard family with solely 55% of their web value in different belongings, akin to automobiles, monetary accounts, retirement funds, enterprise fairness, rental properties, and different actual property.

Taxable Brokerage Accounts: A Small Slice of Web Value

Inside this remaining 55%, Monetary accounts—which I interpret as taxable brokerage accounts—make up a modest 5% for all races surveyed. These are the belongings that may be tapped earlier than 59.5 with out penalty. Clearly, these accounts alone aren’t sufficient to maintain early retirement for many.

Curiously, Pew’s information reveals that for White households, rental properties and different actual property signify 30% of whole web value, indicating that many White People generate rental earnings as landlords.

Maybe Pew’s survey pattern didn’t seize ample information from Black, Hispanic, and Asian households to replicate their possession of rental properties and different actual property. But, actual property is a popular asset class for a lot of Asians, together with myself.

However is a mixed 5% in monetary accounts plus 30% in rental properties and different actual property ample to generate livable passive earnings for early retirement? Realistically, it’s extremely unlikely.

So let’s be beneficiant. Let’s assume your complete 55% of web value is 100% allotted to productive income-generating belongings like shares and actual property. Additional, there isn’t any penalty to promote any of those belongings. What would the extra sensible web value goal based mostly on annual bills be?

45.5X Annual Bills Could Be A Extra Cheap Web Value Goal For The Typical Family

Making use of some primary math, with solely 55% of the standard American family’s web value exterior of their main residence, the standard family would want a web value equal to 45.5X annual bills to attain early retirement.

I can already hear the complaints from readers saying {that a} 45.5X annual bills goal is each unrealistic and demoralizing. But when the info concerning the typical web value composition of People is correct, then this goal is grounded in simple arithmetic.

To grasp why, think about if 100% of your web value had been tied up in your main residence. Each room is occupied, and you may’t hire out any a part of the home for earnings. How would you fund your retirement with such a web value composition? Even when your private home had been value 100X your annual bills, it wouldn’t enable you to cowl your residing prices until you took out a House Fairness Line of Credit score (HELOC), did a cash-out refinance, or carried out a reverse mortgage.

In early retirement, you want to depend on passive earnings or liquidating belongings to cowl your bills. In conventional retirement, Social Safety advantages and pensions present further assist, decreasing the reliance on these methods.

Letting Go of a Strict Definition of Monetary Independence

A closing strategy to the 25X annual bills debate on whether or not it’s sufficient is to let go of a inflexible definition of FIRE: your investments generate sufficient earnings to cowl your residing bills. As a substitute, construct a web value of a minimum of 25X your annual bills and easily withdraw at a 4% (or probably greater) fee, no matter what anyone thinks.

Invoice Bengen’s 4% rule, established in his 1994 research, assumes retirement at age 65. Bengen discovered that retirees starting at this age might safely withdraw 4% of their retirement portfolio within the first yr, then regulate yearly for inflation, anticipating the portfolio to final for a minimum of 30 years—till age 95—with out working out.

If you happen to plan to retire at 65, you may confidently withdraw at a 4% fee or perhaps a 5% fee, as Invoice now suggests. Decreasing the conventional retirement age to 55 for society may even be doable if staff solely have to accumulate 20X their annual bills (inverse of 5%).

Nevertheless, if you wish to your wealth to endure for generations after you retire early, take into account reducing your secure withdrawal fee to make sure the sustainability of your monetary legacy. It’s also possible to generate supplemental retirement earnings.

Components to Calculate Your True Annual Expense A number of Wanted to Retire Early

To find out the true a number of of your annual bills wanted to retire early, you’ll have to assess two key elements:

- The minimal annual expense a number of you imagine is critical for early retirement. 25X is usually a baseline.

- The share of your web value held in income-producing, liquid investments.

Right here’s the way it works:

Let’s assume you imagine {that a} web value of 25X your annual bills, the inverse of 4%, is ample for early retirement. Nevertheless, solely 70% of your web value is in income-producing, liquid investments. To regulate for this, you should utilize the next system:

True Annual Expense A number of = Baseline Annual Expense A number of ÷ Share of Web Value in Revenue-Producing, Liquid Investments

For this instance:

True Annual Expense A number of = 25 ÷ 0.7 = 35.7

If 70% of your web value is in income-producing, liquid belongings, you would want a web value of 35.7 occasions your annual bills to attain the identical monetary safety as somebody with 100% of their web value in such belongings.

It’s because the 30% of non-liquid, non-income-producing belongings will not contribute on to producing earnings for bills, so that you want the next general web value to compensate. In fact, as you alter your web value composition, you may re-calculate your true annual expense a number of for early retirement.

Deal with Constructing Web Value First, Then Money Movement

If you wish to retire earlier, logically, you will need to discover a method to obtain a web value goal equal to your true annual expense a number of sooner. This often requires working longer, saving extra, and taking up extra threat. It could additionally imply forsaking homeownership to spice up your liquid share.

Additional, the federal government taxes earnings extra closely than funding positive factors, making it extra advantageous to prioritize rising your web value over producing money move within the early phases of your monetary journey. Whereas there’s ongoing debate a couple of potential wealth tax, it’s unlikely to develop into a actuality anytime quickly.

Solely whenever you’re able to cease working solely or your lively earnings sources considerably dwindle ought to producing passive earnings take heart stage.

In our uncommon case, my spouse and I don’t have conventional jobs, but we stay aggressive buyers. Monetary Samurai, our “X Issue,” gives supplemental earnings that we didn’t totally anticipate after we left our company roles in 2012 and 2015. This extra earnings has allowed us to tackle extra funding threat, akin to specializing in progress shares and allocating capital to enterprise funds for personal market publicity.

As we’ve elevated our investments in illiquid belongings, the trade-off has been slower passive earnings progress. In the future, Monetary Samurai will come to an finish, and when that point arrives, we’ll pivot to prioritize liquidity and income-generating investments.

Do not Take The 25X A number of For Monetary Independence At Face Worth

Simply as focusing solely on income as a substitute of revenue can mislead in evaluating a enterprise, so can assuming that 25X annual bills is all one wants for monetary independence. Many individuals have web value tied up in properties, progress shares, non-public corporations, commodities, or collectibles that don’t generate earnings.

Based mostly on my early retirement expertise and that of numerous others pursuing FIRE since 2009, a web value equal to 25X bills is commonly not sufficient. You’ll seemingly end up nonetheless working or looking for new earnings sources when you obtain this monetary milestone. You might even crack the whip and pressure your partner to proceed working as you relax!

To really feel genuinely free, take into account aiming for 50X bills or 20X your common gross earnings over the past three years. Higher but, do the straightforward math to seek out your distinctive a number of as I proposed in my system above. Whereas these web value targets could seem formidable, don’t underestimate the facility of compound returns and disciplined saving.

If you happen to don’t attain these multiples, that’s okay too. Many individuals proceed to earn lively earnings to fund their life-style targets. However now, I am much more emboldened by my web value targets as a consequence of nationwide information from Pew Analysis and my logical system.

Reader Questions And Strategies

Readers, do you assume a web value equal to 25X your annual bills is sufficient to retire early on? Have you ever ever met somebody who did retire early on 25X bills and does not generate any lively earnings?

Free monetary checkup and $100 reward card: In case you have over $250,000 in investable belongings, take benefit and schedule a free session with an Empower monetary skilled right here. Full your two free video calls with the skilled by November 30, 2024, and you may obtain a free $100 Visa reward card. There isn’t any obligation to make use of their providers after.

With a brand new president in workplace, it’s a good time to get a second opinion in your portfolio positioning. Consulting a monetary skilled in 2013 helped me develop my web value by a further $1 million. If I met with one as we speak, I’m certain they’d suggest a extra balanced portfolio. However I’m a risk-taker at coronary heart.

The assertion is offered to you by Monetary Samurai (“Promoter”) who has entered right into a written referral settlement with Empower Advisory Group, LLC (“EAG”). Click on right here to study extra. Be a part of 60,000+ others and subscribe to my free weekly publication right here.