Yves right here. This publish recaps an OECD research of 32 nations on the associated fee and efficiency of social applications, as in authorities funded and even offered measures to assist long-term take care of the aged.

This can be a very thorny matter that we’ve coated on and off, with the US non-public long-term care insurance coverage debacle as the main focus. The very quick model is that within the Nineties, many insurer determined that long-term care was an amazing new world to beat. They wrote a bunch of insurance policies with no sound underwriting knowledge. One in every of their huge unhealthy assumptions was on lapse charges, as in what number of would pay for insurance policies however drop them later, in order that the insurer would get to maintain that cash and never must make any payouts. Apart from early deaths, nearly everybody who signed up for these long-term care insurance policies paid religously.

A second issue the insurers didn’t think about was what wound up being adversarial choice: those that wound up getting long-term care lived longer on common than assumed by the insurer fashions, and plenty of specialists mentioned this was due in no small measure the actual fact of them having the ability to pay for extra care. In different phrases, the insurers didn’t enable sufficiently for the insurance policies working as marketed, as in offering for higher residing situations and medical minding, would enhance longevity and therefor their prices.

Reader ma simply ship a hyperlink to a different instance of personal sector measures within the US not understanding in keeping with plan: People Danger Shedding Life Financial savings When Retirement Properties Go Bust. More and more retirement communities invoice themselves as offering full late-in life care, from impartial residing (often renting a unit, with communal meals and providers like a library, reward store, ATM, actions, and generally exterior providers on website, like a magnificence store and a clinic) to assisted residing (which might be quick time period after a nasty ailment or surgical procedure, or ongoing) to full nursing care. Alzheimers care shouldn’t be typically on the menu resulting from problem and value.

Most of those amenities require an up entrance (and generally largely refundable to heirs) buy-in. That makes the residents susceptible to monetary loss. From Bloomberg:

Bob Curtis, 87, and his spouse Sandy bought their house in Nassau County three years in the past and forked over $840,000 to maneuver into The Harborside, a Lengthy Island retirement house that was supposed to offer take care of the remainder of their lives.

Then the power went bankrupt and an effort to promote it to new homeowners was blocked by New York regulators in October. So now, like almost 200 others who stay there, they might see a lot of their life financial savings — and their new house – disappear.

Not surprisingly, this text depicts the intensifying long-term care downside as considered one of longevity, and never additionally neoliberalism. It was once that getting old adults lived very close to their kids; their offspring someday has even moved into the household house when elevating their very own household. Having the oldster on premises with different adults and generally kids serving to with their care was the popular route. Now having aged dad and mom transfer in (save the traditional granny condo over a storage) or an grownup baby take care of a too-often bodily eliminated father or mother is seen as burden and now not appears widespread.

By Satoshi Araki, Jacek Barszczewski, Karolin Killmeier and Ana Llena-Nozal. Initially printed at VoxEU

Fast inhabitants ageing is growing the strain on public funds to offer ample assist for long-term care recipients. This column compares the influence of various social safety measures throughout 32 OECD and EU nations on poverty charges and out-of-pocket bills amongst older adults with care wants. The evaluation reveals substantial room for enchancment and reforms, with current techniques typically unaffordable and badly focused. The promotion of wholesome ageing, proactive use of recent applied sciences to raise care sector productiveness, revision of eligibility guidelines to allow extra focused and inclusive protection, diversification of funding sources, and optimisation of income-testing are all viable coverage choices.

Inhabitants ageing is accelerating quickly. Throughout OECD nations, the share of individuals aged 65+ has doubled from lower than 9% in 1960 to 18% as of 2021 (OECD 2023) and is anticipated to succeed in 27% by 2050, growing demand for long-term care providers (Kotschy and Bloom 2022). On the identical time, there may be rising public strain to scale back the care burden on households and people in favour of presidency funding and the supply of long-term care (Ilinca and Simmons 2022). Mixed with the rising prices of care (OECD 2023), these tendencies are including strain to the fiscal sustainability of public long-term care techniques. Making certain the cross-country comparability of the prices and advantages of public long-term care schemes in 32 OECD and EU nations, 1 a brand new OECD report compares present long-term care prices throughout nations and presents proof on the effectiveness of public expenditures in assuaging the monetary burden on care recipients.

Regardless of Public Help, Lengthy-Time period Care Stays Unaffordable for Many Older Folks

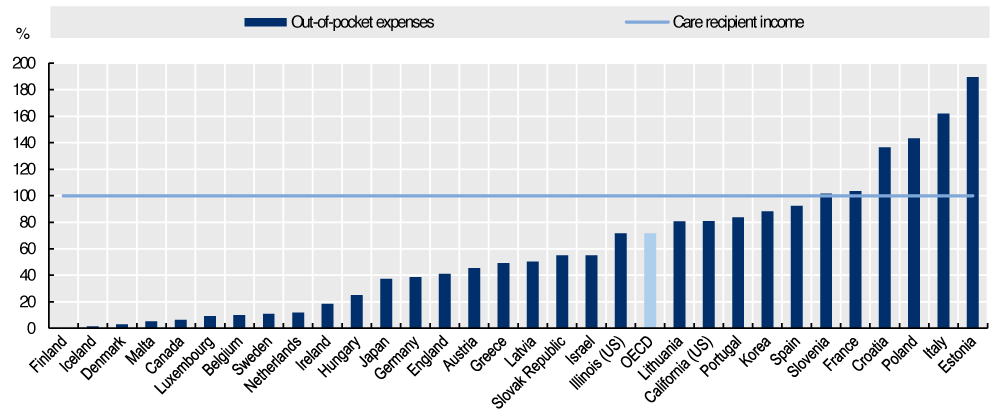

With out enough public assist, long-term care providers are unaffordable for many older individuals. The common long-term care price for people with low care wants, already 42% of the median revenue of older individuals (with out public assist), might attain 259% for these with extreme care wants. Although all OECD nations included within the report cowl no less than a part of the associated fee by way of profit schemes, people’ out-of-pocket bills stay substantial, significantly for older individuals with extreme wants (see Determine 1). On common, these prices characterize over 70% of the median revenue of older individuals throughout OECD nations, even after accounting for public social safety. Nonetheless, there may be vital variation among the many analysed nations. Within the Nordic nations resembling Finland, Iceland, and Denmark, out-of-pocket prices stay beneath 5% of median revenue, whereas in Italy and Estonia, these prices exceed 150%, successfully pushing older adults into poverty or leaving them with unmet care wants.

Determine 1 Out-of-pocket bills for long-term care are near or above the median revenue in almost half of nations

Out-of-pocket bills on long-term care as a share of median revenue amongst older individuals who have extreme long-term care wants with median revenue and no wealth, after receiving public assist

Be aware: Extreme wants are outlined as requiring 41.25 hours of care per week. Estimates assume older individuals with long-term care wants would depend on formal house care. Median revenue refers back to the disposable median revenue of older individuals (65+) in every nation. For readability, knowledge for Czechia, which stands at 482%, aren’t displayed.

Supply: OECD (2024).

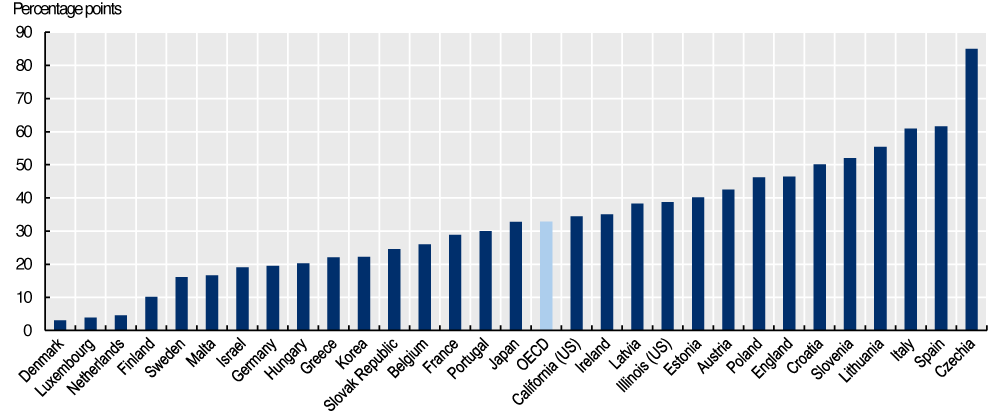

Excessive out-of-pocket bills for long-term care considerably enhance the poverty threat amongst older individuals (see Determine 2). On common, poverty charges for older adults with long-term care wants are 31 share factors increased than for the overall older inhabitants. The long-term care techniques in Scandinavian nations, Luxembourg, and the Netherlands are among the many only at decreasing poverty dangers linked to care bills. In distinction, the poverty threat amongst long-term care recipients in Italy and Spain is way increased – greater than 60 share factors – compared to the whole older inhabitants (aged 65+).

Determine 2 Older individuals with long-term care wants face an elevated threat of poverty in all nations

Proportion level distinction in relative poverty threat between care recipients and all older inhabitants (aged 65+), after receiving public social safety

Be aware: Baseline poverty threat represents the poverty fee amongst all older individuals. Estimates are calculated utilizing adjusted survey weights and assume that each one older individuals with long-term care wants would use formal house care. For nations with subnational fashions, national-level survey knowledge had been used to supply the estimates proven. Poverty is outlined as having an revenue 50% beneath the nation’s median revenue.

Supply: OECD (2024).

Coverage Choices to Sort out Rising Demand for Lengthy-Time period Care Companies

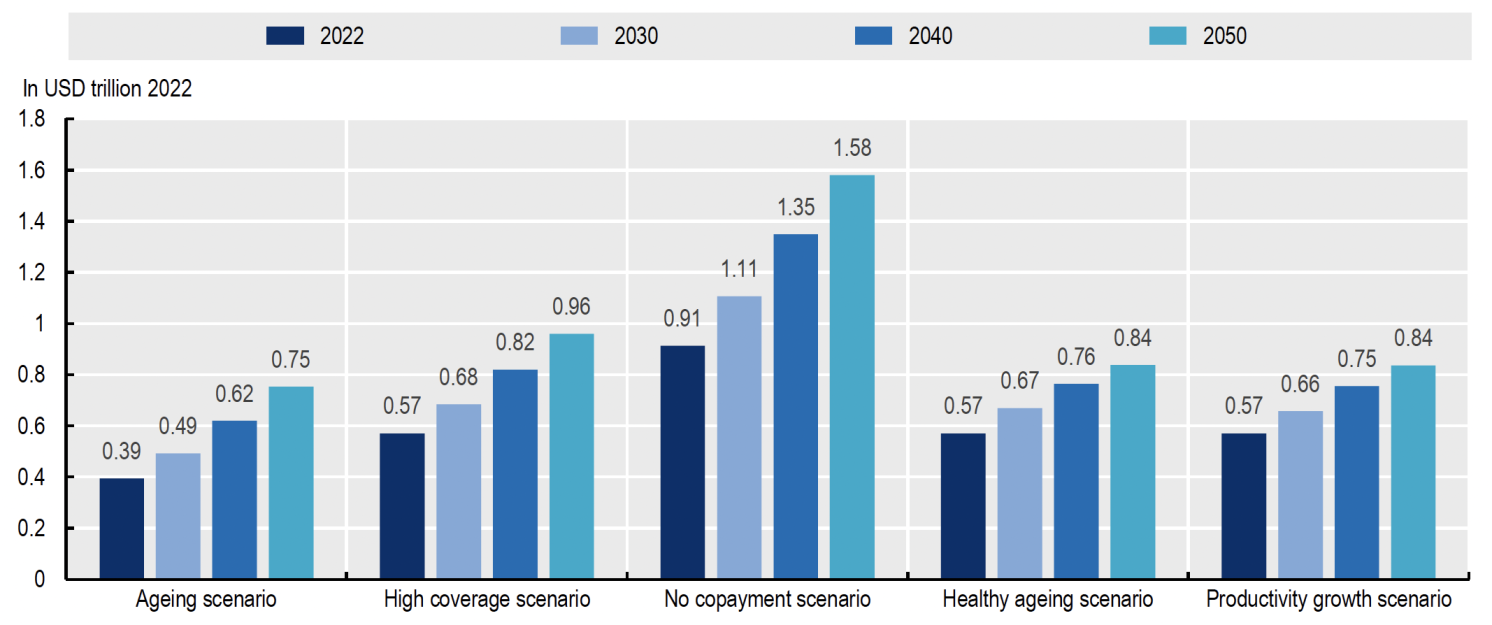

Rising prices, rising demand, and low productiveness beneficial properties are putting substantial monetary strain on public long-term care techniques. The OECD report analyses how this monetary strain might influence future long-term care spending beneath totally different situations (see Determine 3). Within the first situation (the ‘ageing situation’) – whereby nations preserve the present degree of assist and the prevailing share of older adults with wants receiving long-term care – expenditures are projected to rise by a median of 91% by 2050. Within the second situation (the ‘excessive protection situation’), which assumes a rise to 60% of the share of older adults with care wants, expenditures would enhance by 144%. Lastly, within the ‘no copayment situation’, out-of-pocket bills are absolutely eradicated and long-term care expenditures develop by greater than 300%.

Determine 3 Projections of presidency spending on long-term care beneath totally different situations

Sum of all monetary safety for long-term take care of older individuals who obtain public social safety in trillions of 2022 USD

Be aware: Bars present the sum of the simulated long-term care spending throughout 26 OECD and a couple of EU non-OECD nations. For nations with subnational fashions, these are utilized to national-level survey knowledge to supply the estimates proven.

Supply: OECD (2024).

Whereas inhabitants ageing is unavoidable, nations may help older populations undertake more healthy existence and introduce preventive measures to scale back dependency and well being points for so long as potential. Programmes like house visits in Scandinavian nations have confirmed to be cost-effective by growing the variety of energetic, wholesome years (Kronborg et al. 2006). Such insurance policies might scale back future long-term care spending by 13% in comparison with the baseline excessive protection situation (see wholesome ageing situation, Determine 3).

Though labour productiveness development within the long-term care sector stays low and even destructive (OECD 2023), rising applied sciences may very well be put to raised use to assist scale back general care prices. OECD simulations counsel that if productiveness development in long-term care reached even half the typical productiveness development of the general economic system, long-term care spending by 2050 may very well be 13% decrease than within the baseline excessive protection situation (see productiveness development situation, Determine 3). New user-centred assist instruments, resembling environmental and wearable sensors, can help long-term care suppliers in monitoring, positioning, and recognising bodily actions (Bibbò et al. 2022). Digital carers additionally play an more and more vital function, supporting each care recipients and suppliers in managing situations like diabetes, despair, and coronary heart failure (Bin Sawad et al. 2022).

Whereas taxes are the most typical supply of long-term care funding, some nations have launched public long-term care insurance coverage to realize higher risk-sharing and handle transparency challenges. For instance, Slovenia launched a long-term care insurance coverage scheme in 2023, aiming to create a extra complete system, enhance funding transparency, and keep away from growing public-sector debt.

With restricted public sources, nations might prioritise supporting people most in want: these with low incomes and people with extreme long-term care wants. An instance of such a coverage could be capping out-of-pocket bills at 60%, 40%, and 20% of care prices for older adults with low, reasonable, and extreme wants, respectively. Our simulation reveals that such a needs-testing method may very well be a sexy possibility for nations like Latvia, Malta, and Hungary. In these instances, the simulation signifies that this technique might scale back general public long-term care spending with out considerably growing the poverty threat amongst recipients (OECD 2024).

Moreover, extra progressive cost-sharing throughout the revenue distribution may help handle long-term care budgets and restrict poverty amongst care recipients. Virtually 90% of OECD and EU nations analysed within the report apply some type of income-testing to outline ranges of assist, however people with low incomes nonetheless face a considerably increased threat of poverty. Optimising income-testing to deal with susceptible populations can additional enhance outcomes. In about one-third of the analysed OECD nations, this method results in decrease long-term care spending and reduces poverty amongst care recipients, or no less than comprises spending with out growing poverty charges (OECD 2024).

Conclusion

Reaching honest entry to long-term care and the fiscal sustainability of public techniques amid inhabitants ageing is a problem for policymakers. The OECD evaluation reveals that current techniques are sometimes unaffordable and badly focused: there may be substantial room for enchancment and reforms. The promotion of wholesome ageing, proactive use of recent applied sciences to raise the care sector’s productiveness, revision of eligibility guidelines to allow extra focused and inclusive protection, diversification of funding sources, and optimisation of income-testing are all viable coverage choices. Every is price exploring within the seek for resilient long-term care techniques that may stand up to demographic shifts and evolving societal wants.

Editors’ observe: This column is a abstract of the publication/builds on the publication OECD (2024), “Is Care Inexpensive for Older Folks?”.This work, in addition to any knowledge and map included herein, shouldn’t be reported as representing the views of the OECD, together with each its Member nations and its Secretariat. The opinions expressed and arguments employed are these of the authors.

See unique publish for references