KEY

TAKEAWAYS

- Tech shares took a dive on Wednesday however seem like they’re making up a few of these losses previous to hitting the subsequent assist degree.

- Anticipate volatility within the inventory market within the coming weeks because it’s earnings season and there is a Fed assembly subsequent week.

- Control small-cap shares since they might outperform large-cap shares within the coming weeks.

Wednesday’s value motion within the inventory market indicated that concern is again. The Cboe Volatility Index ($VIX) closed up by over 22%, the most important proportion transfer for the yr. There’s an opportunity volatility may stay elevated for the close to time period—it is the center of earnings season, the November election panorama has modified, and it is a seasonally weak interval for equities.

On Wednesday, the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) skilled the worst buying and selling day of the yr. The Nasdaq Composite was hit arduous, closing decrease by 3.64%. From a big-picture viewpoint, how a lot injury did the drop do? Let’s look intently on the value motion within the Nasdaq Composite, beginning with the weekly chart.

The Macro View of the Nasdaq

a five-year weekly chart beneath, the uptrend that commenced in October 2023 remains to be in play. The shifting averages overlaid on the chart are adjusted to mirror assist ranges for the uptrend since October 2023. The short-term uptrend adopted the eight-week exponential shifting common (EMA). In April 2024, the Nasdaq Composite bounced off the 25-week easy shifting common (SMA), and in October, the index bounced off its 48-week SMA.

CHART 1. WEEKLY CHART OF NASDAQ COMPOSITE. Will the Nasdaq discover assist at its 25-week shifting common? Chart supply: StockCharts.com. For academic functions.

On Wednesday, the Nasdaq Composite broke beneath its eight-week EMA, the primary alarm bell indicating that issues is probably not nice in AI land. The next day, the selloff continued within the early a part of the buying and selling day however recovered some losses.

If the selloff continues, the subsequent level to look at can be the 25-week SMA which corresponds intently with the assist of the final earlier weekly excessive. Will the Nasdaq bounce off this degree just like what it did in April or will it proceed decrease and bounce off its 48-week SMA prefer it did in October? Or will the Nasdaq honor the assist degree of earlier highs and lows (blue dashed traces)?

Any of the situations may play out, or, as is attribute of the inventory market, it may do one thing distinctive.

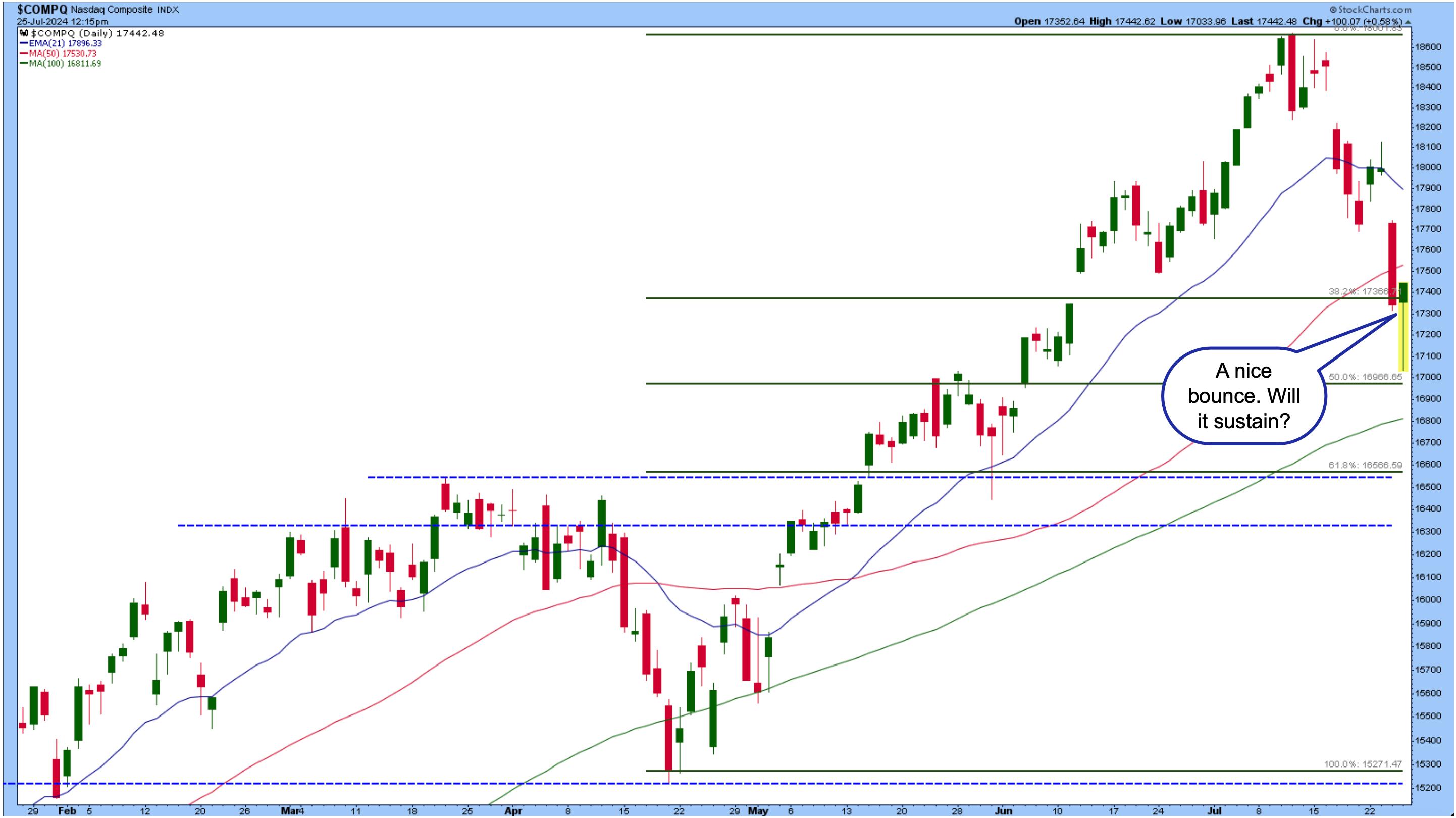

A Shorter-Time period View of the Nasdaq

Let’s flip to the day by day chart (see chart beneath) to zero in on that first assist degree on the weekly chart, 16,670. To hit that degree, the Nasdaq Composite must fall between the 100-day SMA and the 61.8% Fibonacci retracement degree. You may see from the chart that the Nasdaq approached its 50% Fib retracement degree however reversed and moved again as much as the 38.2% retracement degree.

CHART 2. DAILY CHART OF NASDAQ COMPOSITE. The index recovered. The query is, will it maintain? Chart supply: StockCharts.com. For academic functions.

If VIX stays elevated, count on extra sizable actions within the Nasdaq and different fairness indexes. The Private Consumption Expenditure (PCE) for June drops on Friday.

Earnings Volatility

Earnings had quite a bit to do with this week’s value motion. Alphabet (GOOGL) and Tesla (TSLA) reported on Tuesday after the shut. Though GOOGL beat earnings expectations, the decline in YouTube revenues led traders to promote the inventory. TSLA earnings missed estimates, with the inventory closing decrease by 12.33%.

Subsequent week, we’ll hear from extra Magazine 7 corporations. Provided that traders are getting jittery about tech shares, the businesses have to supply extremely robust earnings reviews. Even one unfavourable report can ship the inventory value and all the inventory market decrease.

Assuming that equities fall additional—it is a honest assumption given {that a} correction is anticipated—what sort of funding technique do you have to apply? Your first thought could also be bonds, however they are not exhibiting indicators of energy. Bond costs fell on Wednesday together with shares. Commodities and cryptocurrencies aren’t exhibiting indicators of enthusiasm both.

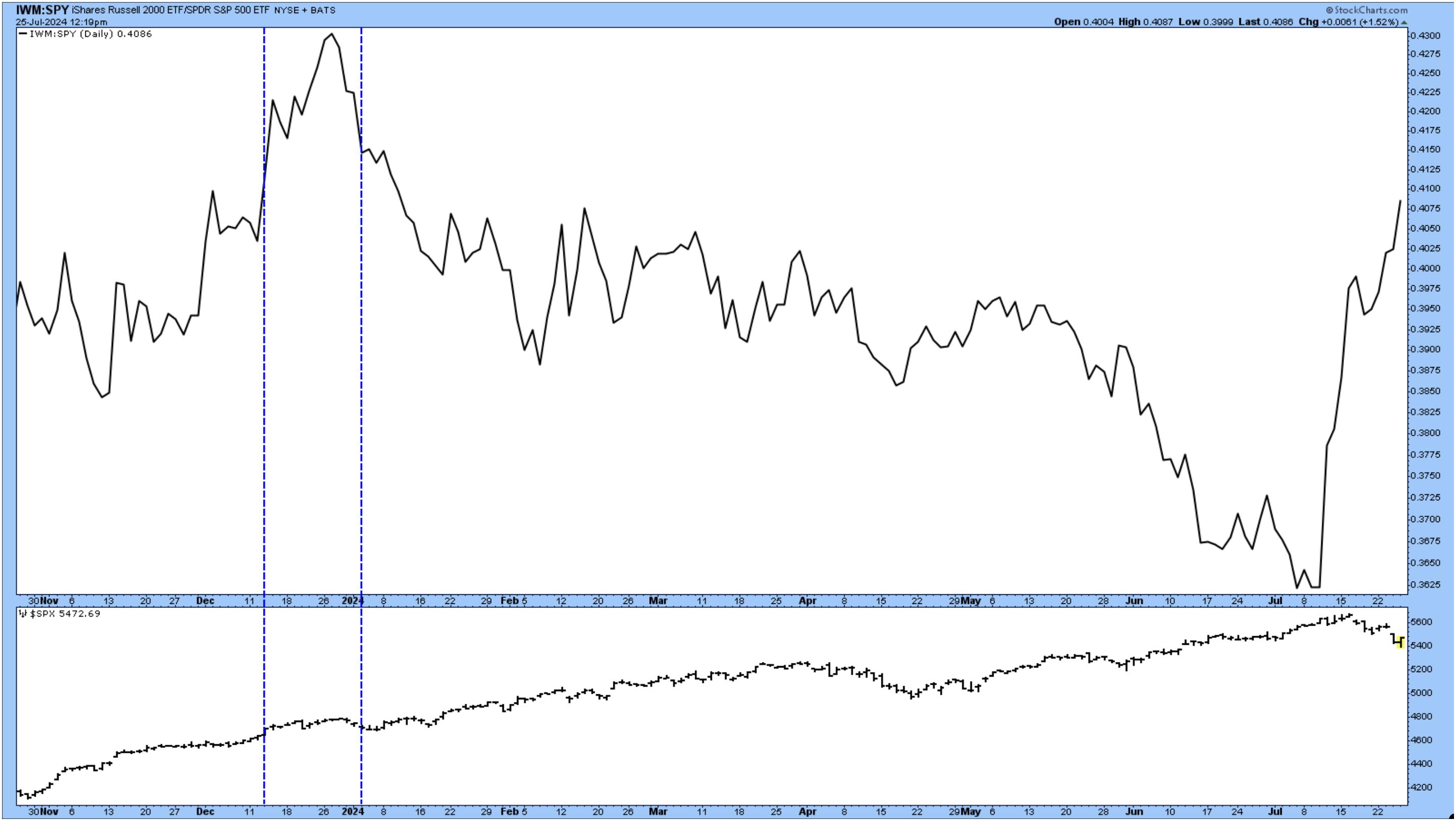

Small-Cap Shares

Small-cap shares are outperforming large-cap shares, as displayed within the chart of the ratio between iShares Russell 2000 ETF (IWM) and the SPDR S&P 500 ETF (SPY) beneath. Evaluate the value motion to what occurred between December 2023 and January 2024. The S&P chart within the decrease panel does not present a large correction throughout that interval. However no two durations are alike so it is best to maintain a detailed watch on the completely different shifting elements of the inventory market.

CHART 3. SMALL CAPS VS. LARGE CAPS. Small caps are outperforming large-cap shares, though it does not essentially imply that giant caps will pull again considerably. It is nonetheless price watching this chart. Chart supply: StockCharts.com. For academic functions.

IWM is made up of small-cap US shares. Curiously, one of many high holdings in IWM is Insmed Inc. (INSM), a inventory with a excessive StockCharts Technical Rank (SCTR) rating. It additionally has an attention-grabbing chart sample (see chart beneath).

CHART 4. DAILY CHART OF INSMED INC. (INSM). The chart gapped about its earlier all-time excessive in 2021 and is now consolidating. With a powerful SCTR rating, will the inventory keep its robust place? Chart supply: StockCharts.com. For academic functions.

The inventory value gapped up above its February 2021 all-time excessive and has continued shifting greater. It is now consolidating. Look ahead to the inventory to interrupt out above the descending triangle sample (blue dashed traces) or to succeed in the assist of its 25-day SMA. An upside follow-through from both of those patterns may make this a powerful buying and selling candidate. So, set your alerts on StockCharts so you do not miss this one.

You might do an identical evaluation on different high IWM holdings, equivalent to FTAI Aviation Ltd. (FTAI), Vaxcyte Inc. (PCVX), and Sprouts Farmers Market Inc. (SFM).

Different Market Segments To Contemplate

Different areas of the market price contemplating are worth shares. Deliver up a ratio chart of the iShares Russell 1000 Worth ETF (IWD) to the iShares Russell 1000 Progress ETF (IWF).

Regional banks are additionally performing effectively. Deliver up a chart of the SPDR S&P Regional Banking ETF (KRE). If this catches your consideration, head to the StockCharts Image Abstract web page, sort in KRE, and begin your analysis. The Profile part has a hyperlink to the ETF web page from the place yow will discover the highest holdings.

Closing Place

If risky circumstances persist available in the market for the subsequent month or so, you may must develop a technique to handle your portfolio to cushion your drawdowns. Subsequent week there are extra earnings and a Fed assembly. So, be ready along with your recreation plan.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.