Current occasions have heightened consciousness of systemic danger stemming from nonbank monetary sectors. For instance, in the course of the COVID-19 pandemic, liquidity demand from nonbank monetary entities induced a “sprint for money” in monetary markets that required authorities help. On this put up, we offer a quantitative evaluation of systemic danger within the nonbank sectors. Regardless that these sectors have heterogeneous enterprise fashions, starting from insurance coverage to buying and selling and asset administration, we discover that their systemic danger has frequent variation, and this commonality has elevated over time. Furthermore, nonbank sectors are likely to develop into extra systemic when banking sector systemic danger will increase.

Measuring Nonbank Systemic Danger

We use the greenback SRISK measure of systemic danger for U.S. monetary companies from the NYU-Stern V-Lab. This measure is outlined because the anticipated capital shortfall of a agency in a disaster scenario and signifies the agency’s contribution to undercapitalization of the monetary system when in misery. Undercapitalization is of consequence since it might result in credit score retrenchment by monetary companies. Whereas the measure is out there day by day, we use month-to-month averages with a view to easy over day-to-day volatility.

Every agency is assigned to the banking sector (depository credit score establishments) or one in every of 5 nonbank sectors (asset administration, insurance coverage, non-depository credit score establishments, actual property, and buying and selling) based mostly on its North American Industrial Classification System (NAICS) code. Since NAICS codes classify companies by their main exercise, some financial institution holding firms (BHCs) with important nonbank enterprise traces are tagged as non-depository credit score establishments. If, as a substitute, we depend all BHCs as banks, the outcomes are comparable. To get the sector SRISK, we sum SRISK throughout companies in every sector, assigning zero when the worth is destructive (which is tantamount to assuming that capital surplus companies can not take over a capital deficit agency in a disaster). Since we examine throughout sectors with completely different agency sizes and, additional, the variety of companies in every sector modifications over time, we divide the sector SRISK by the whole e-book worth of belongings of companies within the sector. Whereas doing so dilutes the impact of dimension on systemic danger, we discover that bigger companies have larger SRISK per greenback of belongings in recessions.

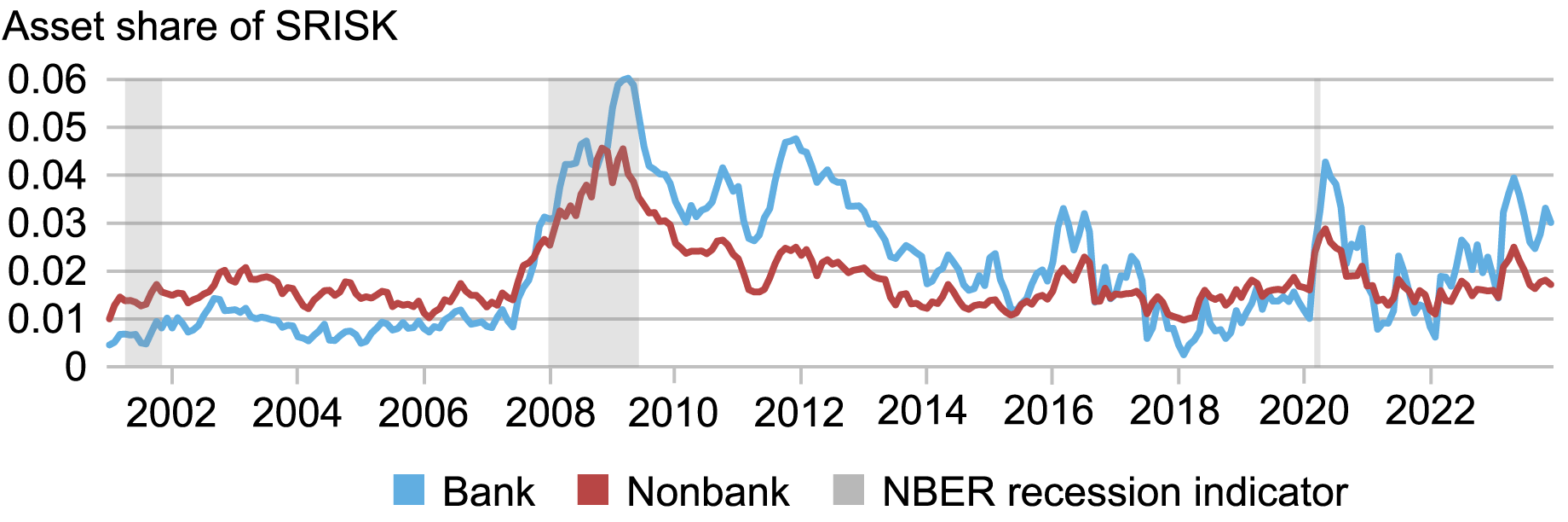

Financial institution and nonbank systemic danger might transfer collectively as a result of they’ve frequent publicity to the macroeconomy and to funding difficulties (as a result of, for instance, banks typically fund nonbanks). The chart under plots the SRISK asset shares of banks and the combination of all nonbank sectors, together with the NBER recession indicator. Financial institution and nonbank systemic danger co-move, rising in the course of the previous two recessions (the Nice Monetary Disaster (GFC) and the COVID-19 pandemic), in addition to round June 2011 firstly of the European debt disaster. As additional proof of co-movement, we estimate utilizing principal parts evaluation (PCA) {that a} single issue explains 88 p.c of the frequent variation in financial institution and nonbank systemic danger and this issue is correlated with macroeconomic outcomes such because the NBER recession indicator and modifications within the tightness of monetary situations broadly.

Financial institution and Mixture Nonbank Systemic Danger Co-Transfer

Notes: The chart plots the asset shares of SRISK for banks and nonbanks, together with the NBER recession indicator. The pattern is 2001 to 2023.

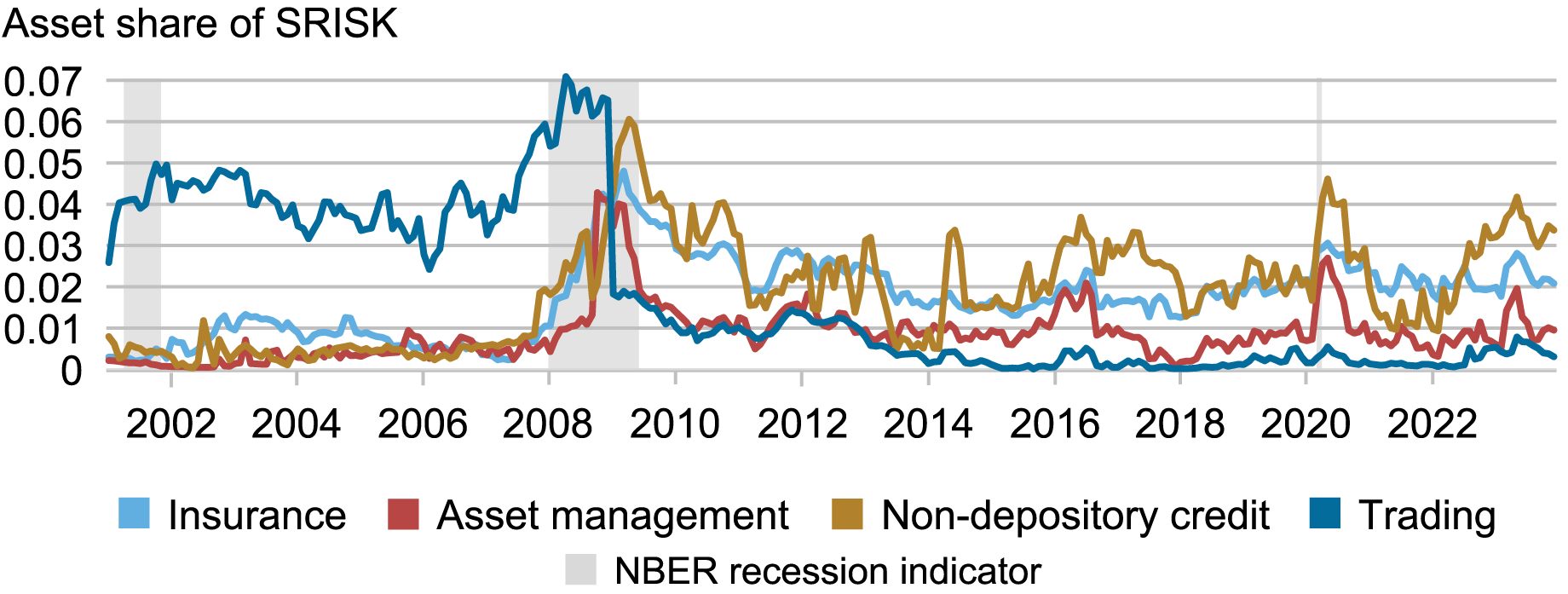

Systemic Danger of Nonbank Sectors

The chart under exhibits the SRISK shares of 4 nonbank sectors; from this level, we omit the true property sector because it has too few companies for dependable inference. The buying and selling sector was initially probably the most systemic however turns into the least systemic after 2008. This occurred as a result of Merrill Lynch, a buying and selling agency, had a dominant share of the sector’s systemic danger however was acquired by Financial institution of America in September 2008. Therefore, its systemic danger migrated to the banking sector by advantage of this acquisition. This occasion highlights how financial institution holding firms might incorporate the systemic danger of nonbanks, as current analysis has highlighted (see right here, right here, and right here). Since September 2008, the SRISK shares of the non-depository credit score sector and the insurance coverage sector have typically been the very best of all nonbank sectors. Furthermore, for the reason that Federal Reserve began to hike rates of interest within the first quarter of 2022, the SRISK share of the non-depository credit score sector has spiked, primarily resulting from companies engaged in mortgage servicing. Apparently, whereas there was a lot curiosity within the systemic danger of the asset administration sector, its SRISK share is comparatively low.

The Systemic Significance of Nonbank Sectors Modifications over Time

Notes: The chart plots the asset shares of SRISK for these nonbank sectors: asset administration, insurance coverage, non-depository credit score, and buying and selling, together with the NBER recession indicator. The pattern is 2001 to 2023.

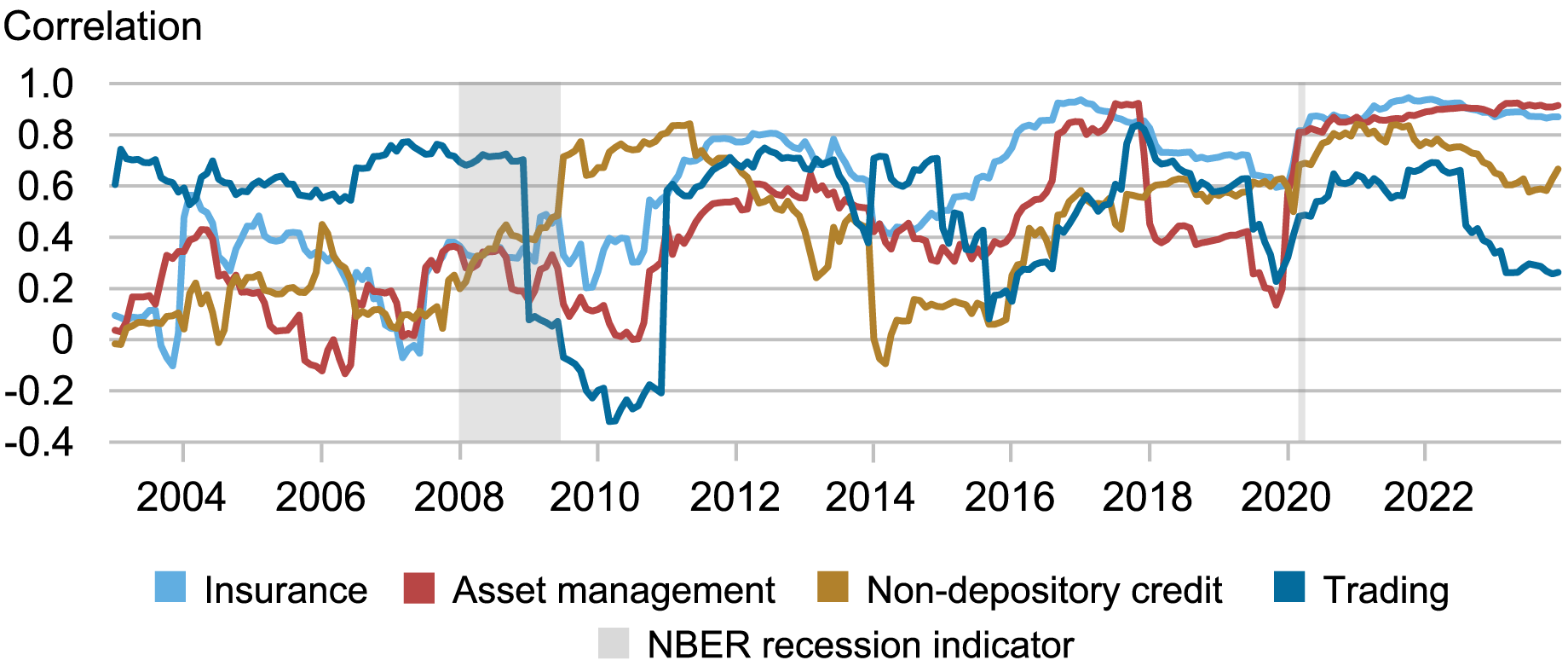

The following chart means that the systemic danger of nonbank sectors could also be extra aligned throughout NBER recessions, as in comparison with regular occasions. We present within the chart under twenty-four-month rolling correlations of the log change in SRISK shares of every nonbank sector with the log change within the banking sector SRISK share. The correlation spikes throughout recessions (apart from the buying and selling sector in the course of the GFC, a mechanical impact as a result of Merrill Lynch acquisition mentioned above). Extra typically, nonetheless, every nonbank sector has develop into more and more correlated with the banking sector. The 2 most systemic nonbank sectors (non-depository credit score and insurance coverage) even have excessive correlations with the banking sector systemic danger. Notably, whereas the asset administration sector has comparatively low SRISK share, it’s typically probably the most correlated with banks for the reason that COVID-19 pandemic. This outcome reinforces the commentary (see right here, for instance) that, to evaluate the systemic danger of a nonbank sector, it’s inadequate to solely contemplate its personal systemic footprint; moderately additionally it is necessary to contemplate its interconnections with the banking sector.

Nonbank Sectors Co-Transfer Extra with Banks Throughout Crises

Notes: The chart plots the twenty-four-month shifting correlation of the log change in asset shares of SRISK for every of 4 nonbank sectors (asset administration, insurance coverage, non-depository credit score, and buying and selling) with the log change in SRISK share of the banking sector, together with the NBER recession indicator. The pattern is 2001 to 2023. The horizontal axis signifies the end-month of the window over which the correlation is calculated.

Heterogeneity of Nonbank Sector Systemic Danger

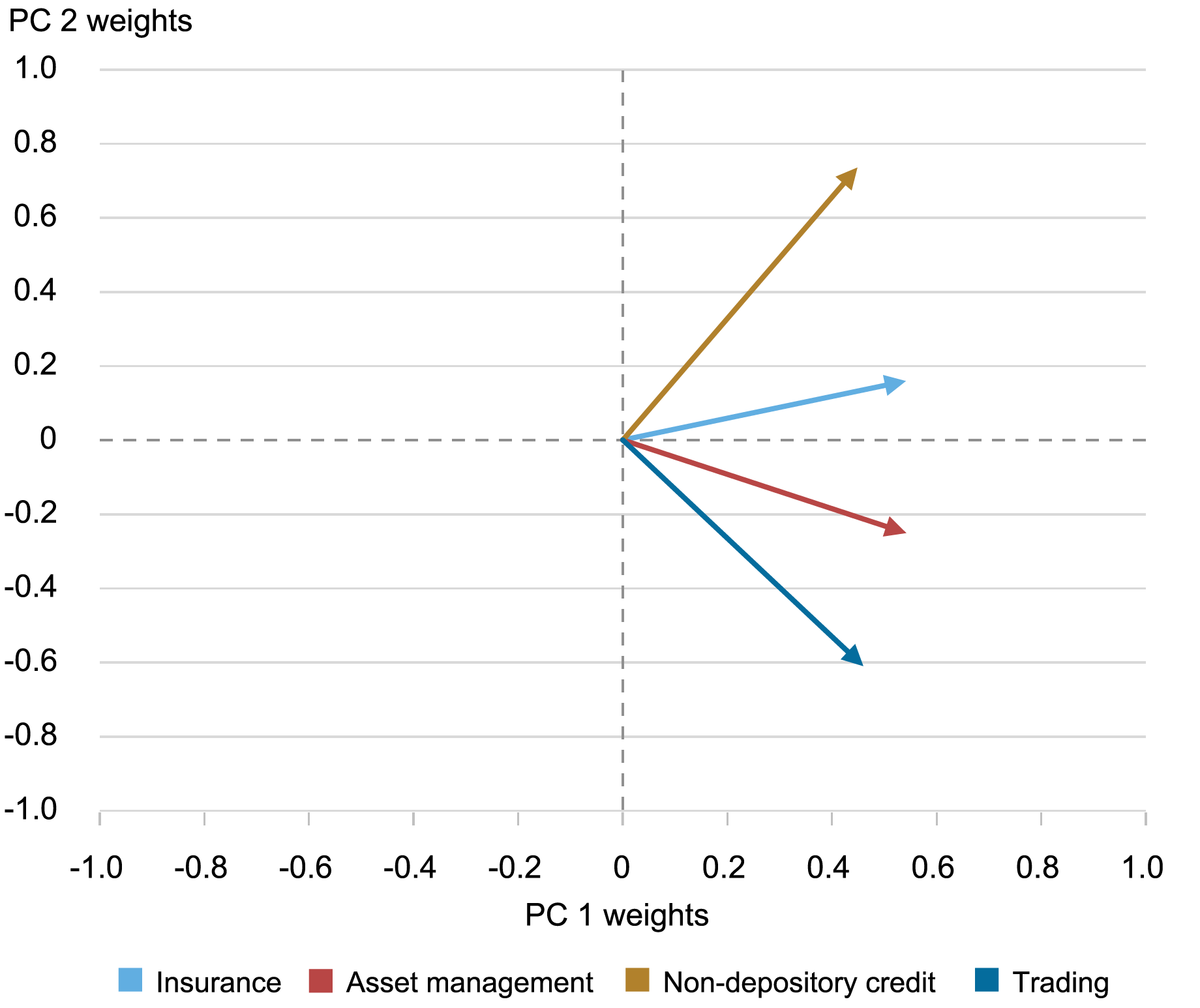

To this point, we now have emphasised the commonalities in systemic danger inside nonbank sectors and between these sectors and banking, particularly throughout recessions. Nonbank sectors, nonetheless, have fairly distinct enterprise fashions (for instance, insurance coverage versus asset administration). To look at this heterogeneity, we conduct PCA of the log change within the SRISK shares of the nonbank sectors.

We deal with the primary two principal parts, which collectively clarify greater than 66 p.c of the whole variation of the 4 nonbank sectors, suggesting robust commonality between the nonbank sectors on common. The chart under exhibits how the 2 principal parts load on the 4 nonbank sectors, as indicated by the 4 vectors. The primary principal part (PC1), which explains greater than 46 p.c of the whole variation of all sectors, masses equally on every sector, as proven by the x-axis values. Thus, this part is near an equal-weighted index and highlights similarities within the systemic danger of various nonbank sectors. In contrast, the second principal part (PC2) has a greater than 73 p.c weight on the non-depository credit score sector (as proven by the y-axis worth), together with brief (or destructive) positions on the buying and selling and asset administration sectors. In different phrases, this part highlights divergences within the evolution of systemic danger of several types of nonbank intermediation companies.

Commonalities and Divergences in Nonbank Sector Systemic Danger

Notes: The spider chart plots the sector loadings of the primary two principal parts of the log change in asset shares of SRISK of 4 nonbank sectors (asset administration, insurance coverage, non-depository credit score, and buying and selling). The horizontal axis plots the loadings from the primary principal part (PC1) whereas the vertical axis plots loadings from the second principal part (PC2). The pattern is 2001 to 2023.

How has nonbank sector heterogeneity developed over the previous twenty years? We repeat the PCA evaluation individually for 9 durations equivalent to main occasions such because the GFC and the COVID-19 pandemic. The chart under exhibits the whole variation within the systemic danger of the 4 nonbank sectors captured by the primary two principal parts in every of those 9 durations. Together, the 2 principal parts clarify an rising proportion of the whole variation in SRISK shares of the nonbank sectors, from about 60 p.c initially to 90 p.c for the reason that COVID-19 pandemic. Thus, the systemic danger of various nonbank sectors more and more evolves in a typical means. Whereas the commonality is excessive in crises, as could also be anticipated, it has not decreased considerably in regular occasions, particularly just lately.

Nonbank Sector Systemic Danger More and more Strikes Collectively

Notes: The chart plots the proportion of complete variance of the log change in asset shares of SRISK of 4 nonbank sectors (asset administration, insurance coverage, non-depository credit score and buying and selling) defined by the primary two principal parts (PC1 and PC2) for 9 durations individually. The durations are: Pre-GFC (January 2001-July 2007; GFC (August 2007-October 2009); Submit-GFC (November 2009-November 2014); Oil (December 2014-June 2016); Charge hike (July 2016-February 2020); COVID-19 (March 2020 to October 2021); Submit-COVID (November 2021 to December 2022); Silicon Valley Financial institution [SVB] (January 2023 to Could 2023); Submit-SVB (June 2023-December 2023). The blue coloration signifies the proportion of complete variation defined by PC1 and the orange the proportion of variation defined by PC2. The pattern is 2001 to 2023.

Closing Phrases

The systemic danger of numerous nonbank sectors has frequent variation that will increase when banking sector systemic danger will increase, per current disaster episodes the place each financial institution and nonbank sectors have develop into confused. In future work, we plan to discover the robustness of those findings to different measures of systemic danger.

Andres Aradillas Fernandez was an undergraduate analysis intern within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group on the time this put up was written.

Martin Hiti is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Asani Sarkar is a monetary analysis advisor in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Tips on how to cite this put up:

Andres Aradillas Fernandez, Martin Hiti, and Asani Sarkar, “Are Nonbank Monetary Establishments Systemic?,” Federal Reserve Financial institution of New York Liberty Avenue Economics, October 1, 2024, https://libertystreeteconomics.newyorkfed.org/2024/10/are-nonbank-financial-institutions-systemic/.

Disclaimer

The views expressed on this put up are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).