Within the first half of this collection, we appeared on the historical past of the infamously car-centric American suburb, and the second evaluated their desirability. On this ultimate half, we’ll flip to their fiscal affect and the query of sustainability.

Are the suburbs merely the much less dense outskirts of a metropolis, or are they—as their detractors wish to say—a Ponzi scheme that’s swamping states and native municipalities with unrepayable debt whereas leeching off the cities that subsidize them?

Sponsored by the Cities?

The advocacy group Sturdy Cities is likely one of the most ardent supporters of city densification and highlights the city of Lafayette, Louisiana, to make its case that cities unfairly subsidize their suburbs. As they describe it:

“Like most cities, Lafayette had the written experiences detailing an enormously giant backlog of infrastructure upkeep. At present spending charges, roads had been going dangerous sooner than they may very well be repaired. With aggressive tax will increase, the price of failure may very well be slowed, however not reversed. The story underground was even worse. That didn’t make sense to Kevin or to town’s mayor, a man named Joey Durel.

Joe, Josh, and I interviewed all town’s division heads and key employees. We gathered as a lot knowledge as we might (they’d quite a bit). We analyzed and then mapped out all of town’s income streams by parcel. We then did the identical for all the metropolis’s bills. This was essentially the most complete geographic evaluation of a metropolis’s funds that I’ve ever seen accomplished. Once we completed, we had a three-dimensional map exhibiting what components of town generated extra income than expense.”

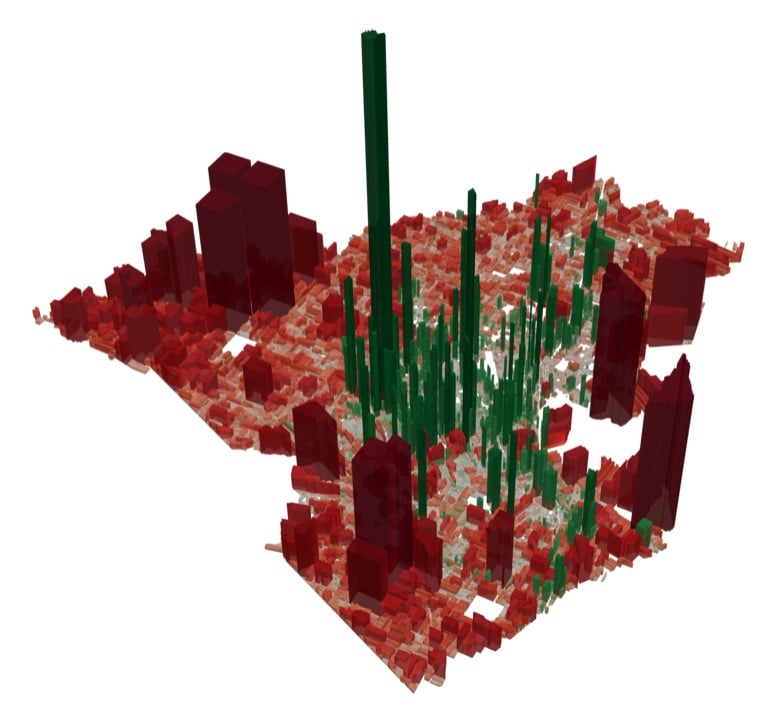

This is the map they got here up with:

Inexperienced areas herald cash, and pink are a internet expense. The peak of the road reveals how a lot of a internet earnings/expense these areas are.

The article continues:

“The largest downside that jumped out was that the substitute value of town’s infrastructure was $32 billion, whereas all the inhabitants’s wealth added to solely $16 billion! They estimated that the median family would have to pay at the least $3,300 a 12 months and as a lot as $8,000 in taxes simply to take care of the infrastructure versus the roughly $150 they had been paying.”

We’ll get to the finances shortfalls quickly sufficient. For now, as you’ll be able to see, the denser city areas herald cash, whereas the outlying, much less dense (i.e., extra suburban) areas value cash.

Nevertheless, this evaluation is clearly skewed, because the downtown space seems to be like inexperienced skyscrapers. Downtowns are sometimes business hubs, each when it comes to work and retail. They’d be internet boons even when nobody lived there in any respect, as many individuals from the suburbs and exurbs journey there to work and store. Merely densifying the outlying areas wouldn’t change this.

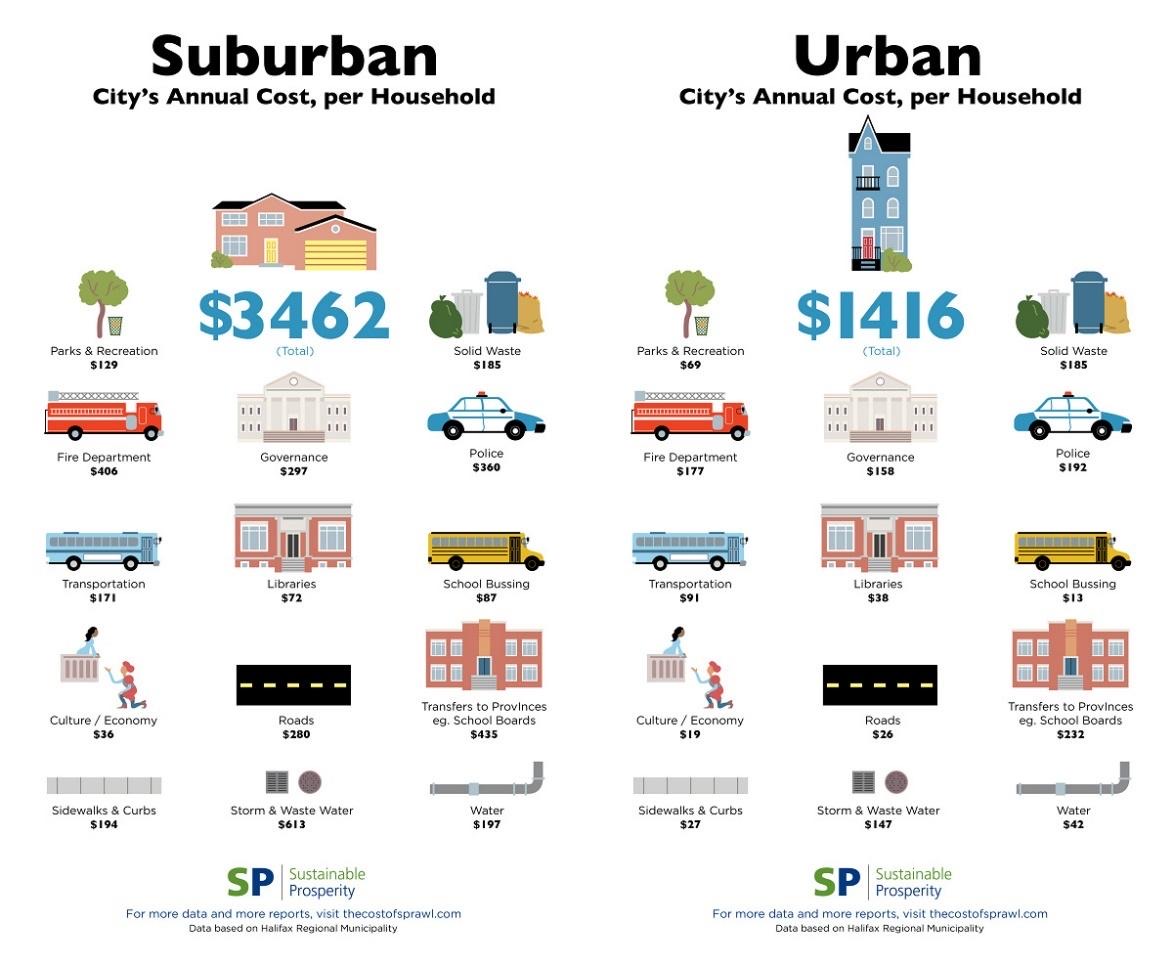

One other evaluation from the Canadian city of Halifax offers what I feel is a greater (and definitely much less dramatic) image. It discovered that the typical annual value to town for an city family was $1,416, in comparison with $3,462 for a suburban family.

The very first thing to notice is that the numbers supplied by Halifax don’t sq. with the state of affairs in Lafayette in any respect. Certainly, the price of all infrastructure (roads, sidewalks, curbs, water traces, and sewer traces) amounted to $1,284 for suburban properties—not even near the $8,000 Lafayette supposedly wanted. I believe the Halifax numbers are extra consultant. In any case, our cities have been sprawled for some time now and haven’t fully collapsed.

We must also be very cautious about claims about who’s subsidizing whom. For instance, the Brookings Institute notes, “At present, almost 60% of all welfare instances could be present in 89 giant city counties,” whereas TIFs (Tax Increment Financing, a way of subsidizing actual property improvement) is, because the U.S. Division of Transportation states, “extra frequent in city areas than in rural areas.”

Different company tax incentives are usually for developments in city areas as nicely. For instance, the Division of Transportation additionally notes that of Certified Alternative Zones (one other tax profit for improvement), “38% are in city tracts, and 22% are in suburban tracts.”

Rural areas have essentially the most Alternative Zones, however this is nonetheless deceiving. In any case, in 2018, there have been about 151 million individuals in America’s suburbs and exurbs and solely 25 million within the city cores, which makes the distinction per capita within the variety of alternative zones for city areas versus the suburbs over 10 to 1.

In Kansas Metropolis, the place I dwell, town just lately put in a streetcar that (will ultimately) go from downtown Kansas Metropolis to the favored Plaza space. In different phrases, it’s going to go from the densest a part of all the metro space to the second-densest a part of the metro space. The challenge obtained a $20 million federal grant in August 2013 and is in search of $174 million extra in federal cash to finish.

In different phrases, on this case, the suburbs are subsidizing town.

And this is true with nearly all public transit aside from buses. In 2018, authorities spending on public transit was $54.3 billion. Talking of ageing infrastructure, it had an over $100 billion upkeep backlog.

However that doesn’t change what appears to be a well-documented truth: Suburban infrastructure is dearer to take care of than city. The spotlight of this inefficient use of land and the compelled subsidization of the suburbs (and rural cities, for that matter) is the city of Backus, Minnesota. As the favored anti-suburb YouTuber Not Simply Bikes notes:

“An excessive case is the small city of Backus, Minnesota, which was on the finish of lifetime of its wastewater system. However as a result of this city was made up of sprawling, low-productivity, car-centric infrastructure, the wastewater system was sprawling and wasteful as nicely. The substitute value was $27,000 per household, which was the median family earnings of the city.”

Not Simply Bikes notes that such cities ought to have septic programs and wells, not a “sprawling wastewater system.” And it’s onerous to argue with that logic. He’s proper right here.

Certainly, the case for this kind of prudence, in addition to growing density the place attainable and viable, is pretty sturdy. Clearly, densifying rural farming cities would defeat the aim of farming, however for essentially the most half, infill is superior to additional sprawl. However the case being made is commonly overstated or even wildly overstated, whereas the issues inflicting flight to the suburbs (just like the crime situation mentioned in Half 2 of this collection) get ignored.

There’s additionally a bizarre city bias at play. For instance, one other well-liked anti-suburb YouTuber named Alan Fisher has a video with the textual content on the thumbnail studying “I Don’t Care Concerning the $$$” with regards to one of many largest boondoggles in American infrastructure historical past, specifically, California’s high-speed rail challenge to attach San Francisco and Los Angeles.

Again in 2008, this challenge was initially envisioned to value $40 billion in complete and be completed by 2020. Effectively, it’s 2024, the challenge is now anticipated to go a cool $100 billion over finances (hopefully, this makes you’re feeling a bit higher about your final rehab challenge), and there actually is not any finish in sight.

So, if we’re going to wag our finger at Backus, Minnesota, what ought to we make of this farce of a challenge? And why ought to taxpayers—each city and suburban alike—be subsidizing it?

A Ponzi Scheme?

Regardless of my criticisms of city activists, the proof they supply does point out suburban infrastructure is notably dearer to take care of than city infrastructure. Thereby, we must be trying to construct denser when attainable, even in outlying areas. This would additionally assist alleviate a number of the “soullessness” I complained about in Half 2 relating to business facilities in suburban areas.

However once more, the anti-suburb of us take their arguments manner too far. In actual fact, this time, they go overboard, claiming “the suburbs are a Ponzi scheme.” Charles Marohn with Sturdy Cities explains that the primary strategies of development profit a metropolis instantly “from all of the allow charges, utility fees, and elevated tax assortment… [but] Cities additionally assume the long-term legal responsibility for servicing and sustaining all the brand new infrastructure, a promise that received’t come absolutely due for many years.” The second half is the issue, as “the income collected over time doesn’t come close to to protecting the prices of assembly these long-term obligations.”

This is the “development Ponzi scheme” the car-centric suburbs have created, or extra precisely, are the product of. To ensure that a metropolis to remain solvent with this mannequin, they need to proceed to develop till, like with Bernie Madoff and all Ponzi schemes, you’ll be able to’t get sufficient development to finance the prices of the present infrastructure, and all of it comes crumbling down.

Marohn concludes that:

“To financially maintain itself, then, a metropolis or city using the American suburban improvement sample and making this tradeoff should imagine one of many following two assumptions to be true:

1. The quantity of monetary return generated by the brand new development exceeds the long-term upkeep and substitute value of infrastructure the general public is now obligated to take care of, OR

2. The town will at all times develop in ever-accelerating quantities in order to generate the money circulate essential to cowl long-term obligations.”

Because the monetary return generated by new development with suburbs doesn’t exceed long-term upkeep prices, for a metropolis to be financially possible, it should develop eternally to remain financially viable; thus, it’s a Ponzi scheme.

This is, nevertheless, the precise similar mistake that some libertarians make when describing Social Safety as a Ponzi scheme. Sure, like a Ponzi scheme, Social Safety takes cash from traders (or taxpayers, on this case) and pays out their principal to different traders (on this case, retirees). However that’s not sufficient to make for an excellent analogy. In any case, a lot of your intestine flora and the bubonic plague are each micro organism, so ought to we assume they’re the identical?

A Ponzi scheme is inherently a closed system. The principal from new traders is used to pay the returns of earlier traders. Not solely that, however the returns must be excessive sufficient to elicit new “funding.” With Social Safety, the returns could be decreased to ranges under that which the taxpayer put in (they usually have been to admittedly paltry ranges).

Infrastructure doesn’t want excessive returns; it simply must be maintained. Furthermore, American infrastructure, like Social Safety, just isn’t a closed system. Tax cash could be raised from different sectors of the economic system to fund it, as has been carried out to the chagrin of many city advocates.

Marohn admits this a lot himself in one other piece, the place he notes there are 4 methods American cities finance development:

- Authorities switch funds

- Transportation spending

- Debt

- The expansion Ponzi scheme

The primary two of those might not be perfect, however they’re sustainable.

The state of U.S. infrastructure is kind of dangerous general. Each the Trump and Biden administrations made infrastructure enchancment a key plank of their platform, for good cause. In 2021, the American Society of Civil Engineers launched a report concluding that, amongst different issues, 43% of U.S. roadways are in poor or mediocre situation, and america faces a $2.59 trillion shortfall in infrastructure wants over the following 10 years.

Whereas this sounds daunting, that quantities to a “mere” $259 billion per 12 months. In 2024, america GDP is over $28 trillion, and the federal government spent an obscene $916 billion per 12 months on “protection,” greater than the subsequent high 10 nations mixed.

I feel we might nonetheless defend our nation moderately simply by reducing that in half. That may pay for all of the infrastructure wants with out ending the suburbs and nonetheless have sufficient left over to scale back the deficit or lower taxes in addition.

The entire “Ponzi scheme” argument would possibly make for a pleasant sound chunk, nevertheless it’s not true and doesn’t assist their case. Subsequently, the suburbs should not a Ponzi scheme.

Unpayable Debt?

As an alternative of paying as they go, have American cities relied as a substitute on mountains of debt to take care of their overly sprawled infrastructure every time it requires an overhaul? As Not Simply Bikes places it:

“The town might get it constructed for reasonable, however the metropolis is finally chargeable for sustaining that infrastructure eternally. The large downside begins if there isn’t sufficient tax income collected to cowl the substitute value of the infrastructure…whenever you get a few generations into the suburban experiment, the upkeep obligations of the previous begin to meet up with you.”

So what do our cities do? They tackle debt.

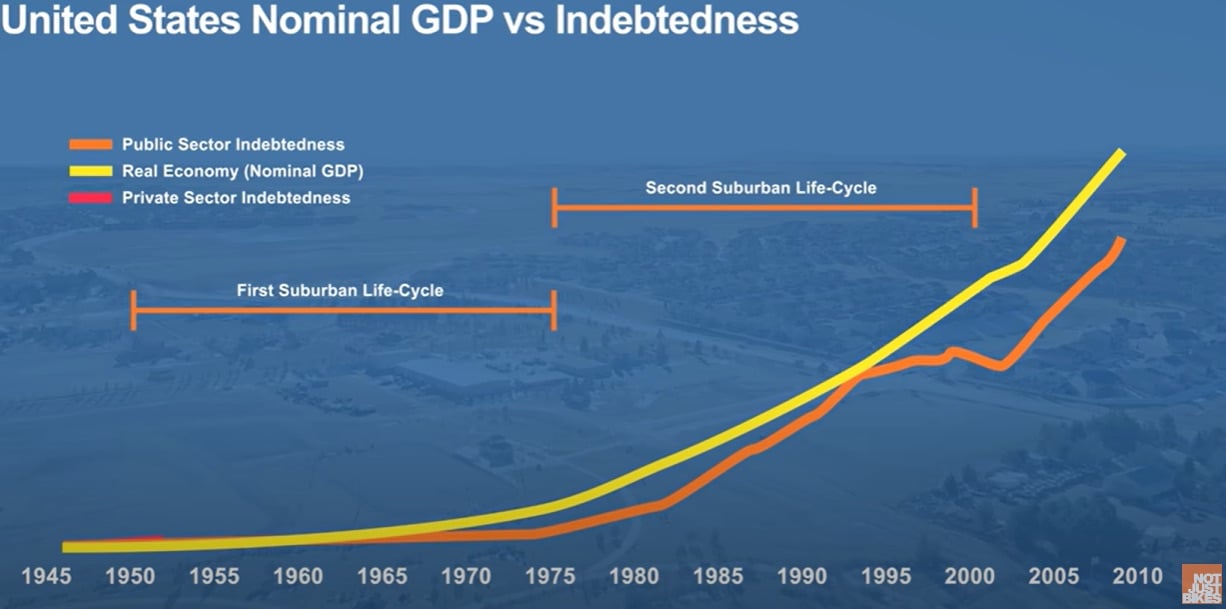

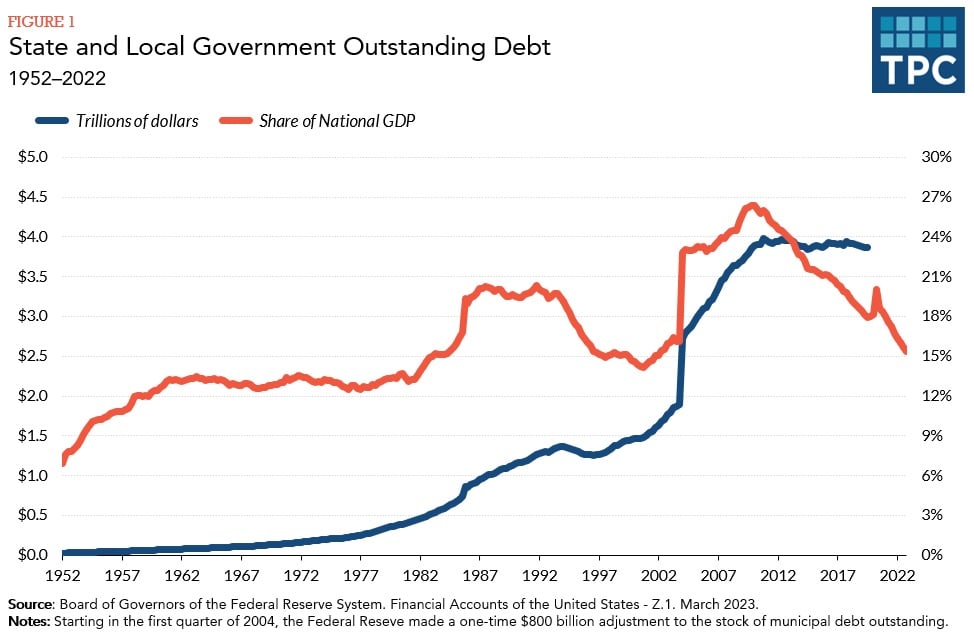

In one other video, Not Simply Bikes offers this chart to indicate that public sector indebtedness is extremely correlated to overhauling our infrastructure after every life cycle, which is closely correlated with the nation’s indebtedness.

The argument makes logical sense however doesn’t appear to be backed up by the chart he offers, which reveals debt rising at about the identical tempo after which nearly doing the other of what anti-suburb activists say it ought to in 2000 when the “second suburban life cycle” completed.

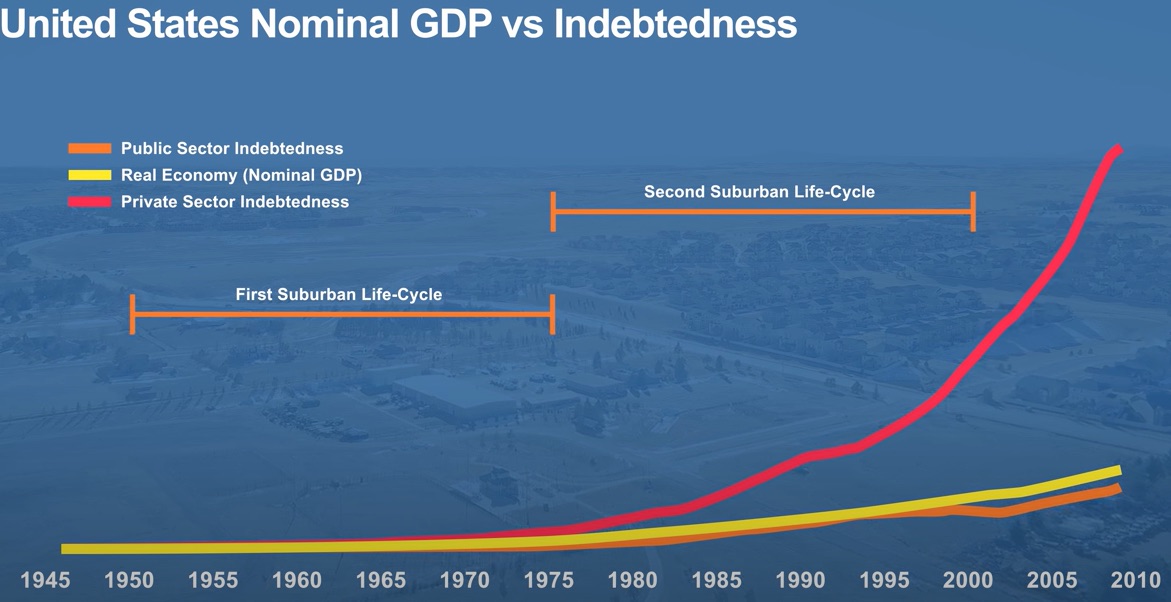

Not Simply Bikes then provides personal indebtedness to the image, and it’s ugly. However shouldn’t failing public infrastructure primarily have an effect on public debt, not personal?

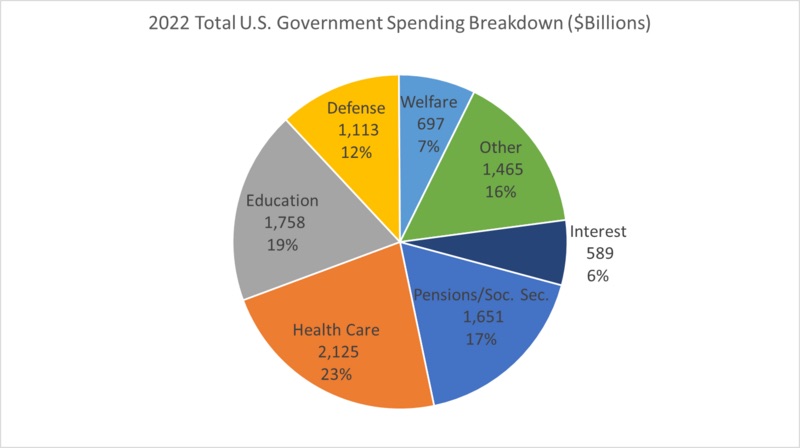

Moreover, if we have a look at what the U.S. authorities spends its cash on on the native, state, and federal ranges, infrastructure is a comparatively small piece of the puzzle.

Infrastructure would fall below “different,” making it considerably lower than 16% of public sector spending. In 2017, for instance, all ranges of presidency spent $5.6 trillion in complete and $309.2 billion on infrastructure and transportation. So 5.48%, to be precise.

Moreover, whereas municipal debt has grown to a whopping $4.1 trillion in 2022, it has leveled off during the last decade, and as a proportion of GDP, it has fallen from nearly 27% in 2012 to somewhat over 16% in the present day.

Remaining Ideas

It could appear that I have been fairly vital of the pro-urban, anti-suburb activists all through this three-part collection. And certainly, lots of their claims, from the streetcar conspiracy to the suburban Ponzi scheme, don’t maintain water.

Certainly, even evaluating American suburbs to European ones is a little bit of a pink herring. The stereotype of dense, city European cities with unimaginable public transportation applies predominantly to its giant cities. There are loads of suburbs in Europe that look moderately American, as you’ll find from any fast Google search.

However there are some good factors buried inside. Suburban improvement prices extra to take care of than city improvement, and it thereby is sensible to construct denser when attainable. Moreover, the business facilities in suburbia are boring, car-dependent monstrosities. Walkable malls appear to have died, however making extra walkable “vacation spot factors” moderately than limitless rows of strip malls can be a marked enchancment.

Single-use zoning must also be carried out away with in business areas and (at the least principally) changed with multi-use zoning, which provides vibrancy and prevents business zones from going useless and turning into crime magnets at evening.

However city advocates not solely exaggerate (typically wildly) their claims—additionally they have vital blind spots. The obvious is crime. As an alternative, they have an inclination to deal with extra coercive strategies of stopping suburban sprawl than creating incentives for individuals to remain in and transfer to city areas (like decreasing crime). We see this course of in issues like city development boundaries, which usually trigger actual property costs to extend dramatically and value out the center class.

Higher options would embody incentives to infill versus constructing new subdivisions. Current strikes towards permitting property house owners to construct ADUs (accent dwelling items) in varied cities is an excellent begin.

Total, suburbia was created predominantly by what the automobile allowed individuals to do, not by conspiracies amongst automobile producers. And the suburbs haven’t been a catastrophe, though it comes with vital downsides.

It’s commonplace for the outlying areas of cities to be considerably much less dense than the city core. Whereas it is sensible to maneuver towards extra densification general, it doesn’t make sense to desert the suburbs, pack individuals into pods in dense cities like sardines, or attempt to section out the car with varied coercive strategies.

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.