Investing.com– Most Asian shares rose barely on Monday amid persistent cheer over decrease rates of interest, whereas Australian markets lagged as main retail shares fell sharply within the face of an antitrust lawsuit.

Chinese language markets superior after the Folks’s Financial institution of China minimize a short-term lending fee, though total positive aspects had been restricted.

Regional buying and selling volumes had been held again by a market vacation in Japan. A weak Friday shut on Wall Avenue additionally made for middling cues, though U.S. inventory index futures rose in Asian commerce.

However Asian markets had been sitting on sturdy positive aspects from the prior week, as sentiment was boosted by an rate of interest minimize by the Federal Reserve, with the central financial institution additionally kicking off an easing cycle.

Markets had been awaiting a string of key alerts from the U.S. for extra perception into the Fed, with a number of officers set to talk this week. Key inflation knowledge can also be on faucet.

Chinese language markets rise after repo fee minimize

China’s and indexes rose 0.5% and 0.4%, respectively, whereas Hong Kong’s index added 0.7%.

The PBOC minimize its 14-day reverse repo fee to 1.85% from 1.95%, additional loosening native financial circumstances to assist increase financial progress.

However the transfer got here simply days after the PBOC disillusioned markets by leaving its benchmark mortgage prime fee unchanged. Chinese language indexes had been nonetheless buying and selling simply above seven-month lows hit earlier in September.

Buyers have been calling on Beijing to roll out extra stimulus measures amid few indicators of an financial pick-up within the nation.

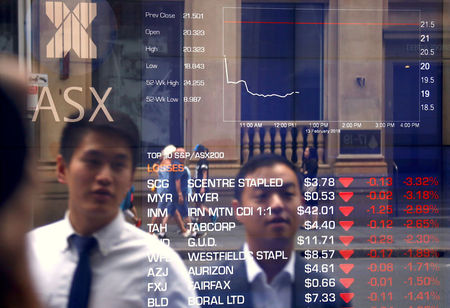

Australian shares hit by retailer losses, RBA on faucet

Australia’s was the worst performer in Asia, dropping 0.6% because it fell from document highs.

Losses in grocery store giants Woolworths Ltd (ASX:) and Coles Group (OTC:) Ltd (ASX:) had been the most important weights, with the 2 falling between 3% and 4% after Australia’s competitors regulator sued the 2 for allegedly deceptive prospects over reductions.

Sentiment in the direction of Australia was additionally frail earlier than the conclusion of a on Tuesday. Whereas the RBA is just not anticipated to hike rates of interest, it’s anticipated to strike a hawkish chord within the face of persistent labor market energy and sticky inflation.

Broader Asian markets drifted larger amid persistent cheer over decrease rates of interest. rose 0.9%, as native markets had been closed for a vacation.

South Korea’s added 0.1%, whereas futures for India’s index pointed to a constructive open, with the index now in sight of document highs at 26,000 factors.