The place did BD% thought come from?

Traditional Customary Deviation (CSD) is among the oldest volatility measurement indicators utilized in technical evaluation. The technician has used it for a very long time. CSD is the sq. root of the distinction between costs and their common. A excessive studying signifies that volatility is robust as a result of costs transfer distant from their common. A low studying signifies that volatility is low as a result of costs transfer round their common in a slim vary.

After I used CSD lengthy sufficient I discovered that it’s a good volatility measurement instrument for the present value, however I can not use it to match the volatility of 1 safety with one other, as a result of CSD calculation is in level, not in p.c. This led me to create the Berma Deviation P.c.

BD% Method.

Bermaui Deviation P.c (BD%) is a volatility index that measures volatility in proportion relatively than factors. The concept of BD% is to make an index relying on Traditional Customary Deviation (CSD) that strikes between 0 and 100%. This may be defined within the subsequent steps:

1. Calculate Traditional Customary Deviation (CSD) for X variety of days.

2. Discover the Highest Excessive of the CSD in the identical X variety of days (= HHV (CSD)).

3. Discover the Lowest Low of the CSD in the identical X variety of days (= LLV (CSD)).

4. Calculate the distinction between the Highest Excessive of the CSD & the CSD itself. Let’s name it “the Change” (= HHV(CSD) – CSD).

5. Calculate the distinction between Highest Excessive of the CSD & Lowest low of the CSD. Let’s name it “the Vary” (= HHV(CSD) – LLV(CSD)).

6. Now, divide “the Change” over “the Vary” and multiply the outcome by 100.

So, the Berma Deviation P.c formulation is:

BD% = 100 x (= HHV(CSD) – CSD) / (= HHV(CSD) – LLV(CSD))

Subsequently, BD% is a William R% Oscillator calculated on Traditional Customary Deviation. Some folks ask me why I calculate BD% like this & why I didn’t invert the calculation methodology. That’s as a result of I exploit BD% within the calculation of one other necessary indicator known as the “Berma Bands”.

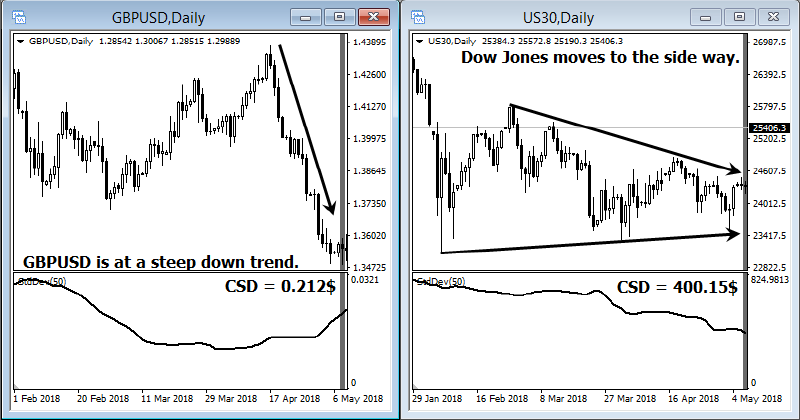

Measuring volatility as proportion relatively than in factors may be very helpful in technical evaluation. BD% helps technicians to match the volatility of 1 safety with the opposite. For example at 08/05/2018, the Dow Jones Industrial normal deviation learn $400.15 whereas GBPUSD normal deviation of the identical day learn $0.212. In the event you present these numbers to anybody, he’ll inform you that the Dow Jones Industrial is extra risky than GBPUSD, whereas the other is the correct reply, as a result of the Dow Jones Industrial was in a sideways motion and GBPUSD was in a steep downtrend as you possibly can see from the subsequent charts.

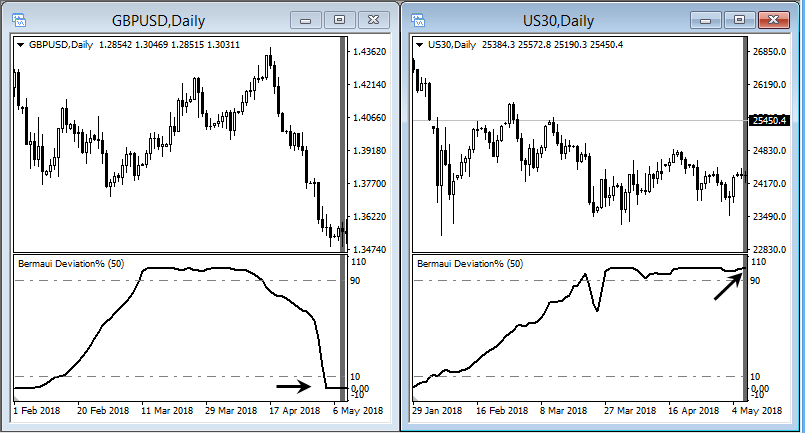

In the event you take a look at the identical chart relying on BD% you will notice that the Dow Jones Industrial reads 100% which signifies that volatility could be very low whereas GBPUSD reads 0% which signifies that volatility could be very excessive (do not forget that BD% is an inverted scale the place 100% is the bottom and 0% is the very best).

That’s one purpose why BD% could be a good technical evaluation instrument.

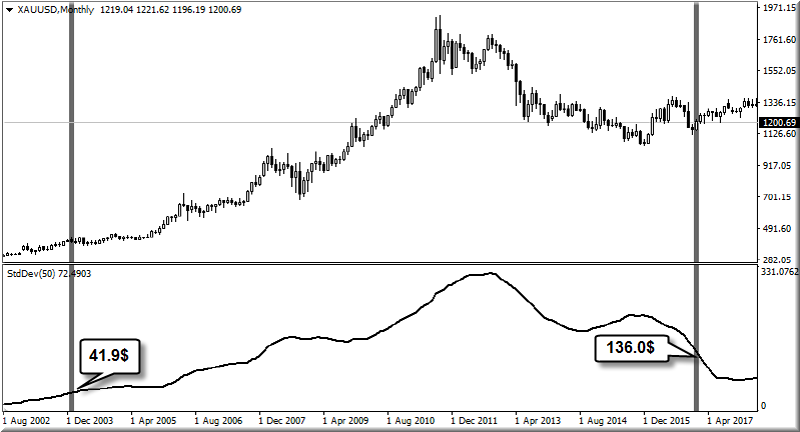

As well as, BD% helps examine the volatility of the identical safety in several intervals. For example, the 50-bar interval normal deviation of Gold on the month-to-month chart in January 2004 was $41.9, whereas it learn $136 in January 2017. In the event you present the numbers to anybody, he’ll inform you that Gold in 2017 is extra risky than what it was once in 2004, whereas the other is the correct reply.

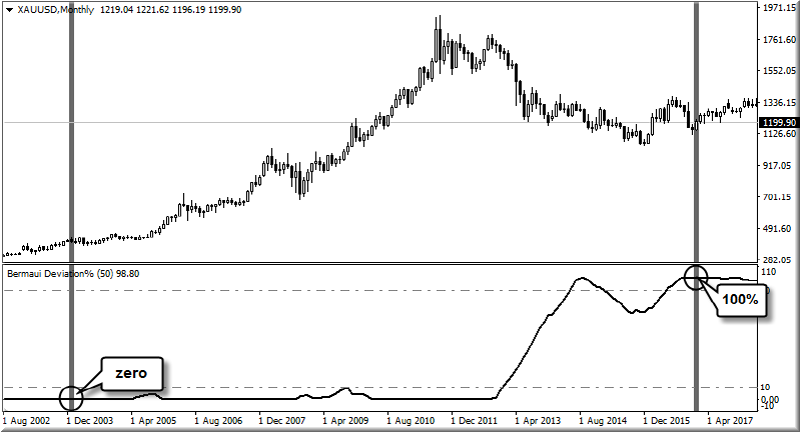

In the event you take a look at the identical chart relying on BD% you will notice that the chart of the gold reads 100% in January 2017 which signifies that volatility could be very low whereas it reads 0% at January 2004 which signifies that volatility was very excessive.

As you possibly can see, relative technical indicators may be very helpful giving merchants an important benefit when analyzing the market.

I hope you loved this weblog

Greatest regards