Yesterday, Bitcoin had one in all its most bullish days in historical past, skyrocketing previous its all-time excessive to achieve $76,990. This new milestone has ignited widespread pleasure and confidence amongst traders, who now see the potential for additional features.

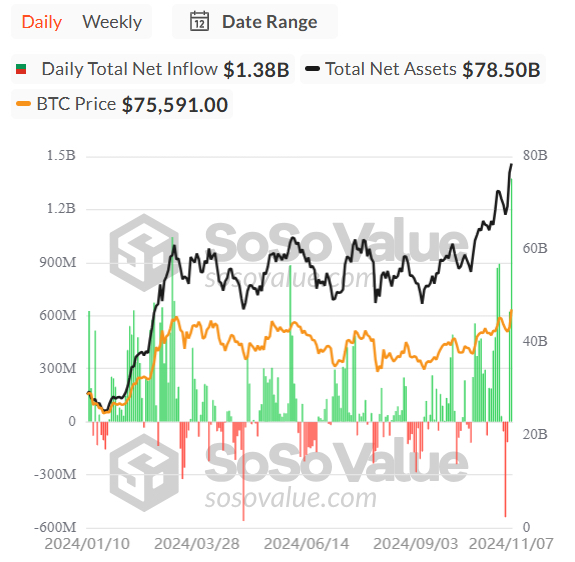

Key information from Carl Runefelt reveals that Bitcoin ETFs skilled a historic surge, with $1.38 billion in internet each day inflows. This record-breaking determine highlights institutional demand for Bitcoin, as main gamers like BlackRock are shopping for BTC in anticipation of long-term progress.

Associated Studying

The inflow into Bitcoin ETFs underscores a broader development of institutional adoption, with rising curiosity from monetary giants as they acknowledge Bitcoin’s potential as a retailer of worth and hedge in opposition to financial uncertainty. Runefelt’s evaluation means that this stage of demand is unprecedented, marking a turning level that might maintain Bitcoin’s bullish momentum.

The current surge is not only a technical breakout but additionally a elementary shift pushed by institutional confidence, setting Bitcoin up for potential additional highs as large-scale traders proceed to enter the market.

Bitcoin Hits New ATH

Bitcoin has surged into uncharted territory, breaking its earlier all-time highs as soon as once more to achieve a brand new peak that has captivated the crypto neighborhood. This historic rally comes on the heels of the U.S. election, which noticed Donald Trump emerge victorious.

Market sentiment means that Trump’s pro-crypto stance may have performed a job in driving renewed confidence amongst U.S. traders, who want to Bitcoin as a hedge amid altering financial insurance policies.

Including to this momentum, conventional traders more and more pour into Bitcoin by way of ETFs, marking a big shift in institutional curiosity. In accordance with key information from SoSo Worth, shared by outstanding analyst Carl Runefelt on X, Bitcoin ETFs skilled record-breaking each day inflows yesterday, totaling an astounding $1.38 billion.

This historic influx underscores the rising urge for food from institutional gamers who’re viewing Bitcoin as a important asset for his or her portfolios.

The current bullish shift amongst establishments follows a protracted 7-month accumulation part that had solid shadows of doubt over Bitcoin’s potential to interrupt new highs this 12 months. Many traders remained cautious, with market volatility and uncertainty testing their confidence.

Associated Studying

With institutional backing at file ranges, Bitcoin’s current rally may signify the start of an prolonged bullish part. As large gamers like BlackRock buy-in by way of ETFs, the market sees this as a sign of renewed power. All eyes are actually on Bitcoin’s subsequent strikes, with analysts suggesting the current worth motion could solely be the start of a bigger bull run for the world’s largest cryptocurrency.

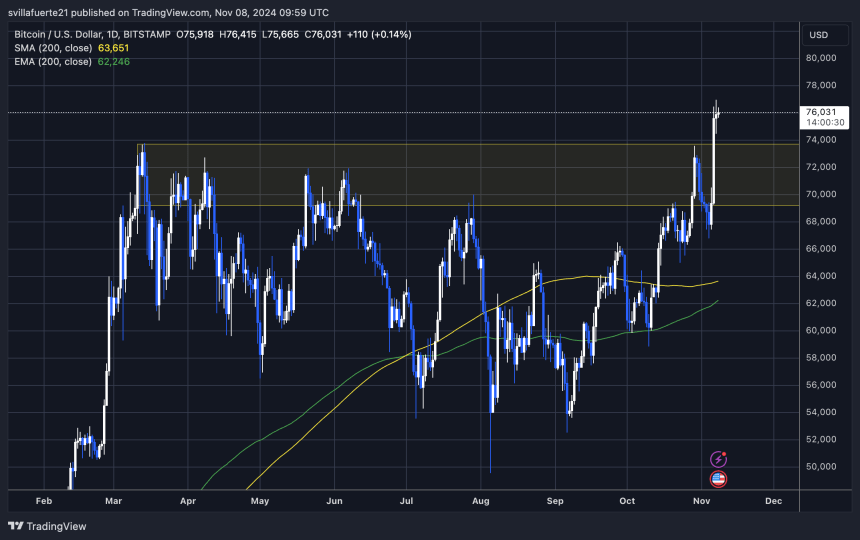

BTC Pushing Up: Robust Worth Motion

Bitcoin is buying and selling at $76,000 after reaching new all-time highs. BTC is coming into a robust consolidation part above the earlier file stage of $73,800. This worth zone is essential for bulls, as holding above it may present stability for Bitcoin’s rally to proceed. Analysts are intently watching this stage; if BTC can respect it, the bullish momentum could persist, encouraging additional features.

Nonetheless, the current euphoria may result in a consolidation part slightly below $77,000—a stage some consultants establish as a short-term native prime. This resistance may take time to beat because the market digests current features and awaits recent catalysts for one more breakout.

Associated Studying

Regardless of potential consolidation, demand stays sturdy, and on-chain information displays robust shopping for strain that might proceed driving the value upward. The technical outlook suggests additional upside potential if Bitcoin can keep above $73,800 over the approaching days. Bulls are optimistic, because it may set up a stable basis for the subsequent leg up in Bitcoin’s ongoing rally.

Featured picture from Dall-E, chart from TradingView