Information exhibits the cryptocurrency derivatives market has suffered a large quantity of liquidations after the Bitcoin flash crash through the previous 24 hours.

Bitcoin Has Witnessed Important Volatility Throughout The Final Day

BTC has displayed some wild value motion prior to now day, with each a excessive of $103,500 and a low $90,500 occurring inside a slender window. The transfer to the latter stage, specifically, was so sharp that it might solely be described as a flash crash.

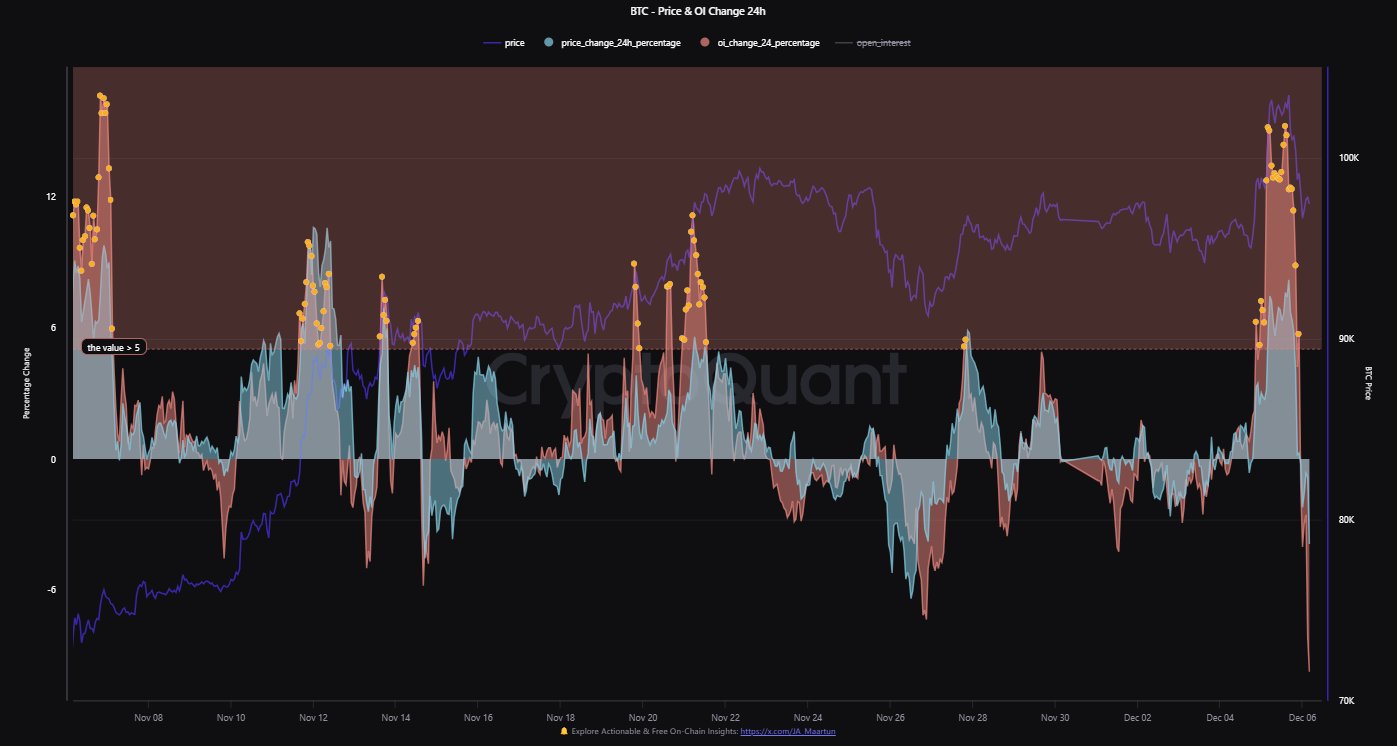

Beneath is a chart that exhibits how the asset’s current trajectory has been like.

From the graph, it’s seen that the sharp pink candle solely lasted briefly, because the cryptocurrency was fast to rebound again to larger ranges. After the restoration, the coin is buying and selling at round $98,000, which suggests it’s nonetheless down round 5% for the reason that high.

In ordinary style, the opposite high digital property have additionally adopted BTC on this bearish value motion, however the likes of Ethereum (ETH) and Solana (SOL) have confirmed to be extra resilient as their costs are down simply 2% through the previous day.

The newest market-wide volatility has meant that chaos has occurred over on the derivatives aspect of the cryptocurrency sector.

Cryptocurrency Longs Have Simply Witnessed A Liquidation Squeeze

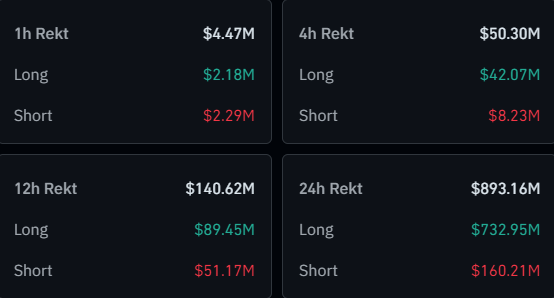

In accordance with information from CoinGlass, the cryptocurrency derivatives market has suffered a considerable amount of liquidations as property throughout the sector have seen sharp value motion.

As displayed within the above desk, cryptocurrency derivatives positions value a whopping $893 million have discovered liquidation within the final 24 hours. A contract is alleged to be “liquidated” when the alternate forcibly shuts it down after it amasses losses of a sure diploma.

Nearly $733 million of those liquidations have concerned lengthy contracts, which represents 82% of the full. This steep dominance of the longs is of course a results of the online bearish motion that Bitcoin and others have gone by way of.

A Mass liquidation occasion like this newest one is popularly often known as a “squeeze.” Since longs made up for almost all of this squeeze, it might be known as an extended squeeze.

The lengthy squeeze that the derivatives sector has simply suffered might maybe have been the apparent conclusion to the red-hot market situations that have been growing in its lead-up. As CryptoQuant group analyst Maartunn has identified in an X put up, the Open Curiosity shot up alongside the Bitcoin surge.

Usually, at any time when derivatives positions explode throughout a rally, it implies that the surge is leverage-driven. Value strikes of this sort can unwind in a risky method.

The Open Curiosity rose by greater than 15% within the current Bitcoin run, which is taken into account a really important quantity. When the worth reversed its path, all these leveraged longs have been caught up within the squeeze, which solely offered additional gasoline for the crash, explaining its notably sharp nature.