The Bitcoin quantity has skilled a extreme crash amidst its preliminary value momentum, falling by roughly 27% and triggering a subsequent decline within the worth of the pioneer cryptocurrency. This important drop in quantity has caught the eye of market contributors, as a crypto analyst is discussing the mechanics and significance of a decline in Bitcoin and whether or not it signifies a Distribution or Accumulation part.

Bitcoin Worth Falls As Quantity Plummets 27%

Information from CoinMarketCap has revealed that the every day buying and selling quantity of Bitcoin has crashed 26.46%, pushing the worth to $85.89 billion. This important decline within the Bitcoin quantity coincides with a broader correction within the cryptocurrency’s value.

Associated Studying

Within the final 24 hours, BTC has skilled a value pullback to $87,848, as of writing. The cryptocurrency was beforehand buying and selling above $90,000, however has lately declined by 2.87%. This plummeting quantity typically signifies a lowered market curiosity or lack of enthusiasm. Nonetheless, this is probably not the case for Bitcoin, because the cryptocurrency has been experiencing excessive market exercise because of the just-concluded US Presidential elections that resulted in a Donald Trump win.

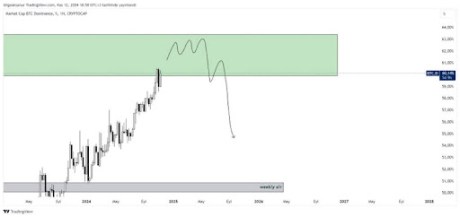

The extra seemingly cause for the decreased quantity may very well be a market consolidation, the place the value of Bitcoin may stabilize earlier than a possible breakout. Supporting this, a crypto analyst, ‘Private Dealer,’ said that the market has entered a part of decline, the place Bitcoin may enter its final correction interval earlier than shifting towards the $100,000 milestone.

BTC Worth Decline Might Point out A Distribution Or Accumulation Section

Given the current decline in Bitcoin value and quantity, a crypto analyst recognized as ‘IonicXBT’ has taken to X to determine and focus on the importance of this decline utilizing two most important traits exhibited in a Bitcoin market cycle: the Accumulation and Distribution phases.

Associated Studying

The Accumulation part is when good cash, together with buyers or establishments, begins to purchase Bitcoin. Throughout this part, costs are usually low or have stabilized after a decline. Moreover, Bitcoin’s buying and selling quantity will increase in the identical interval as patrons step in to push costs greater. Furthermore, each upward value motion tends to showcase a powerful quantity, indicating elevated shopping for strain.

In distinction, the Distribution part is when good cash are promoting or distributing their Bitcoin. Throughout this part, costs might have peaked or are being seen as overvalued. The amount of BTC rises whereas its value falls, signaling intense promoting strain. Furthermore, value spikes accompanied by low buying and selling quantity counsel a weak shopping for curiosity, a pink flag that signifies that good cash are exiting the market.

Primarily based on these Bitcoin phases, IonicXBT has revealed that he’ll name the Bitcoin market prime and backside quickly. The analyst has proven that Bitcoin is at the moment not in its distribution part, which implies it’s nonetheless a “purchaser’s market,” suggesting the potential for future value will increase.

Featured picture created with Dall.E, chart from Tradingview.com