As we speak the 20-Yr Bond ETF (TLT) 50-day EMA crossed down by means of the 200-day EMA (Loss of life Cross), producing an LT Pattern Mannequin SELL Sign. This was the results of a down development lasting over two months. We observe that the PMO has been working flat under the zero line for a month, which tells us that regular downward strain has been utilized to cost.

On the weekly chart we observe a bullish reverse head and shoulders sample, which executed when worth broke above the neckline and rallied for a few weeks. Subsequent it carried out a technical pullback to the assist line. If the assist fails, the sample will abort, and we are going to assume a bearish outlook on this time-frame.

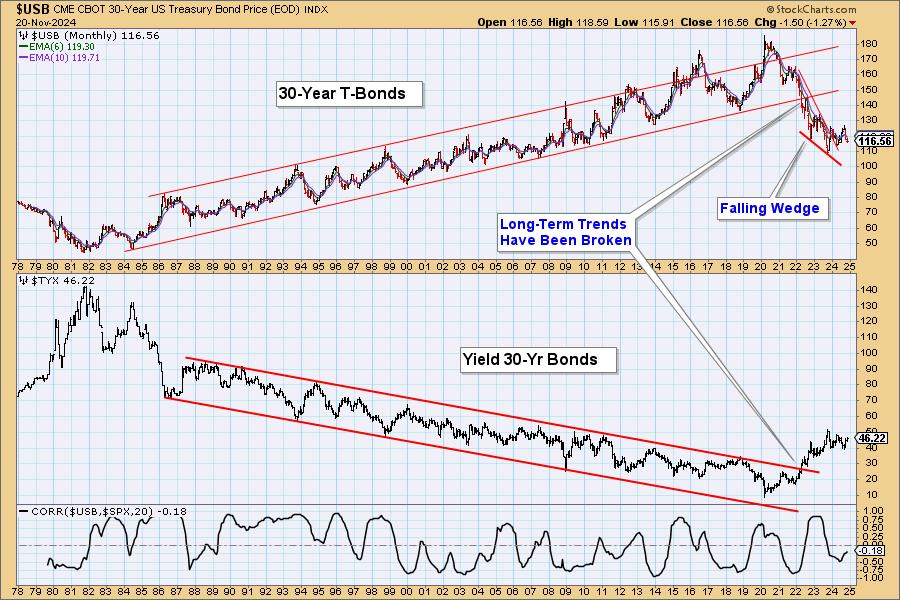

Now we have been watching this 46-year month-to-month chart of the 30-Yr Bond for a number of years now. An especially long-term (40-year) rising development line was violated in 2022. On the time we asserted that bonds had turned bearish and that situation would almost certainly persist for a few years. Now we have not modified our outlook. There could also be encouraging rallies occasionally, however we consider they are going to fail.

Conclusion: The LT Pattern Mannequin SELL Sign was triggered by a persistent two-month decline. Within the longer-term, bonds seem like trying a rally. Our outlook is bearish, however we have to see how far the rally can go. In any case, we consider the final word final result might be bearish.

Introducing the brand new Scan Alert System!

Delivered to your e mail field on the finish of the market day. You will get the outcomes of our proprietary scans that Erin makes use of to select her “Diamonds within the Tough” for the DecisionPoint Diamonds Report. Get the entire outcomes and see which of them you want greatest! Solely $29/month! Or, use our free trial to attempt it out for 2 weeks utilizing coupon code: DPTRIAL2. Click on HERE to subscribe NOW!

Study extra about DecisionPoint.com:

Watch the most recent episode of the DecisionPointBuying and selling Room on DP’s YouTube channel right here!

Attempt us out for 2 weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled. Any opinions expressed herein are solely these of the writer, and don’t in any method signify the views or opinions of every other particular person or entity.

DecisionPoint will not be a registered funding advisor. Funding and buying and selling choices are solely your accountability. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a advice or solicitation to purchase or promote any safety or to take any particular motion.

Useful DecisionPoint Hyperlinks:

Value Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

D

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical assets, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the net. DecisionPoint focuses on inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Study Extra