Lambert right here: “There isn’t a such factor as civil society.” –Maggie Thatcher (apocryphal)

By Samuel Bowles, Analysis Professor and Director of the Behavioral Sciences Program at Santa Fe Institute, Wendy Carlin, Scientific Council at Paris College of Economics (PSE), Exterior Professor at Santa Fe Institute, Professor of Economics at College School London, and Sahana Subramanyam, a third-year economics PhD pupil at Stanford. Her analysis pursuits are on the intersection of gender, growth and behavioral economics. Initially revealed at VoxEU.

Commentary on the 2024 US elections included the Democratic Celebration’s failure to attach with problems with neighborhood, place, household, faith, and identification [and class–lambert]. This column presents proof from analysis papers revealed within the prime economics journals since 1900 exhibiting that half a century in the past, economists took a bit seen flip in the direction of exactly these matters. The authors doc this shift and present that it was related to novel empirical strategies together with experiments, massive information units, and an rising give attention to social norms and strategic interactions – together with the train of energy.

A considerable shift within the focus of financial analysis during the last half century has for probably the most half gone unnamed and unnoticed. That is the flip in the direction of what we name civil society, together with companies as organisations, households, neighbourhood communities, NGOs, commerce unions, social actions, identification teams, and different face-to-face settings. Though the time period can be unfamiliar to many economists, it dates again to Adam Smith and the Scottish Enlightenment, and has been variously utilized within the different social sciences and philosophy (Cohen and Arato 1994, Edwards 2011, Ferguson 1767, Smith 1976 [1759]).

Financial interactions in civil society, as we use the time period right here, have in widespread that relationships are private and enduring. Consequently, identification and other-regarding preferences (for higher or worse) are essential motives. In civil society, the first mechanisms guiding financial interactions are neither governmental laws nor full contracts and market-determined costs, however are as an alternative hierarchies of personal authority and energy, social norms, group identification (together with out-group hostility), and status. (We clarify the idea of civil society at better size in Bowles and Carlin 2025.)

The flip in the direction of civil society in economics that we doc (Bowles et al. 2025) is in line with two propositions. The primary is that a lot of what we consider because the financial system consists of non-market interactions and exchanges beneath incomplete contracts throughout the agency in addition to in labour, credit score, residential housing, and different markets. Second, in these and in different settings, moral and other-regarding preferences have an essential place together with self-interest in explaining behaviour and supporting mutually useful exchanges (Arrow 1971).

The proliferation of civil society themes that we doc within the analysis corpus was enabled by conceptual improvements (together with the knowledge revolution and sport concept) and empirical strategies (together with experiments, different advances in causal identification, and using massive information units). The shift in focus has been mirrored in Nobel awards to Myrdal and Hayek (in 1974), Simon (1978), Coase (1991), Nash (1994), Sen (1998), Akerlof and Stiglitz (2001), Kahneman and Smith (2002), Schelling (2005), Ostrom and Williamson (2009), Hart (2016), Thaler (2017), Goldin (2023), and some weeks in the past, Acemoglu, Johnson, and Robinson (2024).

Markets, States, and Civil Society: Matter Modelling Themes in Financial Analysis

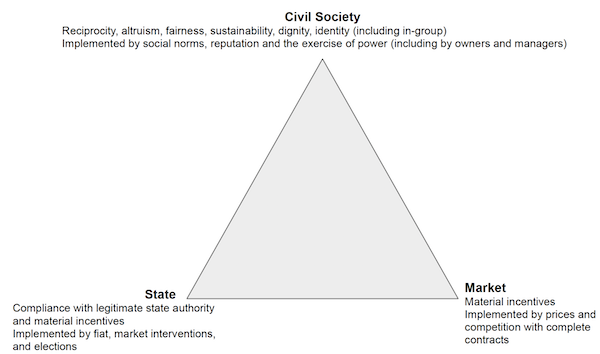

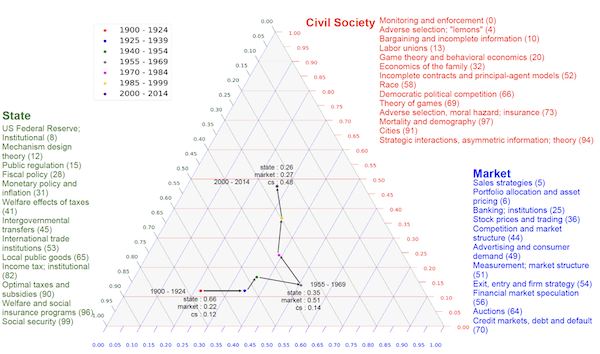

We characterize civil society together with states and markets as distinct and ideally complementary constructions of societal governance. In Determine 1, we deal with the pure kinds of these constructions as vertices of a simplex representing an area for financial insurance policies and establishments. Every of those polar circumstances is characterised within the determine by each a algorithm of the sport (by which allocations are applied) and a set of preferences and social norms (related to how they contribute to general societal governance). The coordinates of any level on the simplex sum to at least one and characterize weights giving the relative significance of state, market, and civil society (for any explicit level within the area, the most important weight is the significance of the closest vertex.)

Determine 1 The area for establishments and insurance policies with ideal-type types of societal governance on the vertices, their implementation mechanisms and behavioural traits

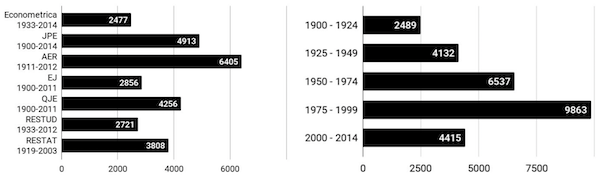

Right here we doc the emergence of civil society as an essential set of themes within the corpus of papers revealed within the main economics journals within the UK and US between 1900 and 2014, a complete of 27,436 articles (as proven in Determine 2). To characterize this shift, we use subject modelling, a probabilistic machine studying approach that treats a corpus of noticed information (the paperwork in Determine 2) as arising from a hidden data-generating course of, the construction of which is to be estimated (Ambrosino et al. 2018, Ash et al. 2022, Blei 2012, Blei et al. 2003). The mannequin gives a solution to the query: what thematic construction is almost definitely to have – hypothetically – generated the noticed information (the distribution of phrases making up every doc within the corpus)?

Determine 2 The corpus: Full textual content of 27,436 analysis articles by journal and 12 months

Utilizing variational Bayes strategies, our subject modelling on the corpus in Determine 2 generated 100 matters (vectors of phrases whose weights measure the relative frequency of their utilization) from the literature. The matters are generated by an unsupervised studying algorithm. We named them by hand primarily based on their most closely weighted phrases. The technical particulars and rationale for the important thing assumptions of our subject modelling are in Bowles and Carlin (2020).

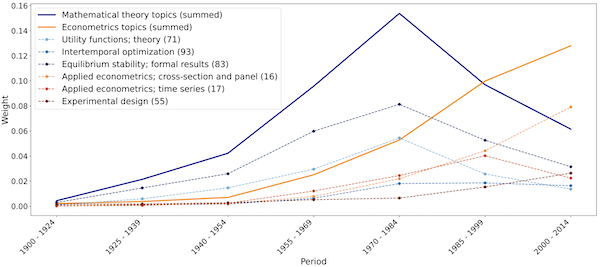

The lens offered by the subject mannequin skilled on this corpus information adjustments within the stability of consideration given to themes referring to the state, the market, and civil society, grouping subsets of the 100 matters into one ‘metatopic’ at every of the vertices. Our process for assigning a subject to one of many three metatopics was to find out whether or not the phrases most closely weighted within the subject are generally related to both the motivations or the mechanisms attribute of the three vertices. Matters whose major phrases are unrelated to the three techniques of societal governance (together with these regarding mathematical or econometric strategies proven in Determine 3) weren’t assigned to a vertex.

As can be anticipated, subtopics constituting a metatopic are clustered within the information. Throughout the paperwork in our corpus, if subtopics i, j, and h are respectively two subtopics of the identical metatopic (i and j) and a subtopic not in the identical metatopic (h), then the weights on i and j are positively correlated throughout paperwork whereas the weights in i and j correlate negatively (weakly) with the weights in h (Appendix 2). Illustrating our outcomes, Determine 3 confirms the expansion and decline of mathematical matters and the well-established elevated focus after mid-century on empirical strategies (Angrist et al. 2017).

Determine 3 Mathematical concept and econometrics matters since 1900

Notes: The weights proven are the relative frequency with which works within the corpus of every interval drew upon the indicated matters. Weights within the earliest interval replicate the infancy of mathematical and econometric strategies on the time. The subject numbers proven in parentheses are arbitrary.

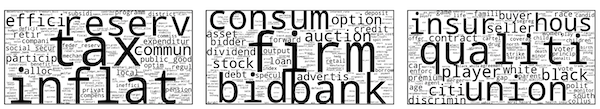

Phrase clouds exhibiting the frequency of phrases within the 100 matters and the ten papers drawing most on the phrases closely weighted in every of the three metatopics are offered on-line in Appendix 3. Determine 4, exhibiting phrase clouds from these metatopics, provides an thought of their content material. For instance, essential market actors – companies, banks, shoppers – are distinguished available in the market metatopic.

Determine 4 Phrase clouds exhibiting probably the most continuously used phrases within the three metatopics respectively from left to proper: State, market, civil society

As an instance, examples of papers drawing closely on the matters making up the three metatopics are: for market, Bain (1970) “Adjustments in Focus in Manufacturing Industries in america, 1954–1966”, and Klemperer (1992) “Equilibrium product traces”; for civil society, Fudenberg and Tirole (1990) “Ethical Hazard and Renegotiation in Company Contracts”, and Fehr et al. (2007) “Equity and contract design”; and for state, Saez (2001) “Utilizing elasticities to derive optimum revenue tax charges”, and Feldstein (1978) “The welfare value of capital revenue taxation”.

The Flip In the direction of Civil Society

Our subject mannequin permits us to find any explicit textual content within the state area of Determine 1, together with the complete corpus beneath examine for varied intervals, proven in Determine 5.

Determine 5 Analysis in economics: The flip in the direction of civil society themes from the Seventies

We see a big motion in financial analysis between 1900 and 1970 away from state-related matters in the direction of market matters, even because the financial significance of the state was rising. This shift was slowed, however not reversed, by the battle financial system of the early Forties. The interval after 1970 witnessed an equally massive and uninterrupted shift in the direction of civil society matters, primarily on the expense of market matters.

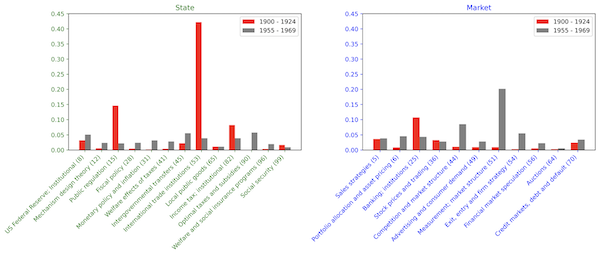

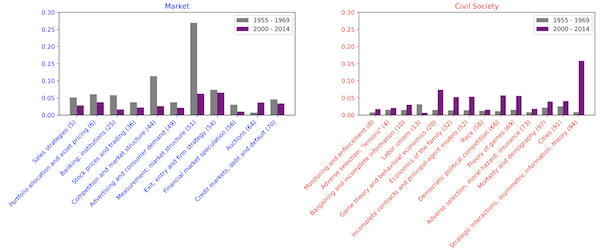

Determine 6 (higher panel) exhibits that the shift from the neighbourhood of the state vertex in the direction of the market vertex previous to 1970 was resulting from dramatic declines within the weight of the matters that we named ‘public regulation’ and ‘worldwide commerce establishments’ together with a considerable enhance within the weights of two matters regarding market construction. Determine 6 (decrease panel) exhibits that the shift in the direction of civil society during the last half century was due primarily to a reversal within the earlier enhance within the weights of those two market construction matters and a rise in matters regarding uneven data, strategic interplay, and the behavioural foundations of economics.

Determine 6 The shift from analysis on state to market matters previous to 1970 (prime panel) and the elements of the flip towards civil society matters after 1969 (backside panel)

Dialogue

The proof in Determine 3 means that the shift from state to market was related to the elevated use of arithmetic, particularly constrained optimization by (for probably the most half) non-strategic actors. This constituted a change in methodology – roughly the mathematical formalization of Alfred Marshall – fairly than any novelty within the sorts of financial behaviour beneath examine.

Adjustments in methodology – together with fashions of restricted data and strategic interplay – together with advances in quantitative strategies have been additionally an indicator of the following shift in analysis in the direction of civil society themes. However in contrast to the sooner methodological shift, analysis after 1970 was characterised additionally by an enlarged conception of the financial behaviour beneath examine.

Because the late Sixties, this occurred by the appliance of typical financial instruments to an expanded set of matters – as within the work of Gary Becker (1974, 1968) on the household and crime – and likewise by way of the appliance of novel insights from different disciplines to the traditional subject material of economics, as within the work of George Akerlof (1982) and coauthors (1982) on present change and cognitive dissonance, and of Oliver Hart (1989, 1995) on authority within the agency and the train of energy by house owners and managers.