Supply: The School Investor

There are over 43.2 million scholar mortgage debtors which have a complete of $1.73 trillion in scholar mortgage debt. Right here is the typical scholar mortgage debt stability by state.

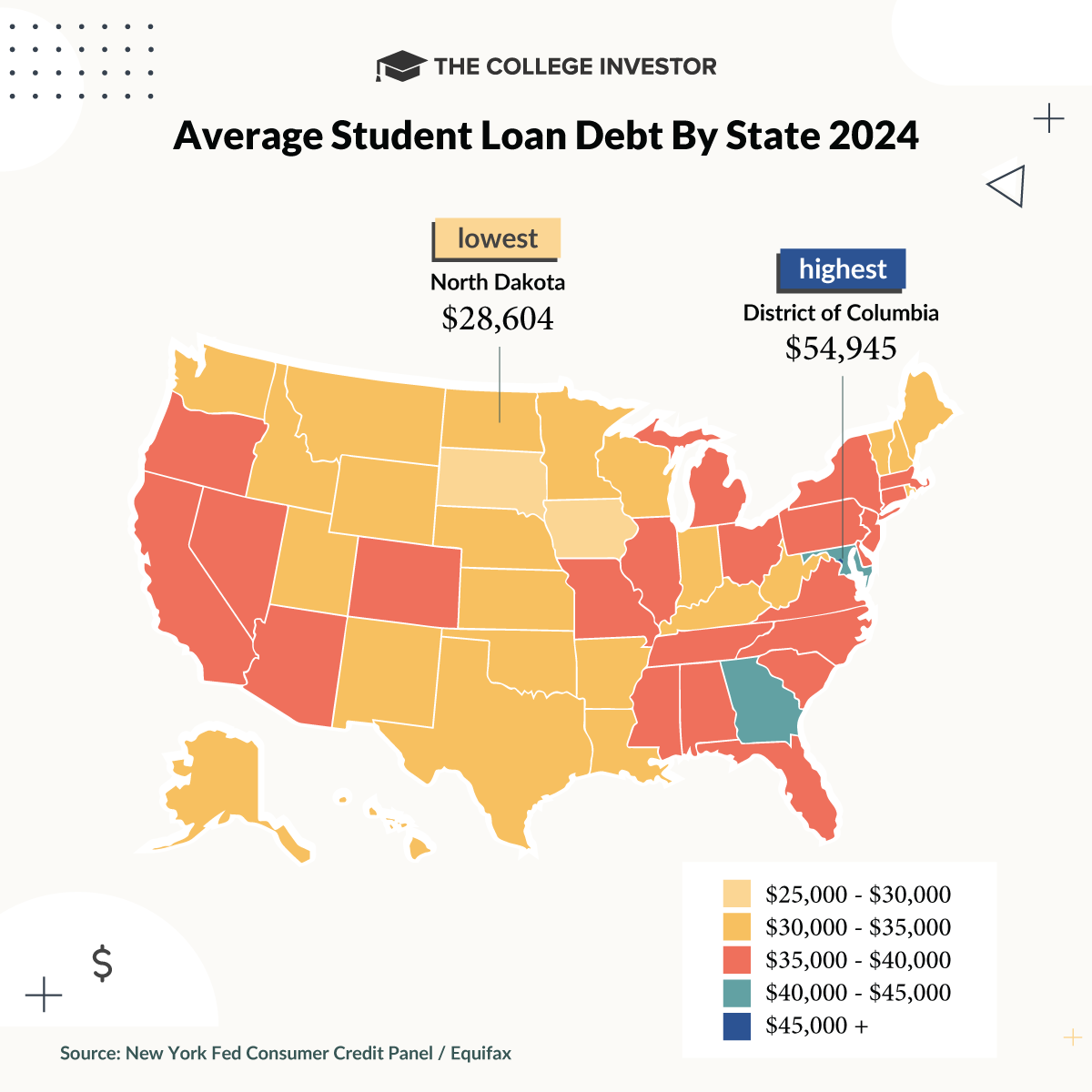

Whereas the typical balances throughout the USA hover in a variety, Washington DC has the best common scholar mortgage debt, whereas North Dakota has the bottom common scholar mortgage debt.

Here is a breakdown of the typical scholar mortgage debt by state in 2024. Be sure you try all of our scholar mortgage debt statistics.

Nationwide Pupil Mortgage Quick Information

The descriptive statistics under replicate the state of scholar mortgage debtors throughout the USA by way of the third quarter of 2023. Nonetheless, the delinquency details within the desk under are seemingly skewed due to the reimbursement restart.

- Variety of Debtors: 43.2 million

- Median Debt Stability: $19,281

- Common Pupil Debt Stability: $37,088

- Variety of Debtors with delinquent or defaulted loans: 3.3 million (7.5% of all debtors)

- Variety of debtors that noticed their debt lower in 2023: 11.5 million (26.6% of all debtors)

- Proportion of scholar mortgage debtors who’ve paid off their debt: 49%

- Estimated variety of debtors eligible for mortgage forgiveness: 38.6 million

Word, given the pandemic and all federal scholar mortgage funds being paused, the typical scholar mortgage cost knowledge is skewed. You possibly can see the previous common scholar mortgage cost and common scholar mortgage debt by graduating class right here.

Though debt ranges proceed to rise, some scholar mortgage debtors are seeing their debt masses fall. Practically half (49%) of all debtors who took out loans to pay for his or her training have paid the loans off in full.

Amongst present debtors, 31.4% noticed their debt masses shrink in 2023.

Pupil Loans By State Quick Information

Whereas the nationwide debt statistics paint a regarding image, the precise debt masses differ considerably from state to state inside a variety of about $30,000.

Whereas it is anticipated to see that California has essentially the most debtors, it is fascinating to see a number of the different knowledge.

- Most debtors: California (3.8 million)

- Fewest debtors: Wyoming (54,400)

- Lowest Common Stability: North Dakota ($28,604)

- Highest Common Stability: Maryland ($42,861)*

*Washington D.C. is a district reasonably than a state, however its common scholar mortgage stability is a whopping $54,945.

Evaluation of New York Federal Reserve Client Credit score Panel and Equifax Information, Compiled by The School Investor. Supply: The School Investor

Pupil Mortgage Debt By State Breakdown

You possibly can see a state by state breakdown of the scholar mortgage debt state of affairs under.

“Financial Properly-Being of U.S. Households in 2020 – Could 2021”, Board of Governors of The Federal Reserve System, October 7, 2022, https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-student-loans.htm

The USA Authorities. “President Joe Biden Declares $7.4 Billion in Pupil Debt Cancellation for 277,000 Extra Individuals, Pursuing Each Path Obtainable to Cancel Pupil Debt” April 12, 2024, https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/12/president-joe-biden-announces-7-4-billion-in-student-debt-cancellation-for-277000-more-americans-pursuing-every-path-available-to-cancel-student-debt/

Schooling Information Initiative, “Pupil Mortgage Debt By State”, Could 13, 2024. https://educationdata.org/student-loan-debt-by-state