Welcome to this web page. I’m going to offer you the operational traits of Cybele Unbound and some helpful details about testing procedures of knowledgeable advisors. I hope you will see that the knowledge supplied on this web page helpful and productive on your future endeavors with our in addition to different knowledgeable advisors.

I’m a 44 12 months previous PhD graduate proprietary dealer. I’m primarily buying and selling index futures. My buying and selling historical past goes again to the Nineteen Nineties once I was in highschool the place we ship our quotes by telephone and watch the costs trough teletext system in our CRT TVs (Cathode Ray Tube TVs)

I met with algorithmic buying and selling within the 2010s. At these instances, with none exception all algorithms have been simply crap. After blowing a number of accounts with knowledgeable algorithms, I made a decision to shut the e-book of algorithmic buying and selling for an additional subsequent 10 years.

Buying and selling is a job area the place you become profitable by solely “sitting”. As your buying and selling evolves and your eyes are educated, then you definately begin to decide solely A++ high quality trades. It seems that I’ve been spending most of my days by solely ‘sitting’. Having redundant of spare time, I made a decision to develop my buying and selling algorithm that mimics the behavioral traits of my handbook buying and selling rules.

That was the time when Establishment Breaker and Cybele have been born.

3- Distinguishing Traits of Cybele Unbound

Cybele Unbound is an AI-powered quant buying and selling bot primarily based on worth motion and chance theories, using institutional buying and selling methods. It repeatedly adapts to altering market situations and employs strict threat administration strategies.

What units this EA aside is using chance principle into the commerce selections. That is made doable by its use of a posh machine studying algorithm, enabling the advisor to compute the percentile of the present worth.

Using this strategy we might remove dangerous high quality trades and take solely A++ high quality ones which have the very best chance of successful. This studying functionality additionally ensures Cybele Unbound to remain in tune with varied market eventualities.

4- How Likelihood Fashions Developed With Synthetic Intelligence?

The AI revolution is dramatically altering the panorama of inventory buying and selling, and one space that has been profoundly affected is chance principle—the muse for threat evaluation, prediction, and decision-making within the monetary markets.

1. Enhanced Information Processing and Sample Recognition

Conventional inventory buying and selling fashions relied on historic information and customary chance principle to foretell future market actions. Merchants would use statistical strategies to calculate chances primarily based on previous patterns, equivalent to worth motion and volatility. Nevertheless, the AI revolution has reworked this course of by enabling machines to course of huge quantities of information at speeds people can not match.

AI techniques, notably machine studying algorithms, now analyze not solely historic worth information but in addition incorporate different variables like social media sentiment, information occasions, and macroeconomic information. This has added complexity to conventional chance fashions, as machines can detect non-linear relationships and hidden patterns that have been beforehand unseen, thus altering the possibilities assigned to sure outcomes. The result’s extra correct predictions and a redefinition of threat chances in inventory buying and selling.

2. Dynamic Adjustment of Chances

In classical chance principle, inventory market fashions usually assume that worth actions observe a random stroll, implying that future costs are impartial of previous costs, and the chance of an final result is comparatively mounted. With AI, this assumption has been re-evaluated. AI algorithms modify chances dynamically, studying from each new information level. This steady studying course of permits machines to replace the chance of an occasion in real-time primarily based on altering market situations, considerably enhancing the accuracy of short-term buying and selling predictions.

As an illustration, if a information occasion happens that modifications market sentiment, AI can instantly modify the chance of a worth improve or lower, making selections extra conscious of new data and enhancing real-time market effectivity.

3. Improved Threat Administration

AI can be reshaping how chance principle is utilized in threat administration. By combining huge information units with subtle algorithms, AI instruments are more proficient at figuring out uncommon market occasions or “black swan” occasions, which are sometimes poorly dealt with by conventional fashions that assume a standard distribution of returns. This has led to the event of probabilistic threat fashions that higher account for excessive occasions and tail dangers.

AI-based techniques now present merchants with extra lifelike chance estimates for uncommon occasions, permitting for higher risk-adjusted returns. In different phrases, AI is enhancing the precision of calculating chances in tail-risk eventualities, resulting in extra sturdy hedging methods and threat mitigation.

4. Probabilistic Buying and selling Methods

The rise of algorithmic buying and selling powered by AI has additionally led to the adoption of probabilistic buying and selling methods, the place merchants use AI to find out the chance of success for every commerce. Moderately than counting on a hard and fast technique, these AI-driven techniques assign chances to varied outcomes primarily based on steady information evaluation and routinely execute trades with the very best anticipated chance of success.

For instance, AI can predict the probability {that a} sure inventory will hit a goal worth primarily based on hundreds of variables, enabling merchants to make extra knowledgeable selections. This probabilistic strategy strikes away from deterministic, rule-based methods and leverages AI’s capacity to optimize buying and selling primarily based on real-time information and chances.

In conclusion, the AI revolution has essentially shifted how chance principle is utilized in inventory buying and selling. AI’s capacity to course of monumental datasets, dynamically modify chances, and refine threat administration has revolutionized market predictions and buying and selling methods. As AI continues to evolve, its impression on probabilistic decision-making in inventory buying and selling will probably deepen, making it an indispensable software for merchants aiming to navigate the complexities of recent monetary markets.

5- How Cybele Use Likelihood Principle and AI Collectively?

In buying and selling, chance and percentile theories are important instruments for assessing market situations and managing threat. It is vitally new in MQL5 world and so far as we all know, Cybele Unbound is the one knowledgeable advisor that depends on this precept.

Likelihood principle helps merchants estimate the probability of particular outcomes, equivalent to worth actions or development continuations, permitting for extra knowledgeable decision-making. By analyzing historic information and worth patterns, Cybele Unbound can assign chances to future occasions and craft methods with increased possibilities of success.

Percentile principle enhances this by providing a approach to consider an asset’s efficiency relative to historic benchmarks. For instance, the knowledgeable advisor makes use of percentiles to determine whether or not present costs or market situations fall inside excessive ranges, serving to to find out overbought or oversold eventualities. Collectively, these theories empower the Cybele Unbound to strategy the markets with a extra structured, statistical mindset, enhancing each threat administration and revenue potential.

6- How Cybele Unbound Was Developed: The Excessive Method

There are 2 key phrases we must always pay attention to: The information becoming and inhabitants era fashions. Earlier than growing a mannequin, builders have to decide on one in every of these strategies.

Within the information becoming strategy, a mannequin is pushed to suit the previous information. As a result of you can also make any buying and selling mannequin to suit to the previous information, such algorithms will not be dependable. The reality is, you may present any buying and selling mannequin as if it performs completely nicely and completely worthwhile with optimization. As I said initially, this was the dominant strategy within the 2010s and with out exception all EAs have been nothing however crap.

Within the second strategy, you’d wish to generate a mathematical mannequin that mimics the behavioral traits of the unique information producing course of. You’ll be able to consider this like an imitation of a actuality.

For instance, there’s an interplay each millisecond within the Nasdaq inventory alternate that produces these graphical representations amongst market individuals, particularly patrons and sellers. We see this interplay within the type of graphical illustration of worth modifications. In a inhabitants producing mannequin, you mainly develop a mannequin that behaves like an imitation of Nasdaq.

Since you are engaged on the true information era course of itself, these fashions are dependable.

If you develop a mannequin that you just assume is an effective imitation, THEN, you apply it to the info and see the way it behaves.

7- Beating Backtest Pitfalls With Utilizing High quality information and Second Simulator

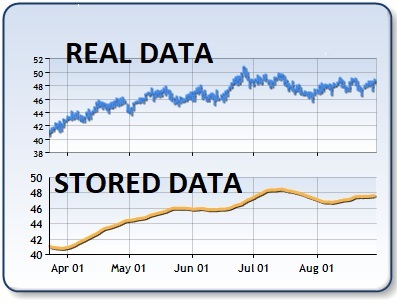

On the planet of Meta Quotes, brokers take care of the previous information in two methods: both they retailer their very own information or they use Meta Quotes servers. However, Meta Quotes don’t retailer the 100% of actual ticks, it makes use of type of smoothed ticks that occupy a lot much less area.

The reality is, most brokers don’t retailer the info in their very own servers. If you check the mannequin with previous information, they name the info from the servers of Meta Quotes. Subsequently, you check the mannequin with this smoothed information. After all once you check a mannequin with smoothed information, you truly do not check it correctly just because the info is just not an excellent illustration of the true world. On this case your outcomes wouldn’t be dependable.

Meta Quotes’ buying and selling platform, Meta Dealer can be repeatedly updating and after each replace some algorithmic modifications are utilized. Even in case you check the mannequin with the identical information, outcomes can differ between 2 meta dealer variations.

These are the pitfalls of normal testing procedures that many retail merchants use on a regular basis. To beat these pitfalls, we check our fashions with Ducascopy information. Ducascopy has its personal information servers and shops the info impartial from Meta Quotes. Subsequently, Cybele Unbound is examined utilizing 99.9% of actual ticks of Ducascopy information.

8 – Gird System and the Outcomes

Within the backtest, we think about 2018+ . As a result of Cybele Unbound is just not a historical past reader, there isn’t any level to go greater than that. Certainly, in any bot, when the algorithm is nice you actually don’t must transcend 2 -3 years of backtest. As a result of market dynamics at all times change and never steady – the market situation 10 12 months in the past is just not similar because it was 5 years in the past, 2 years in the past and so on. That’s, the the algorithm simply can’t be taught the pricing dynamics of the market 10 years in the past and people 5 years in the past on the similar time. It must be re-optimized.

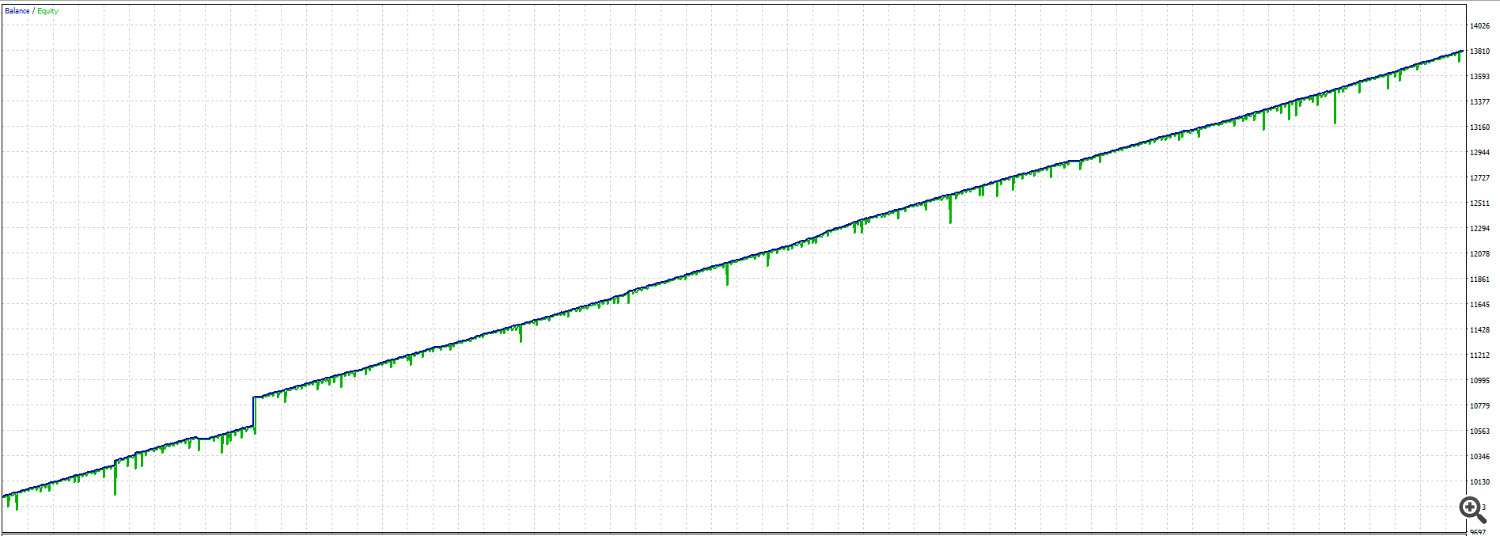

We additionally added a easy grid mechanisms on prime of the core algorithm to reinforce outcomes. Listed here are the outcomes with and with out grid:

CYBELE UNBOUND 0.1 LOT WITH GRID OFF: $3804 PROFIT – $278 MAX EQUITY DD