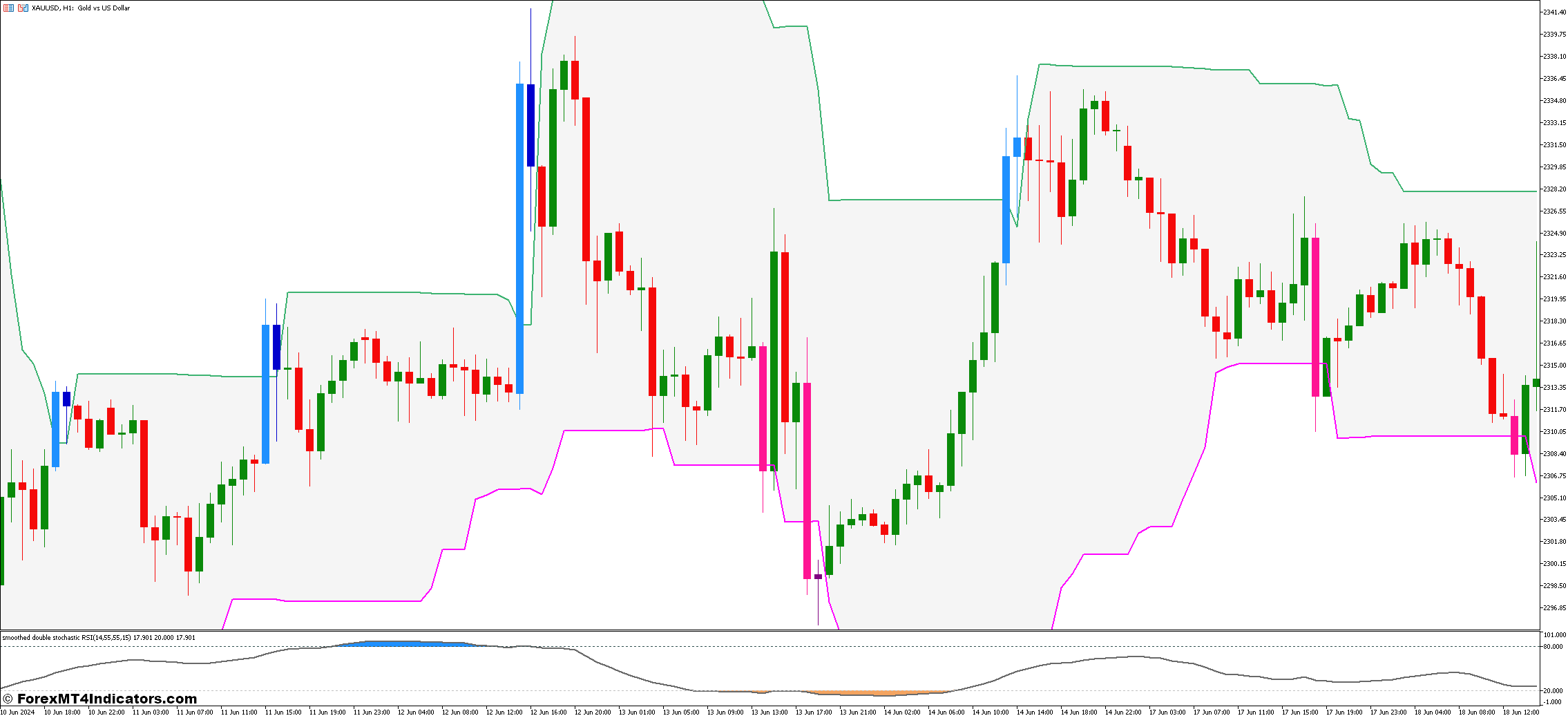

Donchian Channels Indicator

The Donchian Channels, developed by Richard Donchian, are a technical indicator used primarily to establish the highs and lows of value actions over a specified interval. This indicator consists of three strains: the higher band (highest excessive over the chosen interval), the decrease band (lowest low over the chosen interval), and the center band (sometimes the typical of the higher and decrease bands). Merchants use these bands to gauge the market’s volatility and potential breakout factors.

One of many key strengths of the Donchian Channels is their simplicity and readability in illustrating value motion. The higher and decrease bands act as dynamic ranges of help and resistance, serving to merchants establish traits and potential reversals. Breakouts happen when the worth breaches the higher or decrease band, signaling potential alternatives to enter trades within the route of the breakout.

Merchants typically use completely different intervals for the Donchian Channels relying on their buying and selling type and market circumstances. As an example, shorter intervals like 20 days could also be used for short-term buying and selling, whereas longer intervals like 50 or 100 days are extra appropriate for figuring out long-term traits. By incorporating the Donchian Channels into their evaluation, merchants can acquire worthwhile insights into value actions and improve their decision-making course of within the foreign exchange market.

Double Stochastic RSI Indicator

The Double Stochastic RSI is a variation of two widespread technical indicators: the Stochastic Oscillator and the Relative Power Index (RSI). This indicator is designed to offer a extra refined view of market momentum and overbought or oversold circumstances. In contrast to the standard single Stochastic or RSI indicators, the Double Stochastic RSI makes use of two stochastic oscillators to filter alerts and scale back false positives. The Double Stochastic RSI measures the momentum of value actions by evaluating the present value to its current vary. It consists of two strains: %K1 and %K2, that are sometimes smoothed variations of the standard %Okay line utilized in Stochastic Oscillators. These strains oscillate between 0 and 100, with readings above 80 indicating overbought circumstances and readings beneath 20 indicating oversold circumstances.

Merchants use the Double Stochastic RSI to establish potential development reversals or continuations. Divergences between value motion and the indicator’s readings can sign momentum shifts, offering merchants with alternatives to enter or exit trades. By incorporating this indicator into their evaluation, merchants goal to capitalize on modifications in market sentiment and improve the accuracy of their buying and selling selections.

Understanding learn how to interpret and apply the Double Stochastic RSI successfully can considerably bolster a dealer’s technical evaluation toolkit. By combining insights from each stochastic oscillators and the RSI, merchants acquire a extra complete view of market dynamics and potential buying and selling alternatives in varied market circumstances.