The RSI (Kernel Optimized) indicator integrates Kernel Density Estimation (KDE) with the Relative Energy Index (RSI), making a probability-based framework to find out how carefully the present RSI stage aligns with traditionally vital pivot factors. By using KDE, discrete historic pivot values are reworked right into a clean likelihood distribution, enabling extra refined pattern evaluation than conventional RSI alone.

Core Idea: Kernel Density Estimation (KDE)

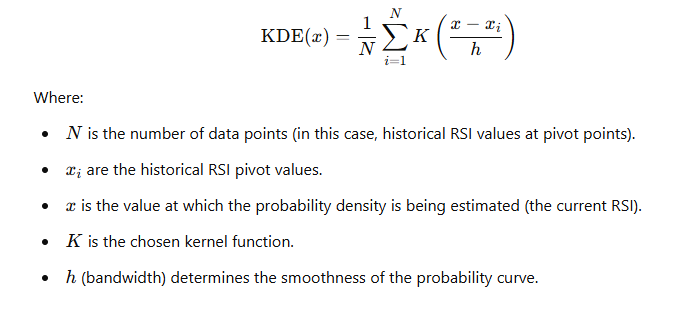

KDE is a non-parametric methodology used to estimate the likelihood density perform of a dataset. As an alternative of counting on discrete bins as in histograms, KDE applies a steady kernel perform over every information level to provide a clean curve that represents likelihood density at each stage of the variable being studied.

Common KDE System:

Step-by-Step Logic

-

Accumulating RSI Pivot Information: The method begins by figuring out historic highs and lows in RSI information. These turning factors are recorded as separate units of RSI values: one set for pivot highs and one other for pivot lows.

-

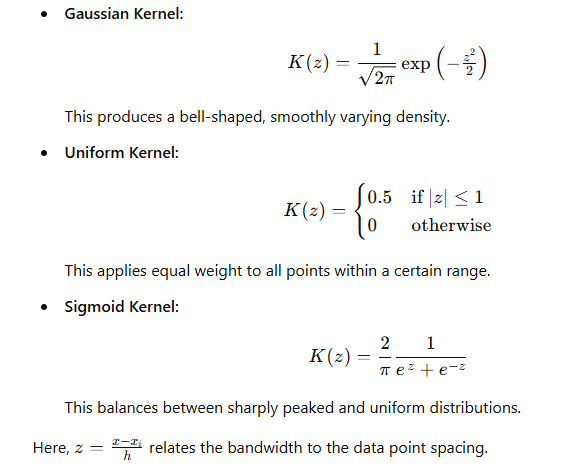

Deciding on a Kernel Perform: A number of kernel choices could also be obtainable, resembling Gaussian, Uniform, and Sigmoid. Every kernel defines how affect diminishes as the gap from a knowledge level will increase.

-

Adjusting the Bandwidth (h): The bandwidth controls how broad and clean the likelihood curve is:

- A smaller bandwidth highlights finer particulars and is extra delicate to particular person information factors.

- A bigger bandwidth creates a smoother, extra generalized likelihood distribution.

-

Developing the Likelihood Distribution: After selecting the kernel and bandwidth, KDE is utilized to the units of pivot RSI values. The result’s a steady likelihood distribution, indicating how possible the present RSI is to be close to traditionally vital pivot ranges.

-

Evaluating Possibilities: Two major strategies can be utilized:

- Nearest Mode: Focuses on the likelihood density on the level closest to the present RSI worth.

- Sum Mode: Integrates possibilities over a variety, offering a cumulative sense of how strongly the present RSI matches historic pivot patterns.

A user-defined threshold determines when the likelihood is taken into account excessive sufficient to counsel that the present RSI carefully resembles earlier pivot circumstances.

-

Producing Market Indicators: By evaluating the present RSI’s likelihood distribution to historic pivot distributions:

- A excessive likelihood of similarity to historic low pivots might sign a bullish alternative.

- A excessive likelihood of similarity to historic excessive pivots might point out a bearish state of affairs.

The brink may be adjusted:

- A better threshold ends in fewer however extra dependable indicators.

- A decrease threshold produces extra indicators however might embrace extra noise.

Advantages of Kernel Optimization

-

Easy Information Illustration: KDE transforms discrete pivot information right into a steady, simply interpretable likelihood curve.

-

Likelihood-Primarily based Evaluation: Quantifying the probability of present circumstances matching historic pivot factors provides depth and robustness to RSI-based evaluation.

-

Flexibility and Adaptability: Customers can choose the kernel perform, regulate bandwidth, and select likelihood analysis modes to tailor the indicator to varied market circumstances.

-

Knowledgeable Choice-Making: Likelihood-driven insights assist merchants distinguish between random market fluctuations and real pivot-like conduct, enhancing confidence in entry and exit selections.

Conclusion

By integrating KDE with RSI, the kernel-optimized logic gives a probability-based evaluation of the place the present RSI stands relative to historic pivot distributions. By way of kernel choice, bandwidth tuning, and threshold changes, merchants achieve a extra nuanced, statistically knowledgeable instrument for figuring out potential turning factors out there.

Obtain the RSI (Kernel Optimized) Indicator with Scanner utilizing the Kernel Optimized Logic above with built-in Scanner of foreign money pairs, time frames right here:

– for MT4: RSI Kernel Optimized with Scanner for MT4

– for MT5: RSI Kernel Optimized with Scanner for MT5