TABLE OF CONTENTS

1. Why ETFs?

When establishing a portfolio, Betterment focuses on trade traded funds (“ETFs”) securities with usually low-costs and excessive liquidity. An ETF is a safety that usually tracks a broad-market inventory or bond index or a basket of property identical to an index mutual fund, however trades identical to a inventory on a listed trade. By design, index ETFs intently monitor their benchmarks—such because the S&P 500 or the Dow Jones Industrial Common—and are purchased and offered like shares all through the day. ETFs have sure structural benefits when in comparison with mutual funds. These embrace:

A. Clear Objectives and Mandates

Betterment usually selects ETFs which have mandates to passively monitor broad-market benchmark indexes. A passive mandate explicitly restricts the fund administrator to the singular objective of replicating a benchmark fairly than making lively funding choices constituting market timing, constructing focus in both a single title, group of names, or themes in an effort to beat the fund’s underlying benchmark. Adherence to this mandate ensures the identical degree of funding diversification because the benchmark indexes, makes efficiency extra predictable, and reduces idiosyncratic danger related to lively supervisor choices.

B. Intraday Availability

ETFs are transactable throughout all open market hours identical to another inventory. As such, they’re closely traded by the total spectrum of fairness market contributors together with market makers, short-term merchants, buy-and-hold buyers, and fund directors themselves creating and redeeming models as wanted (or growing or lowering the availability of ETFs primarily based on market demand).

This various buying and selling exercise results in most ETFs carrying low liquidity premiums (or decrease prices to transact as a result of competitors from available market contributors pushing costs downward) and equity-like transaction occasions no matter the underlying holdings of every fund. This usually makes ETFs pretty liquid, which makes them cheaper and simpler to commerce on-demand for actions like creating a brand new portfolio or rebalancing an current one.

C. Low Charge Buildings

As a result of most benchmarks replace constituents (i.e., the precise shares and associated weights that make up a broad-market index) pretty occasionally, passive index-tracking ETFs additionally register decrease annual turnover (or the speed a fund tends to transact its holdings) and thus fewer related prices are handed by means of to buyers.

As well as, ETFs are usually managed by their directors as a single share class that holds all property as a single entity. This construction naturally lends itself as a protection in opposition to directors practising price discrimination throughout the spectrum of obtainable buyers.

With just one share class, ETFs are investor-type agnostic. The result’s that ETF directors present the identical exposures and low charges to your entire spectrum of potential consumers.

D. Tax Effectivity

Within the case when a fund (no matter its particular construction) sells holdings which have skilled capital appreciation, the capital positive aspects generated from these gross sales should, by legislation, be accrued and distributed to shareholders by year-end within the type of distributions. These distributions enhance tax liabilities for the entire fund’s shareholders. With respect to those distributions, ETFs supply a big tax benefit for shareholders over mutual funds.

As a result of mutual funds will not be trade traded, the one accessible counterparty accessible for a purchaser or vendor is the fund administrator. When a shareholder in a mutual fund needs to liquidate their holdings within the fund, the fund’s administrator should promote securities so as to generate the money required to fulfill the redemption request. These redemption-driven gross sales generate capital positive aspects that result in distributions for not simply the redeeming investor, however all shareholders within the fund. Mutual funds thus successfully socialize the fund’s tax legal responsibility to all shareholders, resulting in passive, long-term buyers having to assist pay a tax invoice for all intermediate (and doubtlessly short-term) shareholder transactions.

As a result of ETFs are trade traded, your entire market serves as potential counterparties to a purchaser or vendor. When a shareholder in an ETF needs to liquidate their holdings within the fund, they merely promote their shares to a different investor identical to that of a single firm’s fairness shares. The ensuing transaction would solely generate a capital achieve or loss for the vendor and never all buyers within the fund.

As well as, ETFs get pleasure from a slight benefit in relation to taxation on dividends paid out to buyers. After the passing of the Jobs and Development Tax Aid Reconciliation Act of 2003, sure certified dividend funds from firms to buyers are solely topic to the decrease long-term capital positive aspects tax fairly than normal earnings tax (which continues to be in pressure for unusual, non-qualified dividends). Certified dividends must be paid by a home company (or international company listed on a home inventory trade) and have to be held by each the investor and the fund for 61 of the 120 days surrounding the dividend payout date. On account of lively mutual funds’ increased turnover, a better share of dividends paid out to their buyers violate the holding interval requirement and enhance investor tax profiles.

E. Funding Flexibility

The maturation and progress of the worldwide ETF market over the previous few many years has led to the event of an immense spectrum of merchandise protecting totally different asset lessons, markets, kinds, and geographies. The consequence is a sturdy market of potential portfolio parts that are versatile, extraordinarily liquid, and simply substitutable.

Regardless of all the benefits of ETFs, it’s nonetheless necessary to notice that not all ETFs are precisely alike or equally helpful to an investor. Betterment’s funding choice course of seeks to pick out ETFs that present publicity to the specified asset lessons with the least quantity of distinction between underlying asset class conduct and portfolio efficiency. In different phrases, we try to reduce the “frictions” (the gathering of systematic and idiosyncratic components that result in efficiency deviations) between ETFs and their benchmarks.

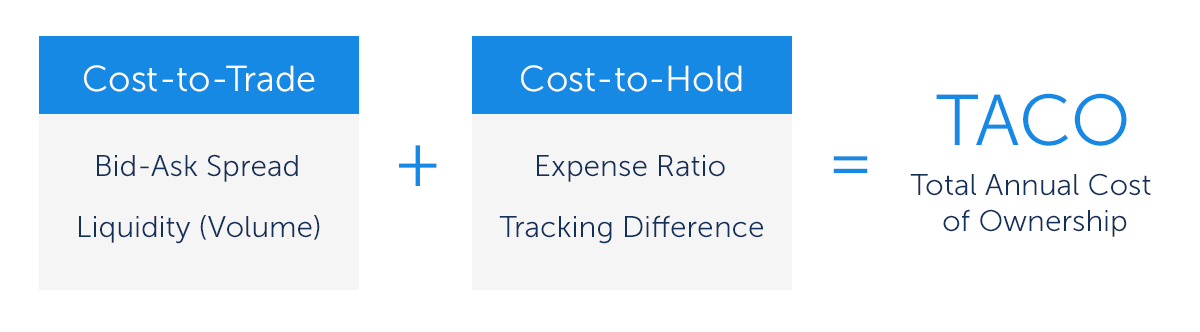

Betterment’s measure of those frictions is summarized because the “whole annual value of possession”, or TACO: a composition of all related frictions used to rank and choose ETF candidates for the Betterment portfolio.

2. Complete Annual Value of Possession (TACO)

The overall annual value of possession (TACO) is Betterment’s fund scoring technique, used to price funds for inclusion within the Betterment portfolio. TACO takes into consideration an ETF’s transactional and liquidity prices in addition to prices related to holding funds. Along with TACO, Betterment additionally considers sure different qualitative components of ETFs, together with however not restricted to, whether or not the ETF fulfills a desired portfolio mandate and/or publicity.

TACO is decided by two parts, a fund’s cost-to-trade and cost-to-hold.

The primary, cost-to-trade, represents the fee related to buying and selling out and in of funds in the course of the course of normal investing actions, comparable to rebalancing, money inflows or withdrawals, and tax loss harvesting.

Value-to-trade is usually influenced by two components:

- Quantity: A measure of what number of shares change arms every day.

- Bid-ask unfold: The distinction between the value at which you should buy a safety and the value at which you’ll promote the identical safety at any given time.

The second part, cost-to-hold, represents the annual prices related to proudly owning the fund and is usually influenced by these two components:

- Expense ratios: Fund bills imposed by an ETF administrator.

- Monitoring distinction: The deviation in efficiency from the fund’s benchmark index.

Let’s evaluation the precise inputs to every part in additional element:

Value-to-Commerce: Quantity and Bid-Ask Unfold

Quantity: Quantity is a historic measure of what number of shares could change arms every day. This helps assess how simple it could be to discover a purchaser or vendor sooner or later. That is necessary as a result of it tends to point the supply of counterparties to purchase (e.g., when Betterment is promoting ETFs) and promote (e.g., when Betterment is shopping for ETFs). The extra shares of an ETF Betterment wants to purchase on behalf of our shopper, the extra quantity is required to finish the trades with out impacting market costs. As such, we measure common market quantity for every ETF as a share of Betterment’s regular buying and selling exercise. Funds with low common day by day buying and selling quantity in comparison with Betterment’s buying and selling quantity may have a better value, as a result of Betterment’s increased buying and selling quantity is extra prone to affect market costs.

Bid-Ask Unfold: Usually market transactions are related to two costs: the value at which persons are keen to promote a safety, and the value others are keen to pay to purchase it. The distinction between these two numbers is called the bid-ask unfold, and will be expressed in foreign money or share phrases.

For instance, a dealer could also be pleased to promote a share at $100.02, however solely needs to purchase it at $99.98. The bid-ask foreign money unfold right here is $.04, which coincidentally additionally represents a bid-ask share of 0.04%. On this instance, in the event you had been to purchase a share, and instantly promote it, you’d find yourself with 0.04% much less because of the unfold. That is how merchants and market makers generate profits—by offering liquid entry to markets for small margins.

Usually, closely traded securities with extra aggressive counterparties keen to transact will carry decrease bid-ask spreads. In contrast to the expense ratio, the diploma to which you care about bid-ask unfold possible is determined by how actively you commerce. Purchase-and-hold buyers sometimes care about it much less in comparison with lively merchants, as a result of they may accrue considerably fewer transactions over their meant funding horizons. Minimizing these prices is helpful to constructing an environment friendly portfolio which is why Betterment makes an attempt to pick out ETFs with narrower bid-ask spreads.

Value-to-Maintain: Expense Ratio and Monitoring Distinction

Expense Ratio: An expense ratio is the set share of the value of a single share paid by shareholders to the fund directors yearly. ETFs usually gather these charges from the dividends handed by means of from the underlying property to holders of the safety, which lead to decrease whole returns to shareholders.

Monitoring Distinction: Monitoring distinction is the underperformance or outperformance of a fund relative to the benchmark index it seeks to trace. Funds could deviate from their benchmark indexes for numerous causes, together with any trades with respect to the fund’s holdings, deviations in weights between fund holdings and the benchmark index, and rebates from securities lending. It’s necessary to notice that, over any given interval, monitoring distinction isn’t essentially destructive; in some durations, it may result in outperformance. Nonetheless, monitoring distinction can introduce systematic deviation within the long-term returns of the general portfolio when put next purely with a comparable basket of benchmark indexes apart from ETFs.

Discovering TACO

We calculate TACO because the sum of the above parts:

TACO = “Value-to-Commerce” + “Value-to-Maintain”

As talked about above, cost-to-trade estimates the prices related to shopping for and promoting funds within the open market. This quantity is weighted to appropriately symbolize the combination investing actions of the common Betterment shopper when it comes to money flows, rebalances, and tax loss harvests.

The price-to-hold represents our expectations of the annual prices an investor will incur from proudly owning a fund. Expense ratio makes up the vast majority of this value, as it’s the most express and infrequently the biggest value related to holding a fund. We additionally account for monitoring distinction between the fund and its benchmark index.

In lots of instances, cost-to-hold, which incorporates an ETF’s expense ratio, would be the dominant issue within the whole value calculations. In fact, one can’t maintain a safety with out first buying it, so we should additionally account for transaction prices, which we accomplish with our cost-to-trade part.

3. Minimizing Market Impression

Market impression, or the change in worth attributable to an investor shopping for or promoting a fund, is included into Betterment’s whole value quantity by means of the cost-to-trade part. That is particularly by means of the interplay of bid-ask spreads and quantity. Nonetheless, we take further issues to manage for market impression when evaluating our universe of investable funds.

A key consider Betterment’s decision-making is whether or not the ETF has comparatively excessive ranges of current property underneath administration and common day by day traded volumes. This helps to make sure that Betterment’s buying and selling exercise and holdings is not going to dominate the safety’s pure market effectivity, which may both drive the value of the ETF up or down when buying and selling.

We outline market impression for any given funding automobile because the Betterment platform’s relative dimension (RSRS) in two key areas.

Our share of the fund’s property underneath managements is calculated fairly merely as

RS of AUM = (‘AUM of Betterment”https://www.betterment.com/”AUM of ETF’)

whereas our share of the fund’s day by day traded quantity is calculated as

RS Vol = (‘Vol of Betterment”https://www.betterment.com/”Vol of ETF’)

ETFs with out an acceptable degree of property or day by day commerce quantity would possibly result in a state of affairs the place Betterment’s exercise on behalf of shoppers strikes the present marketplace for the safety. In an try to keep away from doubtlessly destructive results upon our buyers, we usually don’t think about ETFs with smaller asset bases and restricted buying and selling exercise except another extenuating issue is current.

Conclusion

As with all funding, ETFs are topic to market danger, together with the attainable lack of principal. The worth of any portfolio will fluctuate with the worth of the underlying securities. ETFs could commerce for lower than their web asset worth (NAV). There’s all the time a danger that an ETF is not going to meet its acknowledged goal on any given buying and selling day. Betterment evaluations its asset choice evaluation on a periodic foundation to evaluate: the validity of current picks, potential adjustments by fund directors (elevating or decreasing expense ratios), and adjustments in particular ETF market components (together with tighter bid-ask spreads, decrease monitoring variations, rising asset bases, or decreased selection-driven market impression). Betterment additionally considers the tax implications of portfolio choice adjustments and estimates the online good thing about transitioning between funding autos for our shoppers.

We use the ETFs that consequence from this course of in our allocation recommendation that’s primarily based in your funding horizon, stability, and objective. For the main points on our allocation recommendation, please see Betterment’s Purpose Allocation Suggestion Methodology.