Yves right here. This manufacturing unit constructing pattern, sighted by Wolf Richter, bears watching. It’s a concrete demonstration (pun supposed) that there’s a severe effort underway to “reshore” manufacturing. Nonetheless, need and spending don’t essentially translate into outcomes. Recall the good hyped Foxconn manufacturing unit in Wisconsin, the place they sucked plenty of subsidies out of the state after which punted. From CNBC in 2021:

Taiwan electronics producer Foxconn is drastically scaling again a deliberate $10 billion manufacturing unit in Wisconsin.

Underneath a deal, Foxconn will cut back its deliberate funding to $672 million from $10 billion, and slash the variety of new jobs to 1,454 from 13,000.

And bear in mind, that is a longtime participant, as in Foxconn is aware of how you can begin up and function factories. This isn’t Individuals who may be scrambling to search out desperately wanted manufacturing unit flooring supervisors and better stage manufacturing managers.

Wisconsin did at the very least restructure the deal and clawed again quite a lot of the subsidy commitments.

Equally, Alexander Mercouris has reported lengthy kind on the failed US effort to extend 155 mm shell manufacturing. Along with many mishaps which he recounted lengthy kind, the bottleneck stays a scarcity of gunpowder. There appears to be just one manufacturing unit, in Poland, that makes TNT. The US had determined to maneuver off TNT as a result of environmentally nasty, however the replacements by no means labored (unsure as a result of they failed as explosives or had been too onerous to provide at scale and/or affordable value).

Admittedly, it’s a considerably totally different kind of producing, however I used to be a paper mill brat and my father ran paper mills. Coated paper may be very fussy. The coating, in his day mineral clay, is utilized when the paper is moist. The paper machines must function at very wonderful tolerances or else the paper breaks, inflicting expensive downtime.

The mills must run 24/7 apart from scheduled upkeep as a result of the capital prices are excessive.

My father ran startups and turnarounds as a result of hardly anybody within the trade may execute them. He finally grew to become the pinnacle of producing at one of many main papermakers.

The rule of thumb was a profitable startup (of a single “machine” as in manufacturing line, which value ~$500 million in Nineteen Seventies) took two years and value 20% of the capital prices. An unsuccessful startup was a operating cash sore.

In different phrases, erecting manufacturing unit buildings is the simple half. Keep tuned as to how excessive the profitable opening and manufacturing price is.

By Wolf Richter, editor at Wolf Road. Initially printed at Wolf Road

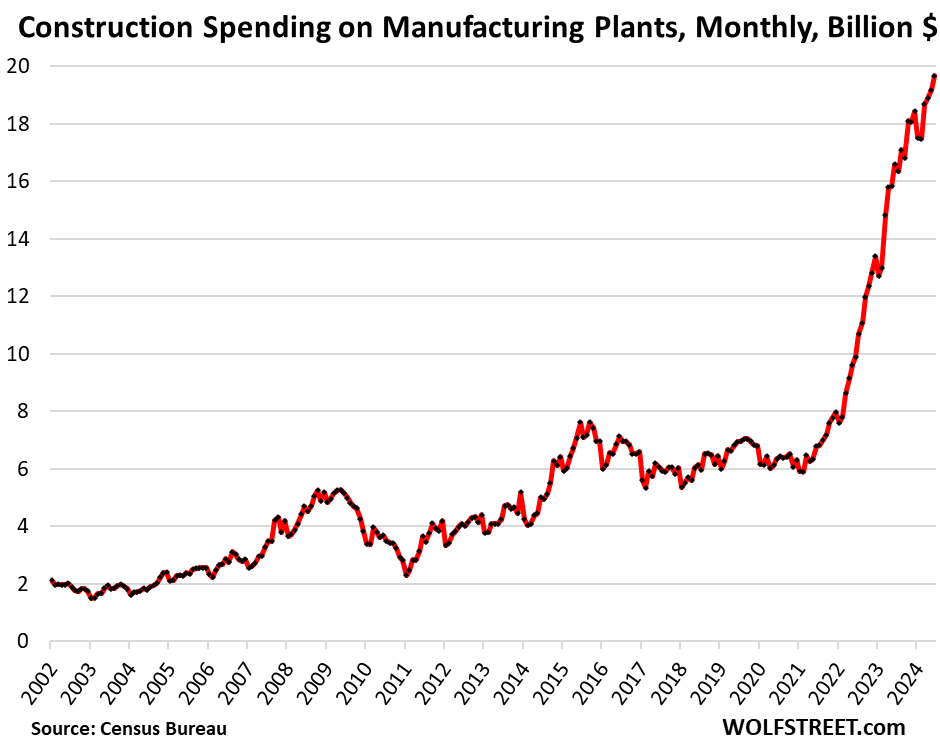

Firms invested a file $19.7 billion in June within the building of producing services, up by 18.6% from the already surging ranges in June 2023, up by practically 100% from June 2022, and up by 209% from June 2019, in accordance with the Census Bureau at the moment.

The funding totals right here solely cowl the precise building prices of the services, not the prices of the manufacturing gear and set up that may dwarf the development prices of the constructing. The full value of a giant chip plant may attain $20 billion, however the building prices are the smallest a part of it. So the entire quantities invested in manufacturing crops, together with the gear and set up, are a lot increased. However right here, the quantities solely consult with the development of the crops, and might be seen as a directional indicator of complete funding in manufacturing.

Along with the development increase of semiconductor crops, numerous different manufacturing crops have been introduced, and proceed to be introduced.

The explosion in manufacturing unit building that began within the second half of 2021 was one of many adjustments that got here out of the pandemic when America’s scary dependence on China grew to become obvious in large shortages of all types of products, together with semiconductor shortages, and unbelievable supply-chain and transportation chaos, that induced company America and coverage makers to rethink the technique of limitless globalization.

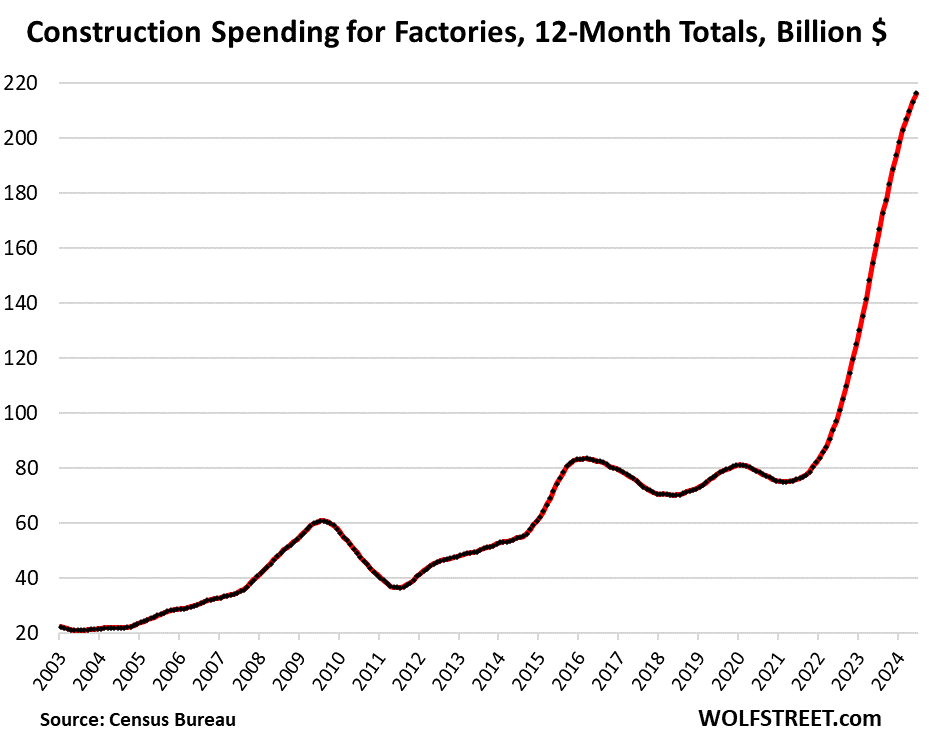

The CHIPS Act, signed into legislation in August 2022, was a part of the motion. Whereas the primary awards have been introduced, there may be plenty of stuff left to do, together with due diligence, and the money hasn’t been disbursed but. That’s nonetheless to come back.

The 12-month complete of funding in manufacturing crops jumped to $235.5 billion, up by 19% from the identical interval a 12 months in the past, up by 100% from two years in the past, and up by 217% from the identical interval in 2019.

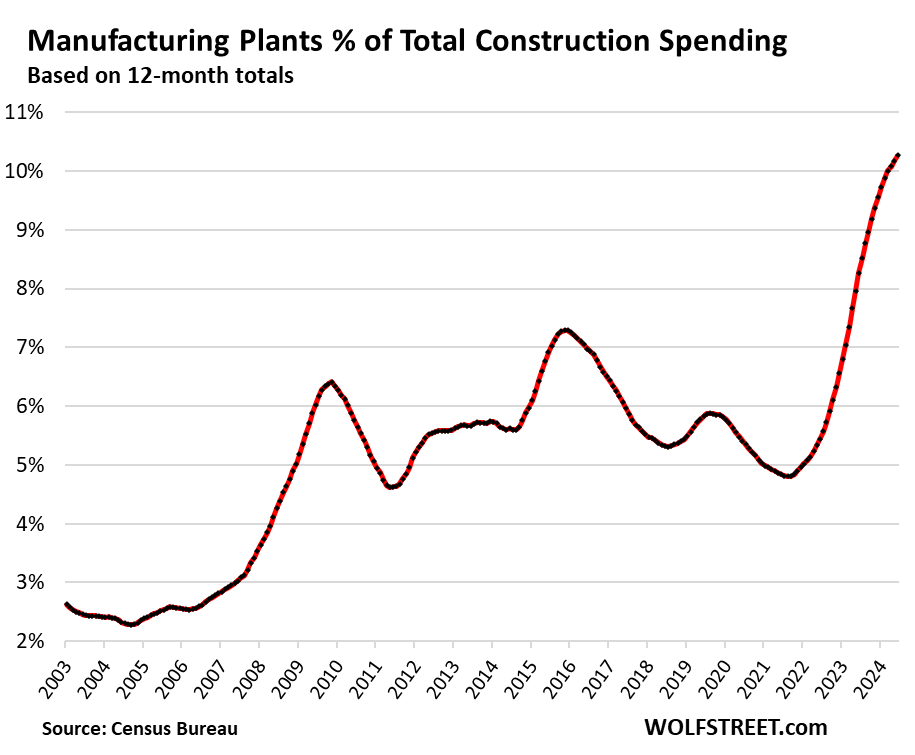

Building spending on manufacturing services now accounts for over 10% of complete building spending within the US, residential and non-residential, from single-family homes to roads and energy crops.

It’s all primarily based on the precept that industrial robots value the identical within the US and China, that guide labor is a a lot smaller value part in trendy automated manufacturing, and that transportation prices (which spiked in the course of the pandemic) and lack of Mental Property (IP), which is a given in China, and different dangers must be added to value equation.

As well as, the more and more difficult and burdened relationship between the US and China has uncovered for all to see that the reckless dependence by US corporations on manufacturing in China is a elementary danger, not just for the businesses, but in addition for nationwide safety.

Nobody goes to construct a manufacturing unit within the US to make low-value merchandise, similar to T-shirts. It’s all targeted on difficult high-value merchandise, similar to motor automobiles, chips, electrical and digital merchandise, heavy elements and gear, and so forth.

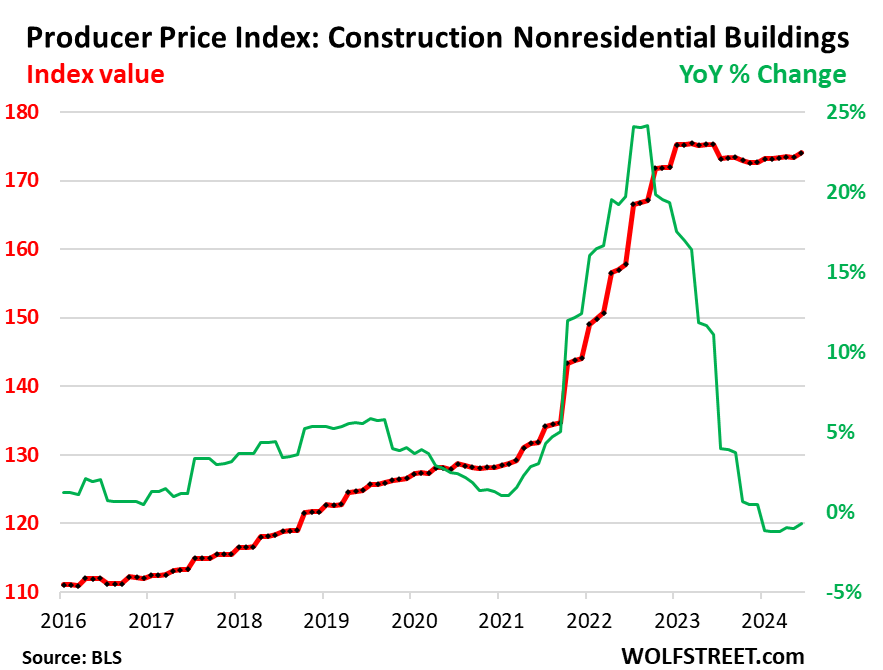

Inflation in Building Has Abated

The Producer Value Index for building prices of nonresidential buildings, after blowing out in mid-2021 via 2022, began plateauing in early 2023 and has remained roughly unchanged since then (purple within the chart beneath).

On a year-over-year foundation, the PPI for nonresidential building has been flat to barely destructive since late 2023, after having spiked by as a lot as 24% in mid-2022 (inexperienced).