There are a selection of ways in which you will discover nice buying and selling alternatives. A method is to easily observe a chart on a WatchList and anticipate sure indicators to succeed in “purchase” factors. For example, an uptrending inventory many occasions will discover help as its 20-day EMA is examined or when its RSI approaches 40 throughout pullbacks. For this text, nonetheless, I wish to present you an attention-grabbing manner to make use of RRG charts to perform the identical factor, solely RRG charts could be higher for merchants who visualize actions higher when evaluating relative strikes.

Reside Nation (LYV) is within the communication companies (XLC) sector and from early-August via late-November, it was in a stealth uptrend outpacing almost all shares on a relative foundation because it gained over 60% in that 3 1/2 month span. I wish to see 20-day EMA checks and this one is sort of clear:

There’s so much to love right here as LYV’s business group – broadcasting & leisure ($DJUSBC) – is now displaying significantly better relative energy to the S&P 500. In different phrases, cash is rotating INTO the leisure space and, as an business group chief, LYV is reaping the rewards. The early-December selloff has taken LYV out of overbought territory on its RSI and allowed it to check its rising 20-day EMA, establishing for a bounce.

If I take advantage of the weekly and every day RRG charts and dissect the part shares inside the communication companies sector, this is what I discover:

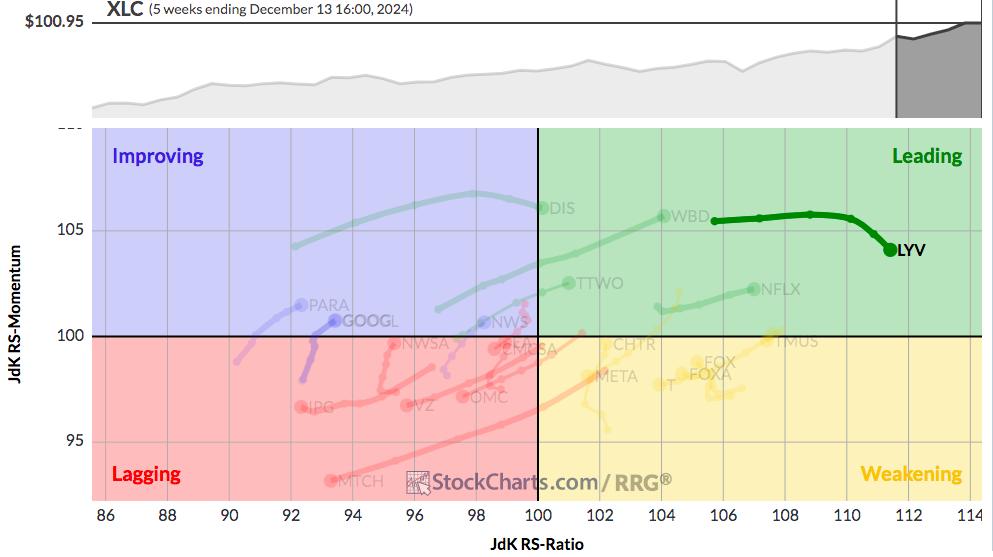

Weekly RRG – XLC

I’ve highlighted LYV as it is the furthest XLC part inventory to the fitting and within the main quadrant, displaying each sturdy bullish momentum and glorious relative energy. That tells us that we’ve got a inventory value looking ahead to attainable commerce setups during times of short-term promoting. For that short-term promoting and the way it appears on a every day RRG, let’s drill all the way down to that timeframe and test it out.

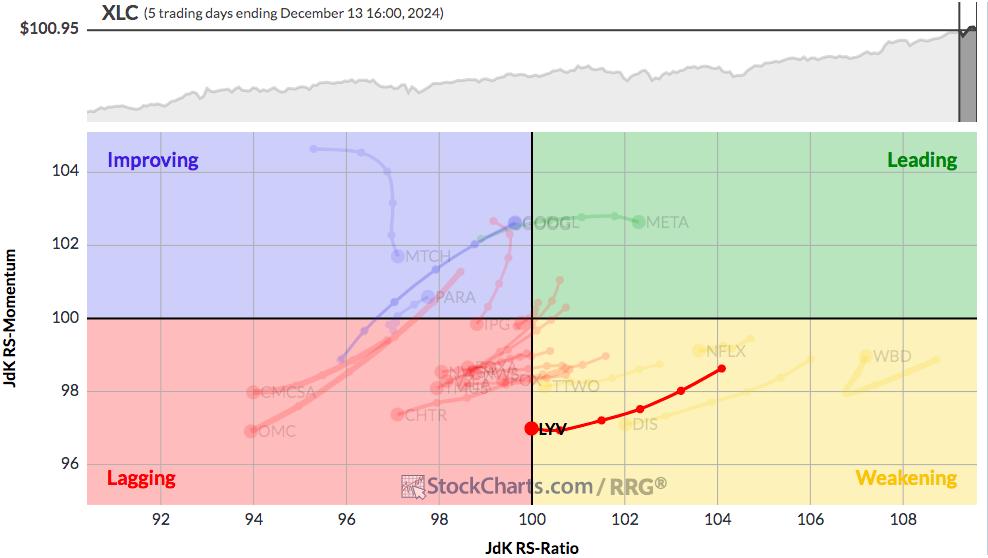

Every day RRG – XLC

As soon as once more, I’ve highlighted LYV with the intention to visualize its motion from an RRG perspective. From expertise, many main shares could have short-term pullbacks the place they transfer throughout the Weakening quadrant, solely to show larger and head again in the direction of the Main quadrant. LYV’s sharp chart would present this as a rally again to check the latest value excessive. If and when that happens, we’ll see LYV’s every day RRG chart flip again in the direction of the Main quadrant. However my level right here is not whether or not LYV strikes larger once more for us to make cash. As a substitute, I am merely mentioning how wholesome shares will look on their weekly and every day RRGs. The weekly chart will spotlight a inventory’s highly effective latest transfer larger and the every day chart will assist us to establish these bullish shares, and attainable entry factors, which are experiencing short-term weak point.

As a swing dealer, that is EXACTLY what we wish to search for.

Large RRG Occasion

Saturday morning at 10:00am ET, Julius de Kempenaer, Sr. Technical Analyst right here at StockCharts.com and the founder and creator of RRG charts, will be part of me for a FREE (no bank card required) EarningsBeats.com occasion, “Key Rotation Into 2025”, the place we’ll use RRG charts to point out everybody the vital rotation that is happening now that may probably assist form the course of our main indices in the course of the stability of 2024 and all through 2025. For extra data and to register for the occasion, CLICK HERE.

For those who can not make the occasion stay, these registering will obtain a replica of the recording of the occasion that you may take a look at at your earliest comfort. So please register NOW and save your seat!

Comfortable buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Every day Market Report (DMR), offering steering to EB.com members on daily basis that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as nicely, mixing a novel talent set to strategy the U.S. inventory market.