EUR/USD: What the ECB and Fed Will Do

● There was a big quantity of stories final week, so we are going to spotlight and analyse solely a very powerful ones.

Germany set the tone for European statistics, with shopper inflation rising as an alternative of falling. In line with the preliminary estimate, the Client Worth Index (CPI) elevated year-on-year from 2.2% to 2.3%, and month-on-month from 0.1% to 0.3%.

The next day, related figures for the Eurozone as a complete have been launched. Preliminary information confirmed that CPI in July rose to 2.6% (y/y) in comparison with 2.5% in June, whereas the markets had anticipated a decline to 2.4%. Alarmingly, core inflation (Core CPI), which excludes risky parts reminiscent of meals and vitality costs, remained at 2.9% for the third consecutive month, towards a forecast of two.8%.

Some financial media retailers described this as an “disagreeable shock” for the European Central Financial institution. It was anticipated that the ECB, at its assembly on 12 September, following the primary price reduce in June, would take a second step and decrease it by one other 25 foundation factors to 4.00%. Nonetheless, given the sudden rise in CPI, this process turns into more difficult. Bloomberg at the moment forecasts that inflation will lower to 2.2% in August. However, contemplating the present pattern, this may increasingly not occur. It’s fairly doable that if the determine doesn’t decline, the ECB might pause and preserve the speed unchanged. That is additional supported by the preliminary estimate of Eurozone GDP, which grew from 0.4% to 0.6% (y/y) in Q2. This means that the European financial system is able to dealing with the regulator’s pretty tight financial coverage.

● One other vital occasion of the week was the assembly of the Federal Open Market Committee (FOMC) of the US Federal Reserve on 30-31 July. It was determined to maintain the important thing price unchanged at 5.50%, the place it has been since July 2023.

Within the accompanying feedback and Jerome Powell’s speech, it was famous that inflation has decreased over the previous yr and, regardless of progress in the direction of the two.0% goal, it stays considerably elevated. It was additionally acknowledged that financial exercise continues to develop at a gradual tempo, with job development slowing and the unemployment price, although elevated, remaining low. (The ADP employment report for the US, additionally launched on 31 July, was disappointing, displaying a decline from 155K to 122K).

CME derivatives estimate the chance of three Fed price cuts by the tip of the yr at 74%. Nonetheless, contemplating the cautious method of the US central financial institution to financial regulation and its goal to keep up a stability between financial development, the labour market, and lowering inflationary stress, the Fed might restrict itself to only two and even one act of financial easing this yr. The subsequent Fed assembly will happen on 18 September and will likely be accompanied by an up to date medium-term financial forecast, which can make clear many points regarding the market.

● The greenback’s place might have been strengthened by key enterprise exercise information and US labour market figures launched on 1 and a pair of August, respectively. Nonetheless, the PMI within the manufacturing sector confirmed a decline from 51.6 factors to 49.6, falling beneath the 50.0 threshold that separates development from contraction. Moreover, in keeping with the report from the US Bureau of Labor Statistics (BLS), the variety of non-farm payrolls (NFP) within the nation elevated by solely 114K in July, which is decrease than each the June determine of 179K and the forecast of 176K. Different information within the report indicated that the unemployment price rose from 4.1% to 4.3%.

● After the publication of this information, Bloomberg reported that the probability of a 50 foundation factors price hike in September elevated to 90%. Consequently, the EUR/USD pair soared to 1.0926, then completed the working week at 1.0910.

As of the night of two August, all 100% of surveyed analysts take into account this rise within the pair to be short-term and anticipate the greenback to regain its positions quickly, with the pair heading south. In technical evaluation, 100% of pattern indicators on D1 maintain the other view, pointing north. Amongst oscillators, 75% level north, whereas the remaining 25% look south. The closest assist for the pair is positioned within the 1.0825 zone, adopted by 1.0775-1.0805, 1.0725, 1.0665-1.0680, 1.0600-1.0620, 1.0565, 1.0495-1.0515, 1.0450, and 1.0370. Resistance zones are discovered round 1.0950-1.0980, 1.1010, 1.1050-1.1065, 1.1140-1.1150, and 1.1240-1.1275.

● Within the upcoming week’s calendar, Monday, 5 August, is notable for the discharge of the US providers sector PMI. The next day, information on retail gross sales volumes within the Eurozone will likely be launched. On Thursday, 8 August, the standard statistics on the variety of preliminary jobless claims in america will likely be revealed. On the very finish of the working week, on Friday, 9 August, we are going to study the revised shopper inflation (CPI) information for Germany, the principle engine of the European financial system.

GBP/USD: BoE Doves vs. Hawks, Rating 5:4

● After the US Federal Reserve assembly, the market’s consideration shifted to the Financial institution of England (BoE) assembly on Thursday, 1 August. The rate of interest on the pound had been at a 16-year excessive of 5.25% since August 2023. Now, for the primary time in over 4 years, the British central financial institution lowered it by 25 foundation factors to five.0%. The choice was made with a slender margin – 5 members of the Financial Coverage Committee (MPC) voted for the discount, whereas 4 voted to maintain the speed unchanged. It needs to be famous that this consequence typically matched forecasts. The markets had estimated the chance of a price reduce at simply 61%, regardless of the nation’s inflation being on the goal degree of two.0% for the previous two months.

As famous, this transfer was difficult for the regulator, as a number of Committee members expressed issues about rising wages and chronic inflation within the providers sector. Former Prime Minister Rishi Sunak welcomed the BoE’s choice as “excellent news for owners” and an indication that the Labour Social gathering had “inherited a robust financial system.” Nonetheless, he additionally expressed concern that wage will increase within the public sector might jeopardise additional price cuts.

● Allow us to quote some key factors from the Financial institution of England’s assertion following the assembly. The regulator considerably revised the nation’s GDP development forecast for 2024 to +1.25% (Could forecast: 0.5%), with anticipated development of +1.0% in 2025 and +1.25% in 2026. On the similar time, the BoE anticipates “slackness as GDP slows and unemployment rises.” In line with the Financial institution of England’s forecast, the unemployment price will likely be 4.4% in This fall 2024, 4.7% in This fall 2025, and the identical in This fall 2026.

Concerning shopper inflation, the CPI is anticipated to rise to roughly 2.75% within the second half of 2024. Nonetheless, over the subsequent three years, the Client Worth Index is anticipated to fall to 1.5%, primarily based on market rates of interest. The BoE forecasts the rate of interest at 4.9% in This fall 2024, 4.1% in This fall 2025, and three.7% in This fall 2026. Additionally it is acknowledged that the “MPC will make sure that the financial institution price stays sufficiently restrictive for so long as needed till the dangers of inflation returning are mitigated.” Moreover, the assertion consists of the compulsory phrase that the scope of financial coverage will likely be decided and adjusted at every assembly.

● The market reacted to the speed reduce to five.0% with a weakening of the British foreign money and a drop within the GBP/USD pair to the extent of 1.2706. Nonetheless, the pound was subsequently supported by weak US labour market statistics, resulting in a pointy upward motion of the pair in the direction of the tip of the working week, finally closing at 1.2804.

● All 100% of specialists, when giving forecasts for the approaching days, anticipate the greenback to strengthen and the pair to say no, simply as with EUR/USD. As for the technical evaluation on D1, 50% of pattern indicators are inexperienced, whereas the opposite 50% are crimson. Amongst oscillators, solely 10% are on the inexperienced aspect, one other 10% are impartial gray, and 80% are on the crimson aspect, with 15% of them signalling oversold circumstances.

In case the pair falls, assist ranges and zones are anticipated at 1.2700-1.2750, then 1.2680, 1.2615-1.2625, 1.2540, 1.2445-1.2465, 1.2405, and 1.2300-1.2330. If the pair rises, it is going to encounter resistance at ranges 1.2855-1.2865, then 1.2925-1.2940, 1.3000-1.3040, and 1.3100-1.3140.

● No vital macroeconomic information publications concerning the state of the UK financial system are anticipated within the coming days.

USD/JPY: New Surprises from the Yen and Financial institution of Japan

● The USD/JPY pair has just lately earned titles reminiscent of “the bundle of surprises” and “probably the most intriguing pair on Foreign exchange.” Final week, with the assistance of the Financial institution of Japan (BoJ), it confirmed these titles. What everybody had been ready for lastly occurred – the Japanese central financial institution raised the important thing rate of interest at its assembly on Wednesday, 31 July. What was sudden was the magnitude of the rise: 150 foundation factors, from 0.10% to 0.25%, reaching a degree not seen since 2008. This choice was made by the Board of Administrators with a vote of seven to 2. All through July, the regulator and different representatives of Japanese monetary authorities had persistently expressed their readiness to tighten financial coverage. Nonetheless, the decisiveness of this transfer caught many market contributors unexpectedly.

“If the financial system and costs transfer consistent with our forecasts, we are going to proceed to lift rates of interest,” stated Financial institution of Japan Governor Kazuo Ueda on the post-meeting press convention. “In truth, we have not considerably modified our forecast since April. We do not take into account 0.5% to be a key barrier for price hikes.”

● On the latest assembly, the regulator additionally introduced an in depth plan to decelerate the large-scale bond purchases, taking one other step in the direction of progressively ending the decade-long cycle of financial stimulus. It determined to scale back the month-to-month bond purchases to ¥3 trillion ($19.6 billion) from the present ¥6 trillion in Q1 2026. This choice adopted a survey of market contributors on the extent to which the regulator ought to reduce the big purchases. Some referred to as for a threefold discount, whereas others instructed a one-and-a-half instances reduce. The Financial institution selected a center floor, deciding to halve the purchases.

● The choice to lift the speed was made towards the backdrop of rising inflation within the nation, growing wages, and repair costs. Another excuse, undoubtedly, was the weakening yen, which had been barely prevented from a whole collapse via quite a few foreign money interventions. Originally of July, the Japanese foreign money weakened to a 38-year low towards the US greenback. This induced critical concern in society, contributed to inflation, and negatively affected the federal government’s score. Now, officers can proudly current themselves to their fellow residents – on 2 August, the USD/JPY pair recorded a low at 146.41, a degree final seen on 12 March 2024. Thus, because of foreign money interventions and the speed choice, the yen strengthened by greater than 1,550 factors in simply 4 weeks.

● Thus, the Financial institution of Japan is tightening financial coverage (QT) towards the backdrop of easing insurance policies (QE) within the US and Europe. That is occurring amid a -1.8% (y/y) contraction within the nation’s GDP in Q2. Family spending can also be declining regardless of rising wages. If the Japanese central financial institution continues to lift charges quickly in an effort to curb inflation and assist the nationwide foreign money, it might push the financial system again into sustained deflation and result in a extra extreme GDP contraction.

● The USD/JPY pair ended the previous five-day interval at 146.52. The skilled forecast for the close to future is as follows: 65% voted for a correction and a rebound of the pair upwards, whereas the remaining 35% took a impartial place. The variety of supporters for additional strengthening of the yen was zero this time. Nonetheless, it’s price remembering the pair’s titles talked about initially of the assessment, which have typically seen it act opposite to any forecasts. All 100% of pattern indicators and oscillators on D1 level to an extra decline of the pair, though 1 / 4 of the oscillators point out it’s oversold. The closest assist degree is round 145.90-146.10, adopted by 144.30-144.70, 143.40, 141.60, 140.25-141.00, 138.40-138.75, 137.20, 135.35, 133.75, 130.65, and 129.60. The closest resistance is within the 148.30-148.90 zone, adopted by 150.85-151.00, 154.65-155.20, 157.20-157.40, 158.25, 158.75-159.00, 160.20, 160.85, 161.80-162.00, and 162.50.

● No vital macroeconomic information releases concerning the state of the Japanese financial system are scheduled for the approaching days.

CRYPTOCURRENCIES: Donald Trump – “Grasp” of the Worth

● The primary occasion of latest days within the crypto world was the annual Bitcoin-2024 convention in Nashville (USA). The spotlight of this convention was the speech by Donald Trump. The previous and presumably future President of america promised to fireside SEC Chairman Gary Gensler if elected and appoint key regulators who will likely be pleasant to the crypto trade. “Any more, the principles will likely be written by those that love your trade, not hate it,” Trump declared, receiving a standing ovation from the viewers.

The politician additionally intends to finish the warfare on digital property, flip the US into the cryptocurrency capital of the world, and embrace the federal government’s present bitcoins within the nationwide strategic reserve. Trump additionally acknowledged that “one high-quality day” bitcoin would surpass gold and silver in market capitalization. Following these guarantees and forecasts by the presidential candidate, the BTC/USD pair surged, reaching $70,000 on July 29. Nonetheless, it didn’t set a brand new all-time excessive.

● A identified supporter of bodily gold and a fierce critic of digital gold, financier Peter Schiff believes Trump ought to have stored his mouth shut. In line with Schiff, the Biden administration, out of a want to hurt its competitor, will now promote the whole lot within the authorities’s crypto stash, leaving not a single satoshi. It seems these are usually not empty predictions – as reported by Arkham Intelligence, 30,000 BTC out of the 200,000 owned by the US authorities have already began transferring. In opposition to this backdrop, the main cryptocurrency plunged, reaching an area backside of $62,210 on the primary day of August.

● Summer time 2024 has been robust for bitcoin. The crypto market confronted vital stress as a result of German authorities’s sale of fifty,000 BTC (roughly $3.0 billion) confiscated by the police. Moreover, one other 62,000 cash (about $4 billion) have been distributed to collectors of the bankrupt crypto trade Mt.Gox, which collapsed 10 years in the past. In line with the analytical company Glassnode, the overall stress for June-July amounted to 147,500 bitcoins (round $10 billion).

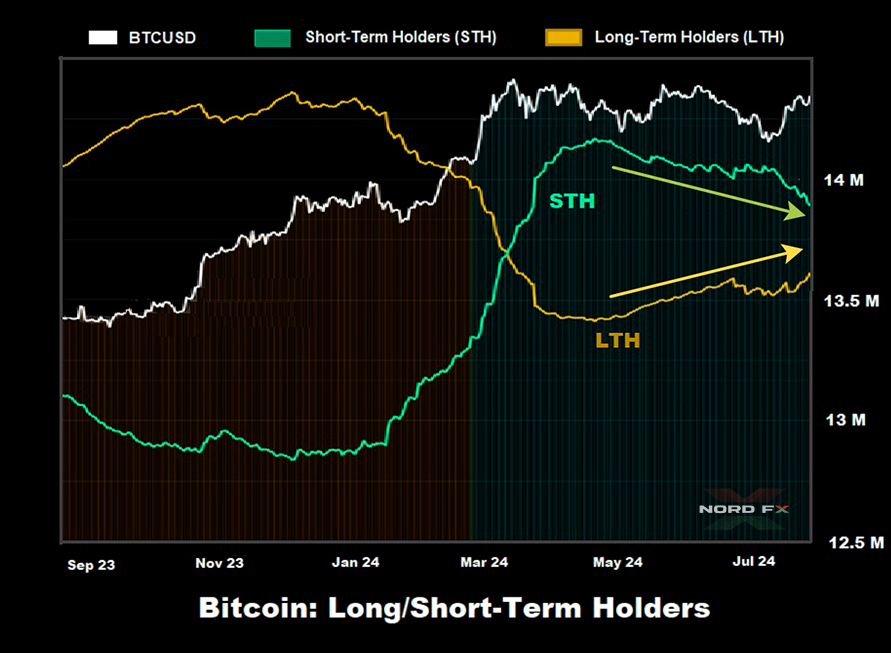

It needs to be famous that the flagship cryptocurrency has honourably withstood the bear assaults. Contributing to its resilience have been the launch of exchange-traded spot ETFs, the April halving, and the anticipation of an imminent easing of the Federal Reserve’s financial coverage. Lengthy-term holders (LTHs) additionally supported the costs, not solely refraining from promoting however persevering with so as to add to their wallets. The Glassnode information clearly reveals how latest months’ sell-offs by short-term holders (STHs) have been offset by purchases from long-term holders.

After all, if the Biden administration decides to half with all 200,000 BTC, it is going to exert new downward stress on the costs. Nonetheless, the market will possible deal with this concern, and any worth decline just isn’t anticipated to be very extreme or long-lasting.

● Economist and dealer Alex Krüger believes that bitcoin is in a super-cycle. In line with him, Wall Road and the standard monetary world have essentially modified the character and construction of the digital asset market. Consequently, draw back volatility will likely be far more restricted, and purchaser exercise will considerably enhance. “Basically, a super-cycle means the next,” defined the skilled, “it is not that we now not have bears or corrections, and we simply preserve going up. It signifies that upcoming corrections will likely be shallow and will not final perpetually.”

“The primary driving drive behind this modification,” Krüger continues, “is that Wall Road is right here, and ETFs [exchange-traded funds] are actually right here, which has essentially altered the market construction. […] The share of bitcoin possession is at the moment very low in mixture phrases and, in fact, in portfolios. The advertising pitch from Wall Road is that this determine needs to be round 2%.” Primarily based on this, the economist believes the super-cycle will proceed till this goal is reached.

Analyst Daan de Rover, higher identified on social community X as Crypto Rover, expects the BTC worth might exceed $800,000. De Rover bases his forecast on Trump’s remarks that bitcoin might surpass gold in market capitalization. If this occurs, in keeping with the analyst’s calculations, the worth of 1 BTC could be precisely $813,054.

● One other speaker on the Nashville convention was MicroStrategy founder Michael Saylor, who introduced that bitcoin’s worth will attain $13 million by 2045. In line with his calculations, with the present bitcoin worth round $65,000, its market capitalization is $1.3 trillion – simply 0.1% of worldwide wealth. With an annual return of roughly 29%, digital gold will attain a market cap of $280 trillion and characterize 7% of worldwide wealth by 2045. In line with Saylor, that is a median end result. If the bullish forecast materializes, the worth of 1 BTC will attain $49 million, totalling 22% of worldwide wealth. If the bearish forecast performs out, the figures will likely be $3 million and a pair of%, respectively.

The MicroStrategy founder is assured that each one bodily capital – from shares and bonds to automobiles and actual property – is topic to the legal guidelines of thermodynamics, together with entropy, which is the tendency of vitality to disperse over time. “Entropy dilutes the worth of bodily property. It sucks capital out of them.” In line with Saylor, the first cryptocurrency is an exception to this rule as a result of it “doesn’t exist within the bodily world” and has an “infinite lifespan.” “Bitcoin is immortal, immutable, and incorporeal,” making it “the answer to our financial dilemma,” the billionaire acknowledged.

● 2045 continues to be a good distance off. Concerning the near-term horizons, the pinnacle and founding father of MN Buying and selling, Michaël van de Poppe, believes that “Donald Trump’s speech [in Nashville] had a constructive affect, because of which bitcoin might take a look at its all-time excessive within the coming weeks.” “So long as it stays above $60,000-62,000, now we have good prospects for additional development,” the skilled acknowledged.

Some specialists, reminiscent of Dan Crypto Merchants and Tanaka, predict BTC will rise to $100,000 and ETH to $8,000-10,000. The well-known analyst Plan B forecasted bitcoin’s worth to succeed in $140,000. After the flagship cryptocurrency hit $70,000 on July 29, he wrote, “I anticipate bitcoin’s worth to double from as we speak’s worth inside 3-5 months.” Plan B defined his prediction by stating that after the April halving, “miner revenues have bottomed out, which means much less worthwhile miners have stopped. Solely probably the most worthwhile ones (with the newest gear and lowest electrical energy prices) have survived.” “The battle is over, the problem will proceed to rise. And buyers will take over pricing,” Plan B acknowledged.

● As of the night of Friday, August 2, the BTC/USD pair is buying and selling at $62,400. The overall market capitalization of the crypto market is $2.22 trillion (down from $2.42 trillion per week in the past). The Crypto Worry & Greed Index has dropped from 68 to 57 factors over the previous 7 days however stays within the Greed zone.

NordFX Analytical Group

Disclaimer: These supplies are usually not an funding suggestion or a information for engaged on monetary markets and are for informational functions solely. Buying and selling on monetary markets is dangerous and may lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #foreign exchange #forex_forecast #nordfx #cryptocurrencies #bitcoin