The School Investor is a non-client promoter of Fundrise. The School Investor receives compensation if you happen to open an account at Fundrise after clicking by means of a hyperlink on this web page.The School Investor is a non-client promoter of Fundrise. The School Investor receives compensation if you happen to open an account at Fundrise after clicking by means of a hyperlink on this web page.

Fundrise is a web based actual property investing platform that enables on a regular basis buyers to entry actual property markets and offers that they couldn’t spend money on on their very own.

By way of Fundrise, you may make investments in both professionally managed residential actual property known as eFunds or a diversified portfolio of economic actual property known as eREITs.

On this evaluate, I’ll cowl the fundamentals of investing in Fundrise, why so many buyers love the platform and funding alternatives, and why I haven’t put my cash with the corporate… but.

You may get began with Fundrise right here.

Fundrise Fundamentals

One of the simplest ways to think about Fundrise as a non-public actual property funding belief (REIT) with out all of the charges. Should you’re not acquainted with a REIT, it means that you’re investing in a basket of properties. Consider it like an ETF for actual property. Contained in the REIT, it holds a bunch of various investments in properties. As an proprietor of the REIT, you get handed alongside your small share of the revenue generated by these properties.

Though Fundrise will not be publicly traded, they will let you liquidate your funding as much as 4 occasions per 12 months with a 30 day discover. That is totally different than a publicly traded REIT, which lets you instantly promote. Nevertheless, for a non-public REIT, this is likely one of the finest we have seen.

So, how will you spend money on Fundrise? Proper now they provide 3 ways:

Starter Portfolio

With the starter portfolio, you may spend money on eREITs for a beginning funding of simply $10. You’ll achieve entry to over 20 totally different properties in main cities all through the nation.

You’ll pay a 0.85% fund administration payment to Fundrise and a 0.15% account administration payment for a complete of 1% in mixed annual charges.

Should you select to speculate, you’ll be in a 50/50 mix of the revenue eREIT and the progress eREIT. It’s best to anticipate to carry onto each investments for 5 or extra years, however you should have the possibility to liquidate as soon as per quarter.

Targets-Based mostly Portfolios

Should you make investments no less than $1,000, you may improve to a Targets-Based mostly Portfolio. Fundrise’s objectives based-portfolios embrace as much as 7 eREITs, and dozens of properties. You may choose between a balanced portfolio, a passive revenue portfolio or an aggressive progress portfolio. Your mixture of eREITs will rely in your objectives.

You could find extra about every eREIT, the properties they personal, leverage and achieve views on future progress and revenue proper from the Fundrise web site.

As with the starter portfolio you’ll pay a 0.85% annual administration payment and a 0.15% portfolio administration payment.

Direct Investments

Should you select to spend money on an eFund slightly than an eReit, you’re really investing in an actual property mission. You can not anticipate a liquidity occasion earlier than the mission completes. Proper now, you may spend money on a Washington DC fund or a Los Angeles Fund.

To spend money on these funds, you’ll pay a .85% annual payment, and a .15% portfolio administration payment (which is waived in choose circumstances, however not many).

One distinctive characteristic of turning into an eFund investor is the “first look” program. Should you stay within the space, you should purchase a house earlier than it goes onto the market. You should utilize your funding within the eFund as part of your down fee.

I don’t wish to oversell the primary look program, you’ll have to purchase your own home on the market charge, however I feel this can be a good program to think about. Housing markets in main cities are on fireplace proper now. Should you ever wish to purchase, it is smart to “peg your down fee fund” to a comparable funding in your metropolis of selection.

Fundrise Professional

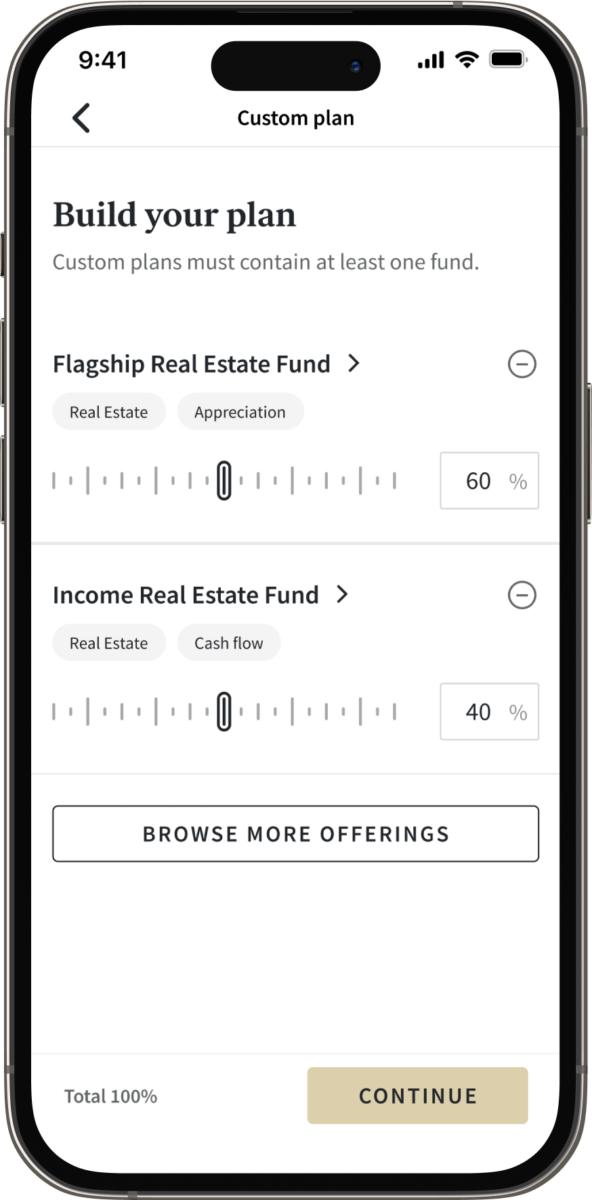

Their newest product is Fundrise Professional, which is an non-compulsory subscription and is made for the energetic investor who needs extra management over allocations and technique. Present members with an account steadiness of $5,000 or extra get grandfathered into Fundrise Professional without spending a dime. These buyers who’ve beforehand positioned a direct funding additionally get grandfathered in without spending a dime.

Fundrise Professional members can:

- Focus investments into particular funds

- Construct a customized funding plan together with your preferences, together with setting a goal allocation throughout numerous investments

- Dive deeper in to the info with Fundrise’s distinctive instruments to make higher funding selections

Value for Fundrise Professional:

- $10 a month or $99 a 12 months paid upfront

You may strive it out without spending a dime for 30 days.

Self Directed IRA

Not too long ago, Fundrise launched a Self Directed IRA program for individuals seeking to shelter their revenue for the IRS. You’ll pay a $75 annual payment for the service, however you may spend money on any of the portfolios provided by Fundrise.

See if it makes extra sense to open your personal self directed IRA right here: Greatest Self-Directed IRA Suppliers.

Why Folks Love Fundrise

I’ve spoken to quite a few individuals who have invested in Fundrise, and so they all rave in regards to the expertise. These are the three options that the majority actual buyers love.

Transparency – Fundrise makes it simple to know what you’re investing in. It helps which you can take a look at an image of the property, discover the place it’s on a map. It’s also possible to dig into the financials of each single property. Have a query? Customer support will reply to emails and cellphone calls.

Lack of liquidity – Logically, most individuals need cash simply accessible, however having cash “locked” into an funding is an effective way to maintain your cash rising. Fundrise has seen phenomenal returns, and a part of their success comes from “forcing” their buyers to remain the course. Nevertheless, notice, that in robust occasions (like a pandemic), Fundrise could stop you from withdrawing your funds.

Aggressive Benefit – Fundrise is an organization that prides itself on its aggressive benefit. They make investments primarily in tasks which have between a $5 million and $100 million market cap. These are too giant for many non-public buyers, however they get neglected by banks who can’t precisely charge the danger profile of the developments. In some instances, Fundrise has a bonus as a result of banks face such excessive prices resulting from burdensome laws.

Nevertheless, if you happen to browse the Fundrise Reddit, you will see that there are considerations or confusion from numerous buyers. I extremely advocate that you just educate your self on the product earlier than diving in.

Fundrise Efficiency

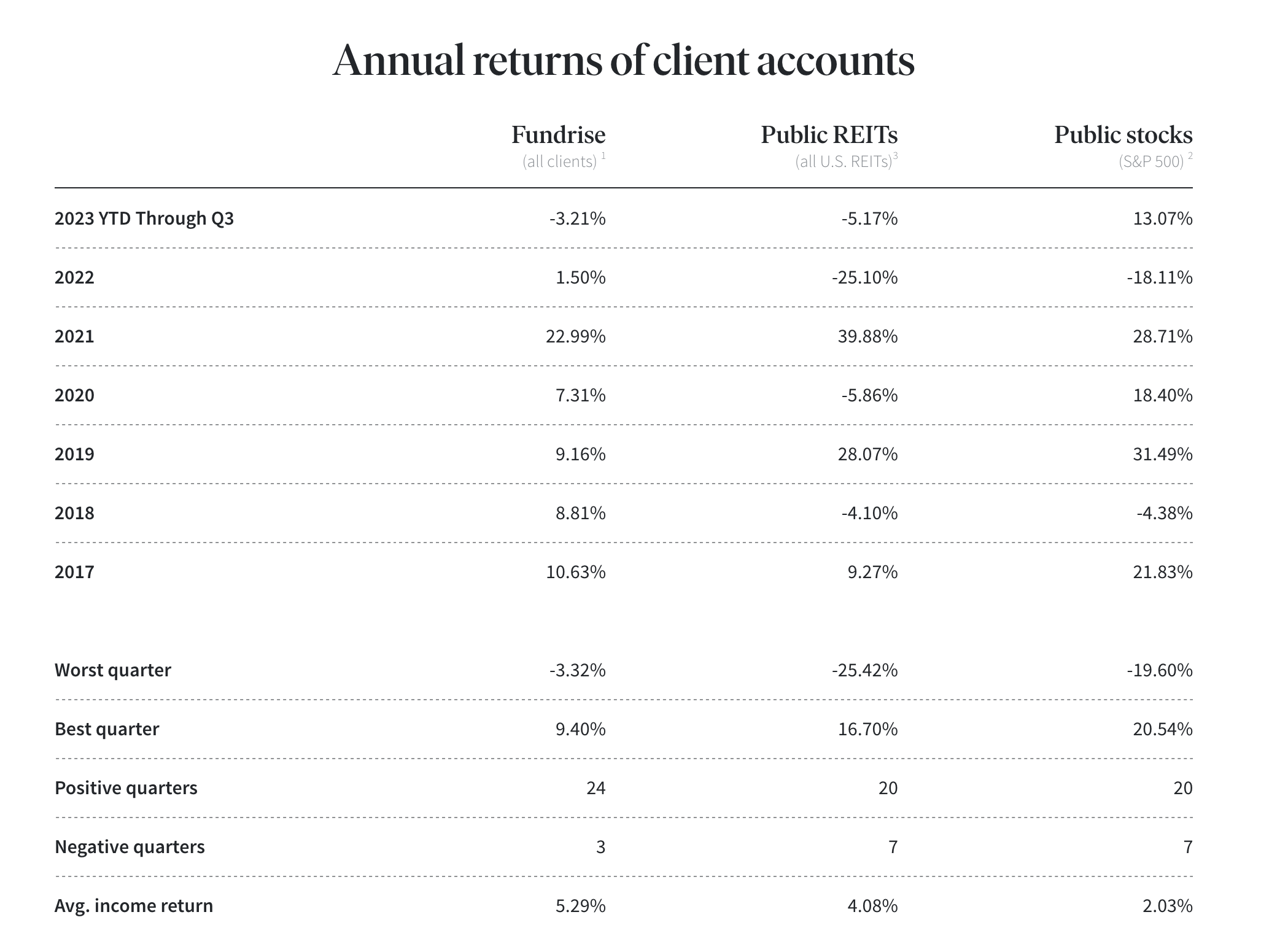

Alongside the identical traces of transparency that we point out above, Fundrise does publish it is historic efficiency and returns.

It is vital to understand that Fundrise (and actual property as a complete) is a non-correlated asset to shares. That is why you see issues like 2023 – the place the inventory market is up double-digits, however actual property (and Fundrise) have considerably underperformed. Nevertheless, in different years, the alternative is true.

Fundrise Annual Returns. Supply: Fundrise

How Does Fundrise Examine?

Fundrise is likely one of the hottest actual property funding platforms on-line, however it’s actually not the one one. The truth is, over the previous few years, a fierce competitors has emerged within the house.

Try these essential Fundrise opponents and see how Fundrise compares:

How Do Taxes Work?

One other massive distinction with Fundrise versus merely proudly owning shares within the inventory market is the way it’s taxed.

Relying on which particular funding in Fundrise you personal, you will obtain a special tax doc and you will be taxed in a different way.

It’s best to obtain a Kind 1099-DIV for every eREIT or interval fund in your portfolio that generated combination distributions of no less than $10 or extra within the given tax 12 months.

Should you personal shares of the Fundrise eFund, it’s best to obtain a Schedule Ok-1.

Should you liquidated any eREIT/interval fund shares within the prior 12 months, it’s best to anticipate to obtain a Kind 1099-B for every fund.

Nevertheless, you additionally have to be looking out for any corrections! REITs are infamous for issuing corrected 1099s and delaying the tax submitting of their clients.

Should you personal a REIT, likelihood is you like the truth that they pay nice dividends, however hate the truth that at tax time, it’s a must to look forward to a corrected 1099 to come back in March. The explanation for that is that many REITs, in addition to some mutual funds, widely-held mortgage trusts, and actual property mortgage conduits, reallocate their dividends or reclassify their long run capital achieve distributions. As a result of they need to go by means of a lot of their revenue, the federal government offers them till the top of their fiscal 12 months, which for many of those firms happens in February.

Associated: What To Do If You are Ready On Late Tax Types

Perceive The Dangers

I discovered about Fundrise greater than six years in the past. On the time, they nonetheless allowed people to spend money on explicit properties. On the time, investing on-line in properties I’ve by no means seen made me nervous. The introduction of the eREIT (and the additional benefit of diversification) eased my fears, however there may be nonetheless a threat.

My main concern is the extent of leverage that Fundrise considers sustainable. Whereas most would think about a 78% leverage ratio conservative (and it’s), lots of the properties are growth tasks. If demand for housing in any main metropolis falls, the leverage may doom the profitability of the investments.

A lot of the properties bought usually are not performed with a purchase and maintain ceaselessly mentality. Somewhat, the eREITs need common liquidity occasions to allow progress.

In my private actual property investments, I solely tackle debt once I can profitability maintain a rental property for the lengthy haul. I’ve been trapped underwater as soon as, and it’s not a very good time. Actually, the 100% passive nature of Fundrise ought to assuage my considerations, however I can’t shake them.

Why Ought to You Belief Us?

I’ve been writing about and reviewing funding companies and overlaying actual property investments for 10 years. I’ve personally owned single household, multi-family, actual property syndications, non-public partnerships, and extra. I am effectively versed in each the funding side and tax side of those services and products.

Moreover, we’ve our compliance group that often checks and updates the information on our critiques.

Who Is This For And Is It Value It?

Fundrise is a good platform for anybody that’s seeking to get actual property publicity of their total portfolio with a low minimal. It’s a non-public REIT, so there are dangers, and it’s best to perceive that the funding return that has traditionally occurred could not occur going ahead.

Nevertheless, the low entry value of simply $10 does restrict draw back threat. I’d advocate Fundrise as an amazing starter platform for getting began in actual property. As all the time, earlier than committing giant quantities of capital do your personal due diligence first.

You may additionally wish to take a look at these Fundrise alternate options.

What do you consider Fundrise? Have you ever ever tried it?

Frequent Questions

Listed here are the most typical questions we get about Fundrise.

Is Fundrise a very good funding?

It may be. Fundrise is a specialised actual property funding, and for some people, it may very well be the kind of funding you are on the lookout for in your portfolio. It invests in a basket of actual property, which does have greater dangers than different varieties of investments. However the rewards could be higher as effectively.

How does Fundrise work?

Fundrise is what’s know as a REIT, a Actual Property Funding Belief. It mainly owns a basket of actual property (multi-family housing, business buildings, and many others.), and also you get a small possession slice of it. In consequence, you get rewarded together with your share of any rents obtained, appreciation on sale, and many others.

Is your cash trapped at Fundrise?

No, whereas Fundrise is focused at long-term buyers (5+ years), its Flagship Fund provides penalty-free redemptions each quarter.

Does Fundrise pay dividends?

Traditionally Fundrise has paid dividends quarterly. However like all investments, dividends are topic to efficiency of the underlying property.

Is Fundrise a rip-off?

No! Fundrise will not be a rip-off. Fundrise is an SEC regulated funding that focuses on actual property.

DISCLAIMER

The data contained herein neither constitutes a proposal for nor a solicitation of curiosity in any securities providing; nonetheless, if a sign of curiosity is offered, it could be withdrawn or revoked, with out obligation or dedication of any sort previous to being accepted following the qualification or effectiveness of the relevant providing doc, and any provide, solicitation or sale of any securities shall be made solely via an providing round, non-public placement memorandum, or prospectus. No cash or different consideration is hereby being solicited, and won’t be accepted with out such potential investor having been offered the relevant providing doc. Becoming a member of the Fundrise Platform neither constitutes a sign of curiosity in any providing nor includes any obligation or dedication of any sort.

The publicly filed providing circulars of the issuers sponsored by Rise Corporations Corp., not all of which can be at the moment certified by the Securities and Alternate Fee, could also be discovered at www.fundrise.com/oc.