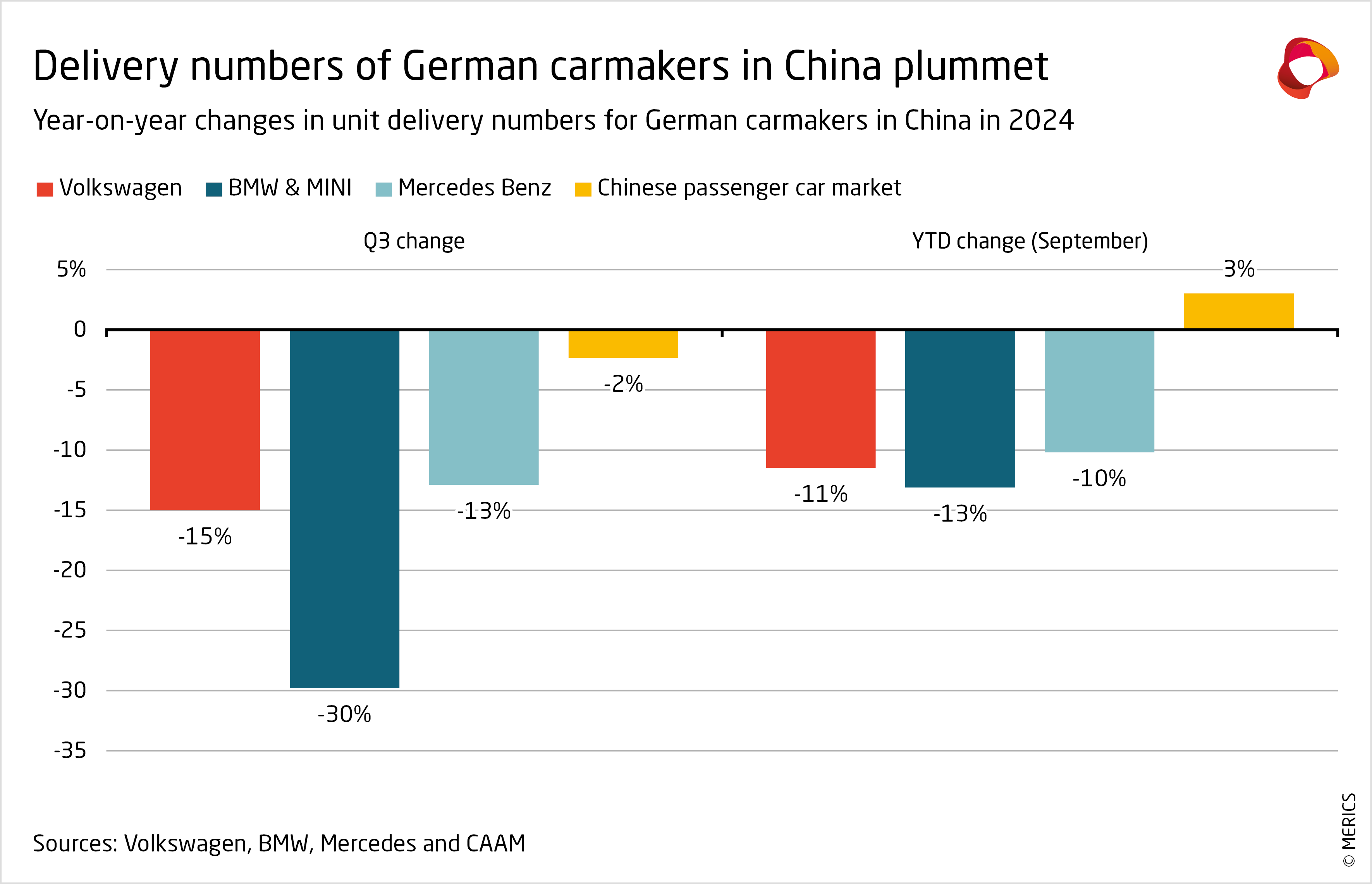

The tide seems to have turned in opposition to German carmakers in China. Volkswagen offered one million fewer automobiles there in 2023 than it did in 2018, representing a 25 p.c decline in simply 5 years. The posh automobile manufacturers Mercedes-Benz and BMW fared higher for just a little longer, seeing all-time highs in 2022. However then gross sales declined in 2023 and dropped sharply in 2024, exhibiting that such sturdy outcomes weren’t sustainable. Within the first 9 months of the 12 months, deliveries by all three corporations fell by 12 p.c on common, whereas China’s automobile market grew by round 3 p.c.

Nonetheless, German automobile corporations have doubled down on the world’s largest automobile market, nearly the scale of the US and Europe mixed, by asserting hefty new investments in 2024. Volkswagen and BMW are every pouring a further 2.5 billion euros into their Hefei innovation hub and Shenyang manufacturing base respectively, whereas Mercedes-Benz is investing 1.8 billion euros with its Chinese language three way partnership (JV) associate BAIC. These commitments come on prime of a document 11 billion euros in new investments in China that the trio introduced in 2022. The partnerships constructed with Chinese language suppliers and native analysis and growth (R&D) operations are thought-about key drivers of innovation.

Undoubtedly, China will stay a part of the long-term success of German automakers. However the challenges they face within the nation won’t go away. Their sluggish begin within the electrical automobile (EV) race and Beijing’s assist for home automobile makers signifies that the premium positioned on “German engineering” is now not a given. The trio underestimated China’s speedy shift to EVs and digitalization in addition to Chinese language rivals’ speedy enhancements in high quality and innovation. These errors are actually proving pricey.

Towards this backdrop, German carmakers ought to recalibrate their targets for the Chinese language market. Counting on future development in China – particularly whereas contemplating manufacturing facility closures in Europe, as VW is doing – may lead them down a slippery slope, given the dismal China gross sales all three corporations have introduced thus far for 2024. Germany’s automobile giants ought to give attention to stabilizing somewhat than increasing their operations in China, releasing up funding to strengthen their aggressive place in different markets with higher development prospects.

International Market Share Is Shrinking as China’s Automotive Market Modifications Quickly

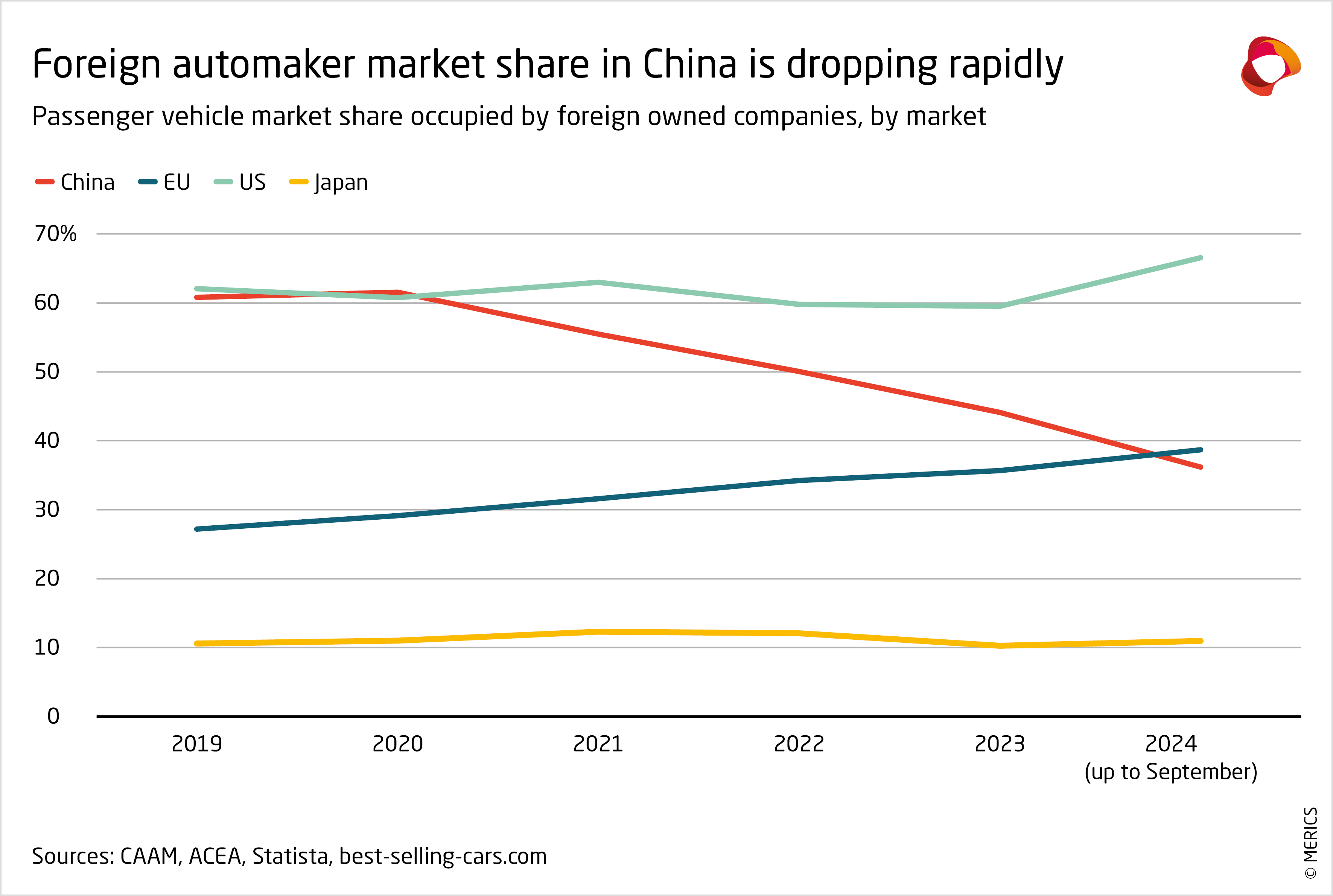

China’s passenger automobile market is altering quickly to the drawback of overseas gamers. It’s shifting away from the U.S. mannequin – the place overseas corporations make barely greater than 60 p.c of all automobiles offered – to one thing extra just like the Japanese mannequin, the place home producers dominate with a market share of round 90 p.c. Given the present trajectory of their gross sales in China, the market share of overseas automobile makers seems set to drop to beneath 20 p.c within the subsequent three or 4 years – a decline of two-thirds in below a decade.

The principle purpose for that is the speedy transition of Chinese language customers to electrical and hybrid automobiles, recognized in China as new vitality autos (NEVs). Their share of China’s automobile market shot up from simply 5.4 p.c in 2020 to 32 p.c in 2023 and hit 39 p.c of automobiles offered from January to September 2024 – and home carmakers are assembly most of this demand. SAIC Volkswagen is the one (partly) German firm among the many prime electrical automobile producers in China, rating tenth with a mere 2.3 p.c of the market from January to September 2024.. Except for Tesla, all the largest corporations are both wholly or partly Chinese language owned.

China’s speedy shift to NEVs and the dominance of Chinese language producers clarify why German carmakers now face an uphill battle on this market. The market share of overseas corporations in China has fallen from 62 p.c in 2020 to 36 p.c within the interval of January to September in 2024. German carmakers have seen their market share decline from 24 p.c to fifteen p.c. It’s exhausting to see how even a number of billion euros in further funding by German carmakers could make a significant dent on this development. Staying on prime as essentially the most profitable overseas carmakers in China seems like an ambition with doubtful advantages.

Chasing the Mirage of the Chinese language Market Might Damage German Carmakers

Within the face of rising competitors from Chinese language gamers, German automobile executives are appearing as if nothing has modified. They’re ramping up analysis and growth and manufacturing capability within the nation, as if the reply to their woes in China is solely “extra China.” Hoping to profit from China’s world management in NEVs and associated applied sciences resembling software program, all three main German carmakers are working with Chinese language companions – Volkswagen with Xpeng, BMW with Baidu, and Mercedes-Benz with Geely.

Behind these strikes is the hope that German carmakers will finally discover a strategy to revive their previous success and the hefty income they made in China. For a few years, heavy funding and collaboration with Chinese language companions labored to determine a premium place for German automobiles within the Chinese language market. However this formulation is very unlikely to proceed delivering. The German trio will discover it troublesome to make up misplaced floor as Chinese language corporations are one step forward in NEVs and luxuriate in a house market benefit. There’s a danger that German carmakers stay overly optimistic about their probabilities in China.

German carmakers shouldn’t pull out of China, however they need to recalibrate their expectations to make sure long-term success. Overly formidable targets in China might result in a dismal return on funding and undermine their world efficiency. As a substitute, corporations that fail to fulfill their ambitions may use China as an export base – though rising commerce obstacles in Europe, the US, and elsewhere will increase the price of this technique.

Alternatively, they may use their sources extra effectively to strengthen their place in third markets as Chinese language rivals are going world. Both means, German carmakers want to search out alternate options to the Chinese language market. From 2022 to 2023, Volkswagen’s unit deliveries rose by 20 p.c in Europe and by greater than 15 p.c in each North America and South America, whereas these in China crept up lower than 3 p.c. The most important overseas automobile maker in China is already demonstrating that sturdy development in different markets is feasible.