Howdy guys!

Currently, buying and selling on the foreign exchange market has turn out to be fairly complicated particularly on this time of uncertainty, with the struggle in Ukraine ranging and the struggle within the center east, the paradigm of worldwide buying and selling has modified dramatically with unprecedent occasions since final 2 a long time. The dollarization of countries and the formation of BRICS cost system has made US foreign money another, and this has affected world buying and selling normally. How can Globus.AI be a recreation changer within the foreign exchange market?

For many years, the US greenback has loved unparalleled dominance because the world’s main reserve foreign money. In accordance with the US Federal Reserve, between 1999 and 2019, the greenback was used in 96 p.c of worldwide commerce invoicing within the Americas, 74 p.c within the Asia-Pacific area and 79 p.c in the remainder of the world.

The BRICS nations have a slew of causes for eager to arrange a brand new foreign money. Current world monetary challenges and aggressive US international insurance policies have prompted the BRICS international locations to discover the chance. They need to higher serve their very own financial pursuits whereas decreasing world dependence on the US greenback and the euro.

The potential influence of a brand new BRICS foreign money on the US greenback stays unsure, with specialists debating its potential to problem the greenback’s dominance. Nonetheless, if a brand new BRICS foreign money was to stabilize towards the greenback, it may weaken the facility of US sanctions, resulting in an additional decline within the greenback’s worth. It may additionally trigger an financial disaster affecting American households. Except for that, this new foreign money may speed up the development towards de-dollarization.

The potential BRICS foreign money would enable these nations to claim their financial independence whereas competing with the prevailing worldwide monetary system. The present system is dominated by the US greenback, which accounts for about 90 p.c of all foreign money buying and selling. Till lately, almost one hundred pc of oil buying and selling was carried out in US {dollars}; nevertheless, in 2023 one-fifth of oil trades have been reportedly made utilizing non-US greenback currencies.

Central to this ongoing scenario is the US commerce struggle with China, in addition to US sanctions on China and Russia. Ought to the BRICS nations set up a brand new reserve foreign money, it could probably considerably influence the US greenback, probably resulting in a decline in demand, or what’s often known as de-dollarization. In flip, this may have implications for the US and world economies.

How would a BRICS foreign money influence the economic system?

A possible shift towards a brand new BRICS foreign money may have vital implications for the North American economic system and buyers working inside it. A few of the most affected sectors and industries embrace:

· Oil and fuel

· Banking and finance

· Commodities

· Worldwide commerce

· Know-how

· Tourism and journey

· The Overseas trade market

A brand new BRICS foreign money would additionally introduce new buying and selling pairs, alter foreign money correlations and have an effect on market volatility, requiring buyers to adapt their methods accordingly.

the potential of difficult the greenback’s dominance as a reserve foreign money stays. And as international locations proceed to diversify their reserve holdings, the US greenback may face growing competitors from rising currencies, probably altering the stability of energy in world markets.

Excepts from the: https://investingnews.com/brics-currency

Is Battle in Europe is destroying European economic system?

Earlier than the struggle, the European economic system was experiencing a heady restoration. The one-two punch of upper vitality costs and commerce disruptions, nevertheless, may destabilise EU companies already weakened by the pandemic, in response to a brand new report revealed by the European Funding Financial institution.

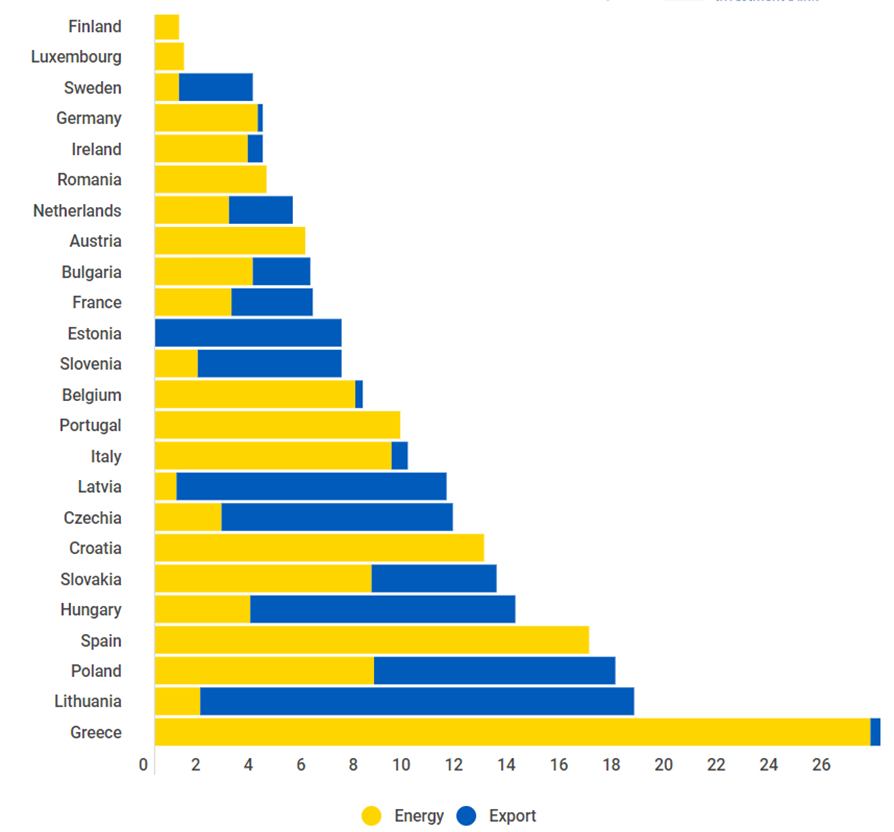

Simulations by the European Funding Financial institution discover that the share of EU companies shedding in cash may rise, notably amongst companies hit by decrease exports to Ukraine, Russia and Belarus and people uncovered to greater vitality costs. On the identical time, rising inflation may push extra Europeans below the poverty line.

the struggle in Ukraine dangers upending Europe’s financial restoration. The Russian invasion induced a large humanitarian disaster – nearly seven million Ukrainians have fled the nation. The battle and ensuing sanctions have disrupted exports from the area for commodities like metals, meals, oil and fuel, pushing up inflation to ranges not seen in a long time.

Actual financial development within the European Union is now anticipated to fall properly beneath 3% in 2022, down from the 4% estimated by the European Fee earlier than the struggle. Additional commerce disruptions or elevated financial sanctions may plunge the European economic system into recession.

The slowdown in development is especially pronounced in international locations in shut proximity to Ukraine, like Poland and Hungary – international locations which are additionally internet hosting massive numbers of Ukrainian refugees. Italy and Germany, that are closely depending on Russian oil and fuel, are feeling the stress as properly.

Notes: Power refers back to the variety of losses attributable to greater vitality costs, and exports refers back to the losses ensuing from the suspension of exports to Ukraine, Russia and Belarus.

the share of EU companies shedding cash rises from the conventional common of 8% to fifteen% within the yr after the beginning of the invasion. The share of companies that danger defaulting on their debt additionally surges from 10% to 17% in the identical interval. Corporations in sectors like transport, chemical substances and prescription drugs, and meals and agriculture endure probably the most. Corporations situated in international locations near Ukraine, reminiscent of Poland, Latvia and Lithuania, are additionally exhausting hit, as are companies in Greece, Croatia and Spain.

Banks below stress

The battle has compelled some European banks, like Raiffeisen, to think about pulling out of Russia. Total, nevertheless, European banks’ direct publicity to Russia and Ukraine is comparatively low. On the finish of 2021, European banks’ publicity to Russia (loans, advances and debt securities) was €76 billion, whereas publicity to Ukraine was €11 billion, in response to the European Banking Authority.

Austrian, French and Italian banks have been probably the most energetic in Russia, whereas French, Austrian and Hungarian banks have been closely concerned in Ukraine. But solely Austrian and Hungarian banks reported that the 2 international locations represented greater than 2% of their whole lending. Normally, banks have shored up their capital reserves sufficiently in recent times to have the ability to take in any losses within the area.

Proper now, the most important supply of danger is banks’ publicity to the sectors – chemical substances, transport, and meals and agriculture – most affected by commerce disruptions. On common, nevertheless, solely 30% of EU financial institution loans went to sectors in danger.

Excerpts from the European Funding Financial institution / https://www.eib.org/en/tales/ukraine-trade-inflation

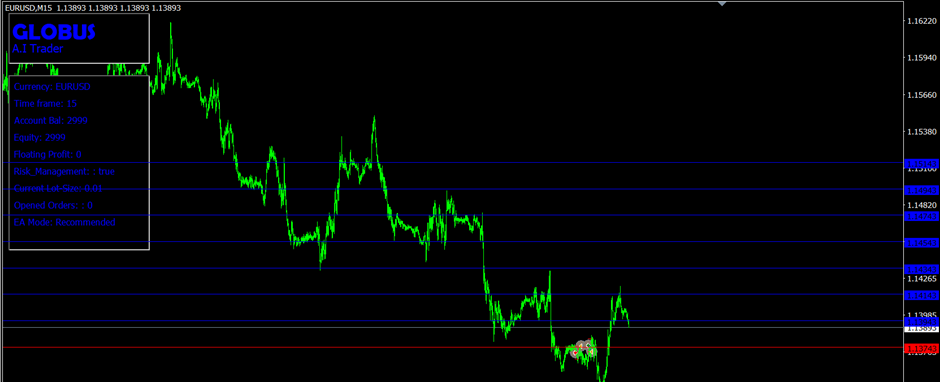

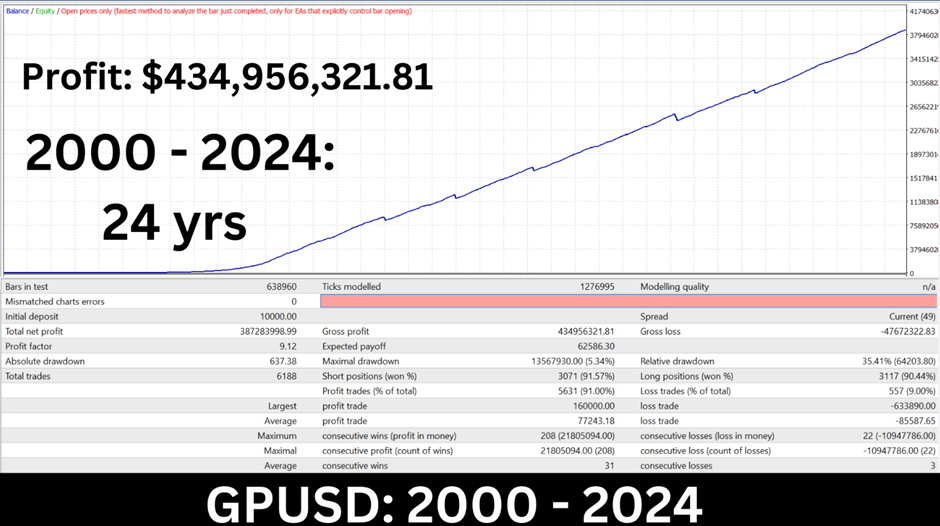

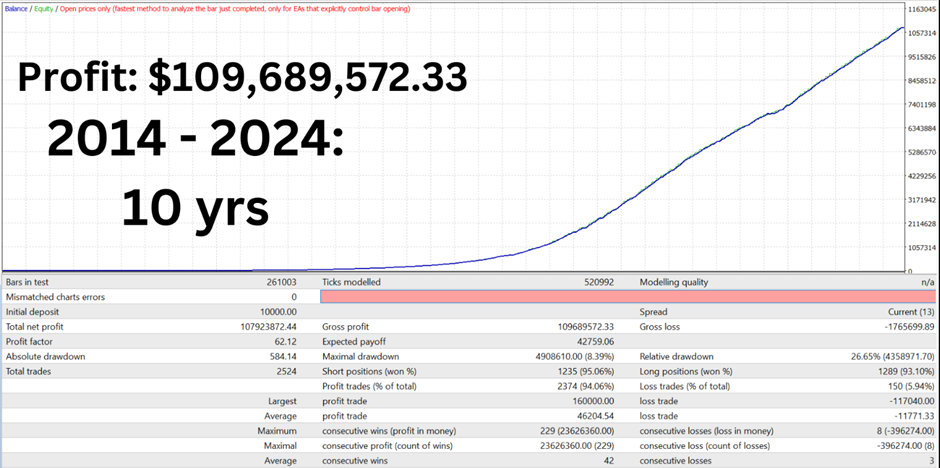

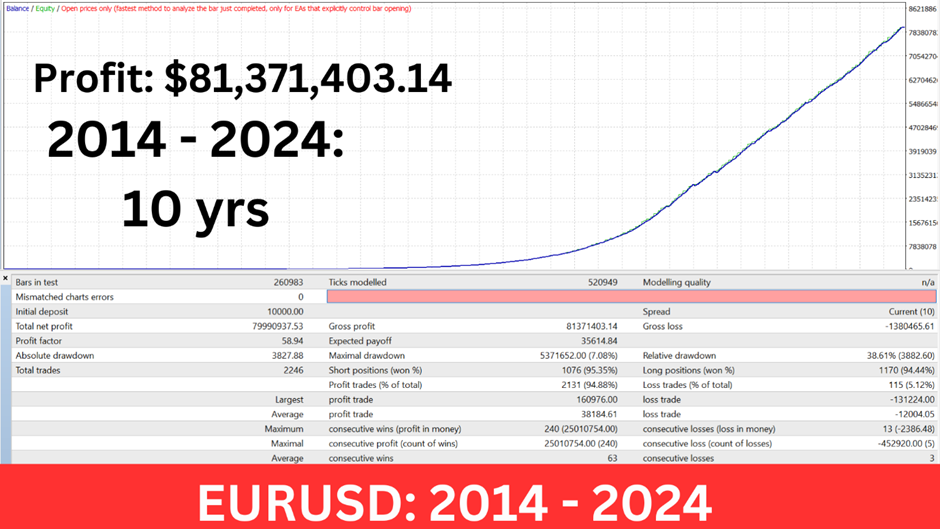

The Globus EA is the designed with the advance AI algorithms that analyse market uncertainties. Globus is developed with machine studying techniques that may adapt to information replace and dynamically trip the market as adjustments stays fixed. Commerce indicators are up to date in keeping with the worldwide financial occasions, information and turns.

The Globus.AI limits fairness drawdown to a minimal stage by utilizing a stoploss, a grid system and studying prevalent situations utilizing horizontal development strains to estimate the availability and demand stage and evaluating worth motion evaluation from D1 timeframe and H1 timeframe.

In sync with predictive AI a machine studying algorithm is used to pick excessive greater lows, greater highs, decrease excessive and decrease low of the market inside a interval and test for related repetitions, it goes additional to check the chart at actual time by utilizing worth motion and horizontal strains.

It additionally adapts to new updates and financial occasions utilizing particular AI rational logic reasoning system. Factually, the present worth is set by earlier costs, it is a pretty primary method of technical evaluation and a extremely efficient buying and selling type that enables for the identification of a particular entry worth in addition to a provide or demand zone.

It additionally considers the market volatility utilizing using the common true vary indicator, the EA adjusts it technique when the market is extremely unstable or when much less. Oversold and over purchased situations are confirmed utilizing the transferring common Convergence and Divergence indicator to adjust to knowledge compiled by the chart development strains. The mix of those algorithmic devices creates a novel entry and exit level that almost all favour buying and selling accounts.

In distinction to different EA that require enormous capital measurement, the Euro Bullion EA has been developed with one of the best machine studying know-how to accommodate adjustments in market occasions and new replace.

The Advisable pair: GBPUSD, EURUSD

Time Body: 15mins

Begin Commerce: $1,000.

Enter Setting

sinput string Globus_Settings;

Fiat Foreign money = GBPUSD or EURUSD;

MagicNumber = 5005 (should be distinctive for every chart);

EA_Mode_Settings = Advisable;

Risk_Managment = true;

RiskLevel = Low_Risk;

Signal_Accuracy = HIGH;

Use_Stoploss = true;

LotSize_Multiple = Computerized;

Fixed_Lot_Multiple = 1;

Danger and warning:

Foreign currency trading is extremely speculative and dangerous. It is just appropriate for these individuals who perceive, and are prepared to tackle, the monetary and different dangers concerned.