By Summer season Zhen

HONG KONG (Reuters) – World hedge funds made an enormous retreat from their bearish bets on the Japanese yen throughout the forex’s robust rise towards the U.S. greenback during the last two weeks, a UBS notice to shoppers seen by Reuters on Tuesday stated.

Hedge funds lined practically all of the brief yen positions constructed up during the last 12 months, because the yen rallied by roughly 5% towards the U.S. greenback since July 10, UBS stated in a notice on Monday, citing its inner foreign exchange circulate knowledge with out disclosing the numbers.

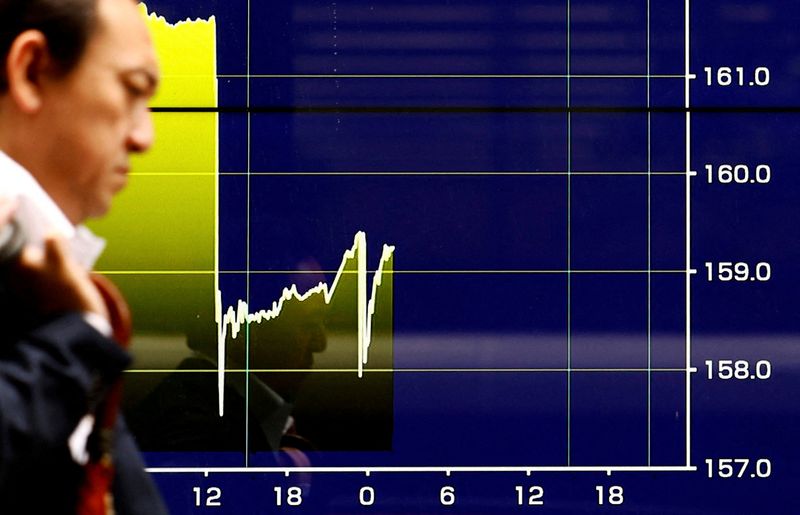

A virtually $40 billion suspected intervention by Japanese authorities has pushed the yen to roughly 153 per greenback from round 162 per greenback in mid-July.

“I believe the Financial institution of Japan’s aim is to persuade buyers to not wager towards them and to push the market to deleverage the carry commerce,” Zhiwei Zhang, president at hedge fund Pinpoint Asset Administration, stated.

The reversal within the yen’s development additionally disrupted standard carry trades whereby an investor borrows in a forex with low rates of interest and invests in a higher-yielding forex.

The yen was the preferred funding forex as Japan has the bottom rate of interest among the many G10 currencies. Analysts stated buyers should search alternate options now the yen has turn out to be too risky.

Japan’s central financial institution began a two-day coverage assembly that may conclude on Wednesday. Market merchants have proven warning this week as they await upcoming rate of interest choices and particulars of its plan to steadily retreat from its enormous purchases of presidency bonds.

Not everyone seems to be satisfied by the BOJ’s intervention, nonetheless, and views on the yen’s future route are rising divergent.

In distinction to the hedge funds’ pull-back, the actual cash group, or conventional long-only asset managers, used “the current yen rally as a possibility to maintain promoting the forex,” UBS stated in the identical notice.