Yves right here. Some issues can’t be stated usually sufficient. On this case, the subject is what brought about the inflation that’s nonetheless stinging many Individuals. It’s turn out to be a favourite hobbyhorse that the admittedly hefty Biden stimulus is the perp. However a extra rigorously look present that that concept is, to cite the wags, “Neat, believable, and improper.”

The preliminary driver was Covid provide chain shocks. That’s why there have been very large will increase in some gadgets like lumber, meat and eggs (there attributable to hen culls) and never others (gasoline). However then, as Tom Ferguson and Servaas Storm clarify, the additional impetus was elite spending. Bear in mind the a lot decried “greedflation” the place some corporations put by way of worth will increase just because they may, versus attributable to rises in labor and supplies prices? These extra income went into the pocket of capitalists.

One other issue not addressed right here: Even when statisticians keep that inflation has moderated (even earlier than attending to the truth that the gadgets they measure might not correspond nicely sufficient with the what center and decrease earnings Individuals purchase frequently), their time horizon is Wall Road’s and the Fed’s: months, 1 / 4, at most a yr. The inflation will increase have been so giant in classes that many shoppers discover important that the truth that the speed of improve has dropped lots nonetheless leaves them at a sturdy new excessive stage in contrast to some years again.

By Thomas Ferguson, Analysis Director of the Institute for New Financial Considering, Professor Emeritus, College of Massachusetts, Boston; and Servaas Storm, Senior Lecturer of Economics, Delft College of Expertise. Initially printed at the Institute for New Financial Considering web site

It should be the Wall Road Journal’s DNA. Nothing else simply explains why the usually cautious Nick Timiraos would focus a lot of his account of “How the Democrats Blew It on Inflation” on the hoary argument that the “Biden Stimulus” by some means triggered worldwide inflation again in 2021.

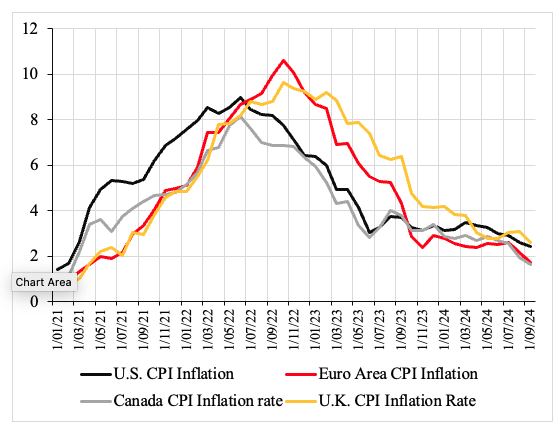

The argument by no means made a lot sense, since, as quite a few research have documented, supply-side elements drove the largest a part of the inflation and it hit nearly all people, no matter their stimulus insurance policies. That is proven in Determine 1, which presents the buyer worth inflation charges throughout 2021-2024 within the U.S., the Euro Space, Nice Britain, and Canada. It may be seen that each one nations went by way of a really comparable inflation expertise, with client worth inflation within the Eurozone and the U.Okay. peaking at even larger ranges than within the U.S.

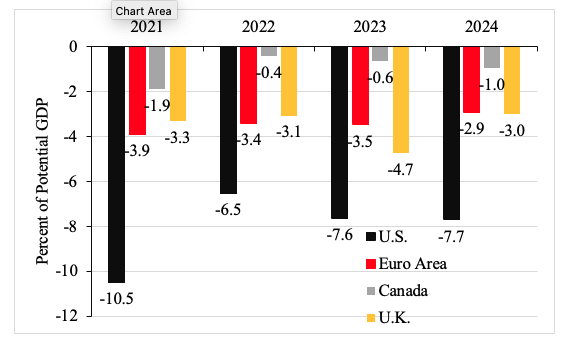

Determine 2 presents the structural authorities finances deficits (as a share of potential GDP) of those 4 nations throughout 2021-2024. It’s evident that the U.S. authorities ran a lot bigger structural finances deficits than governments within the Euro Space, the U.Okay., and particularly Canada. Regardless of these substantial variations within the fiscal coverage stance, the buyer worth inflation expertise has been remarkably comparable throughout the nations (Determine 1). This simply reveals that the inflation was largely pushed by supply-side elements, as quite a few research together with the research by Bernanke and Blanchard (2024) for 11 economies have proven.

Determine 1: Shopper Worth Inflation within the U.S., the Euro Space, the U.Okay. and Canada (Annualized month-to-month inflation charges; January 2021-September 2024)

Supply: FRED database.

Determine 2: Structural Authorities Price range Deficits within the U.S., the Euro Space, the U.Okay. and Canada (as a share of potential GDP)

Supply: IMF World Financial Outlook database (October 2024).

We’re removed from the one individuals making these arguments, however we discovered the Journal’s blithe resuscitation of this virtually prehistoric line notably jarring. Again in early 2023, we traced very rigorously how federal spending flowed into the financial system, utilizing a wide range of knowledge. It shortly grew to become apparent that many of the stimulus cash was lengthy out the door when many of the provide shock inflation hit. As we summarized: “the important thing knowledge sequence—stimulus spending and inflation—transfer dramatically out of part. Whereas the primary ebbs shortly, the second persistently surges.”

Apart from local weather change, conflict, and the opposite shocks that everyone however the Journal now appears to acknowledge, we recognized one other reason for inflation that the Biden administration by no means tried to cope with: the huge improve in spending coming from the wealthy. As we now have documented in two subsequent research, the firehose of prosperous consumption continues to drive inflation, particularly in providers.[1]

There may be nothing mysterious in regards to the supply of this spending: Largely it arises from the huge, traditionally unprecedented (in peacetime) improve within the wealth of upper-income teams produced by the Federal Reserve’s quantitative easing program.

What’s weird although, is, that each of those arguments discover assist in current analysis even by the Federal Reserve.[2]It’s merely foolish for the Journal to maintain preaching the gospel in keeping with Joe Manchin as if there isn’t any counter-evidence. And Democrats and everybody all for severe election postmortems have to get their info straight if their deliberations are to be something however pure self-importance projections.

Notes

[1] Ferguson and Storm, “Trump vs. Biden: The Macroeconomics of the Second Coming”; Good Coverage or Good Luck? Why Inflation Fell With no Recession.

[2] Cf. Thomas Ferguson,”INET Analysis and the 2024 Election;”; S.H. Hoke, L. Feler, and J. Chylak, “A Higher Method of Understanding the US Shopper: Decomposing Retail Spending by Family Earnings.”