Have you ever ever not taken a commerce after which appeared again in hindsight and wished to kick your self? Ever entered an important commerce and exited too early as a consequence of low confidence or over-thinking it, solely to see the commerce go on to be an enormous winner? How usually do you end up in these conditions or comparable?

Have you ever ever not taken a commerce after which appeared again in hindsight and wished to kick your self? Ever entered an important commerce and exited too early as a consequence of low confidence or over-thinking it, solely to see the commerce go on to be an enormous winner? How usually do you end up in these conditions or comparable?

In truth, these conditions are unavoidable typically, however when you’re discovering that you’re in a continuing state of frustration and remorse along with your buying and selling choices that you must do one thing about it.

What if there was a method to cut back these buying and selling errors and the psychological ache that comes from them? What when you might begin getting onboard these huge trades that you just talked your self out of getting into? What if I might show you how to remedy this psychological situation and eventually set you free?

I’ve excellent news and maybe unhealthy information (relying on the way you have a look at it). The excellent news is: This text goes that will help you perceive what’s inflicting these issues and hopefully provide you with confidence to rectify the problem and begin nailing a few of these trades you retain letting get away. No extra dwelling in hindsight saying “I used to be going to take that commerce, however…” or “I used to be going to let that commerce run, however…”. The “unhealthy information” is that I can’t do the be just right for you, I can present you the proverbial “door” to success, however it’s as much as you to stroll by it.

So, when you’re uninterested in standing in the identical spot, getting nowhere quick, right here is the trail, all you must do is begin strolling down it…..

1. Be taught what recency bias actually means and the right way to cease it

People are likely to make choices in regards to the future by trying on the previous and for good cause; that is normally a really useful habits that may forestall us from repeating the identical errors again and again. Nonetheless, though this evolutionary intuition has helped us transfer ahead over the centuries, in buying and selling, it tends to work in opposition to us. We name ourselves “optimists” once we be taught from the previous, and certainly that’s usually a really optimistic factor to do, however in buying and selling, in an surroundings with so many random outcomes, it might probably make us “pessimists” in a short time.

Permit me to elucidate with an instance….

We are likely to assume that what occurred just lately previously will affect what’s about to occur subsequent, and in MOST conditions that might be true. Nonetheless, in buying and selling, there’s a random distribution of winners and losers for any given buying and selling edge. So, this implies you by no means know for certain which commerce will win and which lose, even when your edge is say 80% worthwhile over time. Even in a really small pattern measurement of three profitable alerts and a couple of dropping alerts on a random part of a chart, a dealer might take 1 of the dropping trades in that sequence and get mentally “shaken out”, that means they freeze like a deer in headlights and skip the following completely good sign purely because of the recency bias in buying and selling. In different phrases, they’re being overly-influenced by the previous / latest commerce’s outcomes when in actuality, these outcomes have little to nothing to do with the following commerce’s end result.

An instance of recency bias in motion:

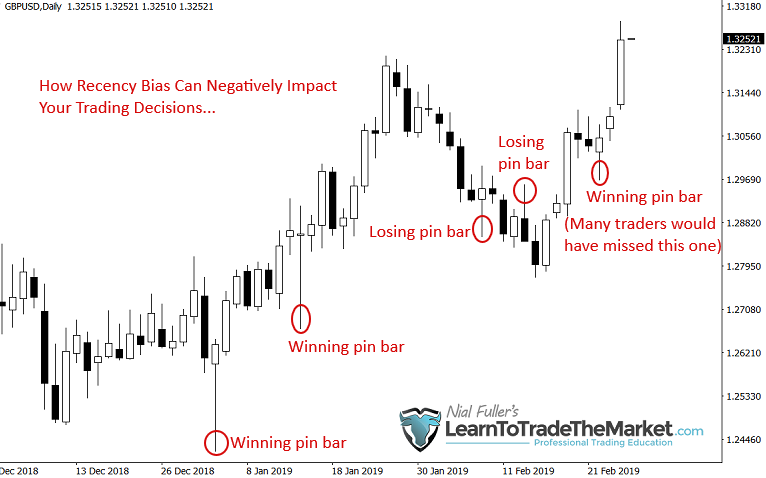

Now, let’s have a look at a latest real-world instance of how recency bias can negatively affect your buying and selling:

In case your major buying and selling edge was pin bars on the each day chart timeframe, you’d have been taking the primary two alerts labeled “profitable pin bars” on the chart under. These have been lengthy tailed pin bars, considered one of my favourite varieties. You may have profited from each of these or at worst, gotten out at breakeven, OK, no hurt no foul.

Now, issues get just a little extra fascinating…

We will then see there have been back-to-back pin bars that ended up dropping. So, had you taken these two pin bars, when you let recency bias “get you”, there was a VERY slim likelihood you have been taking the final pin bar to the precise on the chart; which has ended up working fairly properly as of this writing. That is proof of why that you must proceed taking trades that meet your buying and selling plan standards, regardless of latest commerce failures or outcomes that you just didn’t like. You (nor I) can see into the longer term, so to attempt to “predict” the end result of your subsequent commerce based mostly solely on the final, is just not solely futile, however silly.

- I might be trustworthy with you, we mentioned the 2 “dropping” pin bars you see within the chart above in our each day members e-newsletter, after they shaped. They failed, as trades typically do. However, we then additionally steered merchants contemplate shopping for the newest pin bar purchase sign on the far proper of the chart, which you’ll see is figuring out fairly properly, DESPITE the earlier two pin bars not figuring out. This, my pals, is named TRADING WITH DISCIPLINE. If you happen to let that recency bias get you, you’d have sat out, fearing one other loss, you then’d be riddled with remorse seeing the final pin bar figuring out with out you on board. Remorse, could be very, very harmful, this could result in you leaping again into the market and making a ‘revenge’ commerce (over-trading) and this after all leads to extra dropping.

- Once more, the idea I’m attempting to press house is believing in your edge and sticking to it. It’s essential to perceive that the end result of every commerce is considerably random and winners and losers are randomly distributed over the chart, as talked about above. That doesn’t imply we might be taking each commerce as a result of we are going to filter our alerts utilizing the TLS confluence filtering mannequin that I train my college students, however as we are able to see with this real-world and up to date instance on GBPUSD, whenever you see these alerts, they fairly often result in big strikes and we’ve got to attempt to be on board a big proportion of them for our winners to out-gain our losers.

2. Don’t let worry of loss mentally disable you

The worry of loss, of dropping once more, is a really highly effective catalyst for lacking out on completely good trades. I’m not denying that it’s tough to take a commerce after a dropping streak, however that you must get to some extent the place it isn’t. As we talked about above, it’s foolish to maintain considering you’ll proceed dropping simply because the final commerce was a loser.

- To keep away from this worry, or to extinguish it, that you must really deal with every commerce because it’s personal occasion and as an distinctive expertise, as a result of that’s precisely what it’s. You undoubtedly have to NOT over-commit to anyone commerce, that means, don’t threat an excessive amount of cash! You must shield your bankroll (buying and selling capital) with the intention to all the time really feel assured and optimistic, in order that you realize you may lose a commerce or a number of in a row and maintain going and be simply positive. Bear in mind, your buying and selling capital is your “oxygen” out there, so be sure you all the time have a lot with the intention to maintain “respiratory” correctly.

Many merchants usually affiliate destructive experiences or occasions of their private lives with their buying and selling. These “unhealthy issues” in our private lives can manifest in our buying and selling or funds (take into consideration the addicted gambler dropping all his cash on the on line casino).

- This will turn into fairly complicated, psychologically talking, however simply know that you just want to have the ability to “compartmentalize” your private life and destructive issues occurring with it, out of your buying and selling. If which means you don’t commerce for per week or two till a destructive expertise is just not affecting you anymore, then that’s what it means. However, that you must shield your buying and selling mindset and bankroll in any respect prices.

3. Don’t let overconfidence result in a insecurity

All of us begin out optimistic and assured however the market usually shatters that shortly. We will set ourselves up for years of ache if we exit and check out buying and selling with out the precise examine and observe.

We begin out excited and motivated, learn a number of books, watch a number of movies, do a course, and we exit and threat an enormous chunk of our hard-earned cash. This will destroy even an important dealer within the making, among the greatest merchants don’t make it as a result of they merely didn’t wait their flip and respect the market and the method. One big blow to funds can price them the following decade mentally and financially. One sequence of dropping trades can mentally disable even essentially the most gifted and smartest merchants.

- You must use your head to start with of your profession and really at some stage in your profession. Certain be assured, however first shield capital, examine these charts each day and persist with that routine each day, grind it out week in week out and commit. Apply your craft, grasp your craft. Be at one with the charts.

4. Develop your instinct and intestine really feel

Damaged merchants lack intestine really feel and instinct, they’ve stopped trusting themselves. We have to get you again up on the horse and get that sixth sense (intestine buying and selling really feel) activated once more. Jesse Livermore, in his e book Reminiscences of a inventory operator, usually talked about “feeling the market” and “understanding what was about to occur by a hunch or feeling”, to cite him:

A person should consider in himself and his judgment if he expects to make a dwelling at this recreation. That’s why I don’t consider in suggestions. – Jesse Livermore

- If you happen to determine and repair the three points we mentioned above, then your intestine really feel and instinct will develop slowly however absolutely, like an athlete’s stamina. As soon as this occurs, whenever you go to take a commerce you’ll start to robotically “paint” a psychological map into the longer term from the bars on the chart to the precise and your intestine really feel instinct will serve you nicely in constructing the boldness to enter the commerce. For a worth motion dealer such as you and I, this begins with studying to learn the footprint of the market left behind by the worth motion / worth motion.

- One other factor you are able to do to assist develop your intestine buying and selling really feel or instinct is put collectively a listing of each day buying and selling mantras that you just learn to your self, like the next:

I’m assured in my buying and selling edge and my skill to commerce it.

I’ll respect my filtering guidelines and pull the set off on legitimate trades.

I cannot cover behind my filtering guidelines to excuse me from pulling the set off.

I belief my instinct and intestine really feel.

I cannot overthink this subsequent commerce.

I don’t care in regards to the end result of my final commerce, it’s irrelevant to my subsequent commerce.

5. Perceive that the stats don’t lie

Many instances, merchants miss profitable trades as a result of they merely assume themselves proper out of them because of not trusting or understanding the precise details and statistics of buying and selling. Let me clarify…

As I touched upon earlier on this lesson, there IS a random distribution of wins and losses for any given buying and selling edge. What this implies is that, regardless of your buying and selling edge having XYZ win share, you continue to don’t ever know “for certain” WHICH commerce might be a winner and which might be a loser, the results of this buying and selling truth are three-fold:

- There isn’t any level in altering your threat significantly between trades, since you have no idea if the following setup will win or lose, regardless of “how good” it seems.

- You can’t keep away from dropping trades, all you are able to do is be taught to lose correctly. When merchants attempt to keep away from losses by doing issues like considering they will “filter” out losers or every other equally hair-brained concept, they put themselves ready to blow out their buying and selling account as a result of they’re now attempting to foretell that which is unpredictable which results in an entire host of different buying and selling errors.

- Anybody commerce is solely insignificant within the grand scheme of your buying and selling profession, or a minimum of IT SHOULD BE. If you’re making anyone commerce overly-significant by risking an excessive amount of cash on it and turn into overly-mentally hooked up to it, you might be setting your self up for sure “loss of life” within the buying and selling world.

Conclusion

Buying and selling is just not about by no means lacking a commerce or by no means having a dropping commerce, by no means. Nonetheless, when you discover that you’re chronically lacking trades and in a state of remorse about your buying and selling, you then do have to make some modifications.

As merchants, our primary “enemy” and “competitor” out there is ourselves. How lengthy it takes you to understand that, settle for it and do one thing about, will decide how lengthy it takes you to begin creating wealth out there. Immediately’s lesson has identified and supplied a number of options to 1 facet of buying and selling that usually causes folks to “shoot themselves within the foot”, so to talk; lacking out on profitable trades.

Your mission as a dealer is to completely overcome and get rid of all the varied self-defeating behaviors that each dealer should conquer to achieve a degree the place you might be giving your self the very best likelihood at creating wealth out there. That is what I always attempt to train college students by way of my skilled buying and selling programs and it’s my hope that by following me and studying from me you’ll ultimately get out of your individual method and be capable of benefit from the highly effective worth strikes the market gives up now and again.

Please Depart A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.