Supply: The School Investor

A 529 plan will be an efficient property planning software. However as a result of many households are unaware of its advantages, only a few think about using a 529 plan for property planning.

Nonetheless, households might have to contemplate together with 529 plans as a part of their property plans due to potential adjustments to demise taxes.

We clarify why in additional element beneath and break down all of the “how-tos” of utilizing a 529 plan for property planning. This is what you want to know.

Attainable Modifications To Demise Taxes

In 2024, the unified lifetime present, property and generation-skipping switch tax exemption is $13.6 million ($27.2 million for married {couples}), up from $5.49 million in 2017.

Since 2010, the lifetime exemption has been moveable between spouses, permitting a surviving partner to get the unused portion of their partner’s lifetime exemption. This successfully offers a married couple with twice the lifetime exemption of a single particular person. The deceased partner should have been a U.S. citizen on the time of demise. The surviving partner should elect portability once they file a well timed Federal Property Tax Return, IRS Kind 706, for the deceased partner. IRS Kind 706 should be filed inside 9 months plus extensions after the date of the decedent’s demise. IRS Kind 4768 could also be filed to say an automated 6-month extension.

Nonetheless, the way forward for the exemption from demise taxes is unsure. The Tax Cuts and Jobs Act of 2017 doubled the lifetime exemption. However this enhance will sundown for tax years after 2025 until Congress acts to increase it. The lifetime exemption will revert again to $5 million plus an inflation adjustment for taxpayers who die in 2026 and later years.

As well as, President Biden has proposed slicing the lifetime exemptions to $3.5 million for estates and $1 million for items (returning to the exemptions that had been in impact in 2009). His proposal additionally requires rising the tax charge, which is at the moment 40%. He has additionally proposed eliminating the stepped-up foundation for inherited property and to tax the unrealized capital features at odd revenue tax charges (versus long-term capital features tax charges).

Though President Biden didn’t embrace the proposed decreases within the lifetime exemptions within the American Households Plan, these cuts is perhaps included in future laws.

Opposition To Property Tax Modifications

These proposals have generated bipartisan opposition from lawmakers for a number of causes:

The proposed adjustments additionally generate comparatively little tax income. Fewer than 2,000 households pay federal property taxes every year, yielding lower than $20 billion in tax income.

States That Levy Property Taxes

State property and inheritance taxes, which range by state, might have decrease exemptions than the federal ranges, inflicting smaller estates to be taxed. Households might want to use 529 plans to scale back state property and inheritance taxes in these states.

At present, 13 states have state property taxes: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. The state property tax exemption is $1 million in Massachusetts.

As of writing, 6 states have state inheritance taxes: Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Pennsylvania consists of out-of-state 529 plans within the account proprietor’s property, however not in-state 529 plans.

Inheritance taxes might rely upon the connection of the inheritor to the decedent. In Pennsylvania, for instance, the inheritance tax charge is 0% for surviving spouses or mother and father of a minor baby, 4.5% for direct descendants, 12% for siblings, and 15% to different heirs (apart from charitable organizations, exempt establishments and authorities entities which are exempt from tax).

Advantages Of Utilizing A 529 Plan For Property Planning

The benefits of utilizing 529 plans for property planning contain contributions, distributions, management and monetary help affect. They’re less complicated, simpler to make use of and cheaper to arrange than difficult trusts. In addition they have beneficiant and versatile contribution limits. There are not any revenue, age or cut-off dates.

Account house owners retain management over the 529 plan account and might change the beneficiary. Earnings accumulate on a tax-deferred foundation and distributions are tax-free if used to pay for certified academic bills. Grandparents may use 529 plans to depart a legacy for his or her descendants. And policymakers are unlikely to restrict these estate-planning advantages.

Contributions

Contributions are faraway from the contributor’s property for federal property tax functions. Contributions are thought of to be a accomplished present.

Though there isn’t a annual contribution restrict for 529 plans, contributors can provide as much as the annual present tax exclusion, which is $18,000 per yr in 2024, with out incurring present taxes or utilizing up a part of the lifetime present tax exemption.

There are not any present tax limits if the beneficiary is the account proprietor or the account proprietor’s partner. The partner should be a U.S. citizen. If the partner will not be a U.S. citizen, the items are capped at $157,000 a yr, as of 2000.

If the beneficiary is a grandchild, contributions might lead to generation-skipping switch taxes, however the annual and lifelong exemptions and tax charges are the identical as for present and property taxes. Technology-skipping switch taxes apply if the beneficiary is 2 or extra generations youthful than the contributor or if the beneficiary is at the very least 37.5 years youthful than the contributor. There’s an exception if the grandchild’s mother and father are deceased on the time of the switch.

Superfunding

5-year gift-tax averaging, also referred to as superfunding, permits a contributor to make a lump sum contribution of as much as 5 instances the annual present tax exclusion and have it handled as by it happens over a five-year interval.

The contributor could also be unable to make extra items to the beneficiary in the course of the five-year interval, until the prorated present is lower than the annual present tax exclusion quantity. If the contributor dies in the course of the 5-year interval, a part of the contribution could also be included within the contributor’s property.

For instance, if the contributor dies in yr 3, the remaining 2 years of contributions can be included within the contributor’s property. The contributor might must file IRS Kind 709 to report the contribution, even when there are not any present taxes or discount within the lifetime exemption.

State Limits And Advantages

There are excessive combination contribution limits, which range by state, starting from $235,000 in Georgia and Mississippi to $542,000 in New Hampshire. As soon as the account steadiness reaches the combination restrict, no extra contributions are permitted, however the earnings might proceed to build up.

Households might be able to bypass the state’s combination contribution limits by opening 529 plans in a number of states. However contributors will nonetheless be topic to the annual present tax exclusion limits.

Contributions are eligible for a state revenue tax deduction or tax credit score on state revenue tax returns in two-thirds of the states. The quantity of the state revenue tax break varies by state. There are not any revenue limits, age limits or cut-off dates on contributions. The beneficiary doesn’t must be of school age and might have already got a school diploma.

Distributions

Earnings in a 529 plan accumulate on a tax-deferred foundation. And distributions are tax-free if used for certified academic bills. The cash can be utilized to pay for elementary and secondary college tuition, school prices, graduate or skilled college prices, and persevering with schooling.

Non-qualified distributions are topic to odd revenue taxes on the recipient’s tax charge and a ten% tax penalty. The penalty is just levied on the earnings portion of the distribution, not the complete quantity of the distribution.

Non-qualified distributions will not be topic to capital features taxes, present taxes or property taxes. If the contributor beforehand claimed a state revenue tax deduction or tax credit score, the state revenue tax break could also be topic to recapture if the account proprietor makes a non-qualified distribution.

There are not any revenue limits, age limits or cut-off dates on distributions. Account house owners will not be required to make distributions when the beneficiary reaches a specific age. They’ll select to depart the cash within the account, letting it proceed to build up earnings.

Management

The account proprietor retains management over the 529 plan account, not like direct items to the beneficiary or difficult belief funds. The account doesn’t switch to the beneficiary when the beneficiary reaches a specific age. As an alternative, the account proprietor will get to determine whether or not and when to make distributions.

The account proprietor can change the beneficiary to a member of the beneficiary’s household, together with to the account proprietor. This successfully lets the account proprietor revoke the present, in the event that they select, by altering the beneficiary to themselves.

Monetary Assist Impression

Grandparent-owned 529 plans will not be reported as an asset on the Free Utility for Federal Pupil Assist (FAFSA).

The Consolidated Appropriations Act, 2021, simplified the FAFSA beginning with the 2023-24 FAFSA (subsequently delayed till the 2024-25 FAFSA by the U.S. Division of Schooling). Amongst different adjustments, the simplified FAFSA drops the money help query, so distributions will not rely as untaxed revenue to the beneficiary on the beneficiary’s FAFSA.

This may eradicate any affect from a grandparent-owned 529 plan on federal scholar help eligibility.

Leaving A Legacy

Grandparents can open a 529 plan for every grandchild. If the grandparents have three youngsters and 9 grandchildren, they may open a complete of twelve 529 plans, one for every baby and grandchild.

With 5-year gift-tax averaging, they may make lump-sum contributions totaling $1.8 million as a pair (e.g., $150,000 per beneficiary x 12 beneficiaries = $1.8 million). This yields a major discount within the grandparents’ taxable property. Grandparents may use a 529 plan to trace that they’d like their grandchildren to go to school.

529 plans are an effective way of leaving a legacy in your heirs. If there’s leftover cash within the 529 plan after paying for faculty, the unused funds can proceed to develop and be handed on to future generations.

Leftover cash can be used for different bills by making a non-qualified distribution. However the earnings portion of the non-qualified distribution can be topic to odd revenue taxes and a tax penalty versus property and inheritance taxes.

Main 529 Plan Coverage Modifications Are Unlikely

Policymakers are unlikely to restrict using a 529 plan for property planning. When President Obama proposed taxing 529 plans in 2015, his proposal was met with fierce opposition from each Democrats and Republicans. In actual fact, the resistance was so hostile and swift that he was pressured to drop the proposal just some days later.

Lifetime Exemption For Federal Reward Taxes

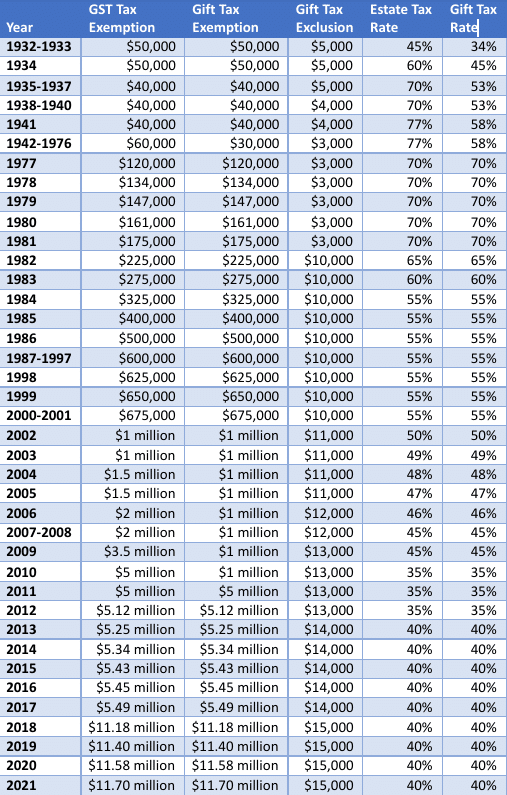

This desk beneath exhibits the adjustments within the lifetime exemption for federal present, property and generation-skipping switch taxes during the last 9 a long time. Key adjustments had been made by the next items of laws:

Historic Reward Tax Exemption. Supply: Mark Kantrowitz

Who Ought to Take into account 529 Plans For Property Planning?

If grandparents are near the lifetime exclusions or are frightened about future cuts within the lifetime exclusions, they need to think about using 529 plans for property planning.

529 plans are notably helpful when the grandparents are rich however the mother and father will not be. The favorable monetary help therapy of 529 plans lets grandparents who’re rich assist pay for elementary, secondary and postsecondary schooling bills with out affecting the grandchild’s eligibility for need-based monetary help.