ICT Market Construction Indicator is a flexible and high-performance software that gives useful insights into worth habits, empowering you to develop efficient buying and selling methods. It’s an indispensable and sensible indicator that shouldn’t be neglected. With this indicator, you possibly can acquire a deeper understanding of worth actions, enabling you to make extra knowledgeable buying and selling choices. By analyzing worth motion and patterns, ICT Market Construction Indicator reveals key market traits and potential buying and selling alternatives. Whether or not you’re a novice or skilled dealer, this indicator is a useful asset in your buying and selling toolkit.

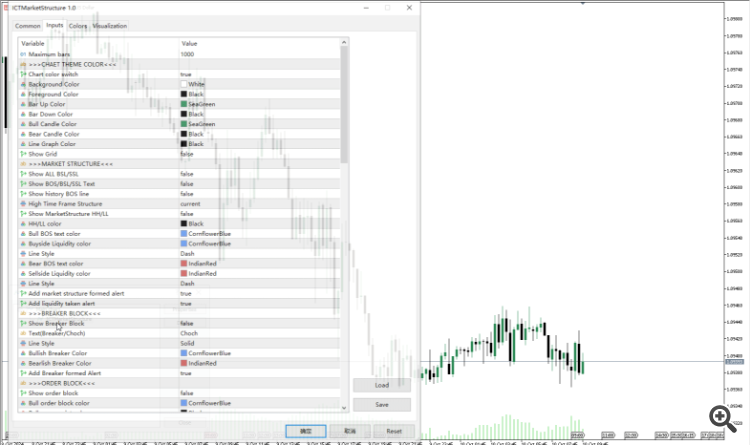

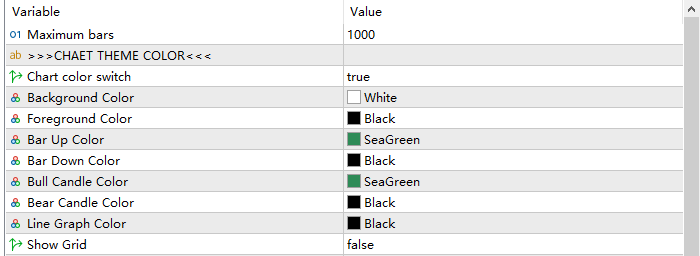

The utmost variety of candles and the theme colour of the chart

This set of enter parameters is used to configure the theme colours of the chart. By modifying these enter parameters, you possibly can change the foreground colour, background colour, and colours of various kinds of candlesticks on the chart. This module overrides a number of the chart colour settings within the authentic properties of MT5/MT4 charts. Please be aware that after enabling this indicator, any colour settings associated to the chart can solely be modified via the indicator settings. The settings within the authentic MT5/MT4 chart will likely be overridden by the indicator.

Excessive Time Body Market Construction

The market construction consists of fractals, and based mostly on the highs and lows of those fractals, we label them as

H ——> Excessive

LH ——> Decrease Excessive

HH ——> Increased Excessive

L ——> Low

HL ——> Increased Low

LL ——> Decrease Low

BSL ——> Purchase Aspect Liquidity

SSL ——> Promote Aspect Liquidity

BOS ——> Break of Construction

The formation of excessive and low fractals available in the market construction can also be the formation of liquidity. Excessive-timeframe market construction refers to a timeframe that’s larger than the present timeframe. You may change the timeframe utilizing the enter parameters to show the next timeframe market construction and liquidity. Please be aware that the enter parameter “present” represents the default worth, and the indicator already specifies the next timeframe by default. Additionally, the timeframe you choose should be larger than or equal to the present timeframe.

Breaker formation relies on the disruption of the market construction within the present timeframe. When a breaker varieties, it signifies a change within the short-term market development inside the present timeframe. This presents us with a chance to enter the market. As soon as the breaker is shaped, and the worth retraces again to the vary between the breaker and its excessive level, this space turns into a possible entry level.Additionally it is means Change of character(CHOCH).

Order blocks are usually shaped by the aggregation of a lot of purchase or promote orders, which can come from giant institutional merchants, fund managers, or different high-volume merchants. The execution of those orders typically results in important worth reversals or rebounds available in the market.Figuring out order blocks can present useful reference info for merchants, as these blocks typically signify essential turning factors available in the market. Merchants can assess market energy and route by observing the formation and response of order blocks, and make corresponding buying and selling choices based mostly on this evaluation.The Order Block indicator identifies the particular places the place institutional orders are positioned. The indicator shows the order blocks utilizing the symbols “+OB” for “Bullish Order Block” and “-OB” for “Bearish Order Block.” Nonetheless, you even have the choice to customise the textual content in line with your choice.

Truthful Worth Gab(FVG) is a variety in Value Supply the place on aspect of the Market Liquidity is obtainable and usually confirmed with a Liquidity Void on the decrease time-frame charts in the identical vary of Value. Value can truly “hole” to create a literal vacuum of buying and selling thus posting an precise Value Hole.Within the indicator, you could have the choice to pick out the variety of FVG extensions in addition to their size. Moreover, you possibly can select to show the excessive, mid, or low factors of the FVG. For example, when the FVG is bullish, you possibly can select to solely show the extension traces comparable to the excessive factors of the FVG. Conversely, when the FVG is bearish, you could have the choice to solely present the extension traces related to the low factors of the FVG.

The buying and selling session function is essential for merchants because it straight impacts the volatility and buying and selling alternatives of foreign money pairs, contemplating the totally different market exercise occasions and buying and selling volumes throughout varied areas. To assist merchants acquire a complete understanding of the market dynamics and devise efficient buying and selling methods, this indicator shows the buying and selling hours of the Asian, London, and New York markets. As depicted within the chart beneath, important worth fluctuations usually happen throughout the London or New York buying and selling classes, whereas the Asian session tends to have comparatively fewer worth actions. Due to this fact, deciding on the best buying and selling session is crucial for these looking for bigger buying and selling fluctuations, and the session indicator can present useful insights into the market situations.

The three time zones talked about within the ICT technique are strategically chosen to seize important market actions and potential buying and selling alternatives. Let’s discover the reasoning behind every zone:

Zone 1: From 3 AM to 4 AM New York time (GMT 7:00 to eight:00)

This time zone represents the intersection of the Asian and London buying and selling classes. Throughout this era, there’s an overlap in buying and selling actions between these two main monetary hubs. In consequence, there’s usually an elevated buying and selling quantity, which might result in important worth fluctuations and market alternatives.

Zone 2: From 10 AM to 11 AM New York time (GMT 14:00 to fifteen:00)

This time zone corresponds to the intersection of the London and New York buying and selling classes. Each London and New York are main gamers within the world foreign exchange market. The overlapping of those two classes brings collectively a excessive focus of market members, leading to elevated liquidity and the potential for robust worth actions.

Zone 3: From 2 PM to three PM New York time (GMT 18:00 to 19:00)

This time zone focuses on the afternoon session in New York, which performs an important position in figuring out the day’s closing costs. As merchants in New York put together to wrap up their buying and selling day, there is usually a surge in buying and selling exercise and momentum as positions are squared and orders are executed earlier than the market closes. This era presents alternatives for merchants to make the most of potential worth actions earlier than the tip of the buying and selling session.

By strategically deciding on these time zones, the ICT technique goals to faucet into the durations of elevated buying and selling quantity and market exercise, the place important worth strikes usually tend to happen. It takes benefit of the intersections between totally different main buying and selling classes and goals to seize the forces that may drive the market throughout these particular occasions.

Weekly Opening Gaps play a major position in worth motion as they function help and resistance ranges. A spot happens when the opening worth of an asset on Monday is considerably totally different from the closing worth on Friday. These gaps kind attributable to varied components, corresponding to information occasions, market sentiment, or in a single day buying and selling exercise.

From a technical evaluation standpoint, merchants typically view these gaps as areas of help or resistance. A spot-up opening suggests that there’s robust shopping for strain, which might act as a help stage for future worth actions. Alternatively, a gap-down opening signifies promoting strain, serving as a possible resistance stage.

Merchants pay shut consideration to those weekly openings gaps as they supply useful insights into market sentiment and might affect buying and selling choices. They could search for worth reversals close to these ranges or use them to set revenue targets and stop-loss orders. Moreover, gaps can signify potential breakouts or breakdowns, including to their significance.

In abstract, weekly opening gaps act as help and resistance ranges in worth habits, reflecting market sentiment and offering useful buying and selling alternatives.

Earlier/Present day by day/weekly/month-to-month excessive/low

Earlier day by day/weekly/month-to-month excessive/low” refers back to the highest and lowest worth ranges has reached throughout the day gone by, week, or month.The earlier day by day excessive/low represents the best and lowest worth ranges that have been reached throughout the latest buying and selling day. Merchants and traders typically monitor these ranges as they will present insights into the present market sentiment and potential help/resistance ranges.Equally, the earlier weekly excessive/low represents the best and lowest worth ranges reached over the course of the earlier week. This may be helpful for figuring out longer-term traits and key ranges of help or resistance.Lastly, the earlier month-to-month excessive/low refers back to the highest and lowest worth ranges reached throughout the earlier calendar month. This will present a broader perspective on the worth motion and assist merchants and traders determine important ranges that will affect future worth actions.Monitoring earlier excessive/low ranges will be a part of technical evaluation, which includes analyzing historic worth information to make knowledgeable buying and selling choices.

The degrees are what ICT mentions as potential draw on liquidity and motivation to make worth transfer towards them or from these stage out. Beneath are the quick label model.

PMH –> earlier month-to-month excessive

PML –> earlier month-to-month low

PWH –> earlier weekly excessive

PWL –> earlier weekly low

PDH –> earlier day excessive

PDL –> earlier day low

You may customise your alert settings within the terminal to remain knowledgeable about essential messages. By going to “Instruments==>Choices==>Notifications,” you possibly can allow notifications for terminal messages and obtain alerts via the app. Moreover, you could have the choice to arrange e-mail alerts by enabling the e-mail setting in “Instruments==>Choices==>Electronic mail.” These options make sure that you obtain well timed notifications and keep up to date with the newest info.