1. Introduction

Plant and Harvest Professional is an Knowledgeable Advisor designed to remodel the buying and selling course of right into a pure cycle of planting and harvesting. Impressed by the cycles of nature, this EA makes use of superior development and candle evaluation algorithms to establish optimum moments to “plant” (open positions) and “harvest” (shut with earnings). The underlying technique is adaptable to completely different buying and selling types and market circumstances, making it a flexible device for merchants of all ranges.

The target of this information is to supply a transparent and detailed methodology for optimizing the parameters of Plant and Harvest Professional. By way of optimization, merchants can modify the EA to maximise profitability, enhance danger administration, and adapt to altering market circumstances. All through this information, we’ll discover the important thing parameters that have to be adjusted, in addition to the steps to observe to realize an optimum configuration that aligns together with your buying and selling objectives.

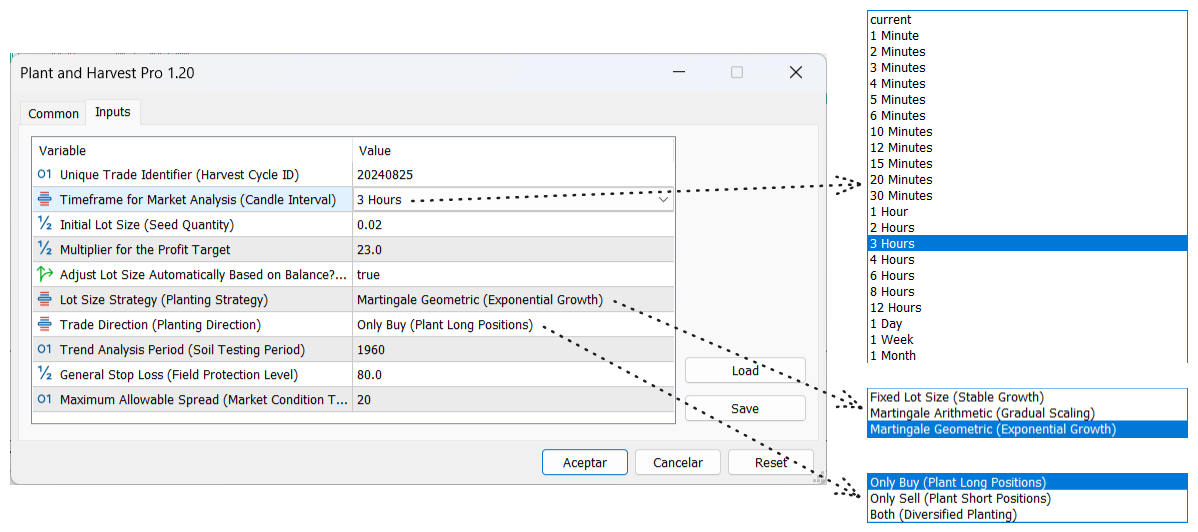

2. Optimization Parameters

-

Distinctive Commerce Identifier (Harvest Cycle ID)

- Description: This parameter units a singular identifier for every buying and selling cycle. This “Harvest ID” permits the EA to distinguish between a number of trades opened by numerous EAs. It’s helpful for avoiding conflicts between a number of cases of the EA working on the identical account.

- Advice: Hold a singular worth for every EA if you’re utilizing a number of cases of the EA.

-

Timeframe for Market Evaluation (Candle Interval)

- Description: Defines the timeframe used for market evaluation. This refers back to the candle timeframe that the EA will analyze to find out entries and exits. For instance, “4 Hours” means the EA will analyze 4-hour candles.

- Advice: Alter this parameter based on your technique and buying and selling type. Longer timeframes are typically extra secure however much less dynamic.

-

Preliminary Lot Dimension (Seed Amount)

- Description: Determines the preliminary lot measurement for every commerce. It’s important for setting the quantity of danger assumed in every “seed” planted.

- Advice: Experiment with completely different sizes to discover a steadiness between danger and reward, relying in your account measurement and the image you might be buying and selling.

-

Multiplier for the Revenue Goal

- Description: This parameter dynamically adjusts the revenue goal based mostly on lot measurement. It refers back to the multiplier utilized to find out the anticipated “harvest” in every commerce.

- Advice: Use this multiplier to scale your revenue targets based on the chance you might be prepared to take.

-

Alter Lot Dimension Routinely Based mostly on Steadiness? (Progress Adjustment)

- Description: When enabled, this parameter permits the lot measurement to be routinely adjusted based mostly in your account steadiness. This helps to adapt danger because the account grows or shrinks.

- Advice: Hold this feature enabled to dynamically handle danger proportional to your account measurement.

-

Lot Dimension Technique (Planting Technique)

-

Commerce Course (Planting Course)

-

Pattern Evaluation Interval (Soil Testing Interval)

- Description: Defines the variety of durations used for development evaluation. This parameter controls how far again the EA appears to evaluate the present development.

- Advice: Longer durations provide extra secure development evaluation, whereas shorter durations are extra reactive to current market modifications.

-

Normal Cease Loss (Area Safety Degree)

- Description: Determines the final cease loss stage for all trades. It’s expressed as a share of the account steadiness and protects the account from important losses.

- Advice: Alter this parameter to guard your capital whereas permitting the EA to function with sufficient flexibility.

-

Most Allowable Unfold (Market Situation Threshold)

- Description: Units the utmost allowable unfold for the EA to open new trades. This ensures that trades are solely executed underneath favorable market circumstances.

- Advice: Set this worth based on typical market circumstances for the image you might be buying and selling, avoiding buying and selling throughout instances of excessive volatility or low liquidity.

3. Optimization Steps

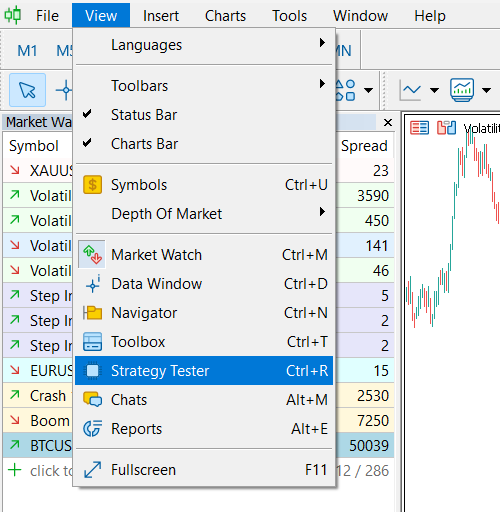

Step 1: Open the Technique Tester

To start optimizing Plant and Harvest Professional, step one is to open the technique tester in MetaTrader 5. Observe these steps:

- Go to the highest menu and choose View.

- Within the drop-down menu, choose Technique Tester or press Ctrl+R in your keyboard.

This can open the technique tester panel on the backside of the platform.

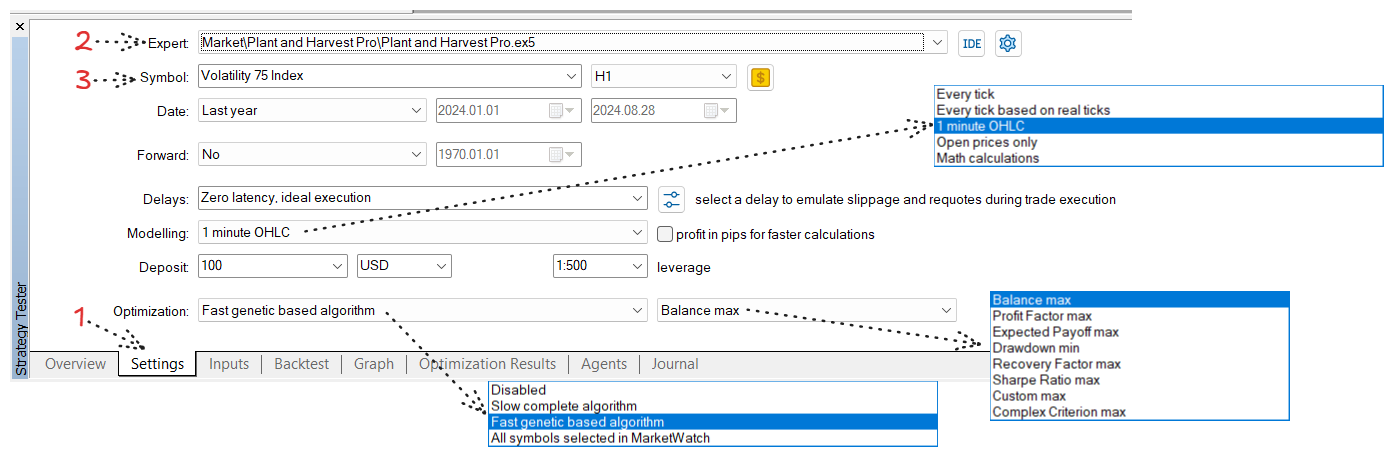

Step 2: Configure the “Settings” Tab

With the technique tester open, observe the steps beneath to configure the optimization within the Settings tab:

-

Choose the Settings Tab: Be sure to are within the Settings tab of the technique tester.

-

Choose the EA: Within the Knowledgeable subject, choose Plant and Harvest Professional.

-

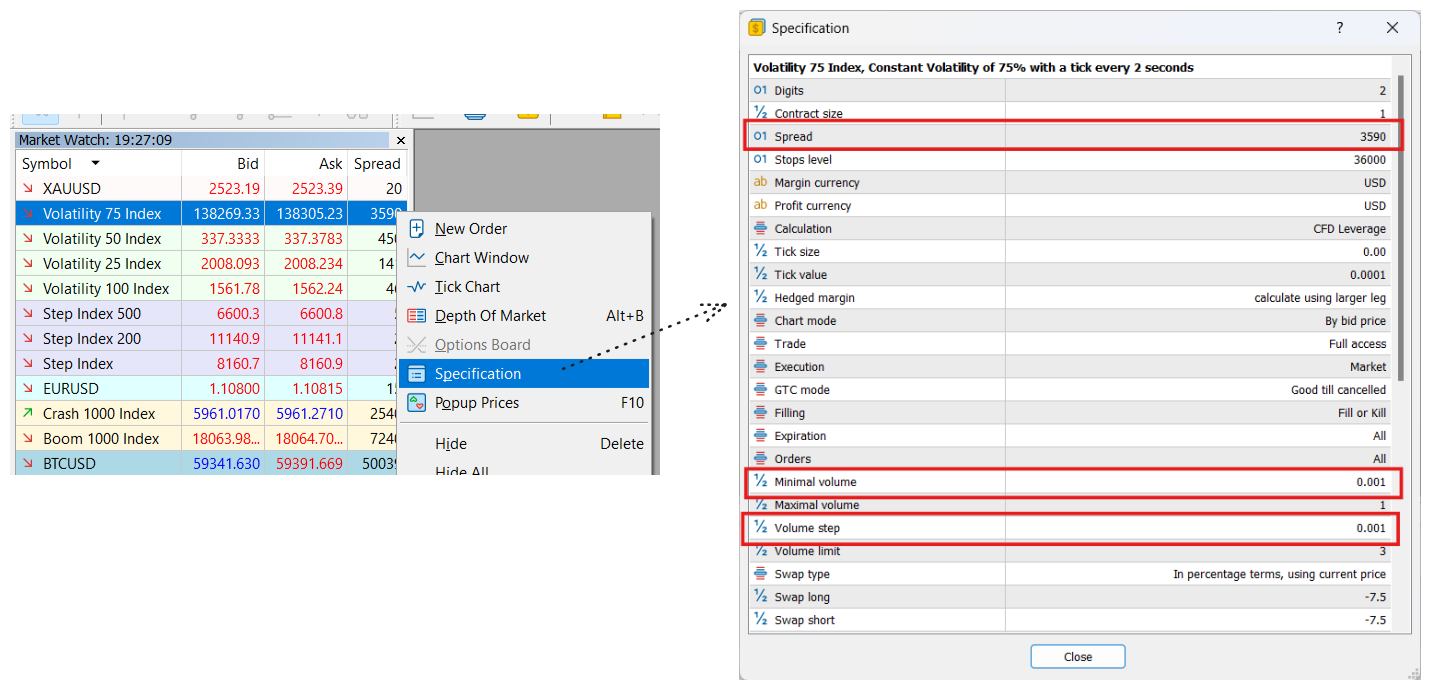

Choose the Image: Within the Image subject, select the asset you wish to optimize. On this instance, we’ll use the Volatility 75 Index.

-

Specify the Date Vary:

- Date: Specify the date vary for optimization. For this instance, we’ll choose knowledge from the final 12 months.

-

Choose the Execution Mannequin:

- Modelling: Select 1 minute OHLC. This mannequin is good for performing fast and correct optimization.

-

Configure Deposit and Leverage:

- Deposit: Alter the preliminary deposit quantity based on your buying and selling account.

- Leverage: Set the leverage based mostly in your dealer’s circumstances and danger administration technique.

-

Choose the Optimization Algorithm:

- Optimization: Choose Quick genetic based mostly algorithm for fast and environment friendly optimization.

-

Choose the Optimization Criterion:

- Optimization Criterion: Select the criterion you wish to use for optimization. On this instance, we chosen Steadiness max to optimize the utmost steadiness reached through the take a look at interval.

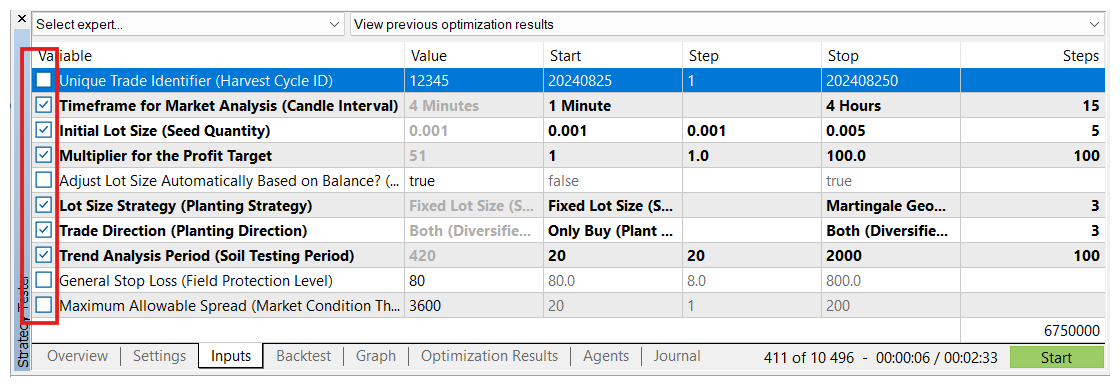

Step 3: Configure the Inputs Tab

After getting configured the Settings tab, it’s time to outline the parameters to be optimized within the Inputs tab. Right here, you may choose the particular parameters you wish to embody within the optimization and set the worth ranges for every.

-

Entry the Inputs Tab:

- Click on on the Inputs tab within the technique tester to view all of the configurable parameters of the EA.

-

Configure Preliminary Lot Dimension:

- Low Preliminary Capital: In case your preliminary capital is low, there isn’t a want to incorporate the Preliminary Lot Dimension (Seed Amount) parameter within the optimization. On this case, it’s endorsed to depart the worth mounted on the minimal allowed for the image you might be buying and selling. This ensures that the EA operates with managed danger from the beginning.

- Appreciable Capital: In case you have appreciable preliminary capital, it might be advisable to incorporate Preliminary Lot Dimension within the optimization. Make sure to set the step (increment) accurately based on the image’s specs to keep away from buying and selling with inappropriate lot sizes.

-

Normal Cease Loss:

- It is strongly recommended to depart the Normal Cease Loss (Area Safety Degree) parameter at a set worth and never embody it within the optimization. This parameter defines what share of the account’s whole steadiness you might be prepared to danger if trades go fallacious.

- Instance: If the steadiness is $1000 and Normal Cease Loss is ready to 10 (representing 10% of the steadiness), the EA will shut all open positions if losses attain $100. This protects your account from important losses and permits the EA to hunt new alternatives available in the market.

-

Most Allowable Unfold:

- Set the Most Allowable Unfold (Market Situation Threshold) parameter barely above the everyday unfold of the image you might be buying and selling. This ensures that the EA solely trades when market circumstances are favorable, avoiding conditions the place the unfold turns into extreme as a result of excessive volatility or low liquidity.

-

Parameter Choice for Optimization:

- Test the bins for the parameters you wish to optimize. Set the preliminary values, vary (begin, step, cease), and ensure to incorporate solely these parameters which are vital to your technique.

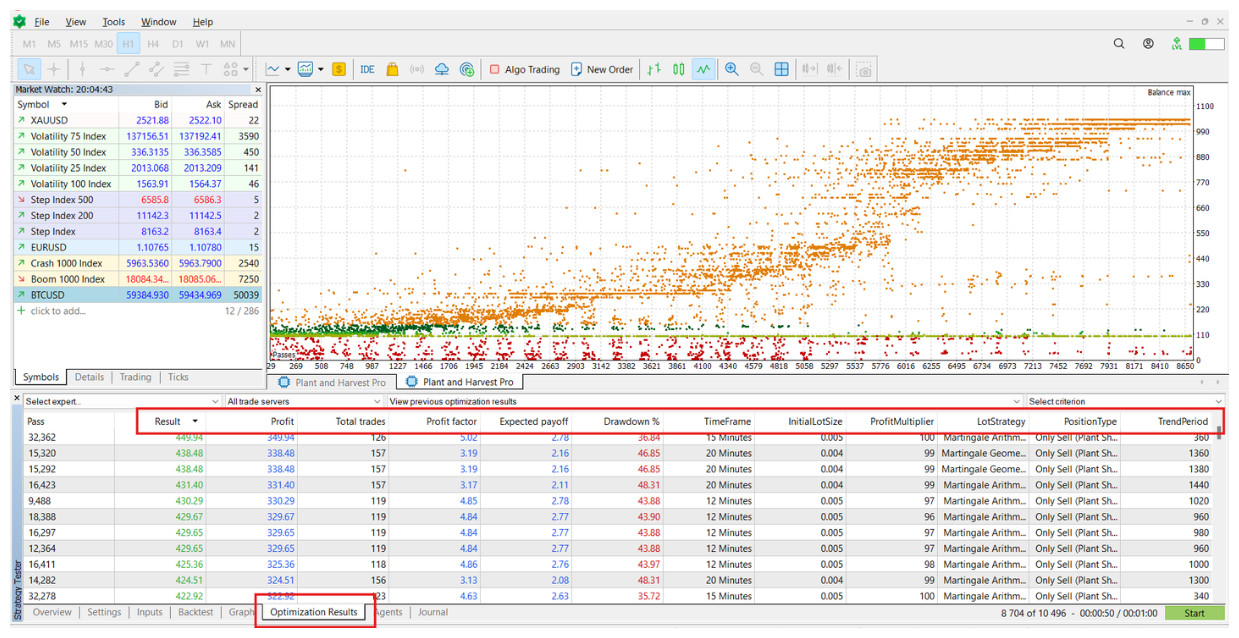

Step 4: Analyze the Ends in the “Optimization Outcomes” Tab

After getting configured the Inputs tab and chosen the parameters you wish to optimize, it’s time to begin the optimization course of.

-

Begin the Optimization:

- Press the inexperienced Begin button within the backside proper nook of the technique tester. This can begin the optimization course of, the place MetaTrader 5 will start testing completely different mixtures of the chosen parameters.

-

Actual-Time Visualization:

- Because the optimization progresses, a scatter plot will open, exhibiting the outcomes of every parameter mixture based on the optimization criterion chosen within the Settings tab (e.g., Steadiness max).

- The scatter plot means that you can shortly visualize which mixtures are yielding higher outcomes and which aren’t.

-

Assessment Ends in the “Optimization Outcomes” Tab:

- Whereas the optimization course of is working, you may evaluate partial leads to the Optimization Outcomes tab. This tab shows a desk with particulars similar to revenue issue, drawdown, whole variety of trades, and different vital parameters.

- The desk means that you can shortly evaluate the completely different configurations examined, sorting them by the criterion you like.

-

Completion of the Optimization Course of:

- As soon as the optimization is full, the Optimization Outcomes tab will show the complete checklist of all parameter mixtures examined, sorted by the chosen optimization criterion (e.g., most steadiness).

- You will notice the most effective consequence on the prime of the checklist, permitting you to shortly establish essentially the most promising configuration.

-

Load a Particular Configuration:

- After the optimization course of is full, you may double-click on one of many options listed within the Optimization Outcomes tab. This can routinely load that particular configuration into the Inputs tab.

- As soon as the configuration is loaded, MetaTrader 5 will carry out a steadiness simulation utilizing the chosen parameters, and the outcomes will probably be displayed within the Graph tab. This lets you visualize how the account steadiness would have advanced with that specific configuration.

This step is essential for analyzing and selecting the right configuration based mostly on the outcomes obtained, making certain that the EA is optimized for the chosen image and your buying and selling account circumstances.

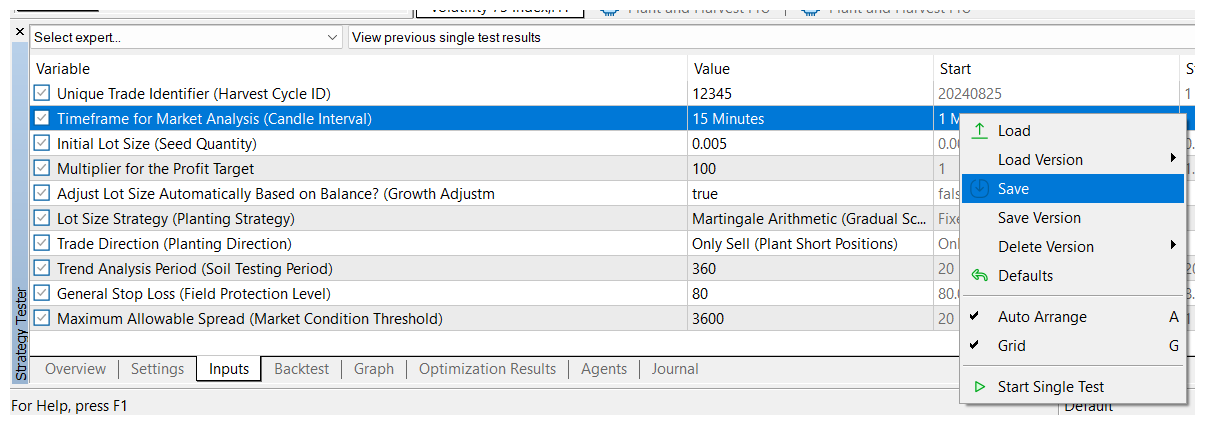

Step 5: Choose and Save the Chosen Set File

After getting recognized a promising configuration within the Optimization Outcomes tab, the subsequent step is to load that configuration and put it aside as a set file for future testing or dwell buying and selling.

-

Load the Chosen Configuration:

- Double-click on one of many options listed within the Optimization Outcomes tab. Doing so will routinely load the chosen configuration into the Inputs tab.

- You will notice that every one optimized values have been utilized to the corresponding parameters, prepared for use in a simulation or dwell buying and selling.

-

Configuration Verification:

- Assessment the loaded parameters within the Inputs tab to make sure that the chosen configuration aligns together with your technique and buying and selling expectations.

- If this configuration matches your goals and market circumstances, it’s advisable to reserve it to have a set file prepared for future use.

-

Simulation in Visible Mode:

- If you wish to visualize how the account would have carried out with the chosen parameters, you may run a simulation in visible mode.

- To do that, go to the Settings tab and choose the Visible mode with the show of charts, indicators, and trades possibility. This can mean you can see graphically how the EA would have operated with these parameters, together with entries, exits, and the impression on the account steadiness.

-

Save the Set File:

- Proper-click anyplace within the parameter checklist within the Inputs tab and choose Save from the context menu.

- Save the set file with a descriptive identify that means that you can establish it simply later. This will embody particulars such because the image, timeframe, and optimization date.

Saving the set file means that you can reuse this optimized configuration in future exams or when buying and selling dwell, making certain that you simply at all times have entry to a configuration that has confirmed to be efficient.

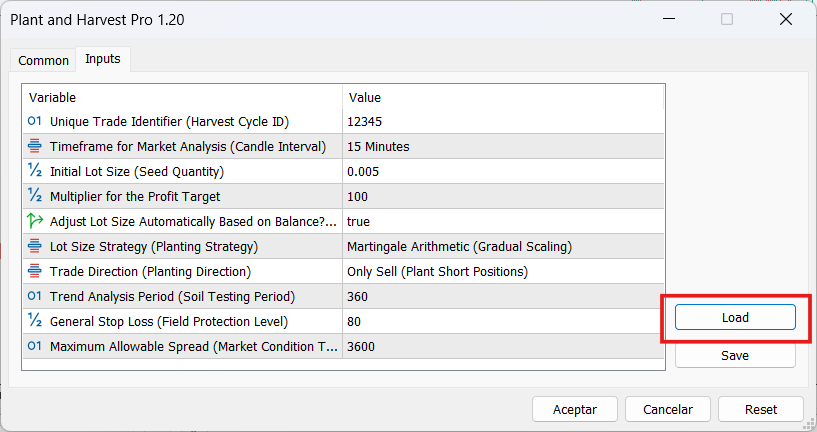

4. Activate the EA and Load the Set File in MetaTrader 5

After getting accomplished the optimization course of and saved your set file, you may proceed to make use of the Plant and Harvest Professional EA within the dwell market. Observe these steps to load the set file and activate the EA:

-

Open the Image Chart:

- Open the chart of the image you wish to commerce utilizing the optimized set file.

-

Activate the EA on the Chart:

- Drag and drop Plant and Harvest Professional from the Navigator window onto the chosen image chart.

-

Load the Set File:

- Within the EA’s Inputs tab, click on the Load button.

- Choose the set file you beforehand saved and cargo it. This can routinely apply the optimized parameters to the EA occasion you might be activating.

Threat Warning

You will need to keep in mind that buying and selling is a high-risk enterprise. The market is unpredictable, and whereas optimization helps establish patterns in value which have repeated prior to now, there isn’t a assure that these patterns will proceed to happen sooner or later.

Through the optimization course of, the aim is to seek out patterns in value habits, and as soon as recognized, to reap the benefits of their future incidence to attempt to make a revenue. Nevertheless, this doesn’t assure that the recognized patterns will repeat in the identical method sooner or later.

Because of this, it’s essential to commerce cautiously and solely with cash you might be prepared to lose. No buying and selling technique, irrespective of how optimized, can utterly remove danger.

I hope this information helps you optimize and commerce with Plant and Harvest Professional successfully. Bear in mind at all times to behave cautiously and handle danger appropriately in all of your trades.

Hyperlinks

Plant and Harvest Professional: https://www.mql5.com/en/market/product/122186

All my skilled advisors: https://www.mql5.com/en/customers/simondelvecchio/vendor

Telegram channel: https://t.me/+geAsOlnUtsZmMzQx