KEY

TAKEAWAYS

- The main sector at the moment was the Financials, adopted by Well being Care and Utilities.

- Expertise shares offered off considerably and was the worst sector performer.

- With rate of interest cuts anticipated within the subsequent FOMC assembly, monetary shares have the potential to rise additional.

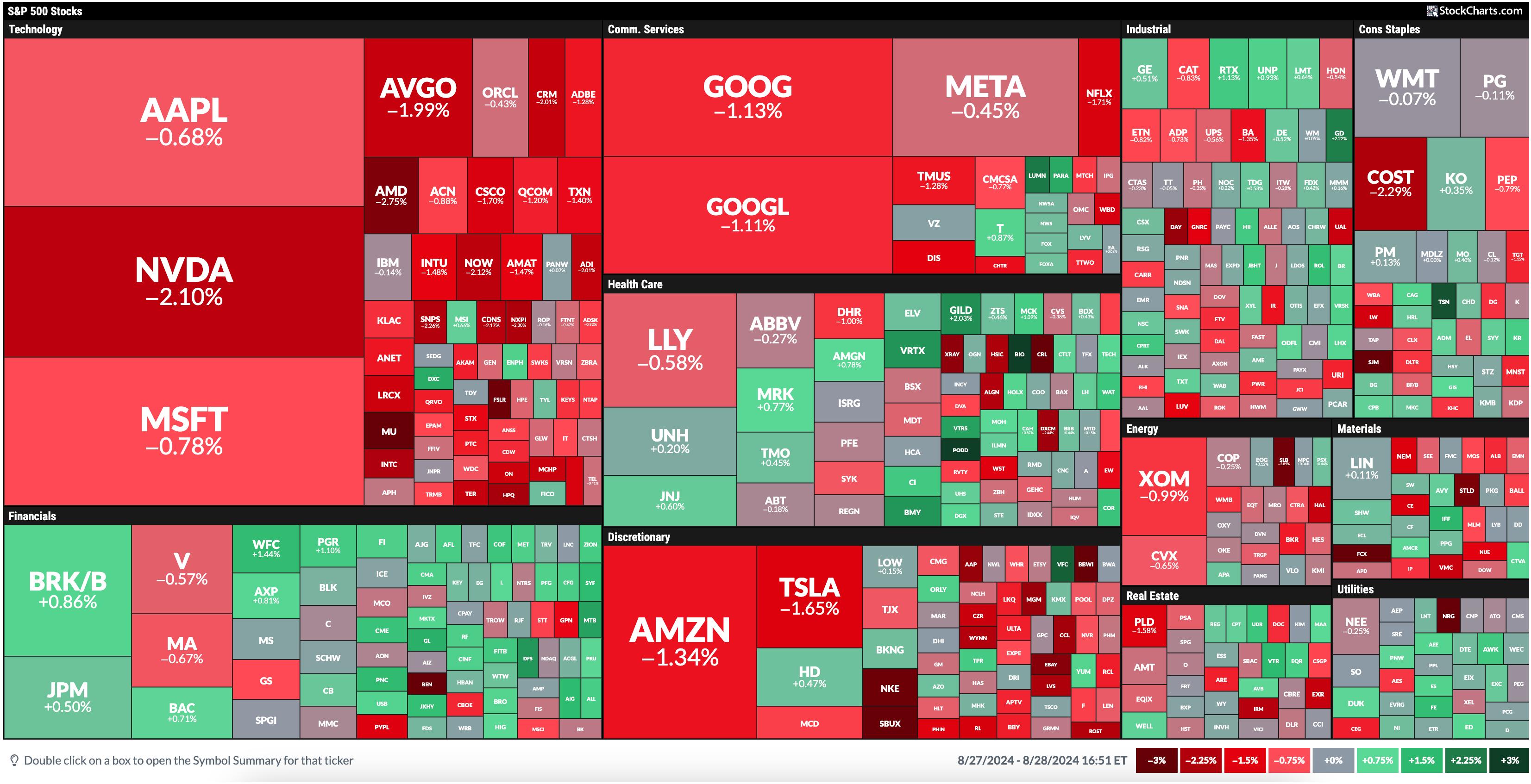

At this time’s MarketCarpet was a sea of pink with just some dabs of inexperienced. Financials took the lead, adopted by Well being Care and Utilities.

FIGURE 1. A SEA OF RED. At this time’s inventory market motion was dominated by promoting stress, however some sectors noticed extra shopping for.Picture supply: StockCharts.com. For academic functions.

The Expertise sector, yesterday’s chief, is on the backside at the moment. The three shares with the most important market cap on this sector, Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT), offered off, with NVDA buying and selling 2.10% decrease. That is forward of NVDA’s earnings, which have been reported after the shut. Although NVDA beat estimates and supplied sturdy steerage, the inventory was extraordinarily risky, with extra promoting stress.

Provided that NVDA makes up about 7% of the S&P 500 ($SPX) and eight% of the Nasdaq Composite ($COMPQ), the indexes comply with NVDA’s path. We’ll have to attend until tomorrow’s open to see if issues cool down.

Discovering Funding Alternatives

Within the meantime, let’s pinpoint areas within the inventory market that present stability. The one sector that stands out is Financials. In yesterday’s submit, the main target was on the Monetary Choose Sector SPDR Fund (XLF), which continues to hit all-time highs. The Financials quadrant in at the moment’s MarketCarpet exhibits that Uncover Monetary (DFS) led the pack with a 1.94% rise.

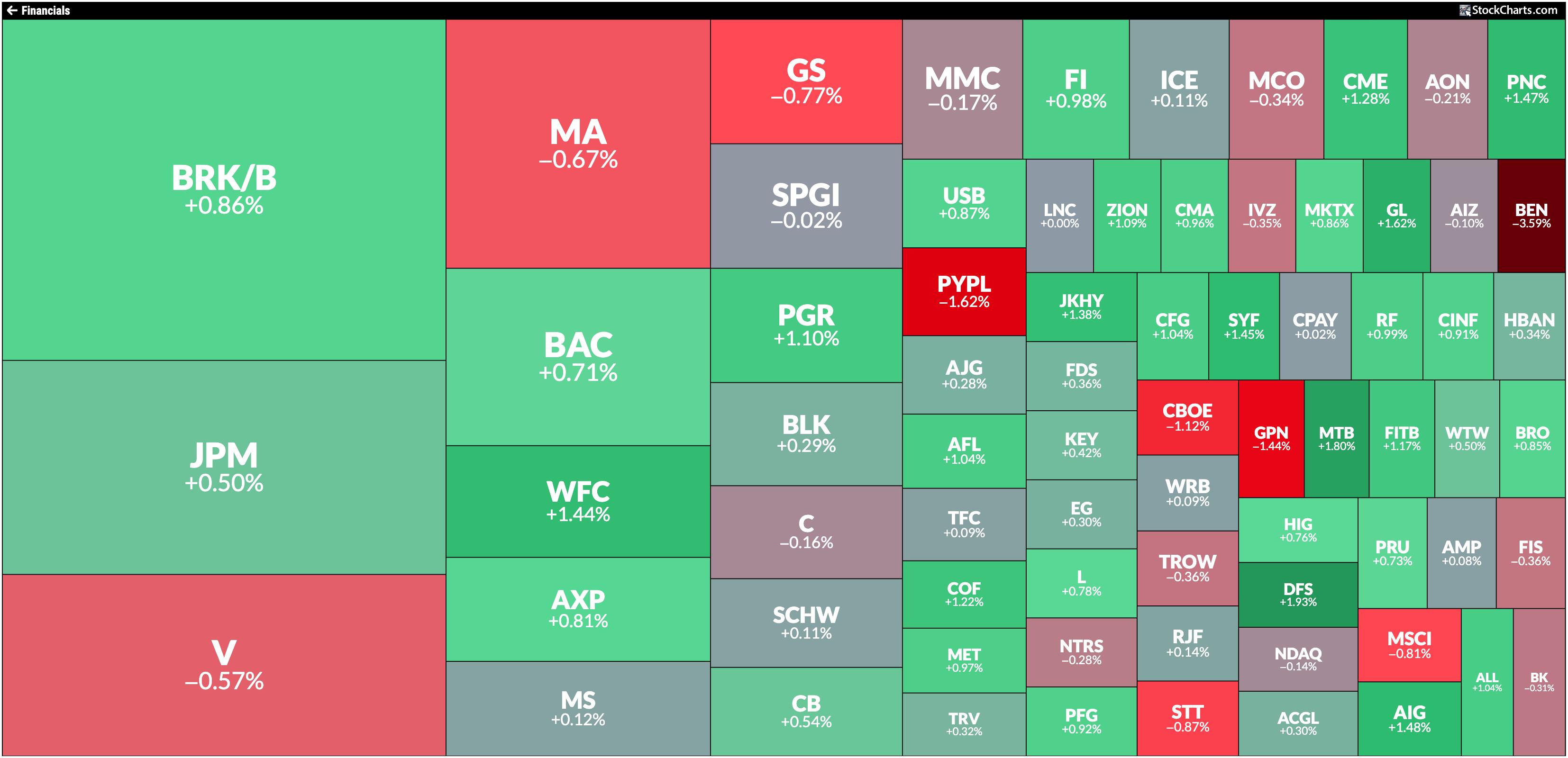

The day by day chart of XLF under exhibits that XLF is buying and selling above its 5-day exponential shifting common (EMA) and its 20-day easy shifting common (SMA).

FIGURE 2. DAILY CHART OF FINANCIAL SELECT SECTOR SPDR FUND (XLF). Relative to the SPDR S&P 500 Fund (SPY), XLF is beginning to acquire power. The ETF can be buying and selling above its one-week EMA and 20-day SMA.Chart supply: StockChartsACP. For academic functions.

Additionally, notice that, relative to the SPDR S&P 500 Fund (SPY), XLF is gaining power. It is now outperforming SPY by a modest 1.06%.

Whereas all the eye was on expertise, communication providers, and client discretionary shares, monetary shares have been quietly gaining power. Given the following FOMC assembly is a number of weeks away, XLF might proceed rising greater. After Fed Chair Jerome Powell’s speech in Jackson Gap on August 23, the place he prompt that the Fed is ready to chop rates of interest, XLF has persistently been hitting new all-time highs. With rate of interest cuts anticipated this yr—there is a chance of a goal price of 4.25%–4.5% by December in accordance with the CME FedWatch Device—consider how excessive XLF might go!

In the event you’re weary of investing in exchange-traded funds, contemplate deciding on a handful of shares within the Monetary sector. Click on the Financials header within the MarketCarpet to see the shares within the sector.

FIGURE 3. FINANCIAL SECTOR MARKETCARPET. The biggest squares signify the most important shares by market cap, whereas the darkest inexperienced squares signify shares with the most important positive factors.Picture supply: StockCharts.com. For academic functions.

On the Shut

The inventory market will be extraordinarily risky, particularly near huge earnings report releases. To keep away from getting caught up in all of the market noise, establish sectors which can be exhibiting stability. Proper now, it could be the Monetary sector. However that may change, so be versatile and, while you see issues altering, be ready to promote your positions.

StockCharts Tip.

StockCharts Tip.

Create a ChartList of the 11 sector ETFs StockCharts makes use of as sector proxies.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra