That is Bare Capitalism fundraising week. 259 donors have already invested in our efforts to fight corruption and predatory conduct, notably within the monetary realm. Please be part of us and take part by way of our donation web page, which exhibits the best way to give by way of test, bank card, debit card, PayPal, Clover, or Sensible. Examine why we’re doing this fundraiser, what we’ve completed within the final 12 months, and our present objective, supporting the commentariat.

Yves right here. This put up, with out giving a time-frame, confirms the warning given by former Israeli normal Yitzhak Birk, in a Haaretz op ed, that Israel would collapse in not more than a 12 months if the Axis of Resistance stored up its conflict of attrition towards Israel. Birk was referring extra to navy sustainment and rising inner schisms. However the deteriorating state of the financial system is yet one more strain level.

This piece if something understates the place issues are headed. First, it doesn’t tease out how the persevering with have to hold extra troopers mobilized will weigh on the financial system. Second, it doesn’t acknowledge the variety of Israelis who’ve left because the conflict began, which is a right away lack of each staff and demand. Take into account that many consider that tech staff, whose expertise are in excessive demand, are over-represented amongst those that’ve departed. It isn’t clear what number of would possibly return. The attraction of Israel was that it loved European dwelling requirements and was a supposed protected haven for Jews. If one or each stay in query, lots of those that fled could by no means return.

Third, one other supply of probably lasting harm is enterprise closures, which this text explains, not surprisingly, are important and anticipated to extend.

Lastly, this text skips over a subject lined by some hyperlinks in our Hyperlinks characteristic going stay shortly at the moment: that Israel is getting down to wreck what’s left of the West Financial institution’s financial system.

By Amr Saber Algarhi, Senior Lecturer in Economics, Sheffield Hallam College and Konstantinos Lagos, Senior Lecturer in Enterprise and Economics, Sheffield Hallam College. Initially revealed at The Dialog

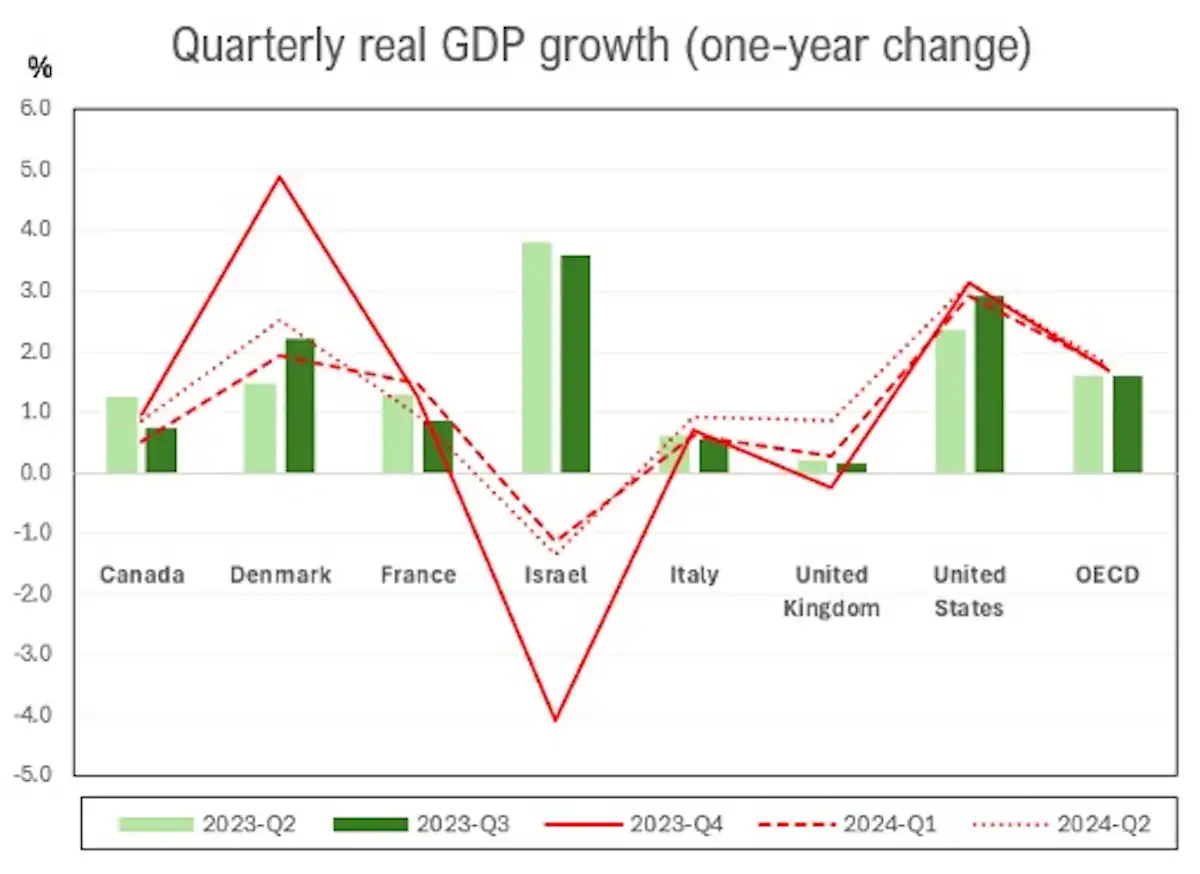

After 11 months of conflict, Israel is going through its greatest financial problem in years. Information exhibits that Israel’s financial system is experiencing the sharpest slowdown among the many wealthiest nations of the Organisation for Financial Cooperation and Growth (OECD).

Its GDP contracted by 4.1% within the weeks after the October 7 Hamas-led assaults. And the downturn continued into 2024, falling by a further 1.1% and 1.4% within the first two quarters.

This case won’t have been helped by a nationwide strikeon September 1 that, albeit very briefly, introduced the nation’s financial system to a standstill amid widespread public anger on the authorities’s dealing with of the conflict.

A graph displaying the quarterly GDP development for a number of OECD nations alongside the OECD common. Israel displays essentially the most excessive fluctuation, with a pointy decline between October and December 2023. Amr Saber Algarhi & Konstantinos Lagos / OECD, CC BY-ND

A graph displaying the quarterly GDP development for a number of OECD nations alongside the OECD common. Israel displays essentially the most excessive fluctuation, with a pointy decline between October and December 2023. Amr Saber Algarhi & Konstantinos Lagos / OECD, CC BY-ND

Israel’s financial challenges, in fact, pale compared to the full destruction of the financial system in Gaza. However the extended conflict remains to be hurting Israeli funds, enterprise investments and shopper confidence.

Israel’s financial system was rising quick earlier than the beginning of the conflict, thanks largely to its know-how sector. The nation’s annual GDP per capita rose by 6.8% in 2021 and 4.8% in 2022, far more than in most western nations.

However issues have since modified dramatically. In its July 2024 forecast, the Financial institution of Israel revised its development predictions to 1.5% for 2024, down from the two.8% it had predicted earlier within the 12 months.

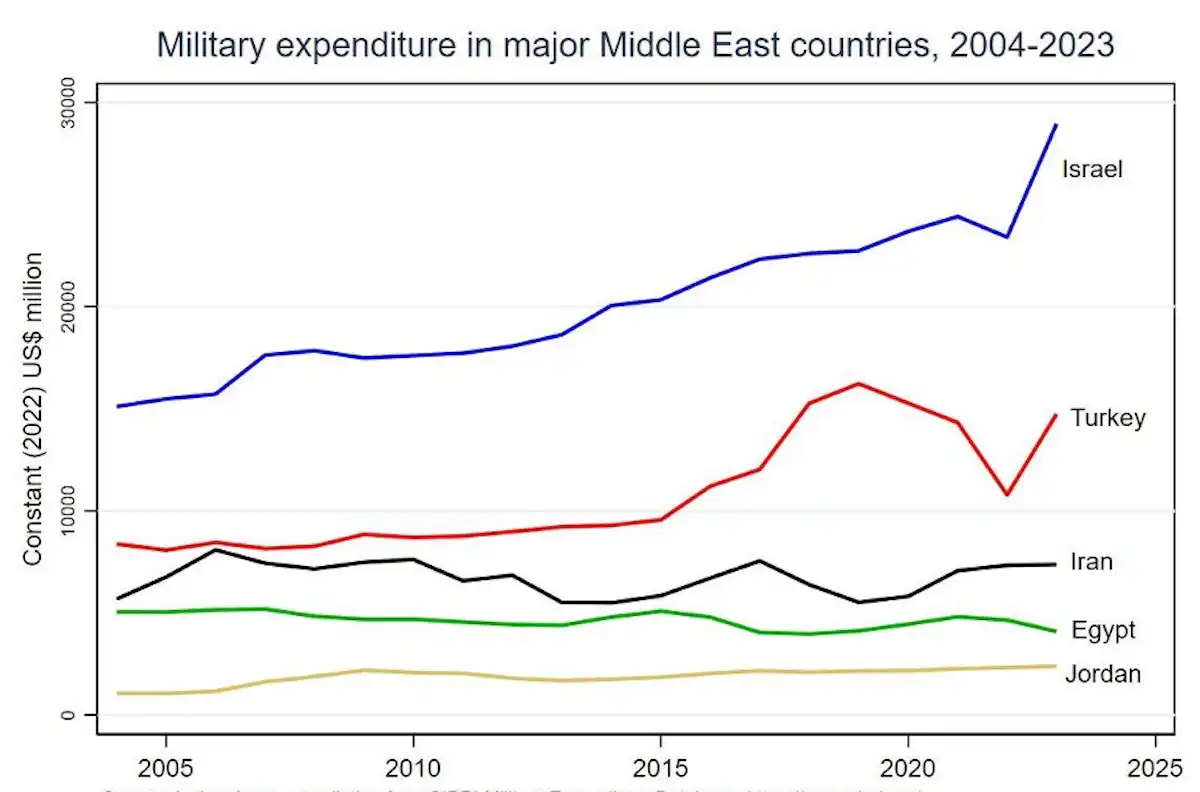

With the preventing in Gaza displaying no signal of letting up, and the battle with Hezbollah on the Lebanese border intensifying, the Financial institution of Israel has estimated that the conflict’s value will attain US$67 billion by 2025. Even with a US$14.5 billion navy assist bundlefrom the US, Israel’s funds might not be sufficient to cowl these bills.

Which means that Israel will face powerful selections about the best way to allocate its sources. It’d, for example, want to chop spending in some areas of the financial system or tackle extra debt. Extra borrowing will make mortgage repayments bigger and extra pricey to service sooner or later.

Israel’s deteriorating fiscal scenario has prompted massive credit standing companies to downgrade the nation’s standing. Fitch loweredIsrael’s credit score rating from A+ to A in August on the grounds that a rise in its navy spending had contributed to a widening of the fiscal deficit to 7.8% of GDP in 2024, up from 4.1% the 12 months earlier than.

It may additionally probably jeopardise Israel’s potential to keep up its present navy technique. This technique, which entails sustained operations in Gaza aimed toward destroying Hamas, requires boots on the bottom, superior weaponry and fixed logistical help – all of which come at an excellent monetary value.

Israel’s navy expenditure has persistently been the very best within the Center East area. Amr Saber Alarhi & Konstantinos Lagos / SIPRI Army Expenditure Database, CC BY-NC-ND

Other than macroeconomic indicators, the conflict has had a profound influence on particular sectors of Israel’s financial system. The development sector, for instance, slowed down by almost a 3rdwithin the first two months of the conflict. And agriculture has taken a success, too, with manufacturing down by 1 / 4 in some areas.

Roughly 360,000 reservists had been referred to as up at first of the conflict – although many have since returned dwelling. Greater than 120,000 Israeli have been compelled from their houses in border areas. And 140,000 Palestinian staff from the West Financial institution have not been allowed to enter Israel because the October 7 assaults.

The Israeli authorities has sought to fill the hole by bringing in staff from India and Sri Lanka. Nonetheless, many key jobs are certain to stay unfilled.

It’s estimated that as much as 60,000 Israeli corporations could have to shut in 2024 resulting from employees shortages, provide chain disruptions and waning enterprise confidence, whereas many corporations are suspending new initiatives.

Tourism, though not a key a part of Israel’s financial system, has additionally been severely affected. Vacationer numbers have dropped dramatically because the begin of the conflict, with one in ten innsthroughout the nation now going through the prospect of shutting down.

How this Struggle Impacts the Wider Area

The conflict could have battered Israel’s financial system. However the impact on the Palestinian financial system has been far worse and can take years to restore.

Many Palestinians dwelling within the West Financial institution have misplaced their jobs in Israel. And Israel’s determination to carry again a lot of the tax incomeit collects on behalf of Palestinians has left the Palestinian Authority strapped for money.

Commerce in Gaza has additionally floor to a halt, which suggests many Palestinians now depend on assist. Whereas, on the identical time, very important communication channels have been lower off and essential infrastructure has been destroyed.

The consequences of the conflict have stretched past simply Israel and Palestine. In April, the Worldwide Financial Fund stated it anticipated development within the Center East to be “lacklustre” in 2024, at simply 2.6%. It cited the uncertainty triggered by the conflict in Gaza and the specter of a full-blown regional battle as the rationale.

A flare-up in violence in Gaza has inflicted financial harm on a fair wider scale than this earlier than. Israel’s bombardment of Gaza in 2008, for instance, pushed up the value of oil by almost 8% and induced concern for markets everywhere in the world.

Israel’s conflict in Gaza, which is quick approaching its first anniversary, is taking a heavy financial toll. Solely a everlasting ceasefire can restore the harm and pave the way in which for restoration in Israel, Palestine and the broader area.