The Kalman Filter is an optimum algorithm used for smoothing knowledge by balancing predicted values and precise measured values. On this indicator, the Kalman Filter is utilized to clean value knowledge, with the flexibleness to decide on the enter knowledge (e.g., shut, open, excessive, or low costs). This customization permits customers to tailor the evaluation to their particular wants.

1. General Goal

The first objectives of the Kalman Filter are:

- Scale back noise in value knowledge: Eradicate random fluctuations to supply a extra secure sign.

- Detect developments: Spotlight market developments by combining predictions (from dynamic fashions) with precise measurements (customizable enter knowledge).

2. Step-by-Step Course of

Step 1: Initialization

The Kalman Filter begins with the next preliminary values:

- Estimate (Present State): The preliminary state is ready to the primary worth within the knowledge collection (e.g., the primary closing value or any user-selected enter).

- Prediction Error: Initialized with a excessive worth, reflecting the preliminary uncertainty of the system.

- Measurement Error: Proportional to the smoothing interval. An extended interval implies larger measurement error, reflecting that the info is much less dependable.

Step 2: Predict the Subsequent State

On this step, the Kalman Filter predicts the subsequent state primarily based on the present state:

- Predicted Worth: Derived from the present estimated state.

- Prediction Error: Stays largely unchanged at this stage, as no new knowledge has been launched but.

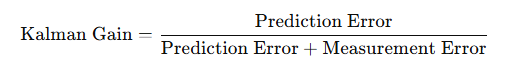

Step 3: Compute the Kalman Achieve

The Kalman Achieve is a weight that determines the affect of the expected worth versus the measured worth. It’s calculated utilizing the components:

- Significance:

- If Measurement Error is small (dependable knowledge), the Kalman Achieve is excessive, that means the measured worth has a larger affect.

- If Prediction Error is small (correct prediction), the Kalman Achieve is low, that means the prediction carries extra weight.

Step 4: Replace the Estimate

Utilizing the Kalman Achieve, the expected worth is adjusted primarily based on the discrepancy between the precise measurement and the expected worth:

- Measurement Distinction: That is the distinction between the precise enter worth (e.g., the chosen value kind) and the expected worth.

- Kalman Achieve: Determines how a lot the prediction must be corrected by the measurement.

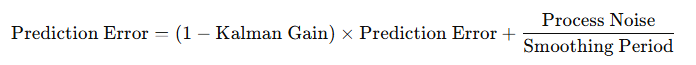

Step 5: Replace the Prediction Error

The prediction error is up to date and progressively decreases over time, reflecting growing confidence within the estimate:

- Course of Noise: Displays the uncertainty within the dynamic mannequin and is adjusted primarily based on the smoothing interval.

- The result’s a steadily reducing error, enhancing the soundness of the output sign.

3. How Kalman Filter Smooths Knowledge within the Indicator

The Kalman Filter balances two sources of data:

- Predicted Worth: The worth derived from the earlier state, representing a secure development.

- Measured Worth: The precise enter knowledge, which displays the most recent market situations (e.g., user-selected value kind).

- When the measured worth is noisy (excessive Measurement Error), the smoothed worth is much less influenced by the measurement.

- When the measured worth is secure (low Measurement Error), the smoothed worth rapidly adapts to the adjustments.

4. Particular Functions within the Indicator

- Customizable Enter: Customers can choose the enter knowledge kind (e.g., shut, open, excessive, low, hl2, hlc3, ohlc4, … costs) relying on the evaluation wants.

- Brief- and Lengthy-Time period Indicators: Two Kalman Filters are utilized concurrently for brief and lengthy smoothing durations:

- Brief-Time period: Reacts rapidly to short-term market fluctuations.

- Lengthy-Time period: Detects extra secure, long-term developments.

- Pattern Detection: The comparability between the 2 Kalman Filter outputs determines the market development:

- If the short-term sign is above the long-term sign, the development is upward.

- If the short-term sign is under the long-term sign, the development is downward.

5. Benefits of Kalman Filter within the Indicator

- Efficient Smoothing: Reduces random noise in value knowledge, producing a extra secure output sign.

- Versatile Customization: The power to decide on enter knowledge enhances evaluation versatility.

- Pattern Detection: Combining short- and long-term indicators gives a transparent identification of upward or downward developments.

- Fast Adaptation: Steady updates with new knowledge make sure the smoothed sign displays latest market adjustments.

6. Logic Abstract

The Kalman Filter on this indicator works by balancing predictions (stability) and precise measurements (sensitivity to alter). With customizable enter choices, customers can optimize the development detection course of to go well with their particular necessities. The Kalman Achieve acts as a dynamic weight, making certain that the output is each secure and responsive. The ensuing smoothed sign gives a dependable basis for figuring out developments in monetary markets.

—

Obtain the Kalman Pattern Ranges Scanner indicator utilizing the Kalman Filter logic above with built-in Scanner of foreign money pairs, time frames right here:

– for MT5: Kalman Pattern Ranges MT5 Scanner

– for MT4: Kalman Pattern Ranges MT4 Scanner