Overview

The LookAtTrend V2 EA is a sophisticated buying and selling instrument that automates trend-following methods, offering flexibility, management, and effectivity. This EA is appropriate for merchants in any respect ranges and consists of strong threat administration and commerce execution options.

We suggest utilizing the default enter values for a seamless expertise, however all settings are absolutely customizable to suit your particular buying and selling targets.

Detailed Parameter Descriptions

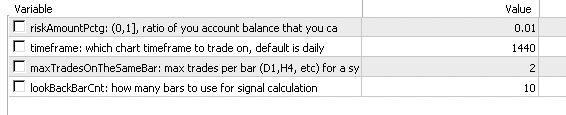

This EA helps 4 enter parameters for simplicity and to keep away from overfitting. Beneath is an in depth description.

1. Danger Proportion (riskAmountPctg)

-

Function: Specifies the proportion of your account stability to threat on a single commerce.

-

Vary: A optimistic decimal worth between 0.0 and 1.0, the place 1.0 represents 100% of your account stability.

-

Clarification: Growing the danger share can amplify potential returns, nevertheless it additionally considerably raises the chance of bigger losses. It’s important to decide on a threat stage that aligns along with your threat tolerance and buying and selling technique.

-

Instance: Suppose your account stability is $10,000, and also you set riskAmountPctg to 0.01 (1%). On this case, the EA will threat $100 per commerce. If the cease loss is triggered, the loss might be roughly $100, though precise outcomes could differ barely on account of elements similar to slippage or place dimension rounding (see MQL5 place sizing dialogue).

2. Timeframe

-

Function: Specifies the chart timeframe used for analyzing market developments and producing buying and selling indicators.

-

Clarification: The chosen timeframe determines the extent of element the EA makes use of to establish developments. A Day by day (D1) timeframe supplies a broader and extra steady view of market developments, making it very best for medium- to long-term methods. Shorter timeframes, similar to H1 or M15, can seize extra frequent, intraday developments however are sometimes extra liable to market noise.

Moreover, utilizing shorter timeframes can lead to a considerably greater variety of trades. Whereas this will likely improve alternatives, it additionally raises buying and selling prices on account of greater spreads and commissions, which might erode total profitability. -

Instance: Day by day (1440), H4 (240), H1(60), and many others

-

Notice: Throughout backtesting, set the interval to Day by day.

3. Max Trades Per Bar (maxTradesOnTheSameBar)

-

Function: Limits the variety of trades the EA can open for a given instrument in a single bar (Day, H4, H1, and many others).

-

Vary: Any optimistic integer (e.g., 1, 2, 5, and many others.).

-

Clarification: Setting a restrict on trades per bar helps keep buying and selling self-discipline and reduces the danger of over-trading, particularly in risky market circumstances. A decrease worth, similar to 2, focuses on high-quality commerce alternatives, making it a conservative and risk-averse alternative. However, a better worth permits the EA to seize extra buying and selling alternatives, which can improve potential income. Nevertheless, this additionally comes with greater publicity to losses, as extra trades inherently imply extra possibilities of encountering unfavorable outcomes. It’s important to strike a stability that aligns along with your buying and selling technique and threat tolerance.

-

Instance: Suppose you set the interval to 1440 (every day) and maxTradesOnTheSameBar to 2, then it means at most 2 trades might be positioned per day for a given instrument (eg, XAUUSD)

4. Look-Again Bars (lookBackBarCnt)

-

Function: Determines the variety of historic bars the EA analyzes to establish developments.

-

Vary: Any optimistic integer (e.g., 5, 10, 20, and many others.).

-

Clarification: The look-back interval performs a vital position in shaping the EA’s sensitivity to market developments. A shorter look-back interval (e.g., 5 bars) permits the EA to reply extra rapidly to latest value actions, leading to extra frequent trades. Whereas this will likely seize extra alternatives, it could additionally result in greater buying and selling prices on account of elevated commissions and spreads, and probably extra losses if market circumstances are uneven.

Conversely, an extended look-back interval (e.g., 20 bars) smooths out market noise and focuses on stronger, extra established developments. This sometimes leads to fewer trades, lowering buying and selling prices however probably lacking out on shorter-term alternatives.

Backtesting Suggestions

To judge the EA’s efficiency, we suggest testing it with the next devices:

-

XAUUSD (Gold)

-

BTCUSD (Bitcoin)

-

JPN225 (Nikkei 225)

-

GBPJPY

For an entire record of examined portfolio symbols and configurations, buy the EA and speak to us by way of direct message.

Contact us at: haylookatus@gmail.com

Checkout our product right here.