On this article, we mentioned the elemental steps required to craft and develop an knowledgeable advisor (EA) rooted within the Truthful Worth Hole (FVG) technique, enhanced by the Good Cash idea strategy. This journey merged artwork and science, demanding a dealer’s capability to research candlestick patterns and visualize idea ranges successfully. We unraveled the mysteries of good cash and harnessed its transformative energy inside the realm of algorithmic buying and selling. Our EA growth journey lined important matters such because the imbalance definition, buying and selling technique description, technique blueprint, MQL5 buying and selling system, and technique tester outcomes.

Instance:

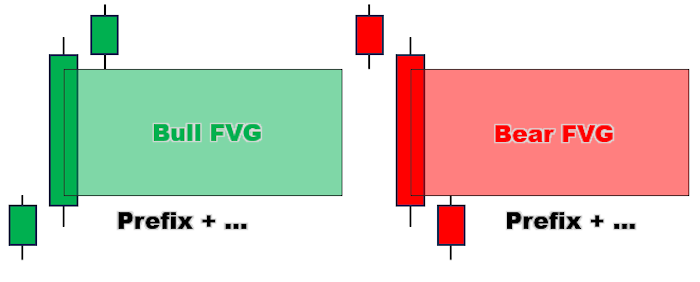

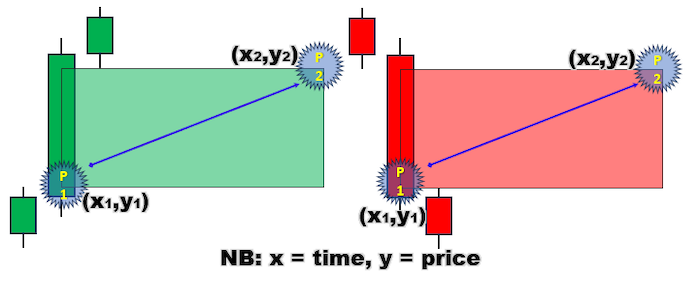

We first explored the Truthful Worth Hole (FVG) to spotlight the imbalances brought on by shopping for and promoting pressures during times of excessive volatility. These imbalances manifested as vital uni-directional actions out there, typically characterised by lengthy candlesticks. By figuring out these gaps, we exploited potential buying and selling alternatives and created a strong technique. We mentioned the strategies for recognizing FVGs on worth charts, specializing in figuring out massive candlesticks and inspecting adjoining ones to find out the honest worth variations.

Instance of illustrative figures used is as beneath:

Our FVG buying and selling technique built-in honest worth assessments with candlestick imbalances to determine buying and selling alternatives. We carried out complete analyses, using patterns akin to bullish and bearish engulfing and doji, to find out market sentiment and potential shifts in momentum. Entry and exit alerts have been executed primarily based on the recognized honest worth gaps and vital candlestick imbalances, with danger administration methods employed to mitigate potential losses. The technique distinguished between bearish and bullish FVGs, every indicating completely different market circumstances and buying and selling alternatives.

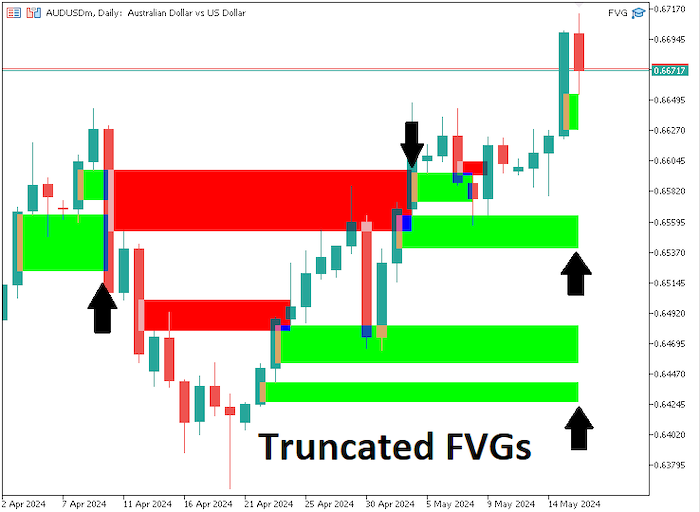

After outlining the technique, we developed an in depth blueprint to commerce the FVG technique successfully. This concerned figuring out bullish or bearish candlesticks with vital worth actions and assessing neighboring candles. As soon as an FVG was recognized, it was documented within the algorithm, and visible cues have been added to the chart for straightforward identification. Trades have been executed primarily based on predefined circumstances, with particular take revenue and cease loss ranges set to keep up a good risk-to-reward ratio.

Instance of visible cues thought-about for straightforward identification:

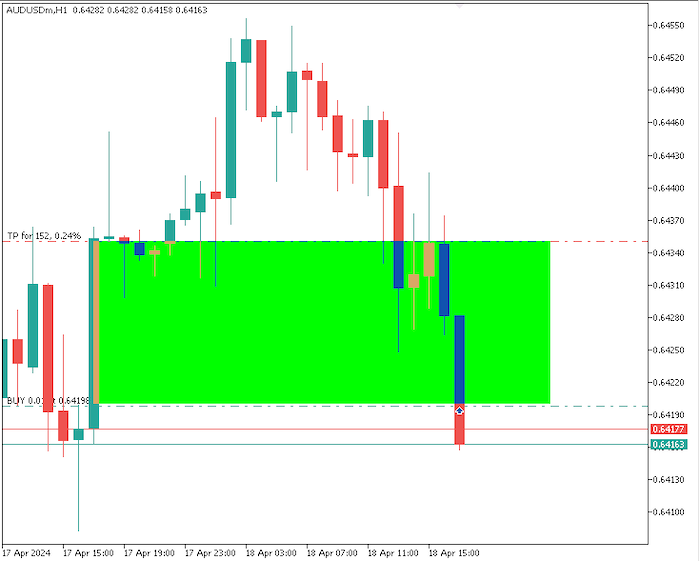

Lastly, we automated the FVG buying and selling technique by crafting an Knowledgeable Advisor (EA) in MQL5 for MetaTrader 5. The MetaQuotes Language Editor surroundings was used to write down the EA, incorporating all of the theoretical features mentioned.

Pattern of the code used of their identification is as beneath:

for (int i=0; i<=visibleBars; i++){ double low0 = iLow(_Symbol,_Period,i); double high2 = iHigh(_Symbol,_Period,i+2); double gap_L0_H2 = NormalizeDouble((low0 - high2)/_Point,_Digits); double high0 = iHigh(_Symbol,_Period,i); double low2 = iLow(_Symbol,_Period,i+2); double gap_H0_L2 = NormalizeDouble((low2 - high0)/_Point,_Digits); bool FVG_UP = low0 > high2 && gap_L0_H2 > minPts; bool FVG_DOWN = low2 > high0 && gap_H0_L2 > minPts; if (FVG_UP || FVG_DOWN){ Print("Bar Index with FVG = ",i+1); datetime time1 = iTime(_Symbol,_Period,i+1); double price1 = FVG_UP ? high2 : high0; datetime time2 = time1 + PeriodSeconds(_Period)*FVG_Rec_Ext_Bars; double price2 = FVG_UP ? low0 : low2; string fvgNAME = FVG_Prefix+"("+TimeToString(time1)+")"; shade fvgClr = FVG_UP ? CLR_UP : CLR_DOWN; CreateRec(fvgNAME,time1,price1,time2,price2,fvgClr); Print("Previous ArraySize = ",ArraySize(totalFVGs)); ArrayResize(totalFVGs,ArraySize(totalFVGs)+1); ArrayResize(barINDICES,ArraySize(barINDICES)+1); Print("New ArraySize = ",ArraySize(totalFVGs)); totalFVGs[ArraySize(totalFVGs)-1] = fvgNAME; barINDICES[ArraySize(barINDICES)-1] = i+1; ArrayPrint(totalFVGs); ArrayPrint(barINDICES); } } for (int i=ArraySize(totalFVGs)-1; i>=0; i--){ string objName = totalFVGs[i]; string fvgNAME = ObjectGetString(0,objName,OBJPROP_NAME); int barIndex = barINDICES[i]; datetime timeSTART = (datetime)ObjectGetInteger(0,fvgNAME,OBJPROP_TIME,0); datetime timeEND = (datetime)ObjectGetInteger(0,fvgNAME,OBJPROP_TIME,1); double fvgLOW = ObjectGetDouble(0,fvgNAME,OBJPROP_PRICE,0); double fvgHIGH = ObjectGetDouble(0,fvgNAME,OBJPROP_PRICE,1); shade fvgColor = (shade)ObjectGetInteger(0,fvgNAME,OBJPROP_COLOR); Print("FVG NAME = ",fvgNAME," >No: ",barIndex," TS: ",timeSTART," TE: ", timeEND," LOW: ",fvgLOW," HIGH: ",fvgHIGH," CLR = ",fvgColor); for (int ok=barIndex-1; ok>=(barIndex-FVG_Rec_Ext_Bars); k--){ datetime barTime = iTime(_Symbol,_Period,ok); double barLow = iLow(_Symbol,_Period,ok); double barHigh = iHigh(_Symbol,_Period,ok); if (ok==0){ Print("OverFlow Detected @ fvg ",fvgNAME); UpdateRec(fvgNAME,timeSTART,fvgLOW,barTime,fvgHIGH); break; } if ((fvgColor == CLR_DOWN && barHigh > fvgHIGH) || (fvgColor == CLR_UP && barLow < fvgLOW) ){ Print("Minimize Off @ bar no: ",ok," of Time: ",barTime); UpdateRec(fvgNAME,timeSTART,fvgLOW,barTime,fvgHIGH); break; } }

We additionally examined it and we acquired the beneath outcomes:

This automation streamlined the buying and selling course of, permitting for environment friendly execution and monitoring of trades. By this journey, we geared up merchants with the instruments and data wanted to harness the potential of the Truthful Worth Hole technique on the earth of algorithmic buying and selling.

Detailed explanations might be present in Learn to commerce the Truthful Worth Hole (FVG)/Imbalances step-by-step: A Good Cash idea strategy. We do hope you will see that the article detailed and simple to know. Thanks. Cheers to many extra coming our means.