Scalping is a buying and selling technique that focuses on making small income repeatedly over very quick time frames.

The 5-minute scalping technique is designed for merchants aiming for fast exchanges in risky markets reminiscent of Foreign exchange, shares, and cryptocurrencies. This information will break down the important thing parts of this technique into seven detailed sections:

- Understanding Scalping,

- Core Ideas of the Technique,

- Important Instruments and Software program,

- Step-by-Step Execution Strategies,

- Superior Suggestions for Optimum Scalping,

- Widespread Errors to Keep away from, and eventually,

- Complete Conclusion.

By the tip of this text, you’ll be geared up with the data to successfully implement the perfect 5-minute scalping technique.

Understanding Scalping

Definition and Evolution of Scalping

Scalping includes executing quite a few trades inside quick time frames, usually only a few minutes, to use minor value actions. The follow has developed with market know-how, permitting merchants to make use of algorithmic programs and complex methods that capitalize on fleeting alternatives.

Our product delves into the idea of scalping, which includes executing quite a few trades inside quick time frames to capitalize on minor value fluctuations, enhanced by market know-how with algorithmic programs and complex methods.Do not forget to verify the hyperlink for extra particulars!

The Energy of the 5-Minute Time Body

The5-minute body gives a balanced method, permitting merchants to understand fast income whereas decreasing publicity to sudden market shifts. This timeframe is perfect for merchants seeking to leverage each intraday value volatility and information occasions which may influence asset costs quickly.

Traits of Appropriate Markets

Scalping is handiest in markets characterised by excessive liquidity, tight spreads, and vital volatility. Merchants ought to deal with:

- Foreign exchange Pairs: EUR/USD, GBP/USD, AUD/USD are fashionable for scalping on account of their excessive liquidity.

- Inventory Indices: S&P500 and NASDAQ supply excessive buying and selling quantity, permitting fast transactions.

- Cryptocurrencies: Bitcoin and Ethereum stand out on account of their inherent volatility but liquidity.

Core Ideas of the5-Minute Scalping Technique

Mastering Technical Evaluation

Technical evaluation is important for scalpers. Merchants ought to deal with particular strategies like:

Assist and Resistance Ranges: Figuring out important ranges can inform entry and exit selections.

Candlestick Patterns: Recognizing candlestick formations like dojis or hammers can sign potential reversals

When you’re desperate to elevate your buying and selling recreation and uncover highly effective methods for fulfillment, do not miss our in-depth article on scalping methods! It is full of insights that may considerably improve your buying and selling method. Test it out now and take your expertise to the subsequent degree!

Superior Entry and Exit

TechniquesTraders should use a mixture of alerts for efficient entries and exits, together with:

Breakout Methods:

Getting into when a value surpasses a resistance degree (or falls under help) signifies sturdy momentum.

Indicator-based Alerts:

Using indicators like MACD for convergence/divergence or Stochastic Oscillator for oversold/overbought situations can improve accuracy.

Complete Threat Administration

Threat administration methods should be flawless for scalpers, together with:

Dynamic Cease-loss Settings: Utilizing trailing stops can defend income as trades transfer favorably.

Place Sizing: Calculating the suitable place measurement primarily based on account measurement and threat urge for food ensures losses are minimized.

Important Instruments and Software program

for Scalping

Deciding on Optimum Buying and selling Platforms

Selecting the best buying and selling platform is essential for scalping. Search for platforms that supply options reminiscent of:

Quick Order Execution:

Milliseconds will be the distinction between revenue and loss.

Person-friendly Interface:

A transparent structure helps in fast decision-making.

Analytical Instruments and Buying and selling Software program

Superior software program options can considerably bolster buying and selling selections. Options to contemplate embrace:

Actual-Time Information and Execution:

Accessing real-time information ensures that value actions are tracked precisely.

Charting Instruments:

Important Charting Instruments and Indicators

Quantity Indicators:

Monitoring quantity helps to substantiate breakout sustainability.

Exponential Shifting Averages (EMA):

Notably short-term EMAs can be utilized to establish tendencies rapidly.

Step-by-Step Execution Strategies

Pre-Buying and selling Evaluation:

The significance of preparation can’t be overstated. Merchants ought to conduct thorough pre-trading evaluation by reviewing:-

Financial Calendars:

Being conscious of scheduled financial occasions can forestall unplanned volatility.

Dwell Market Sentiment:

Gauging market sentiment can assist in decision-making for information releases.

Execution Precision

As soon as a method is in place, deal with executing trades appropriately. Key concerns embrace:

Restrict and Market Orders:

Understanding when to make use of restrict vs. market orders can have an effect on entry costs.

Speedy Response to Worth Motion:

Being ready to behave as costs method pre-determined help and resistance ranges is essential.

Successfully monitoring trades post-execution aids in well timed changes. Use alerts and notifications to stay conscious of market shifts.

Indicators that may be taken benefit of

Candlestick Charts

Though resembling a bar chart, every candlestick encapsulates 4 key information factors for the day: the opening and shutting costs within the strong physique, together with the best and lowest costs within the “candle wick.” Being wealthy in data, it usually illustrates buying and selling tendencies over transient timeframes, usually spanning a number of days or buying and selling classes.

Candlestick charts are primarily utilized within the technical evaluation of inventory and foreign money value patterns. Merchants make use of them to evaluate potential value actions primarily based on historic patterns, utilizing the opening value, closing value, excessive, and low for that point interval. They’re visually much like field plots, though field plots convey totally different data.

Shifting common

Analysts use shifting averages to evaluate help and resistance by analyzing an asset’s value actions, reflecting its previous value motion.

Analysts and buyers use shifting averages to foretell potential value instructions. It’s thought of a lagging indicator because it follows the asset’s value motion to generate alerts or point out tendencies.

Forms of Shifting Averages

The Easy Shifting Common (SMA)

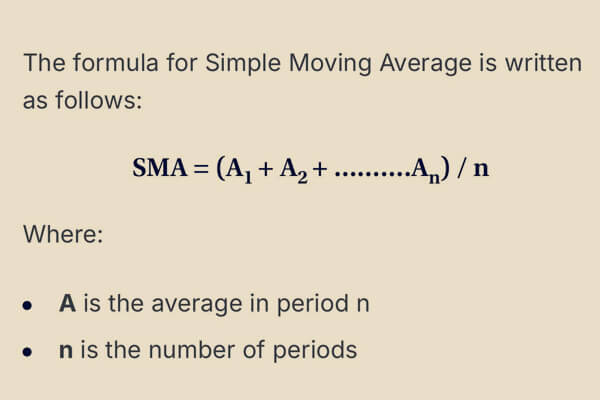

The Easy Shifting Common (SMA) is an easy technical indicator calculated by summing latest information factors and dividing by the variety of time intervals. Merchants use the SMA to generate alerts for getting into or exiting the market. This indicator is backward-looking, counting on previous value information, and will be computed for various kinds of costs, together with excessive, low, open, and shut.Analysts and buyers use the SMA to find out purchase and promote alerts for securities and establish help and resistance ranges. To generate the SMA, merchants first add costs over a selected interval after which divide the overall by the variety of intervals. This data is then plotted on a graph.

Sarah, needs to calculate the easy shifting common for Inventory XYZ by analyzing the closing costs of the inventory for the final seven days. The closing costs for Inventory XYZ for the final seven days are as follows: $30, $31, $30.50, $32, $33, $34, and $35.The SMA is then calculated as follows:SMA = ($30 + $31 + $30.50 + $32 + $33 + $34 + $35) /7SMA = $32.07Therefore, the easy shifting common for Inventory XYZ during the last seven days is $32.07.

Exponential Shifting Common (EMA)

The Exponential Shifting Common (EMA) provides extra weight to latest costs, making it extra conscious of short-term value modifications in comparison with the Easy Shifting Common (SMA), which applies equal weight to all value modifications over a specified interval.**

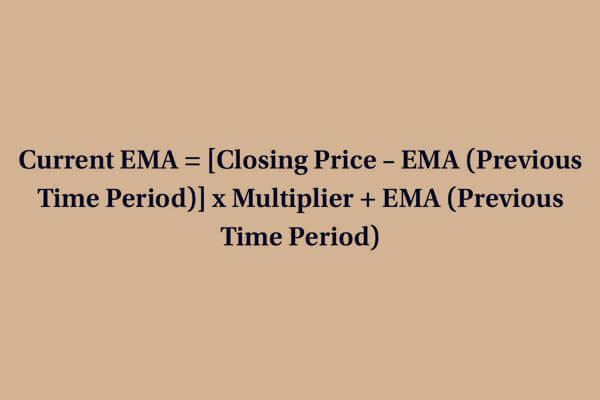

Steps to Calculate EMA:

1. Calculate the Easy Shifting Common (SMA) for the chosen interval:

The EMA wants a place to begin, which is the SMA. The SMA is obtained by summing the closing costs over the interval and dividing by the variety of intervals.

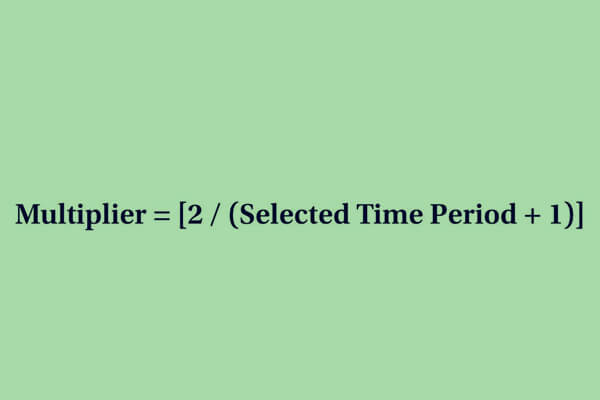

2. Calculate the multiplier for weighting the EMA:

The method for calculating the multiplier is:

For exsmple if time interval in query is 10 . The multiplier

3. The present EMA is computed utilizing the method:

The weighting given to latest value information is increased for a shorter-period EMA than for a longer-period EMA. For example, an EMA over 10 intervals has a better multiplier (18.18%) utilized to latest costs in comparison with a 20-period EMA, which has a multiplier of9.52%.

The relative power index (RSI)

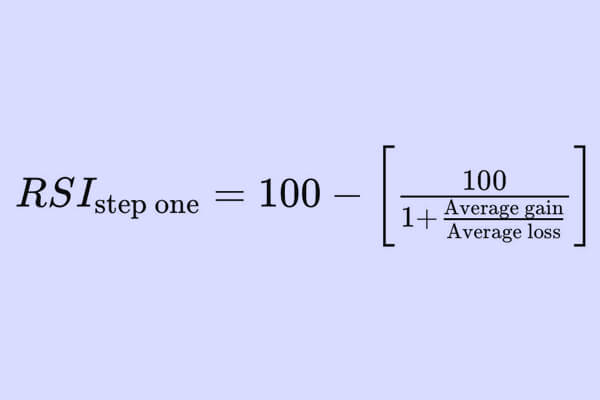

The relative power index (RSI) is a momentum gauge utilized in technical evaluation. RSI assesses the rate and extent of a safety’s latest value fluctuations to establish overbought or oversold situations within the value of that safety.

The RSI is offered as an oscillator (a line chart) on a variety from zero to100. The indicator was created by J. Welles Wilder Jr. and unveiled in his groundbreaking1978 publication, New Ideas in Technical Buying and selling Techniques.

Your Navigator within the Ocean of Market Fluctuations! (RSI)

Measuring RSI

The RSI employs a two-step computation that begins with the next equation:

As soon as there are14 intervals of information accessible, the next computation will be carried out. Its goal is to refine the outcomes in order that the RSI solely approaches100 or zero in a considerably trending market.

As you may observe within the chart above, the RSI indicator can stay within the overbought zone for extended durations whereas the inventory is experiencing an upward development. The indicator may additionally persist within the oversold space for an prolonged time when the inventory is present process a downward development. This may be perplexing for novice analysts, however gaining an understanding of easy methods to make the most of the indicator inside the framework of the present development will elucidate these issues.

Overbought / Oversold

Overbought or Oversold Circumstances in RSI

RSI Ranges:

An RSI above 70 signifies overbought, suggesting a possible value correction.

An RSI under 30 signifies oversold, implying a possible value rebound.

Overbought: A safety is overbought when its value exceeds its true worth, usually prompting merchants to promote on account of anticipated value declines.

Oversold: A safety is oversold when it trades under its true worth, main merchants to contemplate shopping for in anticipation of a value improve.

Buying and selling Implications:

For overbought situations, merchants might promote or take income.

For oversold situations, merchants might purchase, aiming for a possible rebound.In abstract, RSI helps merchants establish overbought and oversold situations, guiding their shopping for and promoting selections.

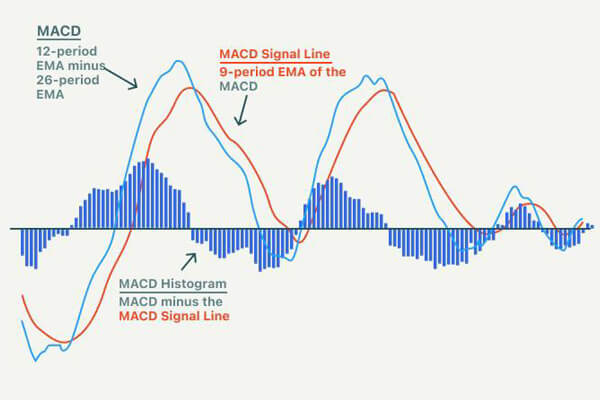

The Shifting Common Convergence Divergence (MACD)

The MACD (Shifting Common Convergence Divergence) indicator is a well-liked buying and selling device utilized in technical evaluation to establish potential purchase and promote alerts. This is easy methods to use it:

1.the Parts

MACD Line : The distinction between the12-day and26-day exponential shifting averages (EMAs).

Sign Line: A 9-day EMA of the MACD Line.