The Backtest Simulator is a buying and selling panel which lets you execute and deal with your trades. It visualized the order entries to make your buying and selling as clean as doable in Technique Tester.

Many merchants need to take a look at their methods manually in Technique Tester mode with historic knowledge, in MetaTrader 5 they haven’t any entry to handle the orders manually. I created this Utility to can handle the trades in Tester mode manually.

There are quite a lot of built-in capabilities to handle the orders like stay mode. They are going to be described later on this handbook.

MT5 obtainable right here: https://www.mql5.com/en/market/product/107411

Key Options:

- Guide Buying and selling: Seamlessly execute handbook trades throughout the Technique Tester mode, together with Purchase by Market, Promote by Market, Promote Restrict, Purchase Restrict, Purchase Cease and Promote Cease orders.

- Customization: Set parameters equivalent to Quantity Lot Measurement, Entry Worth, Stoploss (in factors), and Takeprofit (in factors) to tailor your buying and selling technique exactly.

- Danger Administration: You may set the Order/Place rely upon Fastened Worth Or Share of Steadiness of account, and Fastened Lot Measurement.

- Order Administration: Simply handle your positions and orders with actions like closing every place individually, canceling every order, closing all positions, or canceling all orders.

- Versatile Testing: Backtest Simulator helps testing on historic knowledge for any SYMBOLS and MARKETS, permitting you to evaluate your methods throughout varied buying and selling devices.

- Danger Reward Ratio: In present model you should utilize the Danger Reward Ratio(RRR) to set the Takeprofit value rely upon Stoploss value routinely.

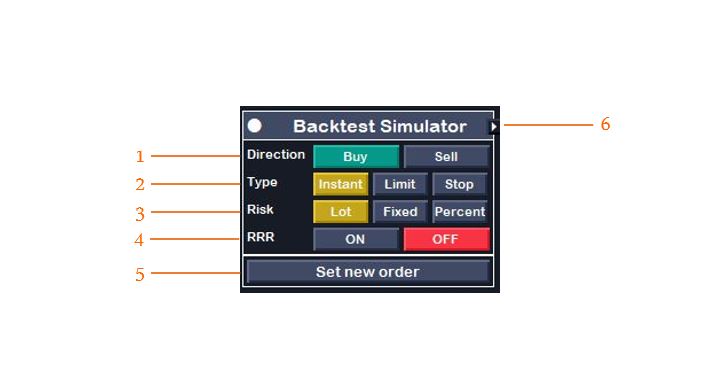

Settings Panel:

In Settings Panel we will handle the kind of order. I has some choices to deal with the all various kinds of orders in Meta Dealer.

- Course: Right here you may select the open commerce should be Purchase or Promote.

- Kind: on this choice you may choose the kind of order.

- Immediate Order: The order execute by value of market at execution time.

- Restrict Order: This can be a pending Restrict Order, you may choose the entry value as you need.

- Cease Order: This can be a pending Cease Order, you may choose the entry value as you need.

- Danger: On this choice you may choose the danger kind.

- Lot: the commerce will open by lotsize quantity that you just set.

- Fastened: the commerce will open by quantity that’s comparable to mounted value that you just set.

- Share: the commerce will open by quantity that’s comparable to share of your whole stability in account.

- RRR: On this choice you may lively/deactive the Danger Reward Ratio choice. When is ON, you may select the ration of TP/SL, in any other case these are free to set any worth and ratio.

- New Order Button: If you press the brand new order button, you may see the management buttons to set the values of every of every above Settings and Execute Order Button.

- Orders Panel: In case you press this button, then you may see the lively orders. (This panel introduce in proceed)

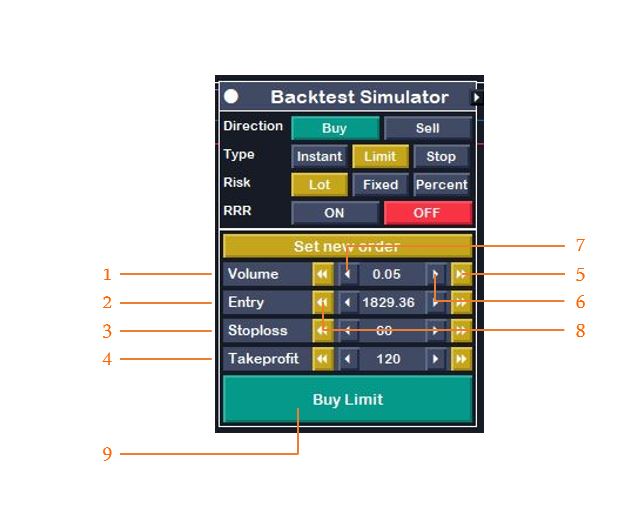

Management Panel:

On this panel you may select the values of every above settings panel. The controls will proven rely upon settings that you just chosen.

- Quantity: On this management you may choose the amount of order. Notice: In case you select Lot in Danger Setting Panel, then right here you see quantity, if select Fastened, then right here you see Funds, and at last if select Share then you definately see Share management.

- Entry: This management is beneficial for pending orders. In case you select Immediate, then this feature not proven and you’ll’t set the entry value and entry value set by market routinely.

- Stoploss: This feature set the stoploss distance from entry level in factors. In case you do not need to set the stoploss can set it as zero.

- Takeprofit: This feature set the takeprofit distance from entry level in factors. In case you lively the RRR choice, then right here you may set the ratio.

- Quick Ahead: It is one of many management buttons to extend the worth of enter with bigger values.

- Gradual Ahead: It is one of many management buttons to extend the worth of enter with smaller values.

- Gradual Backward: It is one of many management buttons to lower the worth of enter with smaller values.

- Quick Backward: It is one of many management buttons to lower the worth of enter with bigger values.

- Execution Button: If you press this button, utility learn the Settings and Management Values and attempt to create a brand new commerce with described values.

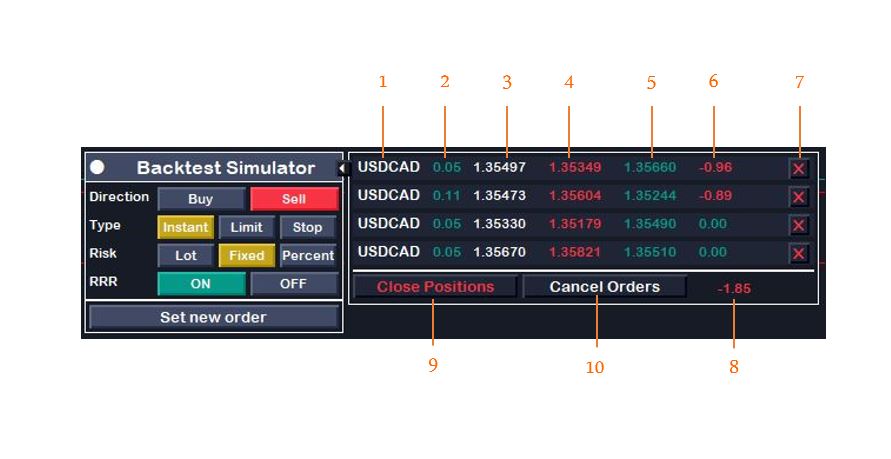

Orders Panel:

On this panel you may see the lively positions/orders and handle them.

- Image identify: The identify of image of place/order is proven.

- Quantity: The lot dimension of place/order is proven:

- Entry Worth: The entry value of place/order is proven.

- Stoploss: The stoploss value of place/order is proven.

- Takeprofit: The takeprofit value of place/order is proven.

- Revenue: The revenue/lack of place/order is proven.

- Shut/Cancle Button: If press the place/order will probably be closed.

- Whole Revenue: The whole revenue/lack of all lively positions/orders is proven.

- Shut All Positions Button: If press all of the lively positions will shut.

- Cancel All Orders Button: If press all of the orders will cancel.

Notice: Positions are lively trades, Orders are pending.

You may obtain this Utility right here.

When you have any concept or suggestion about subsequent model please remark it under.