Supply: The School Investor

In the event you’re searching for free on-line tax software program, Money App Taxes is the solely service providing actually free federal and state submitting to all customers.

Whereas it doesn’t have all the bells and whistles of the premium-priced TurboTax, it may deal with the commonest conditions, together with investments and taxes for your online business or facet hustle.

After a major enchancment final 12 months, Money App Taxes is up to date once more for modifications to the tax code for 2024 taxes (filed in 2025).

The next Money App Taxes assessment breaks down the whole lot you have to learn about doing all your taxes with this no-cost platform. If you wish to see how Money App Taxes compares to different DIY tax prep choices, try our prime tax software program picks for 2025.

Money App Taxes – Is It Actually Free?

Sure, Money App Taxes is 100% free and would not have any paid tiers. If Money App Taxes helps your wants, which it does for most individuals, you gained’t must enter a bank card quantity or pay for any upsells.

Some tax filers, similar to those that labored in a number of states or earned overseas revenue, could not qualify to make use of Money App Taxes. It additionally doesn’t assist state tax filings in Montana, New Hampshire, Tennessee, or Washington for those who’re required to file there. Customers get free entry to the software program in alternate for downloading the Money App and making a Money App account.

Money App, previously often called Sq. Money, presents peer-to-peer cash transfers just like PayPal and Venmo. Block, Inc., the corporate behind the Sq. ecosystem of cost, payroll, and enterprise merchandise, owns Money App and Money App Taxes.

Actually, if you’ll be able to use Money App Taxes, you need to. You may’t beat free tax submitting!

What’s New In 2025?

Money App Taxes has been a part of Money App for a number of years (beforehand it was Credit score Karma Tax). It underwent some vital updates final 12 months and nonetheless makes it simple for most individuals to finish and file their taxes utterly free.

Money App Taxes nonetheless doesn’t work for filers needing to do taxes in a number of states, together with for those who moved to a brand new state mid-year. We additionally seen that it doesn’t deal with underpayment penalty calculations, which might be problematic for some filers, notably self-employed enterprise house owners and freelancers.

When you can’t import funding information, you may import a W-2 if a qualifying accomplice payroll firm handles your W-2.

Updates for the 2025 tax season are commonplace throughout all tax submitting apps. These embody new tax brackets, limits for deductions and credit, and different modifications to the tax code, similar to expanded Ok-1 types for on-line sellers.

You will discover the complete rankings of the Finest Tax Software program right here.

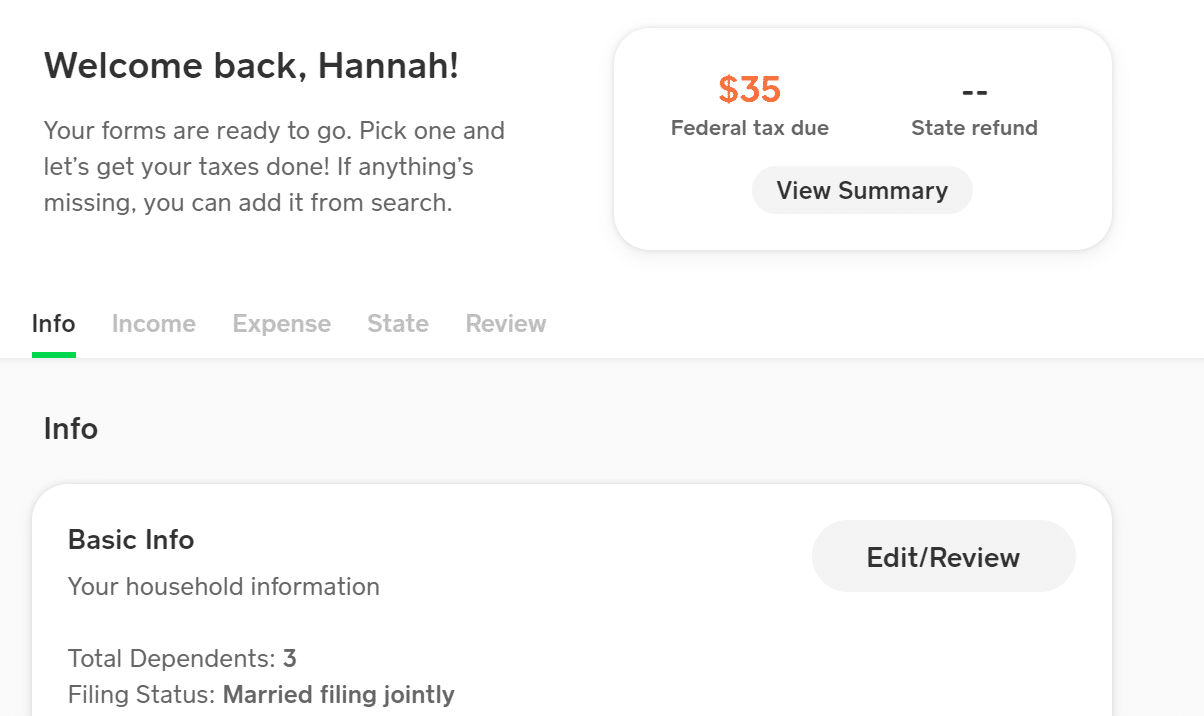

Money App Taxes navigation. Screenshot by The School Investor.

Does Money App Taxes Make Tax Submitting Straightforward In 2025?

Money App Taxes makes tax submitting comparatively simple for many customers. It solely helps some W-2 imports however has first rate calculators and a very good person interface. Money App Taxes is a best choice for those who principally have data from employment, financial institution curiosity, passive investments, or a small enterprise.

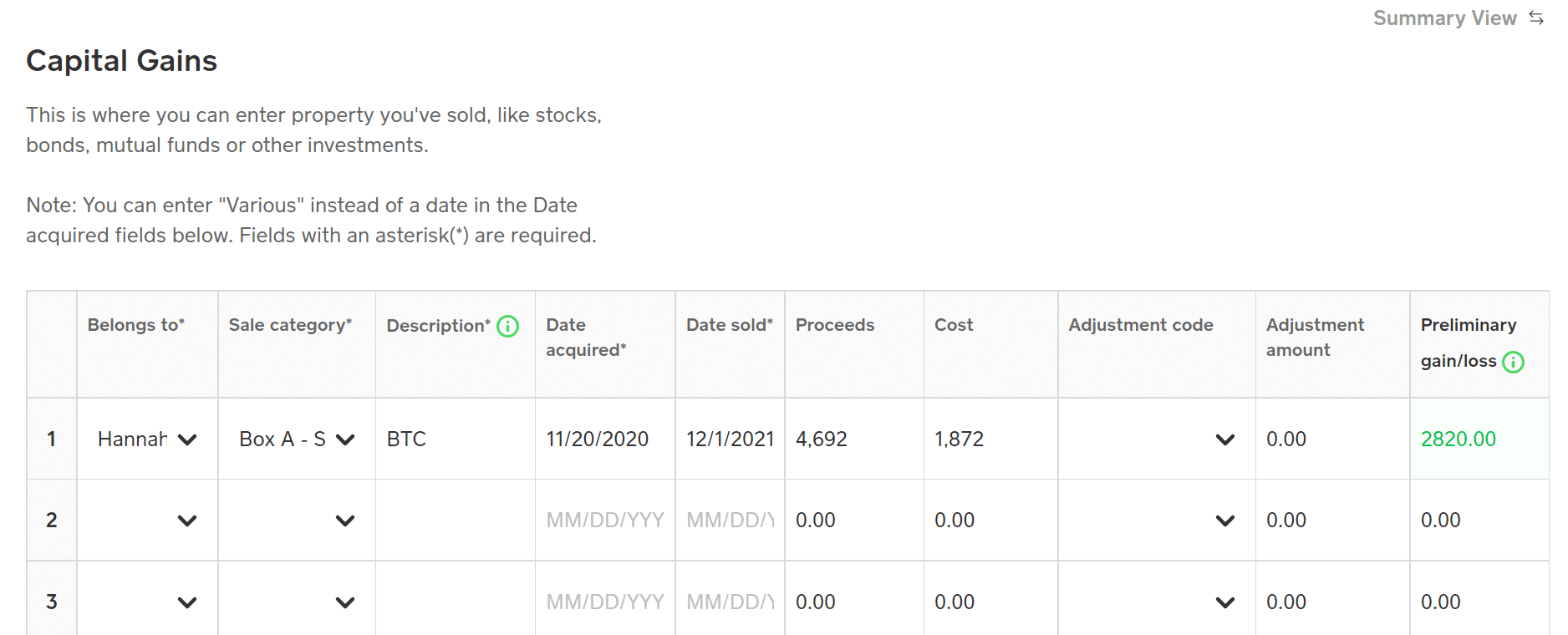

Nevertheless, lively merchants (crypto or shares) should manually enter every commerce, which is tedious, and can lead to errors. It additionally doesn’t assist those that stay in two states, work throughout state strains, or must file in two states for every other cause.

We additionally seen the product didn’t catch errors like over-contributions to self-employed 401(ok) plans, which led to challenges for a member of our staff in precisely getting into and submitting their tax return.

Money App Taxes Options

Money App Taxes presents free tax submitting for most individuals, however the software program is extra sturdy than its price ticket implies. These are a number of of the product’s greatest options.

Utterly Free Federal And State Submitting

Most on-line tax software program presents a free tier that’s extremely restricted, so most individuals are pressured to improve to a paid tier. Not so with Money App Taxes. It presents all of its options at no cost. Customers solely must obtain the Money App to entry the sturdy software program. It truly is free.

Personalized Submitting Expertise

Filers full a brief questionnaire in the beginning of the submitting course of. This streamlines the method so customers don’t must open or assessment data that isn’t related to them.

Required Multi-Issue Authentication

Money App Taxes takes safety very significantly. It requires customers to make use of multi-factor authentication. A second type of authentication is a greatest follow that few different corporations provide or require. You need to use a code from a textual content message or electronic mail when logging in.

Free Audit Help

Money App Taxes supplies free Audit Help (by way of a 3rd celebration) for anybody who recordsdata utilizing Money App Taxes. The assist consists of organizing tax paperwork, writing to the IRS, and attending hearings related to the audit.

Money App Taxes Drawbacks

Money App Taxes is appropriate for the everyday tax submitting situation however has a number of drawbacks, particularly for these in search of premium options. You may verify Money App Help to see what conditions they do not assist.

Restricted Kind Imports

Money App Taxes solely helps restricted W-2 imports. In case your employer or its payroll supplier helps the characteristic, you may obtain your revenue particulars proper into Money App taxes with a number of clicks. In any other case, you’ll must sort it in manually. That’s not an enormous deal for a easy W-2, however it’s a trouble for different tax types.

They do not permit customers to import 1099 types from banks and brokerages. This can be a dealbreaker, particularly for crypto or inventory merchants who don’t need to enter each transaction manually.

Capital Positive aspects Guide Entry. Screenshot by The School Investor.

Attainable To Skip Or Overlook Sure Sections

Money App Taxes’ new navigation depends on custom-made menu navigation. A brief questionnaire simplifies the software program so customers aren’t overwhelmed by irrelevant choices. Nevertheless, customers should manually click on into every part to enter their data. Customers could unintentionally skip sure sections in the event that they don’t notice they apply to their tax submitting.

Money App Taxes Pricing Plans

Money App Taxes presents free Federal and State submitting. Customers don’t must pay for something, together with free Audit Protection.

How Does Money App Taxes Evaluate?

Money App Taxes is a surprisingly sturdy software program, particularly when it is in comparison with cut price and mid-tier software program. This is a fast have a look at the way it compares to FreeTax USA, TaxAct, and TaxSlayer.

|

Header |

|

|

|

|

|---|---|---|---|---|

|

Dependent Care Deductions |

||||

|

Retirement Revenue (SS, Pension, and so on.) |

||||

|

Small Enterprise Proprietor (over $5k in bills) |

||||

|

Deluxe $7.99 Fed & $14.99/State |

Deluxe $29.99 Fed & $39.99/State |

Basic $22.95 Fed & $39.95/State |

||

|

Professional Help |

Premier $49.99 Fed & $39.99/State |

Premium $42.95 Fed & |

||

|

Self-Employed $69.99 Fed & $39.99/State |

Self-Employed $52.95 Fed & $39.95/State |

|||

|

Cell |

How Do You Log In To Money App Taxes?

Money App Taxes considerably improved entry to its product final 12 months.

Customers can merely file their taxes from their cellphone or laptop at money.app/taxes. When logging in for the primary time this 12 months, you’ll must enter a brand new password for Money App Taxes and authenticate your login utilizing a code despatched to you through textual content message.

You might be required to create a Money App account with a view to use Money App Taxes.

Help Choices

When utilizing utterly free tax software program, you need to anticipate to make a number of compromises. Within the case of Money App Taxes, a type of compromises is proscribed assist choices.

Money App does have a brand new devoted Assist Heart for Money App Taxes. However not like premium tax software program corporations, you will not be capable to improve to tiers that embody entry to tax execs.

When you’ve got a technical drawback with the app, you may name the corporate’s predominant customer support at 1-800-969-1940. However if you need the flexibility to ask tax-related inquiries to consultants, you will seemingly need to select a special tax software program.

Is It Protected And Safe?

Utilizing any tax software program entails sure dangers, however Money App takes safety extra significantly than most tax corporations. It leverages its expertise as a banking/brokerage firm to guard person data.

To maintain your information secure, use distinctive passwords for each web site you employ, notably monetary ones like your banking and tax apps. In the event you’re doing all your taxes on a public WiFi community, investing in a VPN can higher safe your data.

Why Ought to You Belief Us?

The School Investor staff has spent years reviewing all the prime tax submitting choices, and our staff has private expertise with nearly all of tax software program instruments. I personally have been the lead tax software program reviewer since 2022 and have in contrast many of the main corporations within the market.

Our editor-in-chief Robert Farrington has been attempting and testing tax software program instruments since 2011, and has examined and tried virtually each tax submitting product. Moreover, our staff has created opinions and video walk-throughs of all the main tax preparation corporations which you’ll find on our YouTube channel.

We’re tax DIYers and desire a whole lot, identical to you. We work onerous to supply knowledgeable and trustworthy opinions on each product we take a look at.

How Was This Product Examined?

In our unique checks, we went by way of Money App Taxes and accomplished a real-life tax return that included W2 revenue, self-employment revenue, rental property revenue, and funding revenue. We tried to enter each piece of knowledge and use each characteristic out there. We then in contrast the outcome to all the opposite merchandise we have examined, in addition to a tax return ready by a tax skilled.

This 12 months, we went again by way of and re-checked all of the options we initially examined and any new options. We additionally validated the pricing choices.

Who Is This For And Is Money App Taxes Value It?

Money App Taxes presents a free product that’s extra sturdy than most paid merchandise in the marketplace at present. It doesn’t rival premium providers (like TurboTax, H&R Block, and TaxSlayer), nevertheless it’s serviceable for many filers who don’t actively commerce shares or crypto.

Given the benefit of use, we’re recommending Money App Taxes as a prime free tax submitting choice for this 12 months. In case your scenario qualifies to make use of Money App Taxes, you need to use it and save on tax preparation prices.

In the event you’re nonetheless unsure, try our listing of Money App Taxes options.

Money App Taxes FAQs

Let’s reply a number of of the commonest questions individuals ask about Money App Taxes:

Can Money App Taxes assist me file my crypto investments?

In the event you traded one or two tokens, you may need to use Money App Taxes to file your taxes. Determining the associated fee foundation on these trades gained’t be too troublesome. Nevertheless, lively merchants should manually enter dozens or lots of of transactions. That is too time-consuming to be worthwhile. Lively merchants ought to think about TaxAct or TurboTax Premier to scale back the time spent submitting.

Can Money App Taxes assist me with state submitting in a number of states?

No. Money App Taxes may also help you file your Federal taxes, nevertheless it doesn’t assist multi-state submitting. Tax filers who filed in a number of states ought to think about an alternate software program like Free Tax USA.

Do I’ve to pay if I’ve a facet hustle?

Money App Taxes is free for all customers, together with self-employed enterprise house owners and facet hustlers.

Does Money App Taxes provide refund advance loans?

Money App Taxes doesn’t provide refund advance loans, however filers can get their returns six days earlier in the event that they deposit to a Money App account. That is an FDIC-insured account.

Does Money App Taxes provide any offers on refunds?

Money App Taxes doesn’t provide any offers or incentives related to refunds.

Money App Taxes Options

|

Sure, from TurboTax, H&R Block, or TaxAct |

|

|

Deduct Charitable Donations |

|

|

Buyer Service Cellphone Quantity |

|