KEY

TAKEAWAYS

- The broader inventory market indexes take a breather.

The day earlier than Thanksgiving, the inventory market took somewhat breather. However the weekly efficiency was nonetheless spectacular.

The day earlier than Thanksgiving, the inventory market took somewhat breather. However the weekly efficiency was nonetheless spectacular.

The Dow Jones Industrial Common ($INDU) stays the broader index chief, rising 0.96% for the week. The S&P 500 ($SPX) and the Nasdaq Composite ($COMPQ) ended the week with smaller good points than the Dow. Earlier within the week, buyers have been extra bullish, however Wednesday’s selloff did not disrupt the uptrend.

It could have been a brief buying and selling week, however we acquired a handful of financial information to chew on. The revised Q3 GDP information reveals the US financial system grew at a 2.8% annual price, final week’s jobless claims got here in decrease than anticipated, and sturdy items fell 0.2% in October.

The Fed’s most well-liked inflation gauge, PCE rose 2.3% year-over-year in October, which was consistent with expectations however barely greater than final month’s 2.1% rise. This means that inflation is shifting away from the Fed’s inflation goal of two%. Core PCE got here in greater at 2.8% year-over-year.

Earlier this week, we had the FOMC minutes. They indicated that the Fed will regularly minimize rates of interest if the financial system continues to carry out as anticipated. In response to the CME FedWatch Device, there’s now a 66.5% chance of a 25-basis-point price minimize within the December assembly.

The Inventory Market’s Response

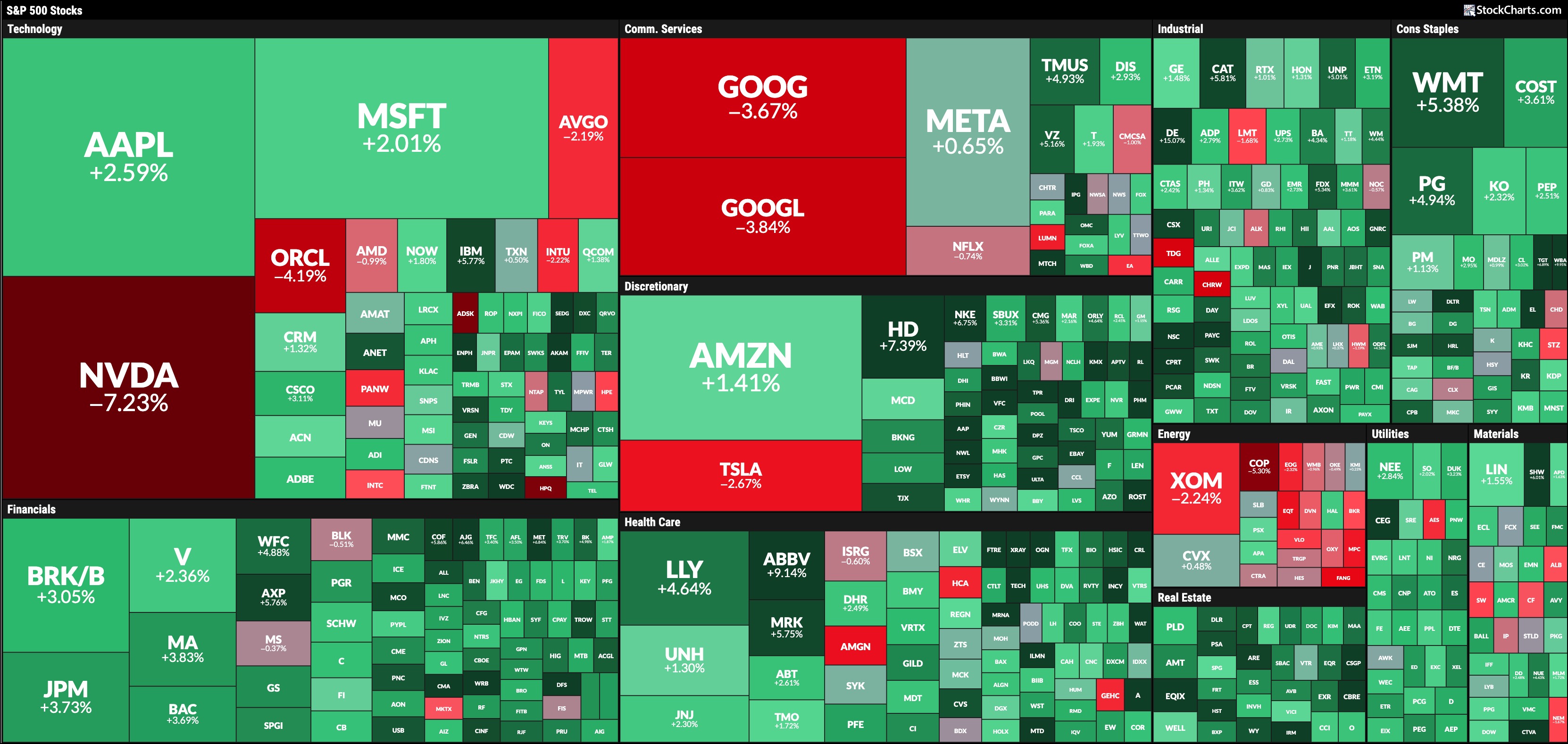

Trying on the 5-day change in efficiency utilizing the StockCharts MarketCarpets, heavyweights NVIDIA Corp. (NVDA), Alphabet Inc. (GOOGL/GOOG), and Tesla Inc. (TSLA) have been the biggest decliners. The efficiency of those large-cap shares would have been the tailwinds that held the Nasdaq and S&P 500 again.

FIGURE 1. 5-DAY PERFORMANCE OF THE S&P 500 THROUGH THE MARKETCARPET LENS. There’s a number of inexperienced, however some large-cap shares noticed declines.Picture supply: StockCharts.com. For instructional functions.

This week, cash rotated from vitality and know-how shares into actual property, client staples, and monetary shares. Antitrust efforts towards Alphabet and now Microsoft, together with tariff talks impacting semiconductor shares, have harm the inventory costs of a number of mega-cap tech shares. With money leaving these shares, small- and mid-cap shares have benefited, though they, too, got here off their highs by the tip of Wednesday’s buying and selling.

The Dow reached an all-time excessive on Wednesday however bought off, ending the day barely decrease. The uptrend remains to be intact, as seen in the day by day chart beneath.

FIGURE 2. DAILY CHART OF THE DOW JONES INDUSTRIAL AVERGE ($INDU). The uptrend remains to be intact with the 21-day EMA, 50-and 100-day SMAs trending upward. The Dow is outperforming the S&P 500 barely.Chart supply: StockCharts.com. For instructional functions.

The Dow is buying and selling effectively above its upward-sloping 21-day exponential shifting common (EMA). It is also barely outperforming the S&P 500 by 1.27%. The S&P 500 has the same sample, however the Nasdaq Composite is struggling.

The day by day chart of the Nasdaq beneath reveals that it’s underperforming the S&P 500, albeit barely.

FIGURE 3. DAILY CHART OF NASDAQ COMPOSITE. Despite the fact that the Nasdaq is the weaker performer of the three broad indexes, its development remains to be positively sloped and holding the 21-day EMA assist. The Nasdaq is underperforming the S&P 500 barely.Chart supply: StockCharts.com. For instructional functions.

The long-term development remains to be in play. The 21-day EMA is trending upward and continues to be a sound assist degree for the index.

Within the Bond World

The largest motion this week was the sentiment shift within the bond market. Treasury yields have been rising till final week. Nonetheless, a number of occasions this week have eased inflation fears, leading to declining Treasury yields and rising bond costs (bond costs and yields transfer in reverse instructions). Wednesday’s PCE information did not change the directional transfer.

The chart beneath reveals that the 10-Yr US Treasury Yield ($TNX) met resistance at its July 1 shut and reversed. It’s now buying and selling beneath its 21-day EMA.

FIGURE 4. DAILY CHART OF THE 10-YEAR US TREASURY YIELD. The ten-year yield hit a resistance degree and, since then, has been trending decrease. It’s now buying and selling beneath its 21-day EMA. The speed of change (ROC) signifies the decline is accelerating.Chart supply: StockCharts.com. For instructional functions.

The price of change (ROC) indicator within the decrease panel is beneath zero. Which means yields are falling comparatively rapidly.

The underside line: Equities could have bought off on Wednesday, however nothing to disrupt the uptrend. Just a little profit-taking forward of the vacation procuring season should not come as a shock. You need to rejoice consumerism infrequently.

Wishing everybody a contented, wholesome Thanksgiving!

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra