The automotive business ex China is reeling, between typical automotive markers having hassle adapting to the EV/hybrid world (the place EV new entrants have appreciable benefits through the autos’ a lot decrease mechanical complexity), European producers being whacked by the brand new regular of a lot larger power costs, and Trump tariffs disrupting provide chains to the critically essential US market. We’ll look at with the dire straits at Nissan, as soon as a bedrock maker of stable mid-range automobiles (I’ve some fondness for Nissan; the primary automotive I drove recurrently was my mother and father’ second automotive, a lime inexperienced Datsun), as a brand new window into these accelerating issues

Readers are invited to pile on, since I’m not a car maven and are doubtless fairly a number of points from the shopper or product/product line finish that we’ll skip over in attending to the broad outlines of the precipitous decline of a once-storied firm. The autumn of Nissan, so far as I can inform, doesn’t have a easy although line, in contrast to Boeing (“Nice engineering firm merges with protection contractor run by beancounters and financiers, placing the cash males in cost, who proceed to price lower and disinvest into unhealthy merchandise and efficiency”).

Regulars little doubt have seen our pointing to extraordinary manufacturing unit closings by Volkswagen in Germany, a direct casualty of the choice to chop the EU off from low cost Russian power as a lot as doable and a poster little one of the blowback to European producers. However earlier than we flip to Nissan, a brand new story on the Monetary Instances exhibits the extent to which different established Western carmarkers are struggling. From Stellantis chief govt Carlos Tavares resigns:

Stellantis chief govt Carlos Tavares has resigned following a pointy decline in monetary efficiency on the world’s fourth-largest carmaker, marking an abrupt exit for one of many automotive business’s most high-profile leaders.

In a press release on Sunday, Stellantis, which owns the Peugeot, Fiat and Jeep manufacturers, stated the corporate’s board accepted the resignation of Tavares…

Individuals accustomed to Tavares’ departure stated there have been rising tensions between him and different Stellantis board members on the way to put the corporate again on monitor following a steep decline in reported earnings in 2024 because of slumping gross sales within the US and Europe. Stellantis’ shares have fallen 43 per cent this 12 months.

Thoughts you, Stellanis just isn’t in severe monetary hassle. The pink paper notes that even with destructive 2024 money stream on the order of €5 billion to €10 billion, nonetheless has a really stable stability sheet.1

Nissan as of early November initiated an emergency turnaround plan after a second lower to its 2024 revenue forecasts. However the protection in main shops just like the Monetary Instances described the deep cuts deliberate with out even mentioning the upcoming money crunch (may the explanation be that the Monetary Instances is Japanese owned?). From its account then:

Nissan has launched an emergency turnaround plan that features 9,000 job losses and a voluntary 50 per cent pay lower for chief govt Makoto Uchida after unveiling it had fallen to a quarterly loss.

Japan’s third-largest carmaker stated it will slash world manufacturing capability by 20 per cent and lower prices by ¥400bn ($2.6bn). It downgraded its full-year revenue forecast for the second time this 12 months, this time by 70 per cent.

The disaster at Nissan got here because it didn’t counter a slowdown in world electrical car gross sales with a powerful hybrid providing, which has helped rivals Toyota and Honda….

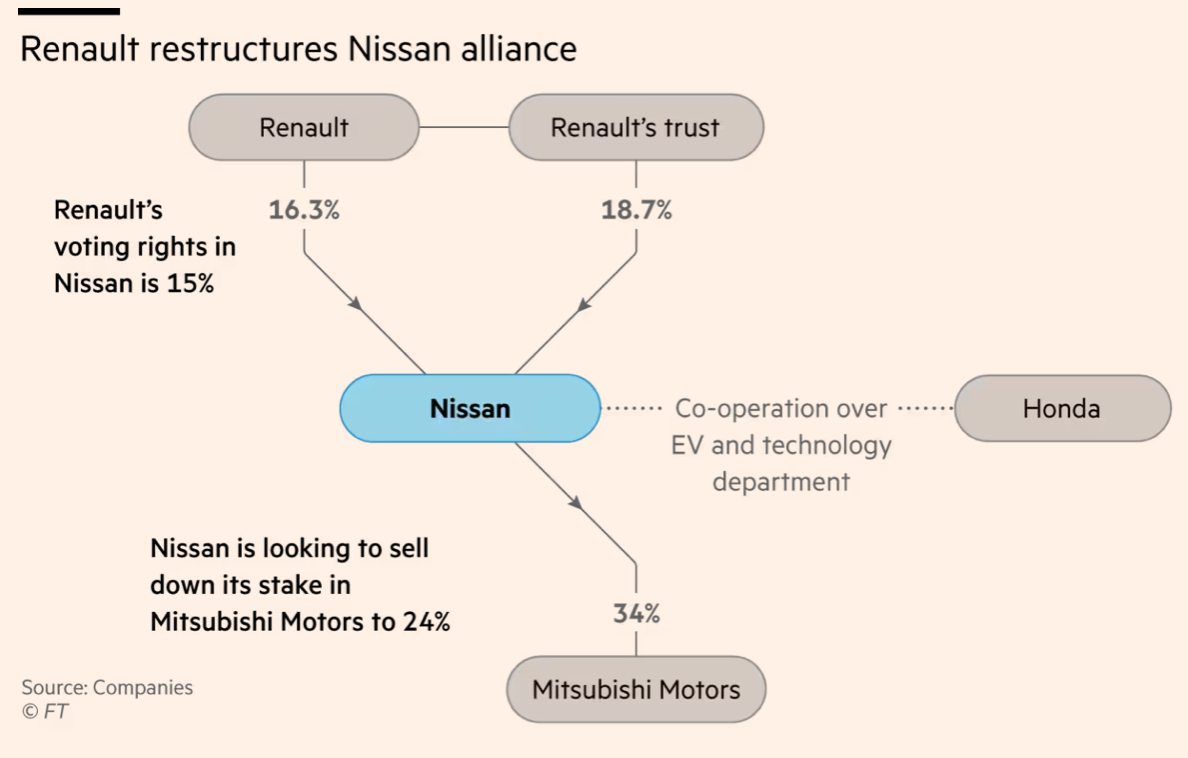

As a part of the measures, Nissan additionally lower its stake in alliance associate Mitsubishi Motors on Thursday from 34 per cent to 24 per cent to bolster its stability sheet.

Nissan just lately turned to a partnership with Honda to outlive the competitors after a long-standing alliance with France’s Renault considerably weakened lately. The 2 Japanese corporations plan to roll out a brand new electrical car earlier than the top of the last decade and collectively develop software program to go toe-to-toe with Chinese language rivals.

This extra tidbit from the Guardian account on the identical date:

The corporate stated it was going through a extreme scenario because it battled with larger prices for gross sales and in its factories, in addition to having too many automobiles with sellers within the US specifically, which might pressure the corporate to provide steep reductions.

If “extreme scenario” is an actual translation (or what was stated in English, since Japanese executives have a tendency to make use of Japanese formulations of their spoken English), that’s Stage 4 illness stage dire.

And certainly, lower than two weeks later, keying off the November 7 presentation, from Nikkei Asia Nissan bleeds money as gross sales hunch and bills mount:

The corporate’s money flows replicate its struggles. Working money stream for its automotive enterprise in April-September got here to minus 234 billion yen. Along with sluggish gross sales, the piling up of stock has been among the many contributing components.

Nissan’s money stream for capital investments for the interval reached minus 214.3 billion yen. Mixed, general free money stream totaled minus 448.3 billion yen. Within the first half of the earlier fiscal 12 months, the corporate noticed a constructive free money stream of 193.9 billion yen.

In contrast with different April-September durations, the money stream deficit is near the 504.6 billion yen recorded in 2020, throughout the coronavirus pandemic. It exceeds the minus 414.9 billion yen recorded in 2019, when Nissan introduced a worldwide downsizing and laid off about 12,500 workers.

Due primarily to the deterioration of its free money stream, Nissan’s money and equivalents available stood at about 1.4 trillion yen on the finish of September, down 575.9 billion yen from the top of March. However for now, the corporate’s money available itself continues to be sizeable, so “the financing danger is minor,” stated Takao Matsuzaka, chief analyst at Daiwa Securities.

Considerations about elevating funds within the medium-to-long time period are rising, due partly to a decline in creditworthiness. On Nov. 8, S&P World stated that if the corporate can not stabilize its earnings, downward stress on its creditworthiness will intensify.

S&P has given Nissan a long-term issuer score of BB+, under funding grade, whereas Japan’s Ranking and Funding Info classifies it as A and Moody’s ranks it at Baa3, the bottom of its investment-grade scores.

More moderen statements by firm insiders belie the cheery take by the Daiwa analyst, significantly in gentle of the junk/borderline junk and deteriorating credit score outlook. Nikkei describes in some element how the upper rate of interest surroundings versus bond refinancings wanted beginning in March 2026 are looming. It then continues:

One other concern is that working and investing money flows are more likely to proceed to be destructive. Though the corporate goals to cut back fastened and variable prices by 400 billion yen per 12 months by slicing jobs and manufacturing, it has few prospects for brand new merchandise that might considerably enhance the stability of funds within the close to future.

A November 26 Monetary Instances story equally signaled misery. From Nissan seeks anchor investor to assist it by way of make-or-break 12 months. The brand new supply of woes is that the Nissan-Renault tie-up, which a headline search exhibits have been wobbly for some time, is now shifting in direction of a breakup:

Nissan is looking for an anchor investor to assist it survive a make-or-break 12 months as longtime associate Renault sells down its holding within the crisis-hit Japanese carmaker.

Two individuals with data of the talks stated Nissan was searching for a long-term, regular shareholder similar to a financial institution or insurance coverage group to switch a few of Renault’s fairness holding, as Nissan finalises the phrases of its new electrical car partnership with arch-rival Honda.

“We have now 12 or 14 months to outlive,” stated a senior official near Nissan.

The article floats the cheery concept that maybe Honda will take Renault out of its stake, because the two have elevated their enterprise collaboration. Hardcore automotive websites dismiss the notion as not not in Honda’s curiosity, each by advantage of the sheer dimension of the funding and Nissan’s cash-bleeding state. In fact, it’s doable that the Japanese authorities might stress Honda into making a rescue (however why ought to a Japanese automotive maker go that far in accommodating a European one?). That may not be so loopy if Nissan acquired some bond financing ensures, as did Chrysler in its bailout. One other risk is Japanese insurers are muscled into serving to a deal, lowering the load on a Honda.

One has to suppose that finally Nissan is just too huge to fail from a Japanese perspective, because the US Large Three have been after the worldwide monetary disaster. Bear in mind what’s in danger isn’t just Nissan’s direct employment but in addition that of its many subcontractors. However I welcome enter from any readers plugged into present views in Japan.

Observe that apart from the speed of the money burn, circling vultures are including to the sense of urgency. Once more from the Monetary Instances:

However the seek for an anchor investor has turn into much more essential with the turmoil at Nissan attracting investments from Singapore-based Effissimo Capital Administration and Hong Kong’s Oasis Administration, two of probably the most high-profile activists in Asia whose campaigns have beforehand focused the likes of Toshiba and Nintendo.

Curiously, the Every day Mail has simply printed two good new items on Nissan going right into a monetary nosedive. Nissan is of curiosity because of its manufacturing plant in Sunderland. Whereas an enormous chunk of the story re-reports the Monetary Instances, Main automotive producer ‘getting ready to collapse’ as official claims firm has ‘simply 12 months to outlive,’ it recognized extra stressors:

Nissan additionally final month referred to as for pressing motion to keep away from automotive makers being penalised for the slowdown in electrical car gross sales within the UK which the agency blamed on outdated targets within the nation’s Zero Emissions Automobiles Mandate.

The mandate forces corporations to extend the proportion of EVs they promote every year till a complete ban on new petrol and diesel motors in 2030.

This 12 months, EVs should make up 22 per cent of a agency’s automotive gross sales and 10 per cent of van gross sales, with the brink rising yearly and makers going through a £15,000 effective for each sale past it.

Labour’s 2030 goal is 5 years sooner than that set by former Tory prime minister Rishi Sunak.

And Nissan stated that lacking the goal would result in important fines for producers except credit are bought from EV-only manufacturers – none of which manufacture within the UK….

The Society of Motor Producers and Merchants has voiced fears that the tempo of the transition might hit automotive makers as demand for zero-emission autos ‘failed to fulfill ambition’.

The organisation forecasts a slowdown in client demand meant EV gross sales would solely attain 18.5 per cent of the whole market, towards the 2024 ZEV Mandate goal of twenty-two per cent.

The newer Every day Mail account gave a bit extra element on a few of Nissan’s emergency responses:

Nissan’s head of producing Hideyuki Sakamoto advised a information convention final month: ‘Globally, we at present have 25 car manufacturing strains. Our present plan is to cut back the operational most capability of those 25 strains by 20 per cent.

‘One particular technique for that is to vary the road pace and shift patterns, thereby rising the effectivity of operational personnel.’

This video, which supplies a short-form have a look at Nissan’s product and gross sales issues in lots of key markets, takes difficulty with the concept that manufacturing cuts are an answer. Or to echo the language makes use of above, that Nissan can obtain efficiencies with a lot funding in fastened manufacturing strains. As we have now stated repeatedly, direct manufacturing unit labor is a small a part of complete automotive prices, estimated usually at 3%. So in case you lower volumes, you’ll don’t do a lot to cut back variable prices whereas totally loaded prices can (will?) be larger on a unit foundation.

Different helpful matters are the results of Nissan not having a hybrid for the US market, the injury completed by an enormous 2023 12 months finish stock overhang, and China consuming Nissan’s lunch in Southeast Asia, with Thailand because the poster little one (lack of 80% of supplier workers):

The fast takes on Nissan are a lot much less variety. If issues are this unhealthy on the product facet, it’s not simple to see how Nissan might be salvaged:

Nissan has 12-14 months to outlive and so they try and discover a Hail Mary investor to save lots of the corporate.

Current Chinese language manufacturers have overtaken Nissan gross sales in lots of Asian nations, which Nissan used to dominate.

Nissan has spent the final 10 years making rubbish/unreliable automobiles and… pic.twitter.com/wlksHBHSAy

— Edward G. 🇺🇸🦅 (@realEdwardG) November 28, 2024

Once more, we’ll see how a lot Nissan is serving as an early warning of how unhealthy issues can get at different automaker quickly sufficient. And don’t neglect that the Trump tariffs are set to be an enormous spanner so far as teh critically essential US market is worried.

____

1 This part from a Magic Markets podcast provides an thought of a few of Stellantis’ tsuris:

If we transfer on shortly to Stellantis, the polony as we prefer to name it, the entire manufacturers that kind of don’t actually belong collectively. However Stellantis is attempting their finest to deliver them collectively by constructing platforms that every one these manufacturers then share. Sadly, what that does is it considerably dilutes the model worth and the heritage.

South America was their solely excellent news story. Very like at Volkswagen, which is why I stated it’s a bit odd. In Q3, South America was up 14% and the remaining was only a mess. North America down 36%, which is ridiculous. Stellantis can not promote Jeeps. It’s simply unimaginable. Europe down 17%, to allow them to’t promote Citrons and Peugeot and Alfas and Fiats in Europe. It’s not good. Alas, my beloved Maserati, my favourite automotive model of all, down 60% when it comes to unit gross sales. However the product vary is simply actually foolish in the intervening time. So it’s no actual shock. Stellantis has just about been making a multitude of just about the whole lot they’ve touched for some time. No excellent news there then.